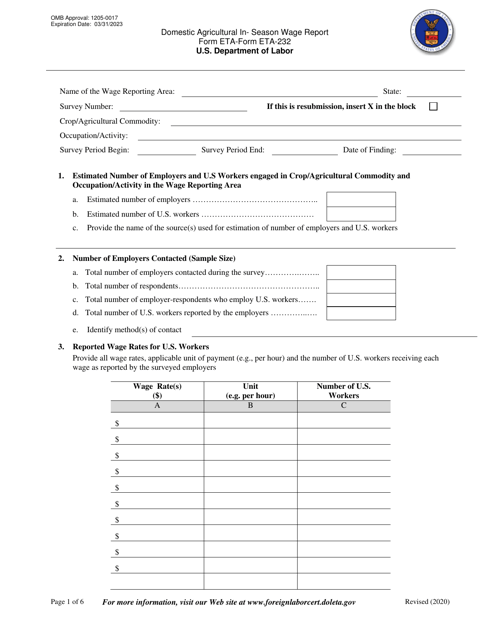

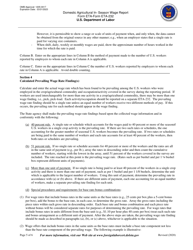

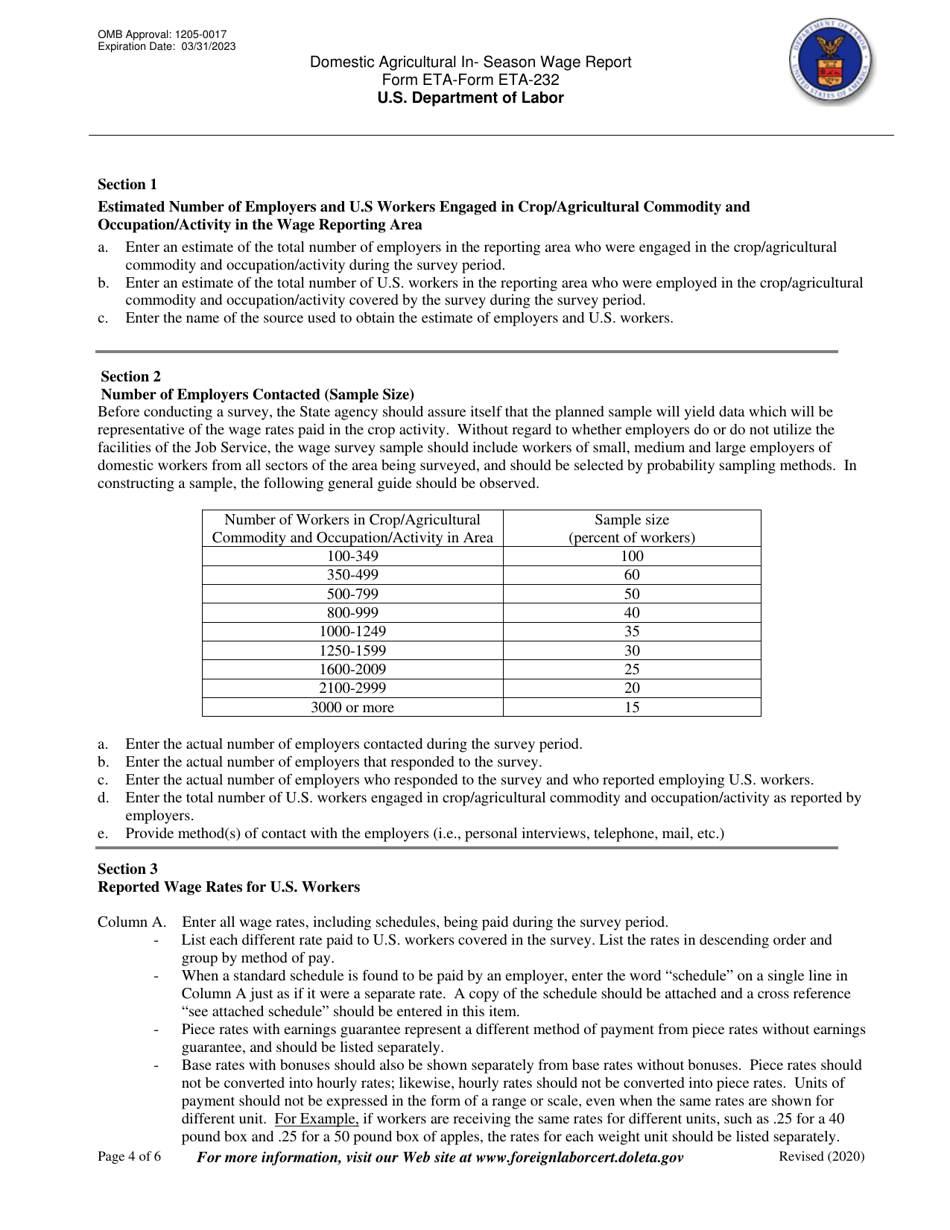

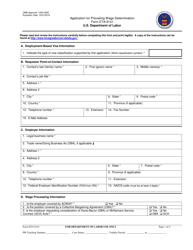

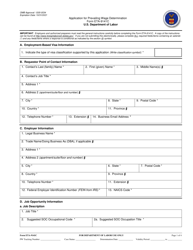

Form ETA-232 Domestic Agricultural in-Season Wage Report

What Is Form ETA-232?

