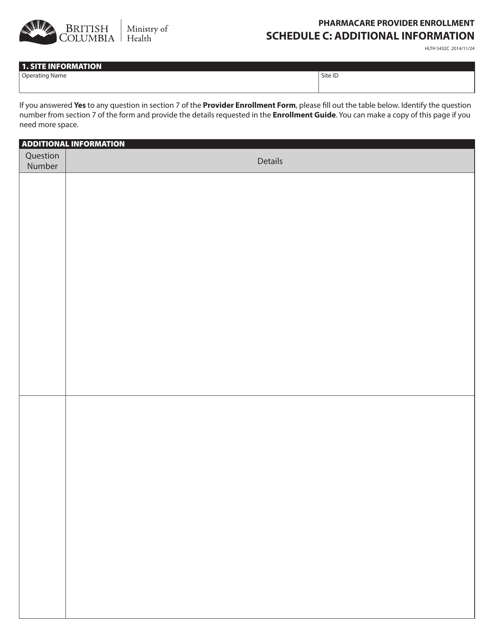

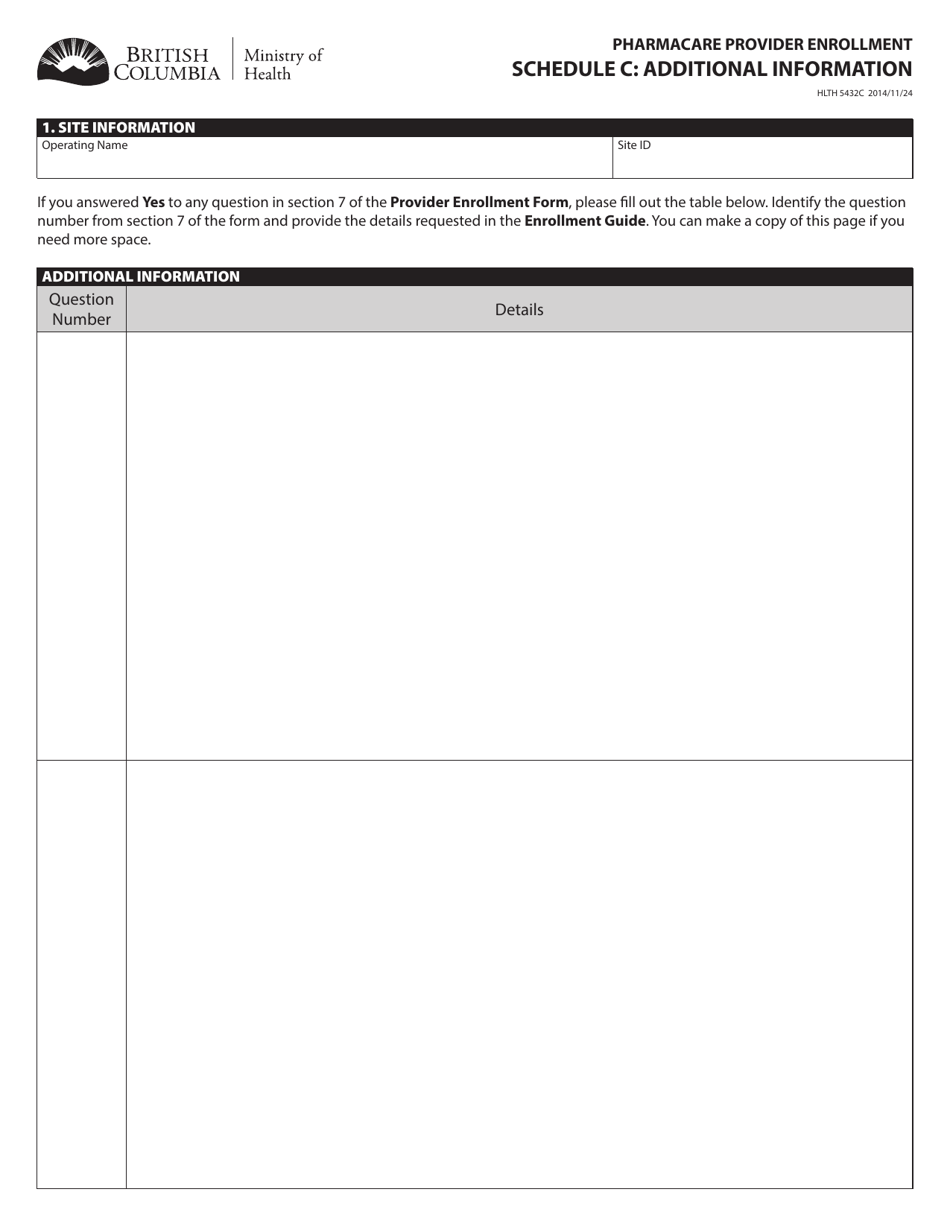

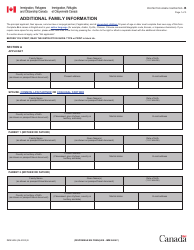

Form HLTH5432C Schedule C Additional Information - British Columbia, Canada

Form HLTH5432C Schedule C Additional Information - British Columbia, Canada is used to provide additional information related to healthcare expenses in the province of British Columbia, Canada. It helps individuals or families provide more details about their healthcare expenses when submitting their tax or benefits claims.

The Form HLTH5432C Schedule C Additional Information is filed by individuals or businesses operating in British Columbia, Canada.

FAQ

Q: What is HLTH5432C?

A: HLTH5432C is a form for reporting additional information related to Schedule C in British Columbia, Canada.

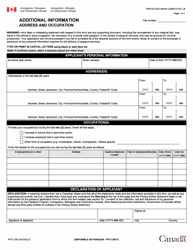

Q: What is Schedule C?

A: Schedule C is a tax form used in British Columbia, Canada, to report income and expenses related to self-employment or small business.

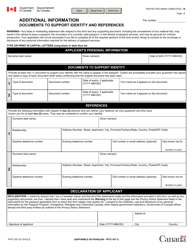

Q: Why would I need to provide additional information on HLTH5432C?

A: You may need to provide additional information on HLTH5432C if you have specific details or explanations related to the entries you made on Schedule C.

Q: Are there any specific instructions for filling out HLTH5432C?

A: Yes, there are instructions provided with the form. Make sure to read and follow them carefully to ensure accurate reporting of additional information.

Q: Is HLTH5432C required for all self-employed individuals or small businesses in British Columbia?

A: No, HLTH5432C is not required for all self-employed individuals or small businesses. It is only necessary if you have specific additional information to report on Schedule C.

Q: When is the deadline for filing HLTH5432C?

A: The deadline for filing HLTH5432C is usually the same as the deadline for filing your annual income tax return in Canada, which is April 30th for most individuals.