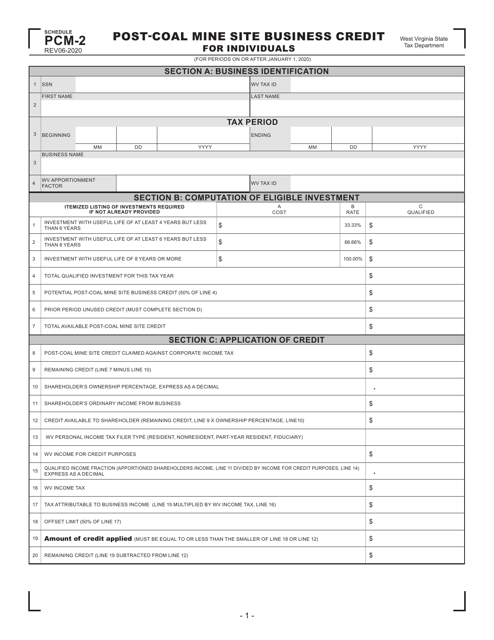

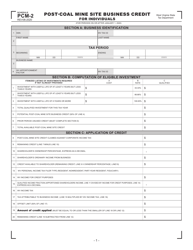

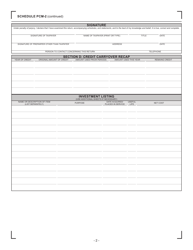

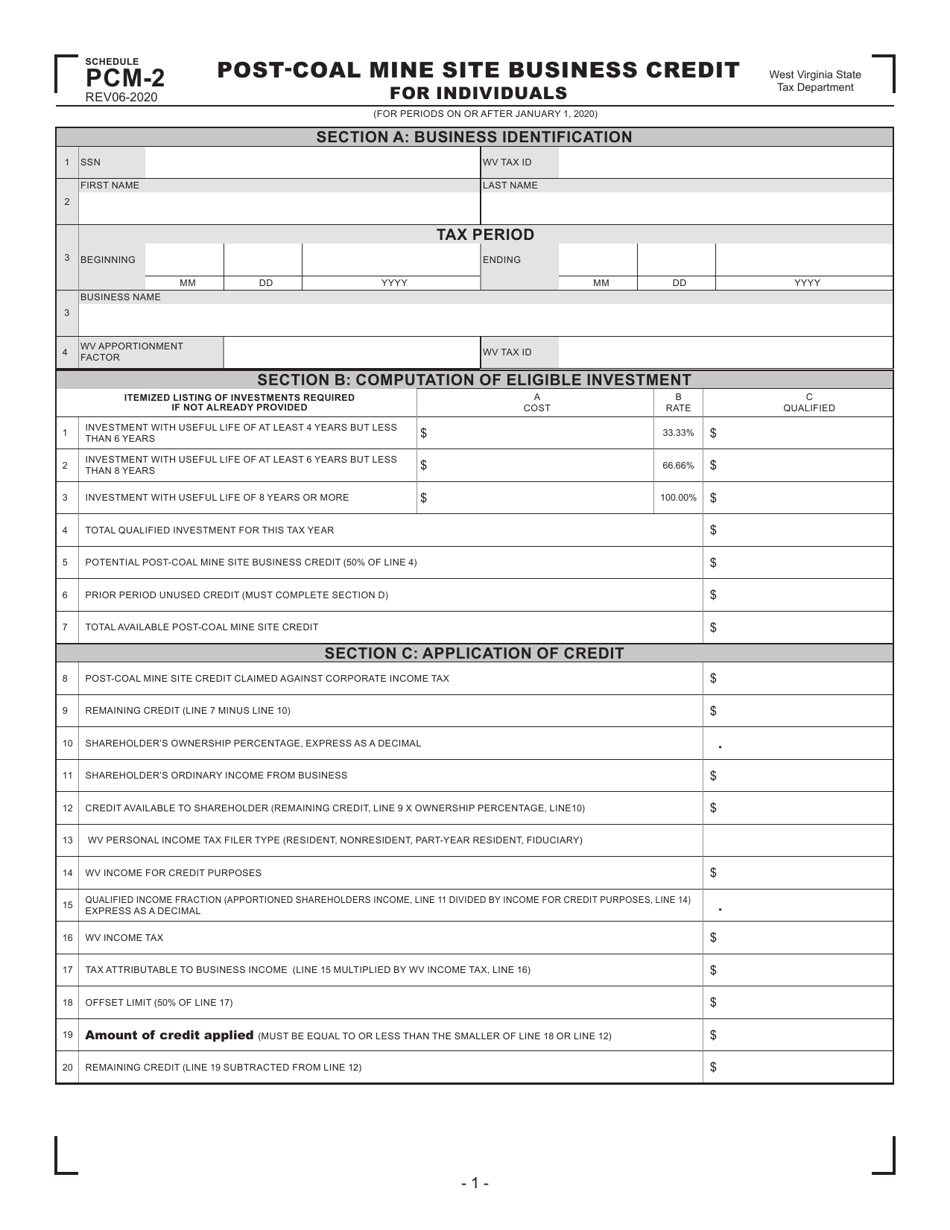

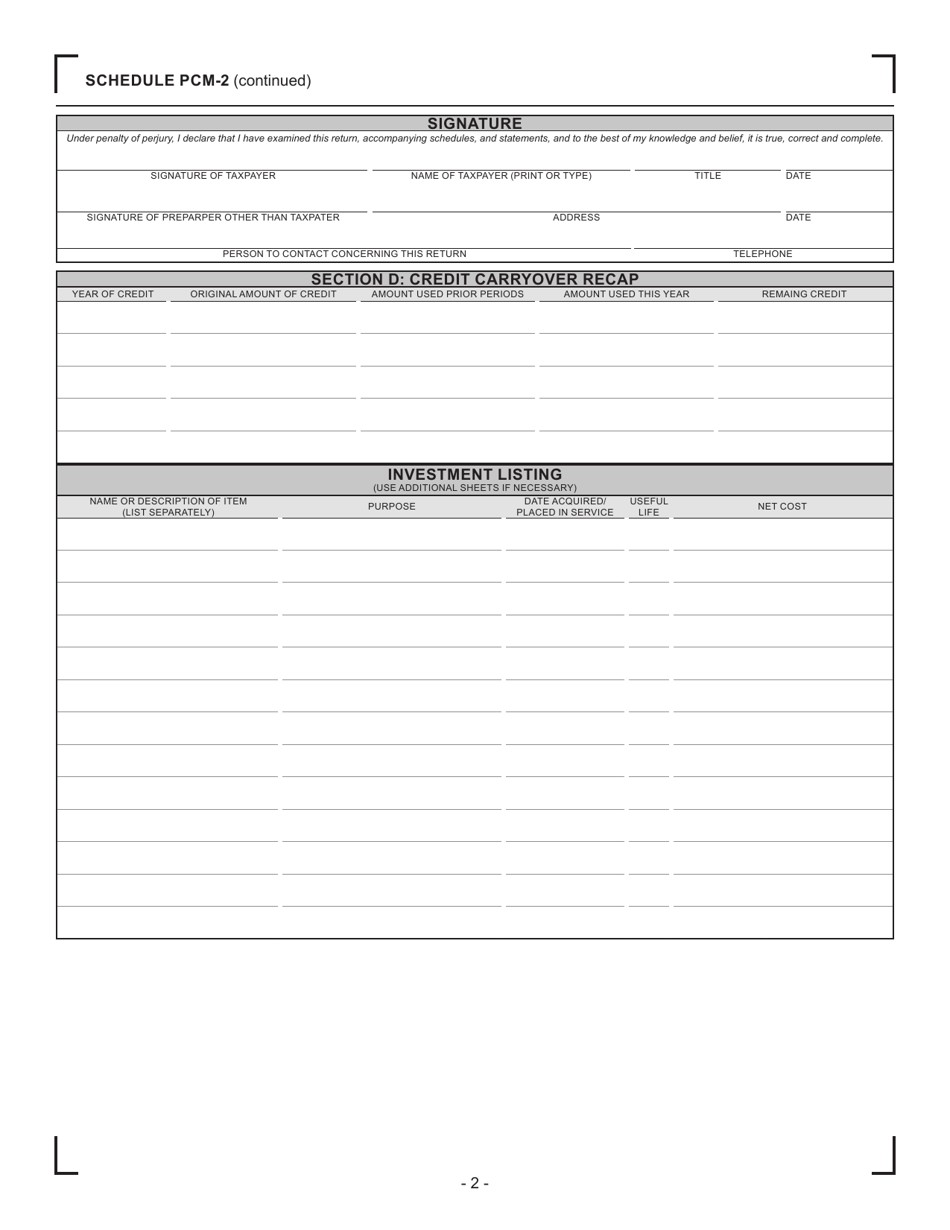

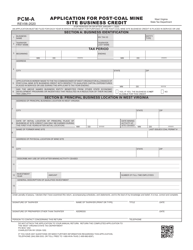

Schedule PCM-2 Post-coal Mine Site Business Credit for Individuals - West Virginia

What Is Schedule PCM-2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PCM-2?

A: PCM-2 stands for Post-coal Mine SiteBusiness Credit for Individuals.

Q: Who is eligible for PCM-2?

A: Individuals who are residents of West Virginia and have been affected by coal mine closures are eligible for PCM-2.

Q: What is the purpose of PCM-2?

A: PCM-2 is designed to provide a business credit to individuals who were negatively impacted by coal mine closures and wish to start or expand a business.

Q: What documents do I need to provide with my PCM-2 application?

A: You will need to provide documents such as proof of residence, proof of coal mine employment, and a business plan.

Q: How much business credit can I receive through PCM-2?

A: The amount of business credit provided through PCM-2 varies depending on various factors. It is best to refer to the program guidelines or contact program administrators for more information.

Q: Can the PCM-2 business credit be used for any type of business?

A: The PCM-2 business credit can be used for various types of businesses, including retail, service, and manufacturing.

Q: Are there any restrictions on how I can use the PCM-2 business credit?

A: There may be certain restrictions on how the PCM-2 business credit can be used. It is recommended to review the program guidelines or consult with program administrators for detailed information.

Q: Are there any repayment requirements for the PCM-2 business credit?

A: Yes, there are repayment requirements for the PCM-2 business credit. The loan must be repaid in accordance with the terms and conditions specified by the program.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule PCM-2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.