This version of the form is not currently in use and is provided for reference only. Download this version of

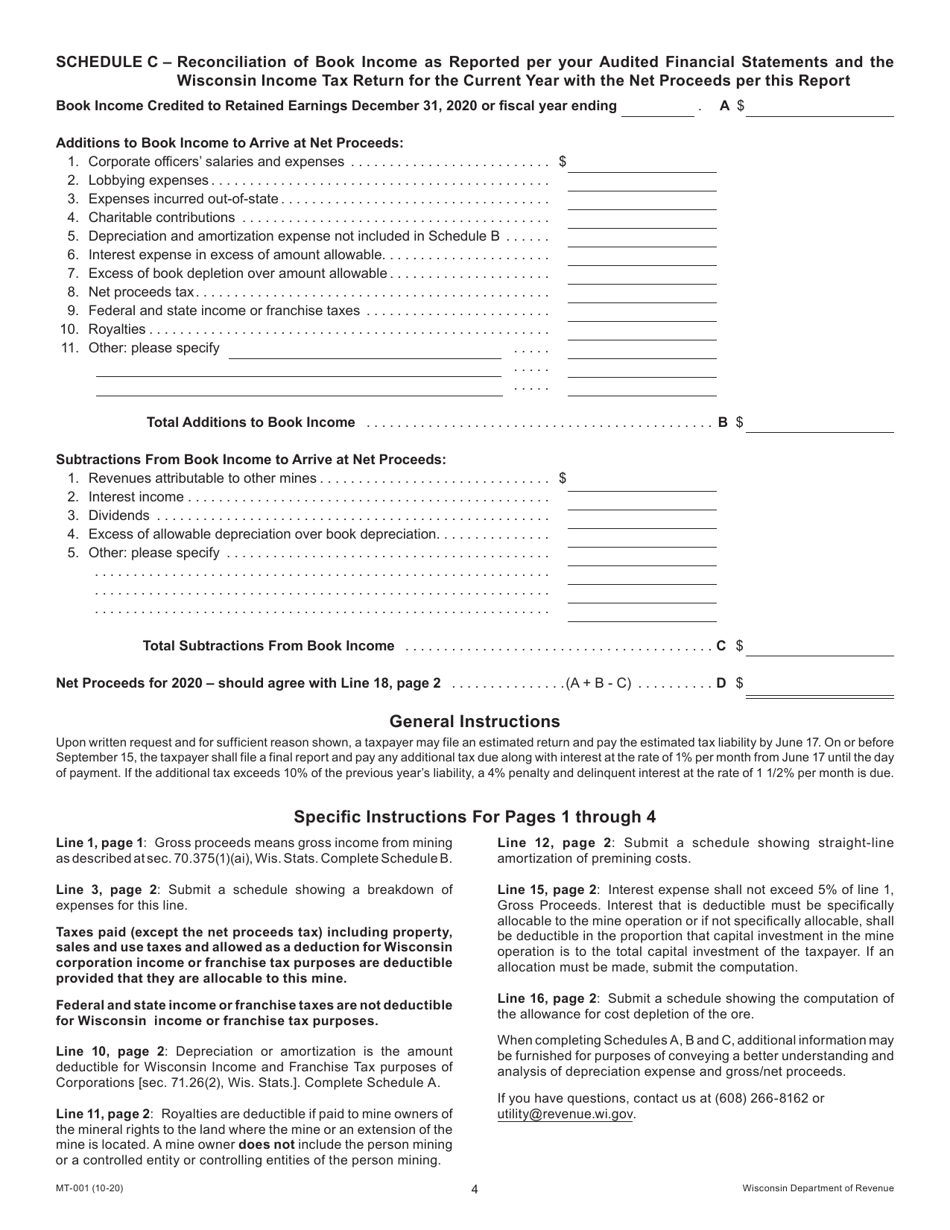

Form MT-001

for the current year.

