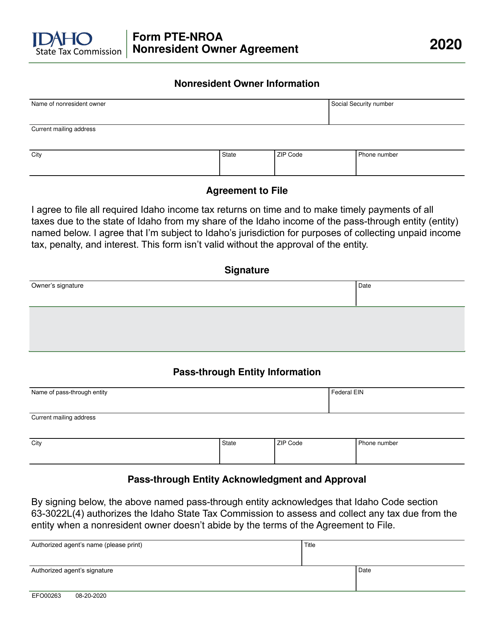

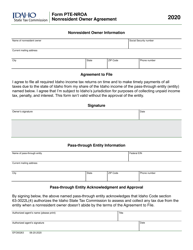

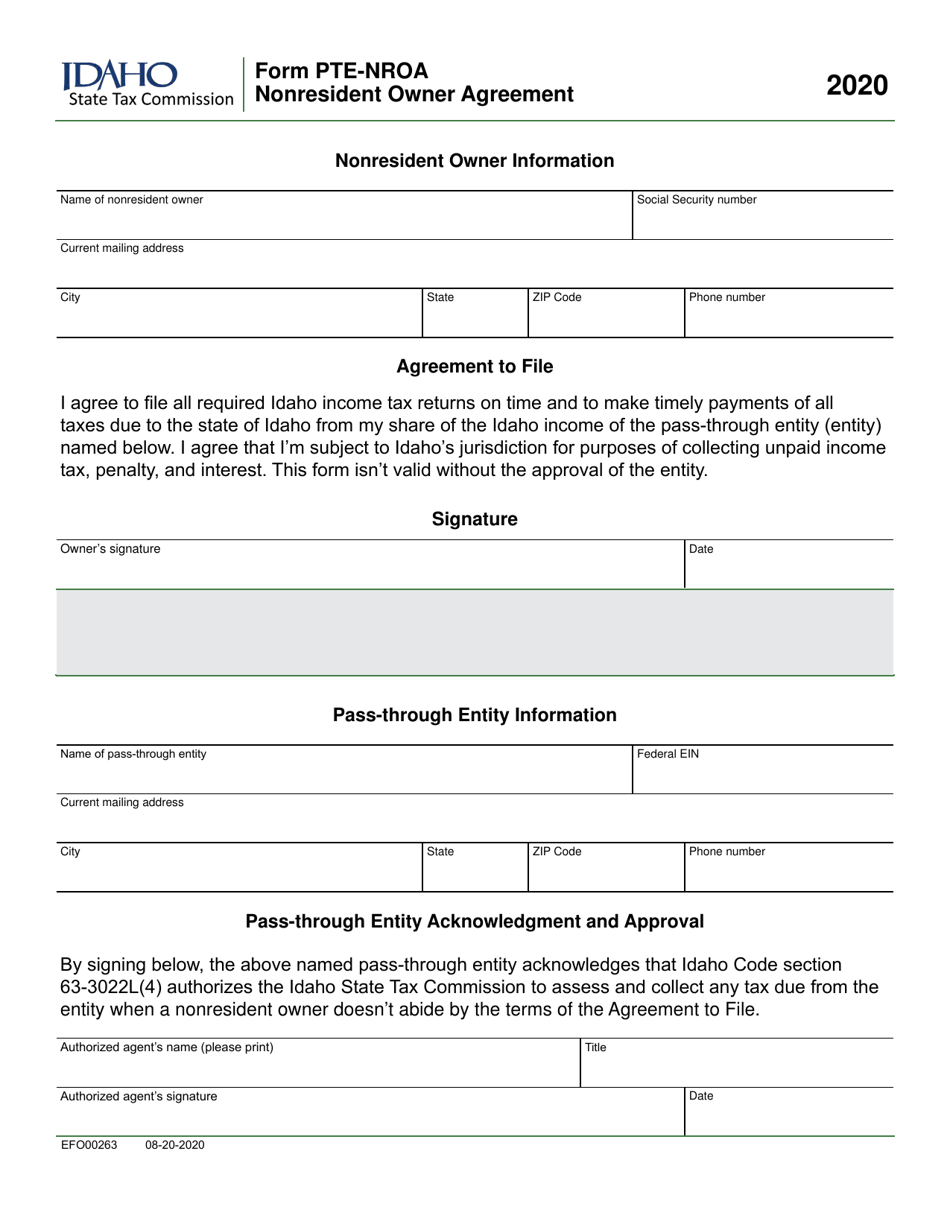

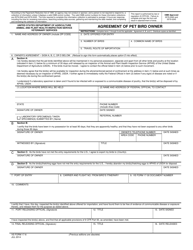

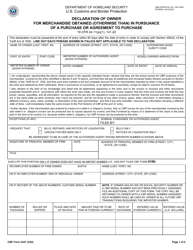

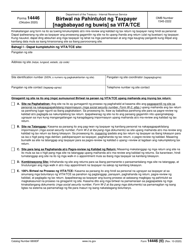

Form PRE-NROA (EFO00263) Nonresident Owner Agreement - Idaho

What Is Form PRE-NROA (EFO00263)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

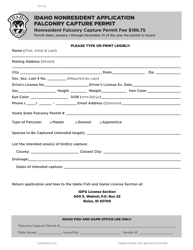

Q: What is the purpose of the PRE-NROA (EFO00263) Nonresident Owner Agreement?

A: The purpose of the PRE-NROA (EFO00263) Nonresident Owner Agreement is to establish an agreement between a nonresident owner and the state of Idaho.

Q: Who is required to submit the PRE-NROA (EFO00263) Nonresident Owner Agreement?

A: Nonresident owners of property in Idaho are required to submit the PRE-NROA (EFO00263) Nonresident Owner Agreement.

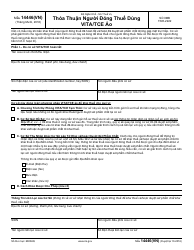

Q: What information is required in the PRE-NROA (EFO00263) Nonresident Owner Agreement?

A: The PRE-NROA (EFO00263) Nonresident Owner Agreement requires information such as the owner's name, contact information, property details, and proof of property ownership.

Q: What is the deadline for submitting the PRE-NROA (EFO00263) Nonresident Owner Agreement?

A: The deadline for submitting the PRE-NROA (EFO00263) Nonresident Owner Agreement may vary, but it is typically required to be submitted by April 15th of each year.

Q: What are the consequences of not submitting the PRE-NROA (EFO00263) Nonresident Owner Agreement?

A: Failure to submit the PRE-NROA (EFO00263) Nonresident Owner Agreement may result in penalties or additional taxes imposed by the state of Idaho.

Form Details:

- Released on August 20, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PRE-NROA (EFO00263) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.