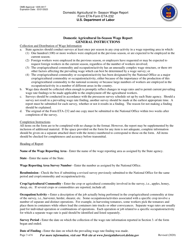

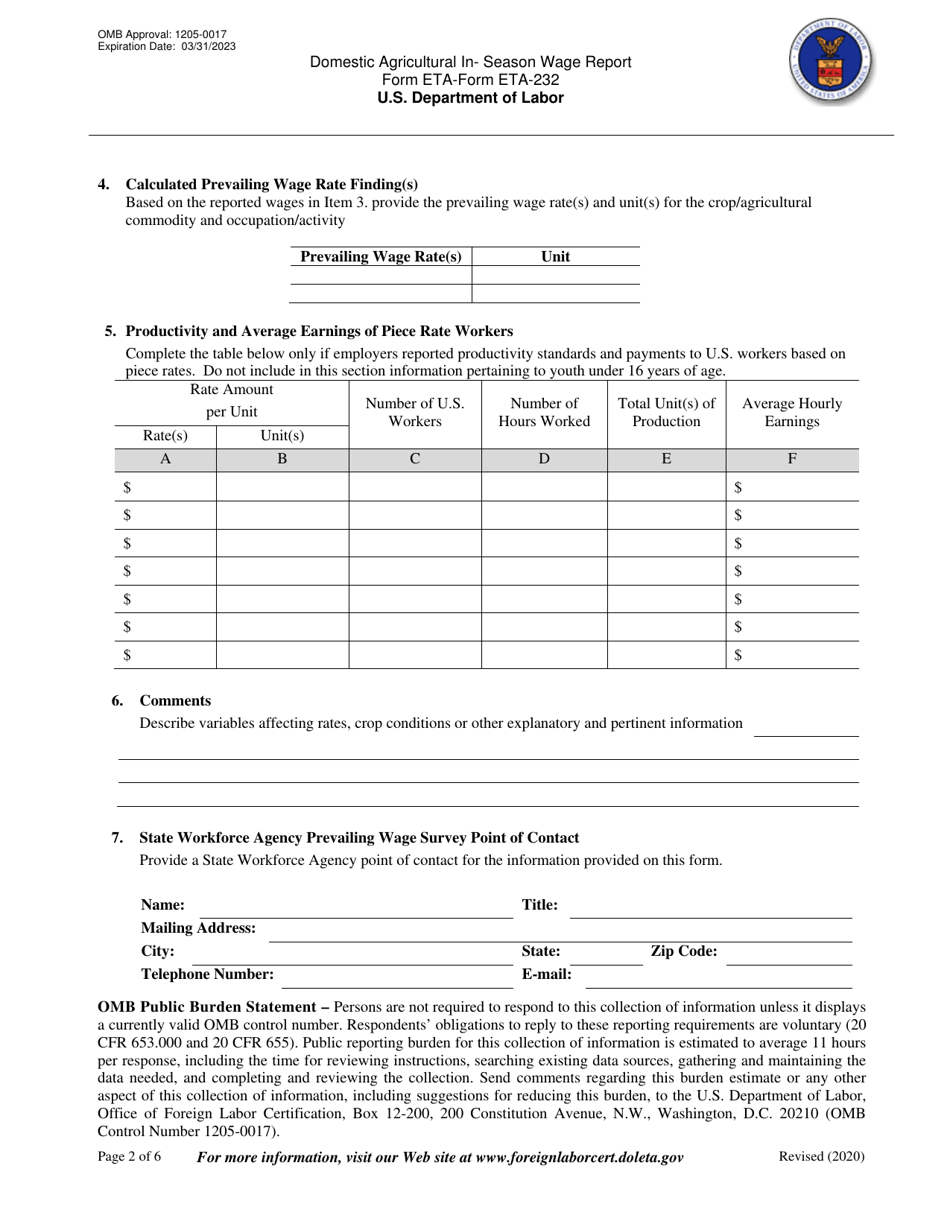

This is a legal form that was released by the U.S. Department of Labor on January 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ETA-232?

A: Form ETA-232 is the Domestic Agricultural in-Season Wage Report.

Q: What is the purpose of Form ETA-232?

