This version of the form is not currently in use and is provided for reference only. Download this version of

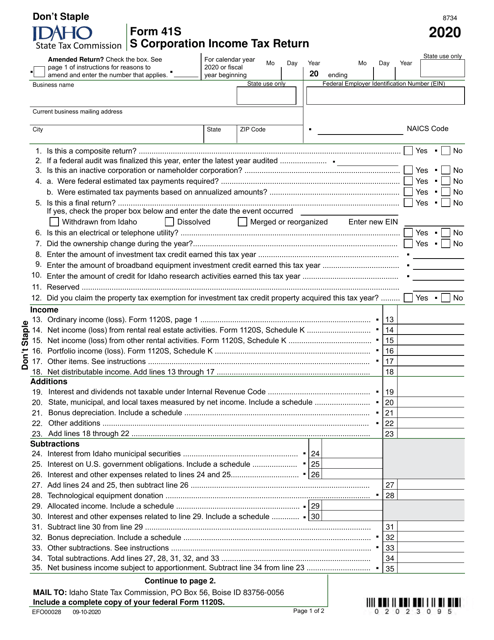

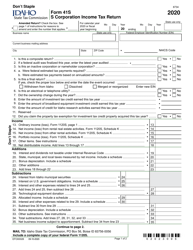

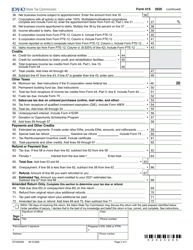

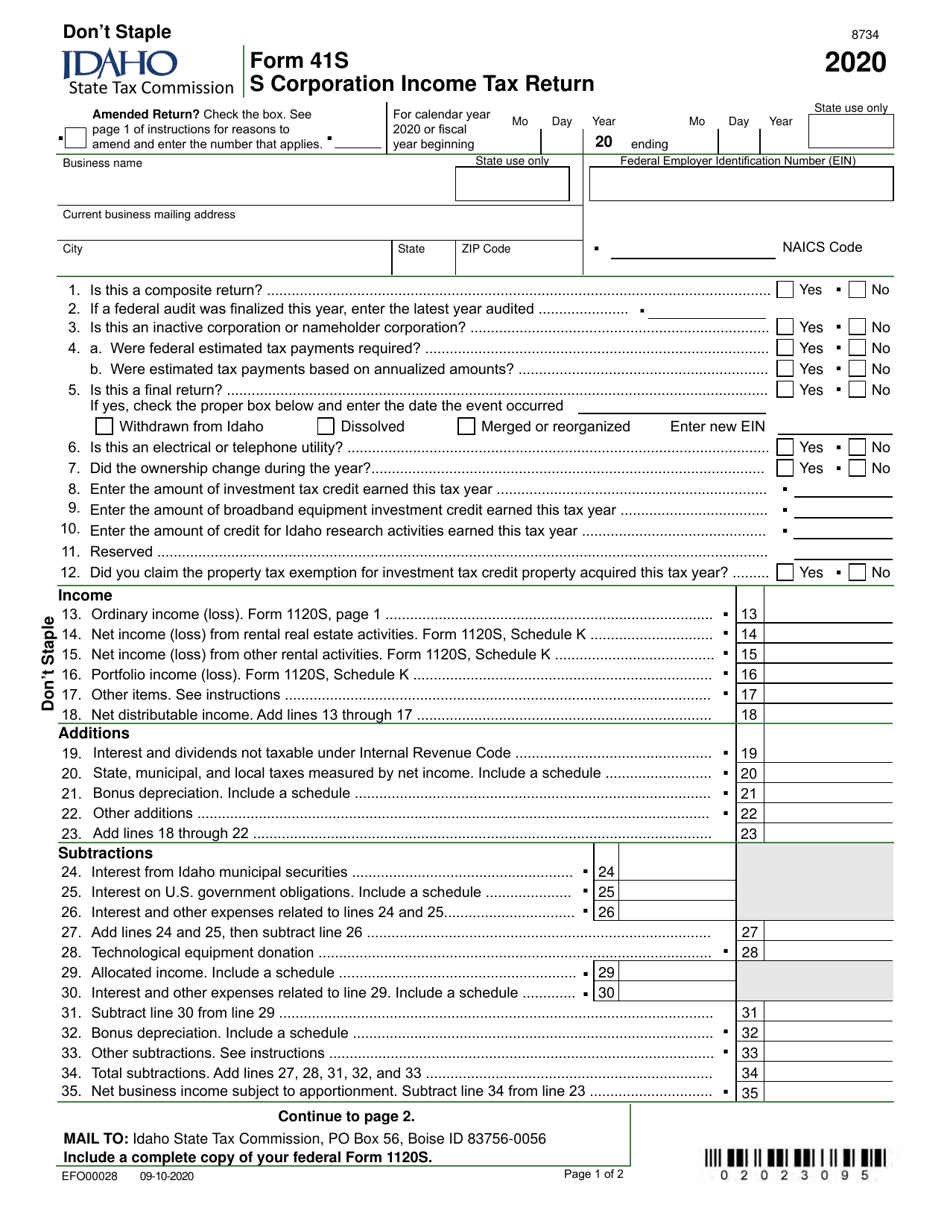

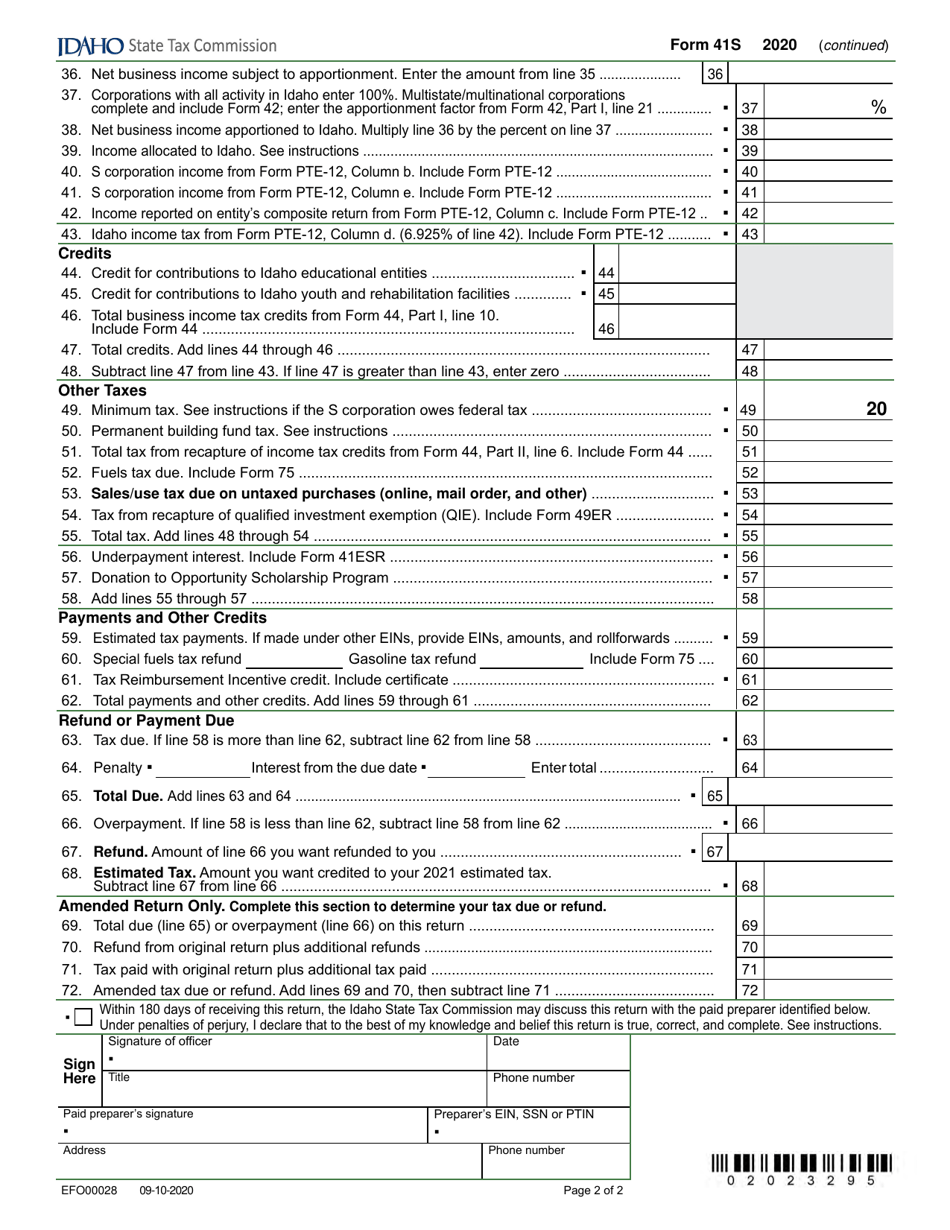

Form 41S (EFO00028)

for the current year.

