This version of the form is not currently in use and is provided for reference only. Download this version of

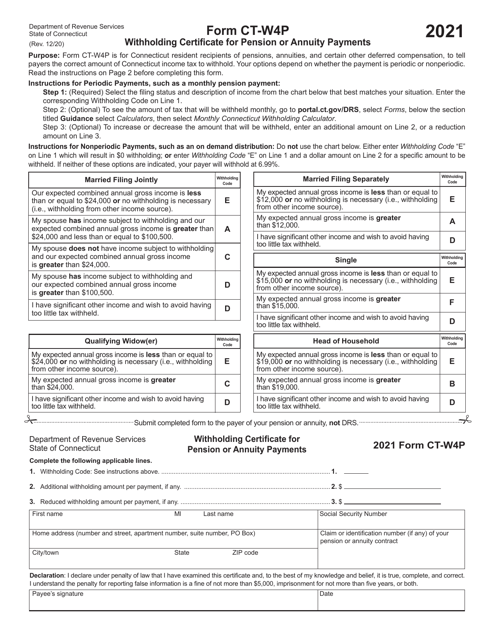

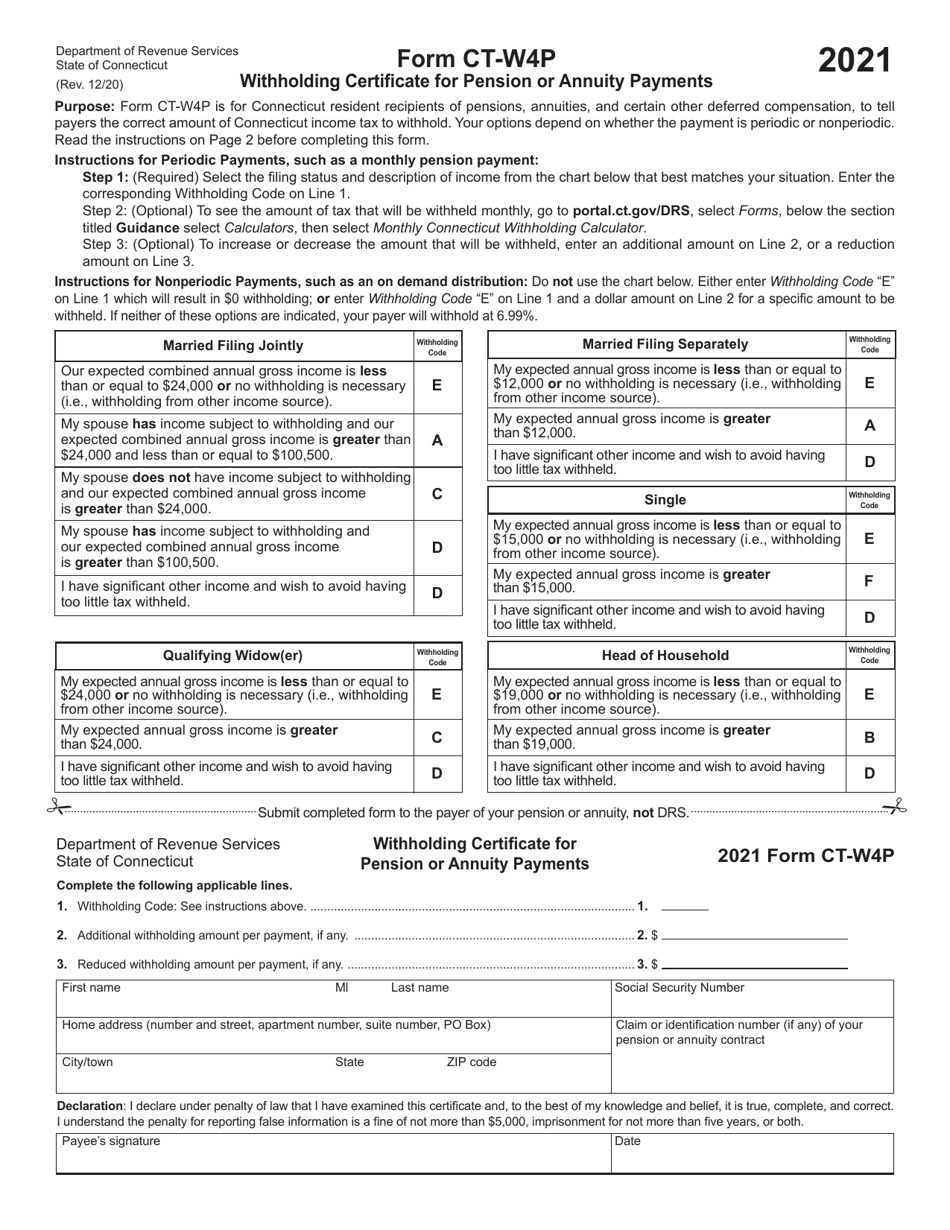

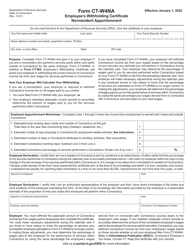

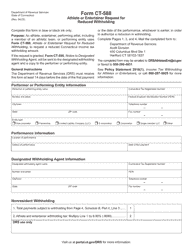

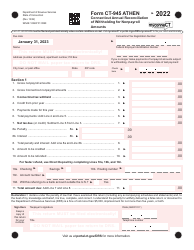

Form CT-W4P

for the current year.