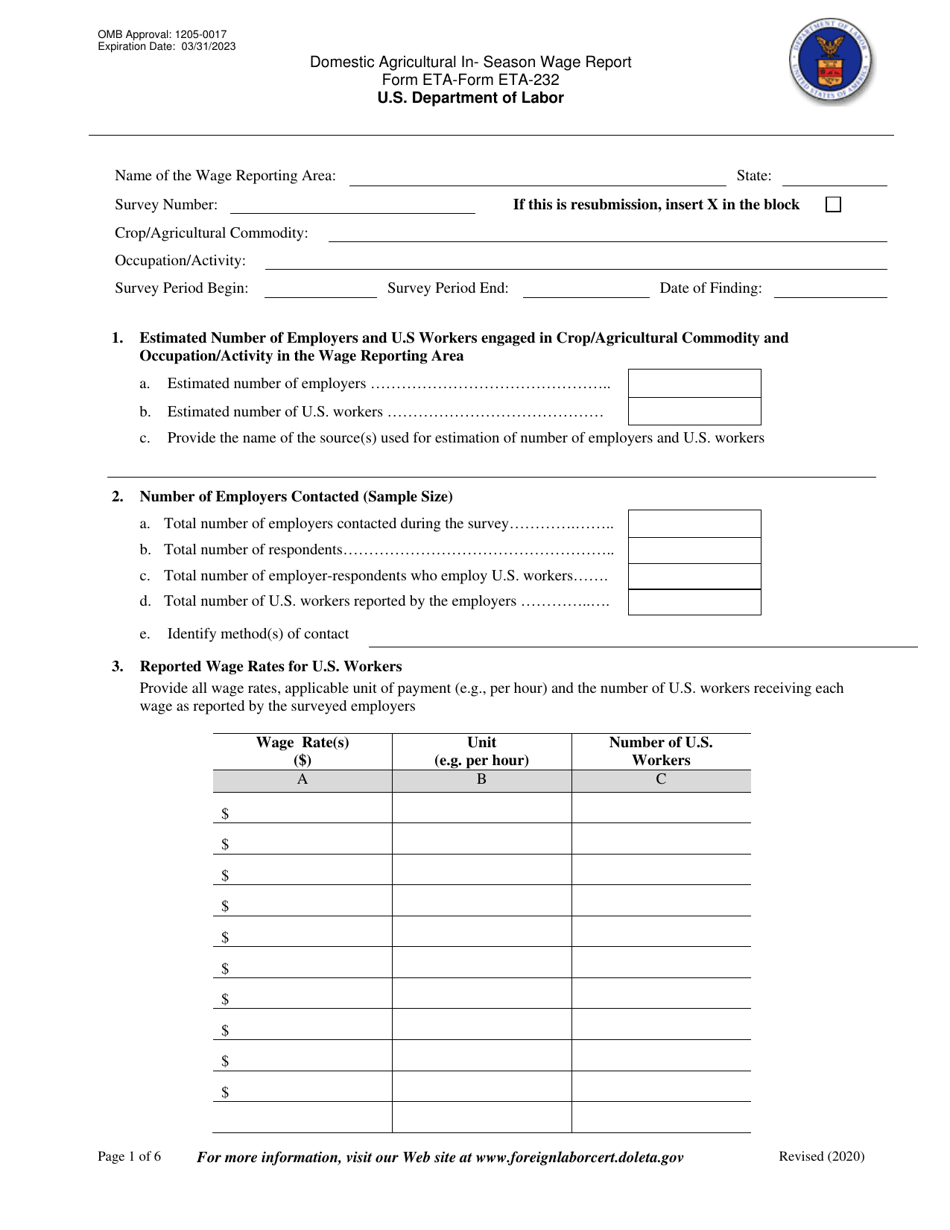

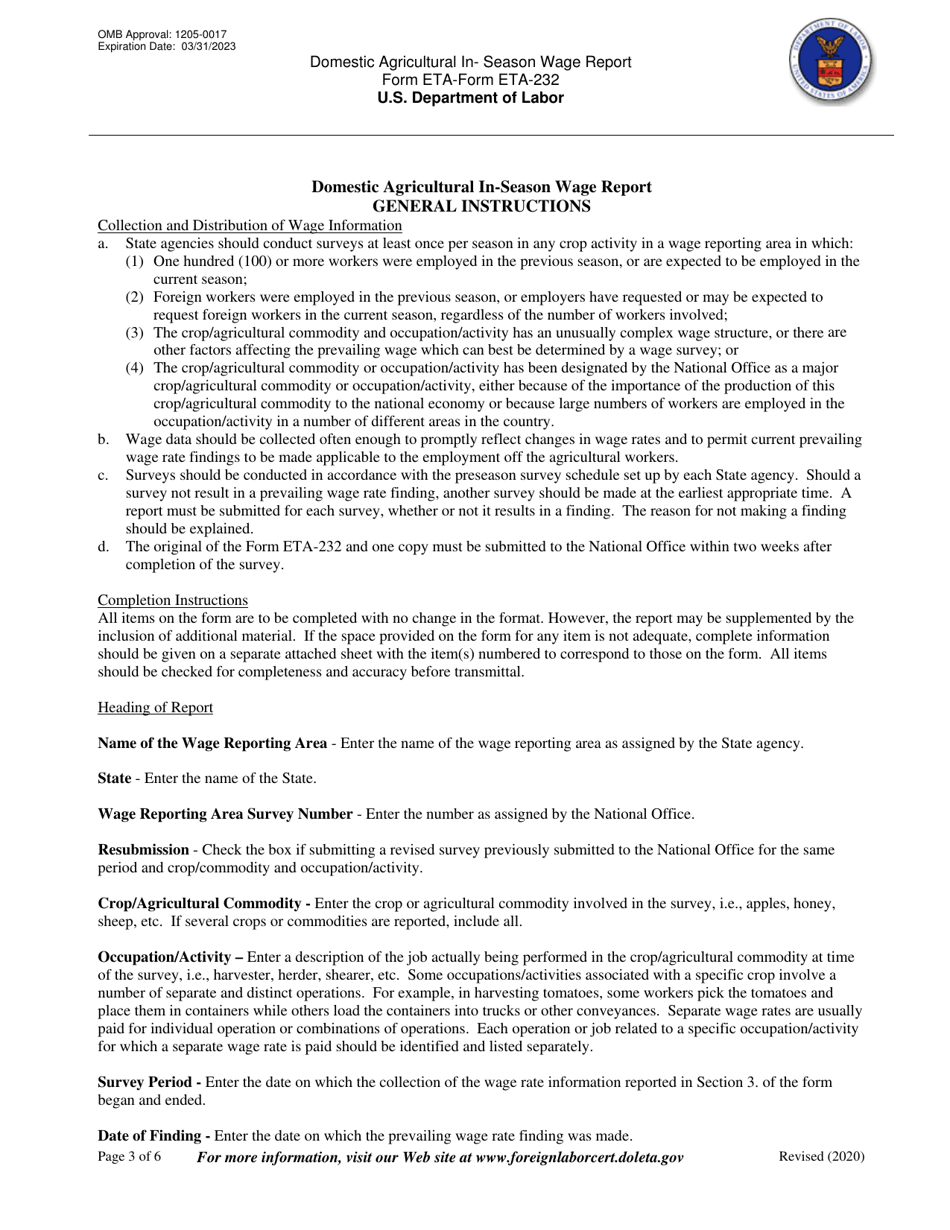

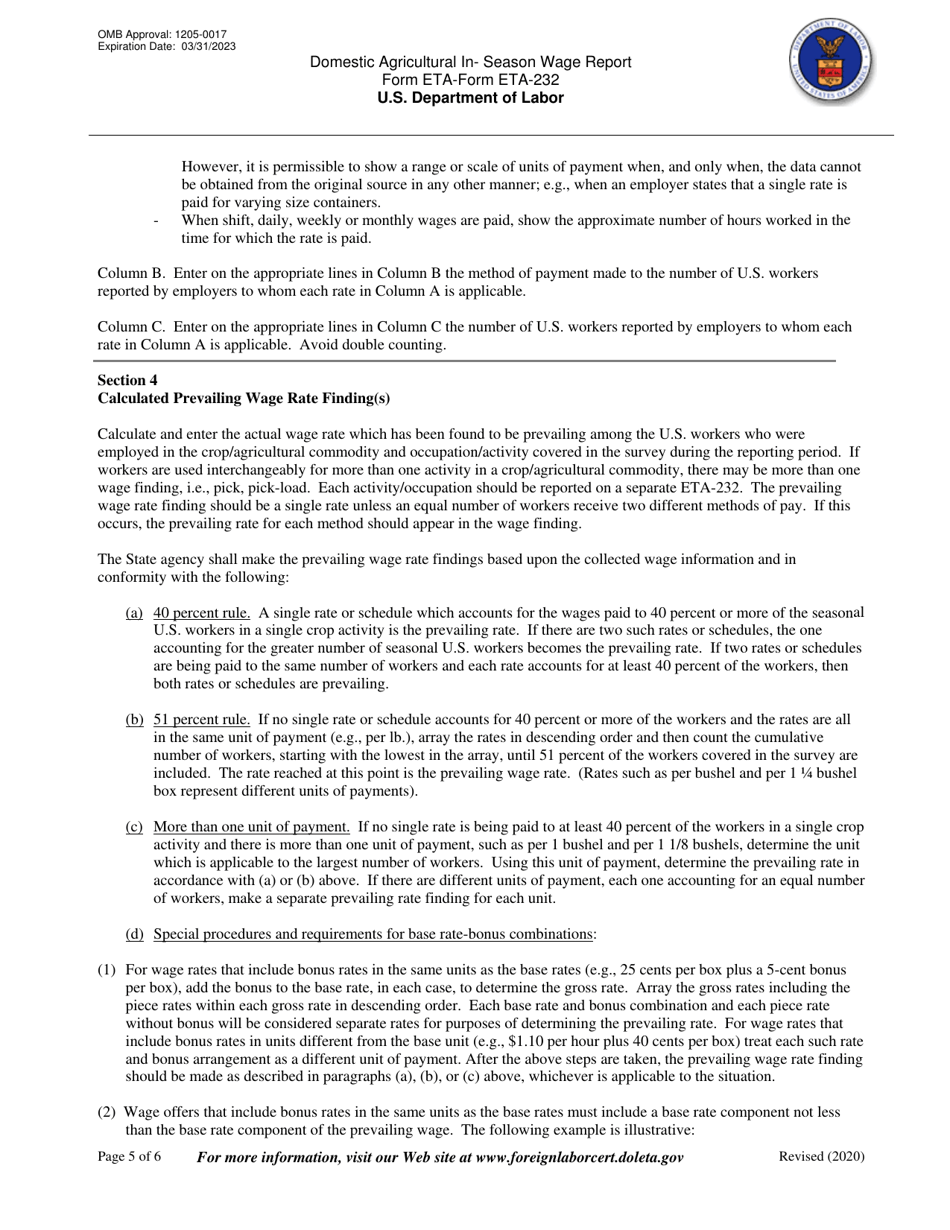

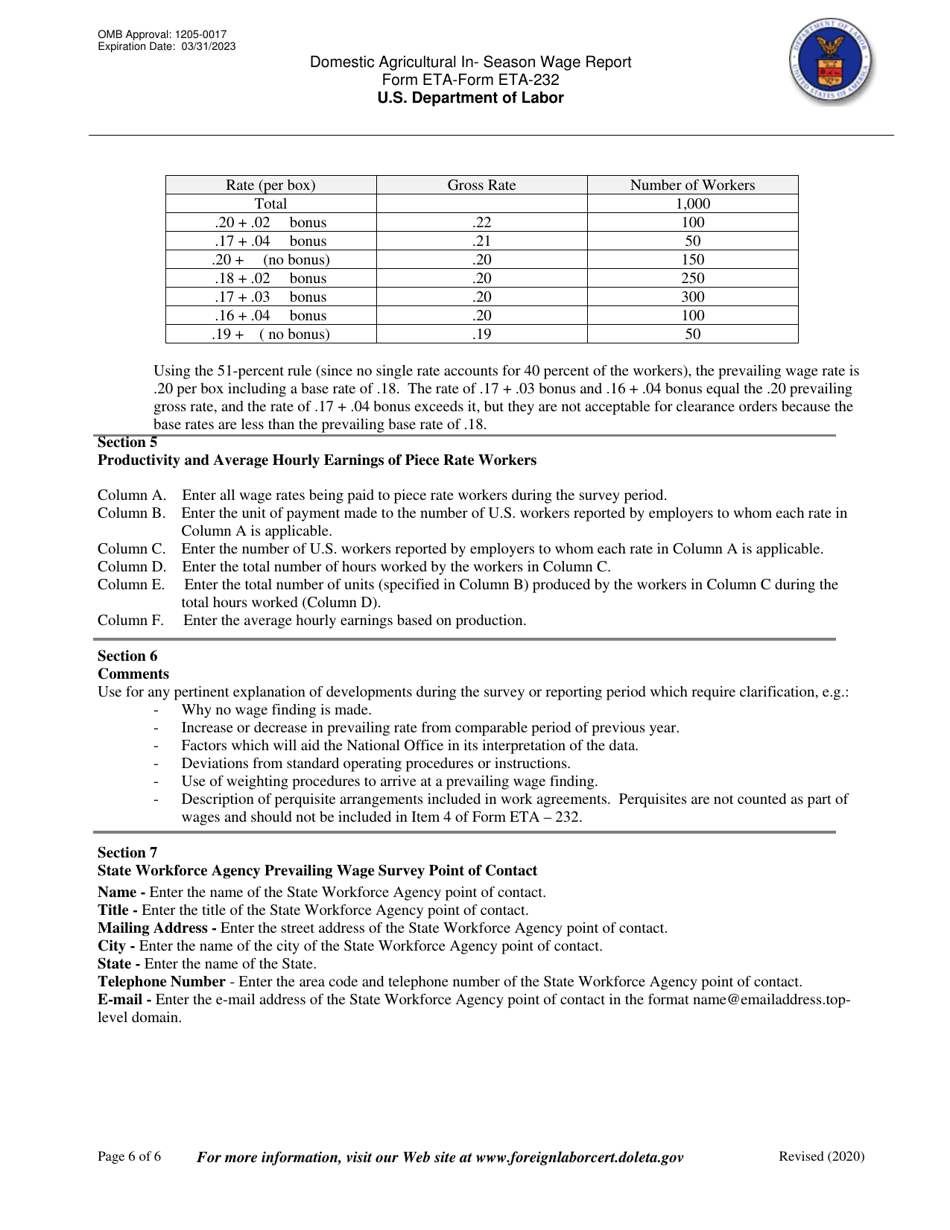

A: The purpose of Form ETA-232 is to collect data on wages paid to agricultural workers in the United States during the growing season.

Q: Who is required to submit Form ETA-232?

A: Employers who employ agricultural workers and pay them wages during the growing season are required to submit Form ETA-232.

Q: When should Form ETA-232 be submitted?

A: Form ETA-232 should be submitted on a monthly basis during the growing season, typically between the months of April and November.

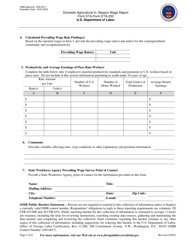

Q: What information is needed to complete Form ETA-232?

A: The form requires information such as the employer's name and contact information, the number of workers employed, the total hours worked, and the wages paid.

Q: Are there any penalties for not submitting Form ETA-232?

A: Yes, failure to submit Form ETA-232 can result in penalties and legal consequences, including fines and potential legal action.

Form Details:

- Released on January 1, 2020;

- The latest available edition released by the U.S. Department of Labor;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ETA-232 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.