This version of the form is not currently in use and is provided for reference only. Download this version of

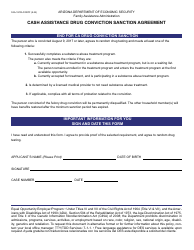

Form FAA-0257A

for the current year.

Form FAA-0257A Individual Development Account Agreement - Arizona

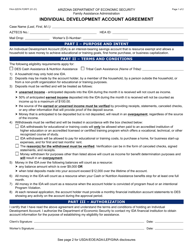

What Is Form FAA-0257A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAA-0257A?

A: Form FAA-0257A is an Individual Development Account Agreement specific to Arizona.

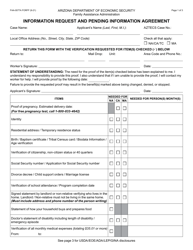

Q: What is an Individual Development Account (IDA)?

A: An Individual Development Account (IDA) is a matched savings account designed to help low-income individuals save money for specific purposes, such as education, homeownership, or starting a small business.

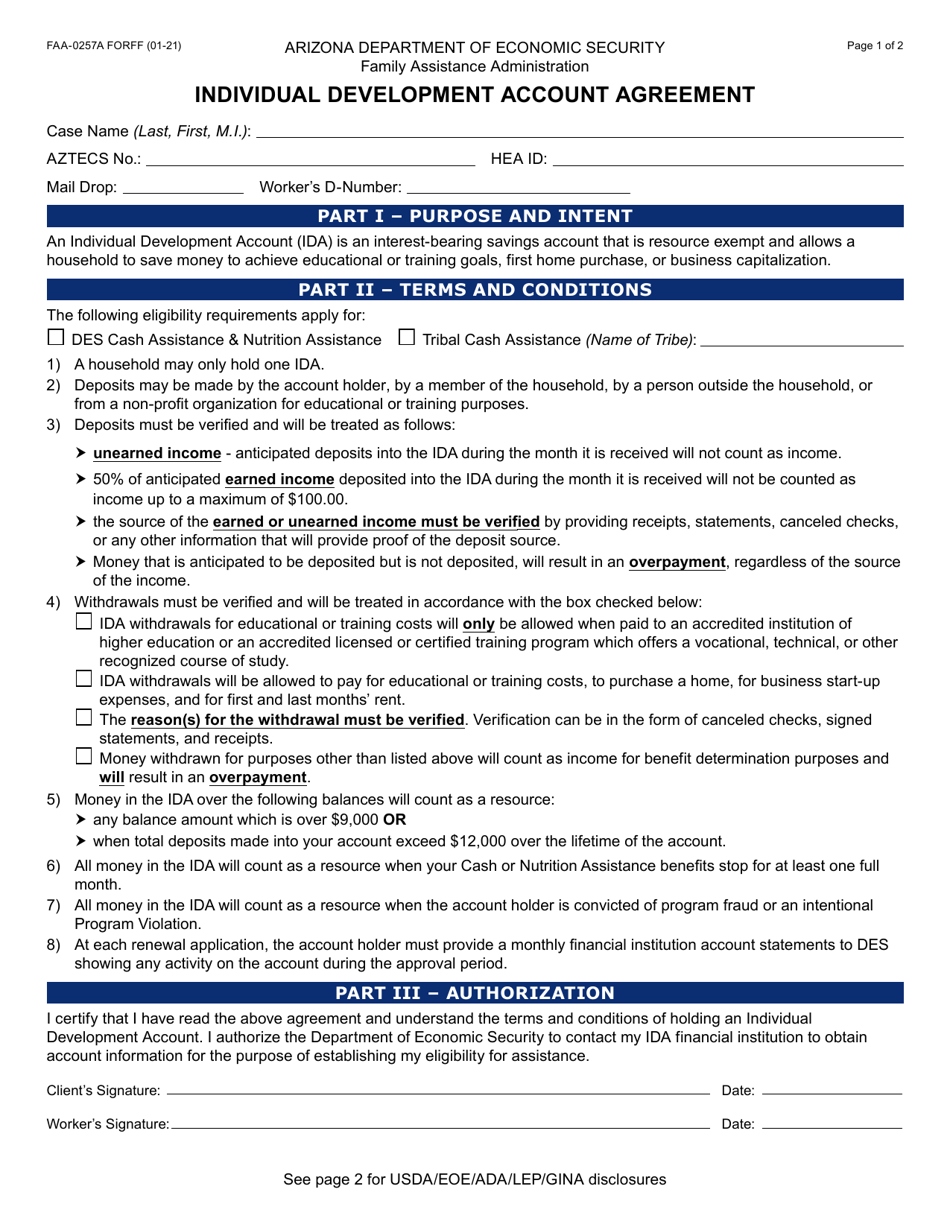

Q: Who is eligible for an IDA?

A: Eligibility for an IDA varies based on the specific program requirements, but generally, low-income individuals and families who meet certain income limits and asset thresholds may be eligible.

Q: What is the purpose of Form FAA-0257A?

A: Form FAA-0257A serves as a legal agreement between the account holder and the IDA program, outlining the terms and conditions of the account.

Q: Are there any fees associated with an IDA?

A: Fees associated with an IDA vary depending on the program. Some programs may charge monthly maintenance fees or withdrawal fees, while others may have no fees at all.

Q: Can I use the funds in my IDA for any purpose?

A: No, the funds in an IDA can only be used for the specific purposes outlined in the program guidelines, such as education, homeownership, or business expenses.

Q: What happens if I withdraw funds from my IDA for non-qualified expenses?

A: Withdrawing funds from an IDA for non-qualified expenses may result in penalties or the loss of matching funds provided by the program.

Q: Can I close my IDA account before reaching my savings goal?

A: Closing an IDA account before reaching the savings goal may have different consequences depending on the program. It is best to consult the specific program guidelines or contact the program provider for more information.

Q: Is my IDA savings match taxable?

A: The tax treatment of IDA savings matches may vary depending on the program and the specific circumstances. It is recommended to consult a tax professional for personalized advice.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FAA-0257A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.