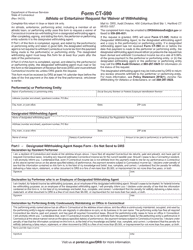

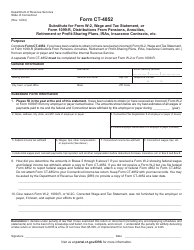

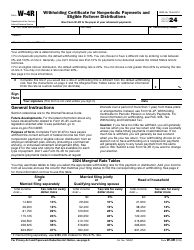

Form CT-W4P Withholding Certificate for Pension or Annuity Payments - Connecticut

What Is Form CT-W4P?

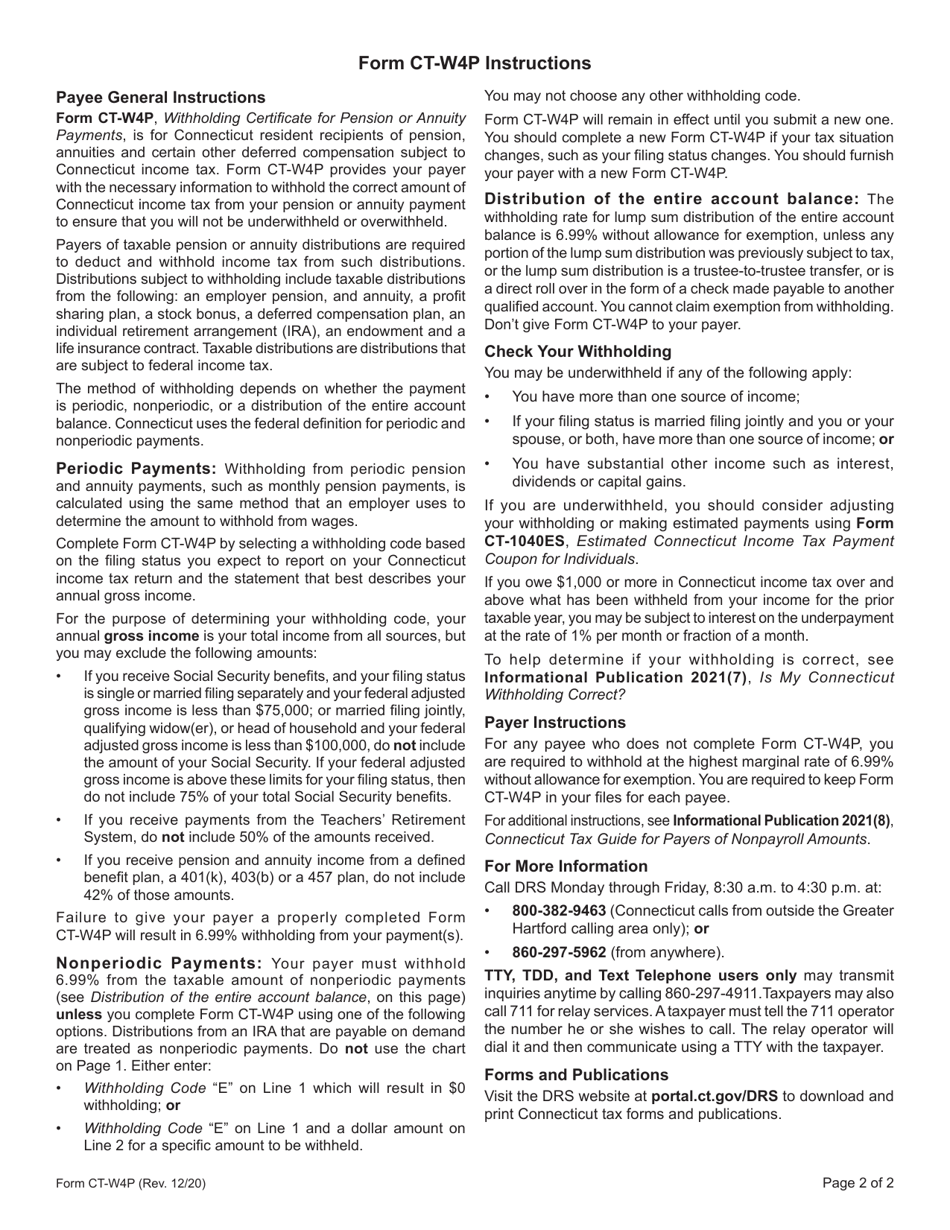

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-W4P?

A: Form CT-W4P is a withholding certificate used for pension or annuity payments in the state of Connecticut.

Q: Who needs to fill out Form CT-W4P?

A: Anyone who receives pension or annuity payments in Connecticut and wants to specify their withholding tax amount.

Q: What information is required on Form CT-W4P?

A: Form CT-W4P requires your personal information, such as name, address, and social security number, as well as instructions for withholding tax.

Q: How do I submit Form CT-W4P?

A: Form CT-W4P should be completed and submitted to the payer of your pension or annuity.

Q: Can I change my withholding amount on Form CT-W4P?

A: Yes, you can adjust your withholding amount by filling out a new Form CT-W4P and submitting it to the payer.

Q: Is Form CT-W4P specific to Connecticut only?

A: Yes, Form CT-W4P is specific to pension or annuity payments in the state of Connecticut.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-W4P by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.