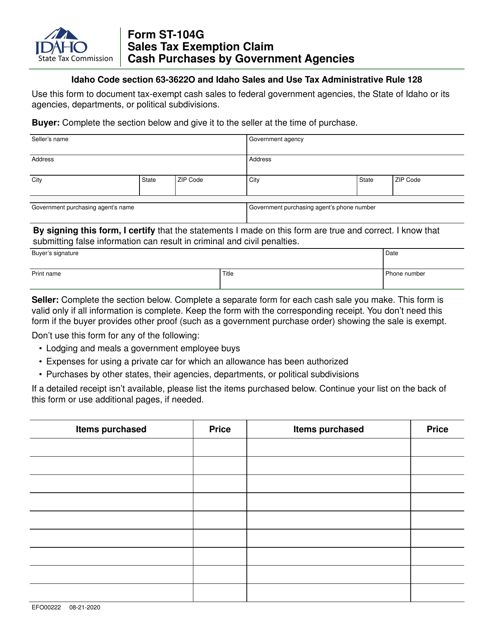

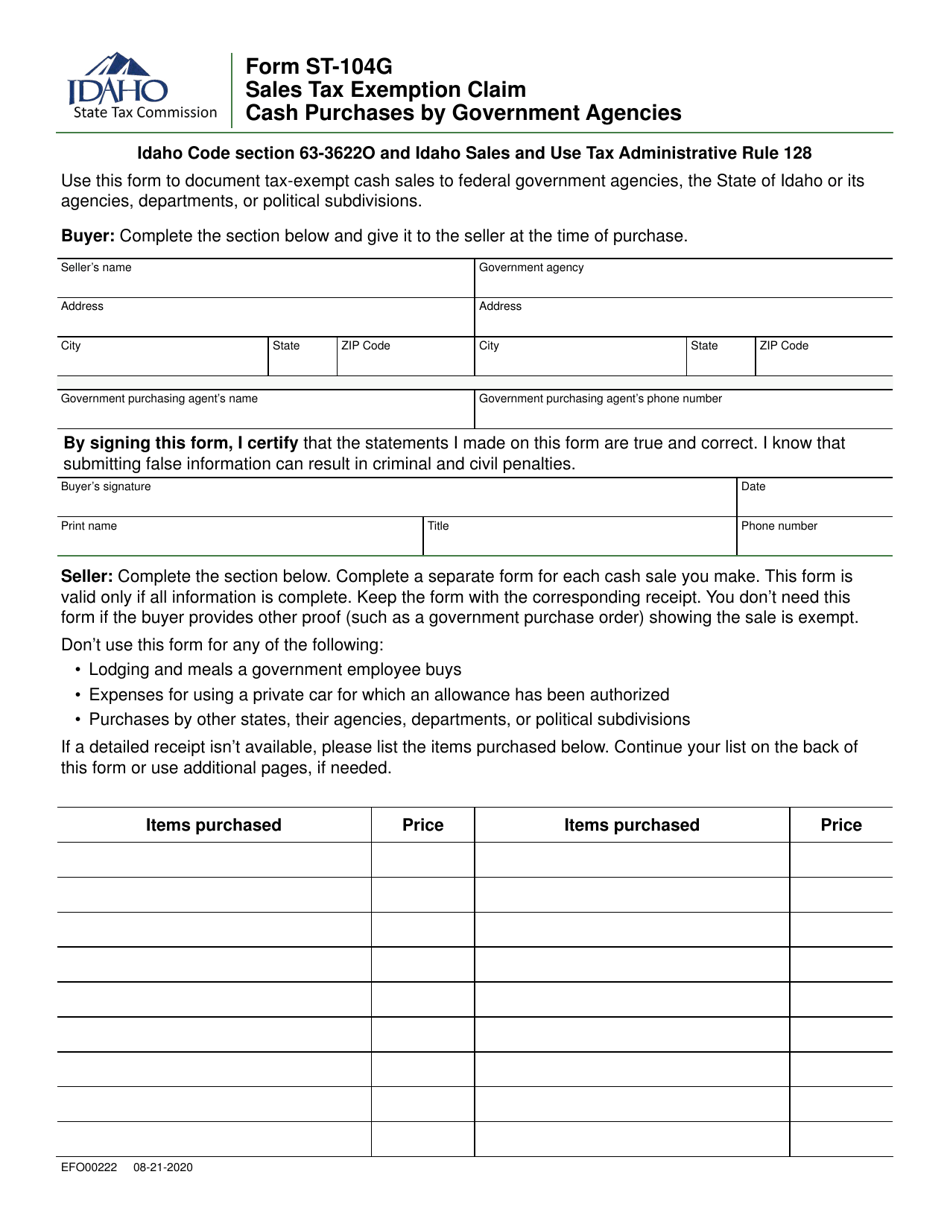

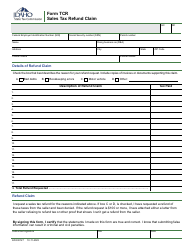

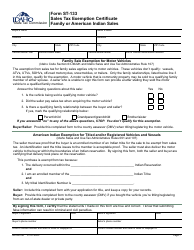

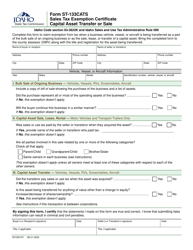

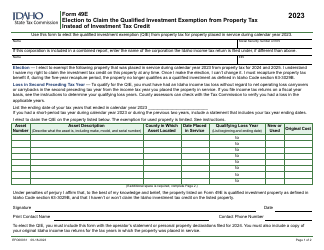

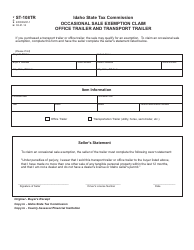

Form ST-104G (EFO00222) Sales Tax Exemption Claim - Cash Purchases by Government Agencies - Idaho

What Is Form ST-104G (EFO00222)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-104G?

A: Form ST-104G is a Sales TaxExemption Claim used for cash purchases by government agencies in Idaho.

Q: Who can use Form ST-104G?

A: Government agencies in Idaho can use Form ST-104G for claiming sales tax exemption on cash purchases.

Q: What is the purpose of Form ST-104G?

A: The purpose of Form ST-104G is to claim sales tax exemption on cash purchases made by government agencies in Idaho.

Q: Are all cash purchases by government agencies exempt from sales tax in Idaho?

A: Yes, all cash purchases made by government agencies in Idaho are exempt from sales tax.

Q: Is Form ST-104G specific to Idaho?

A: Yes, Form ST-104G is specific to Idaho and is used for sales tax exemption claims on cash purchases by government agencies.

Form Details:

- Released on August 21, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-104G (EFO00222) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.