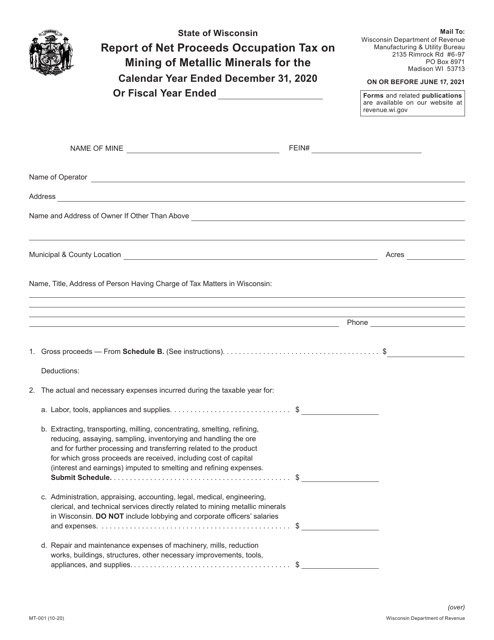

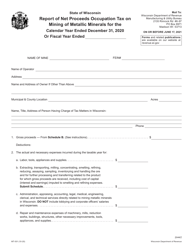

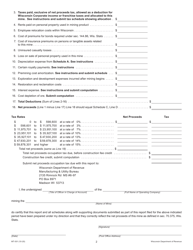

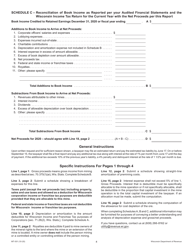

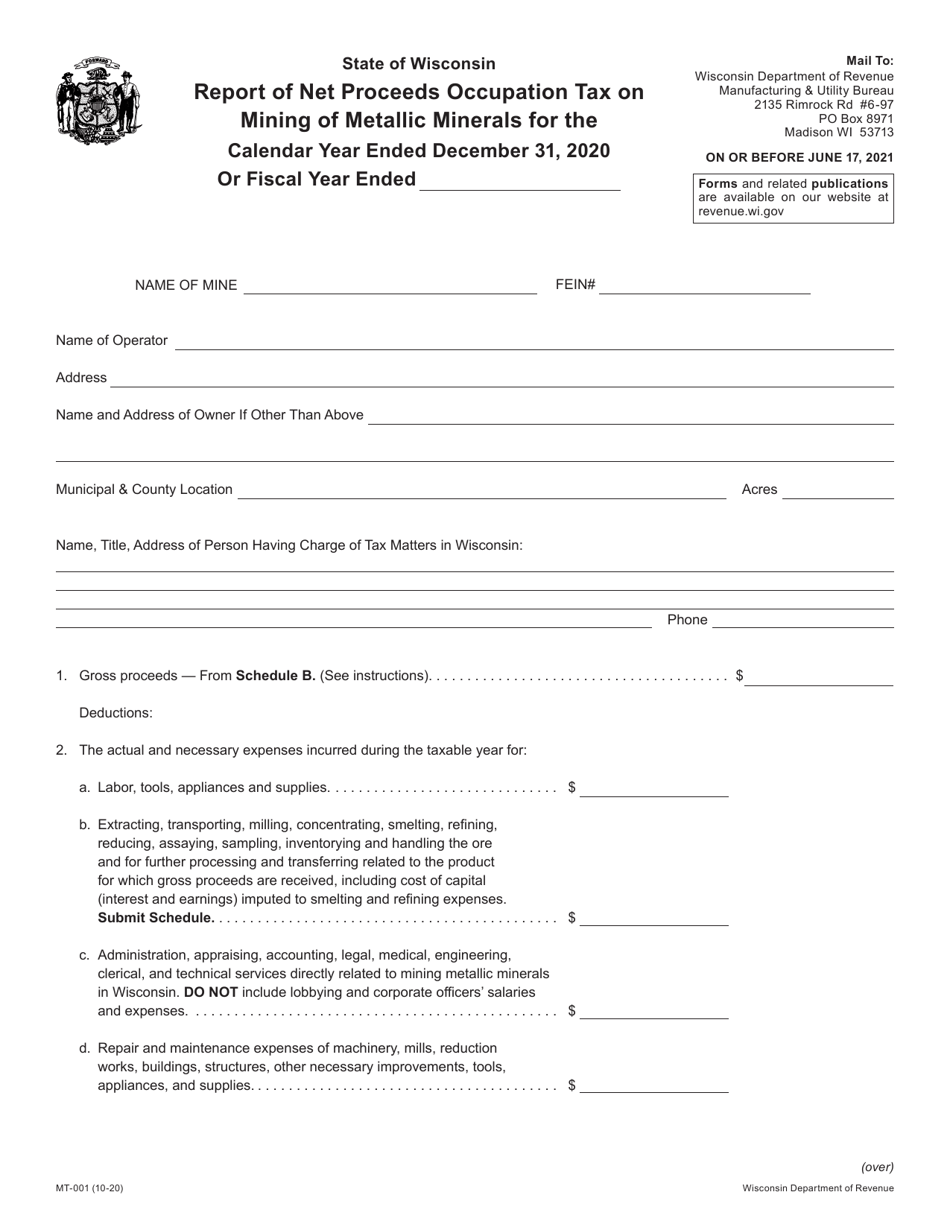

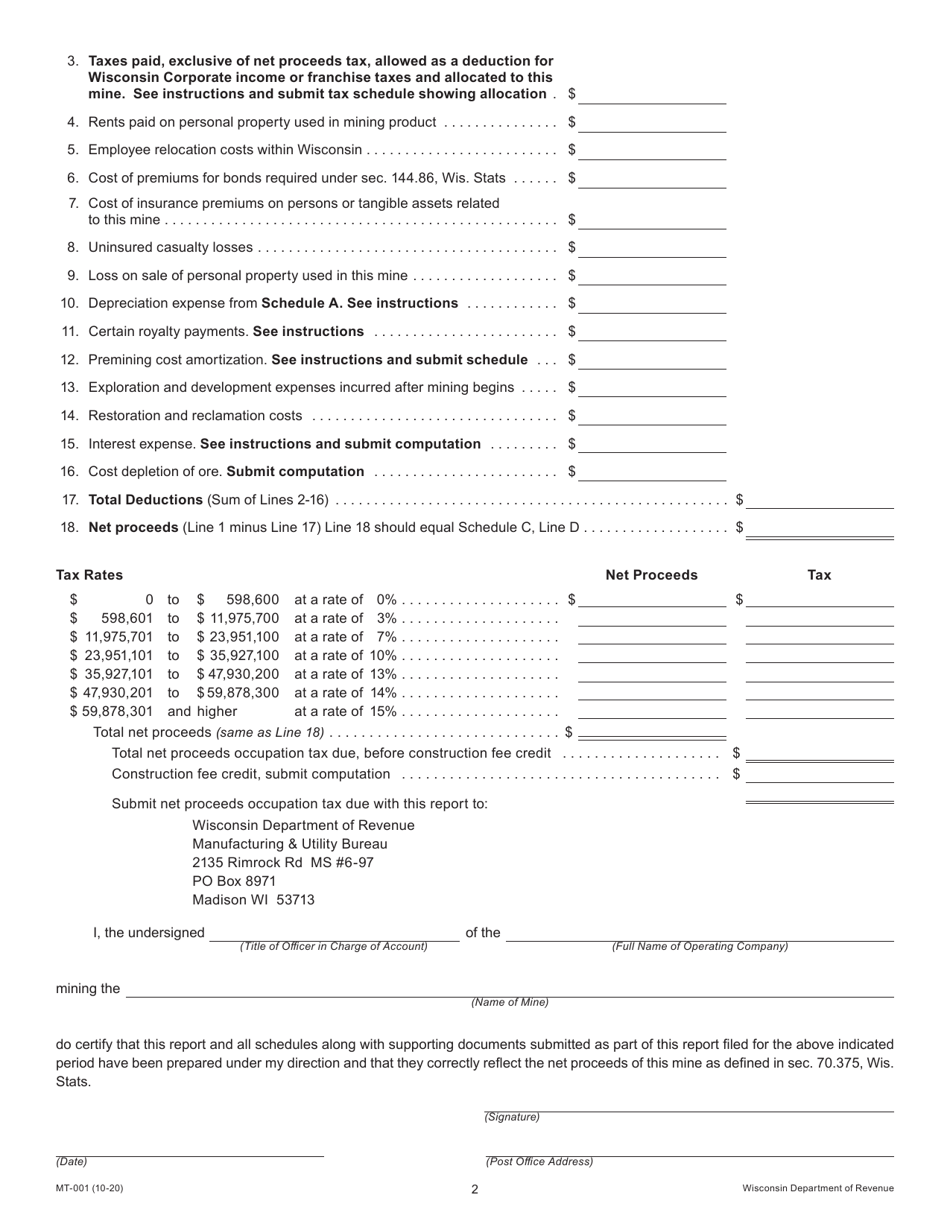

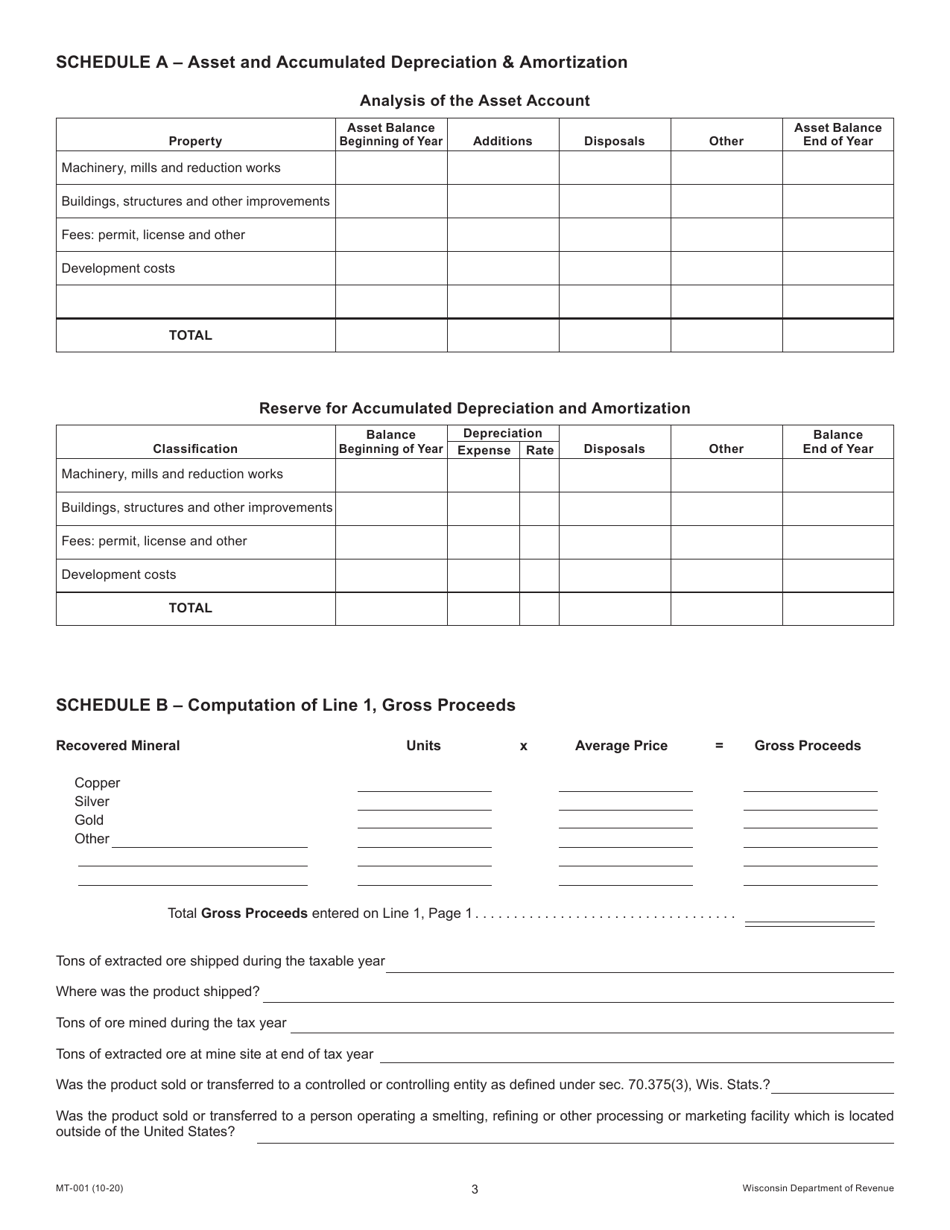

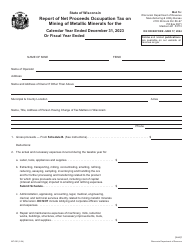

Form MT-001 Report of Net Proceeds Occupation Tax on Mining of Metallic Minerals - Wisconsin

What Is Form MT-001?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-001?

A: Form MT-001 is a report used to calculate and pay the Occupation Tax on Mining of Metallic Minerals in Wisconsin.

Q: Who needs to file Form MT-001?

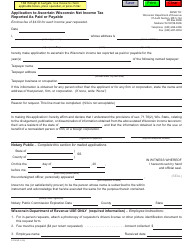

A: Any individual or business engaged in the mining of metallic minerals in Wisconsin needs to file Form MT-001.

Q: What is the purpose of the Occupation Tax on Mining of Metallic Minerals?

A: The purpose of the tax is to generate revenue for the state and compensate for the environmental impacts of mining.

Q: How often should Form MT-001 be filed?

A: Form MT-001 should be filed on a quarterly basis.

Q: What information is required on Form MT-001?

A: The form requires information such as the name and address of the mining operation, the quantity and value of metallic minerals extracted, and the amount of tax due.

Q: Is there a deadline for filing Form MT-001?

A: Yes, Form MT-001 must be filed by the 15th day of the month following the end of each quarter.

Q: What happens if I fail to file Form MT-001 or pay the tax?

A: Failure to file the form or pay the tax can result in penalties and interest being assessed.

Q: Can I file Form MT-001 electronically?

A: Yes, the Wisconsin Department of Revenue allows for electronic filing of Form MT-001.

Q: Are there any exemptions to the Occupation Tax on Mining of Metallic Minerals?

A: Yes, certain small-scale mining operations may be eligible for exemptions or reduced rates. Consult the Wisconsin Department of Revenue for more information.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.