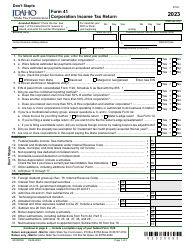

Form 41S (EFO00028) S Corporation Income Tax Return - Idaho

What Is Form 41S (EFO00028)?

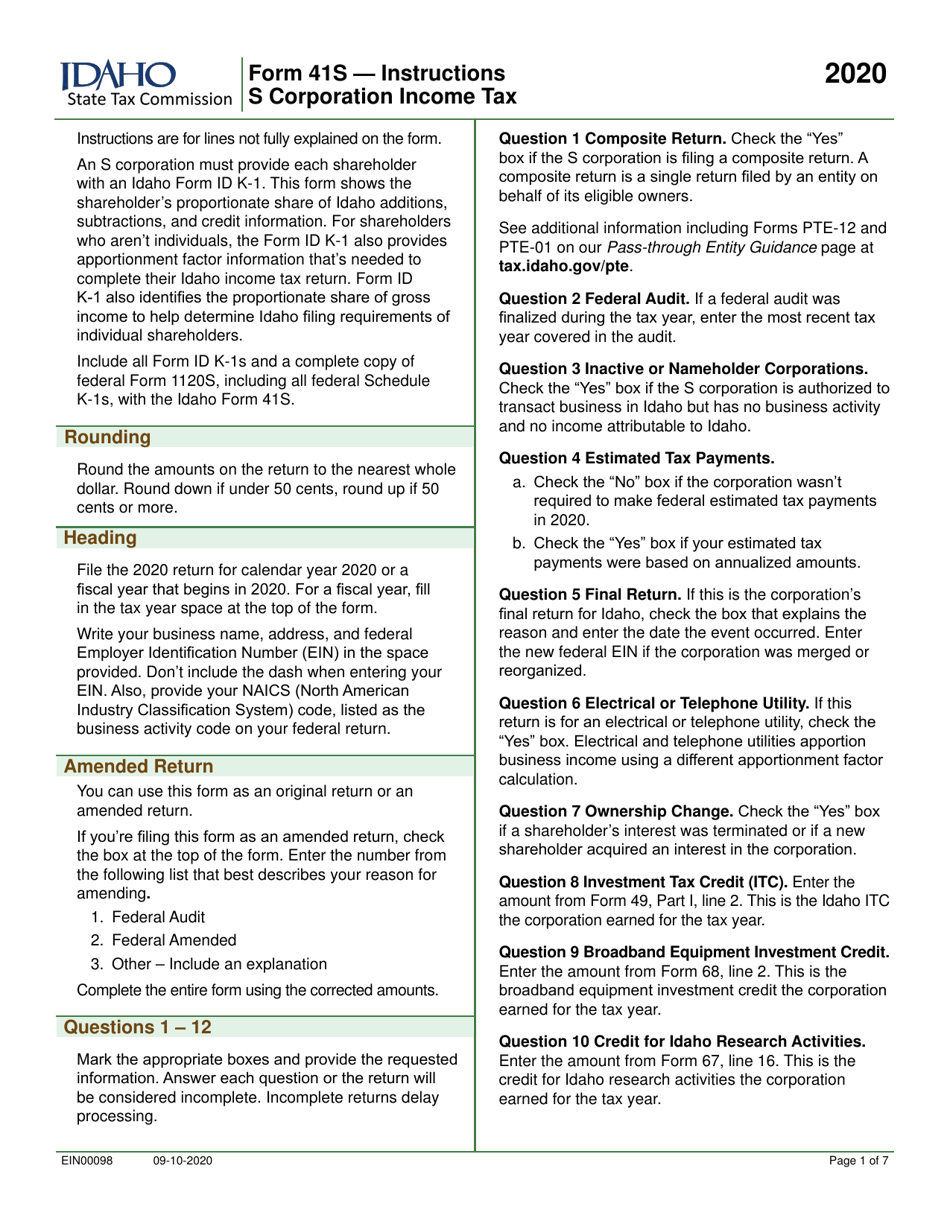

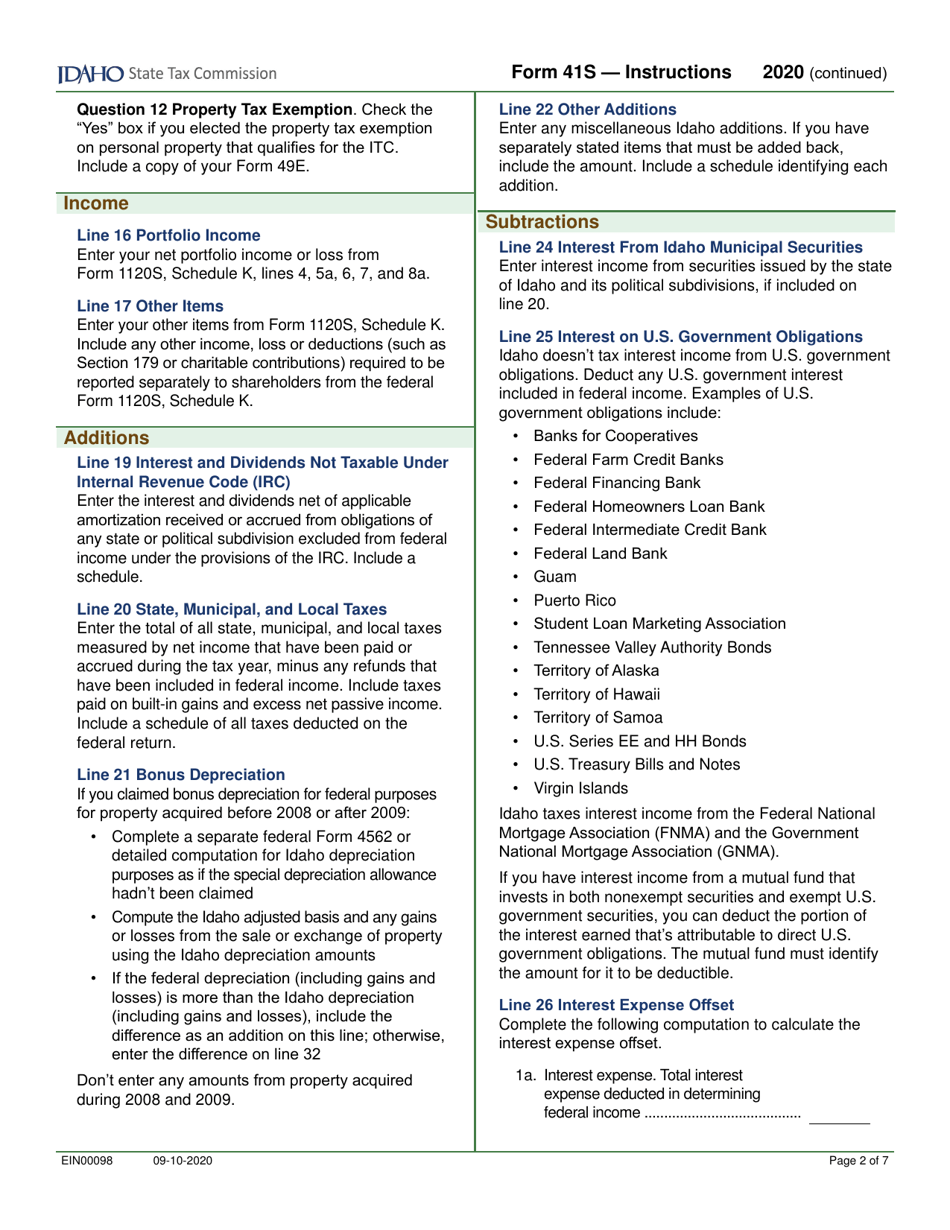

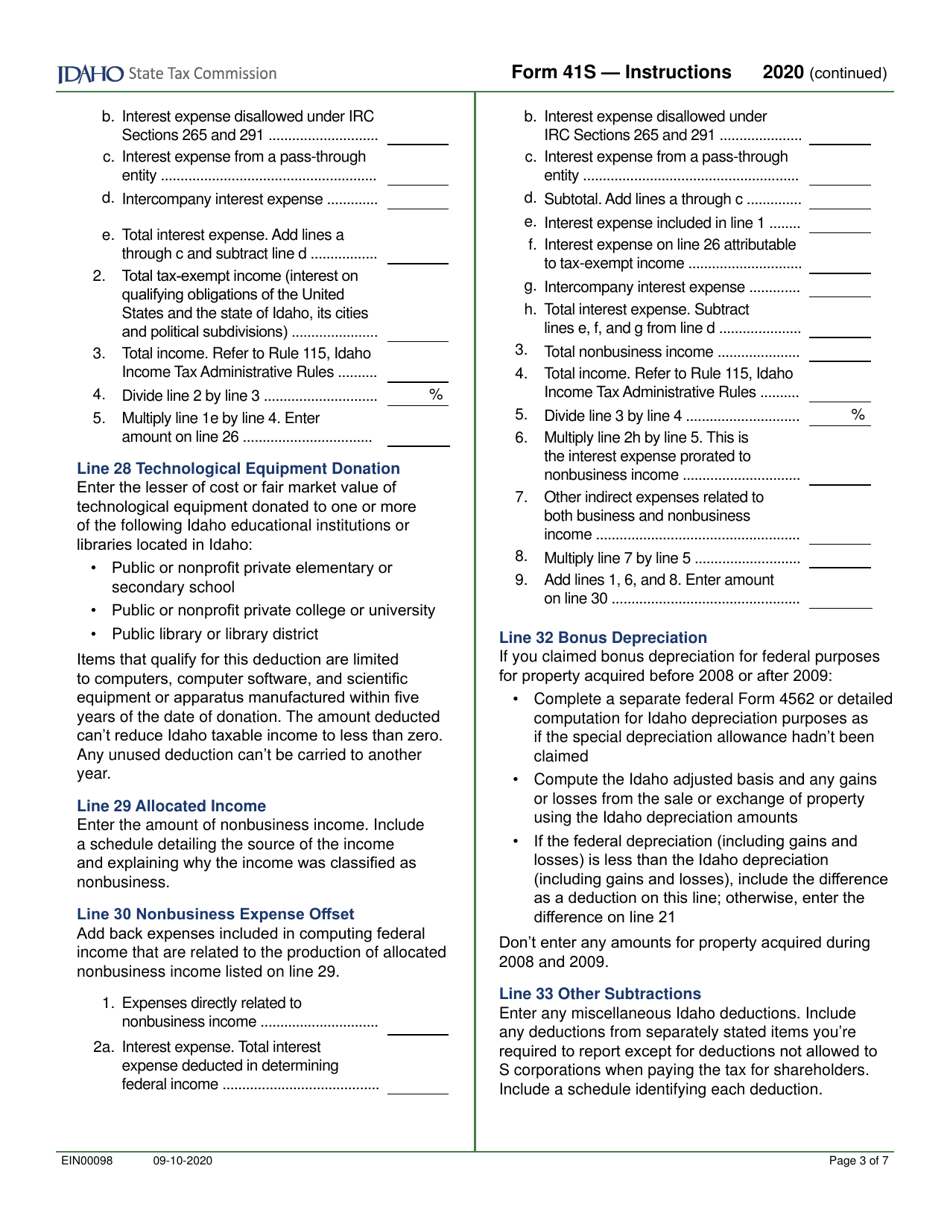

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41S?

A: Form 41S is the S Corporation Income Tax Return for the state of Idaho.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: Who needs to file Form 41S?

A: S Corporations that are doing business or earning income in the state of Idaho need to file Form 41S.

Q: Is Form 41S the same as the federal S Corporation tax return?

A: No, Form 41S is specific to the state of Idaho and is separate from the federal S Corporation tax return.

Q: Are there any filing deadlines for Form 41S?

A: Yes, the due date for filing Form 41S is on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any fees associated with filing Form 41S?

A: Yes, there may be a filing fee for Form 41S. You should check with the Idaho State Tax Commission for the current fee schedule.

Q: What if I need an extension to file Form 41S?

A: If you need more time to file Form 41S, you can request an extension by filing Form 51 with the Idaho State Tax Commission.

Q: What supporting documents do I need to submit with Form 41S?

A: You should attach a copy of your federal S Corporation tax return (Form 1120S) and any other required schedules or forms as specified by the Idaho State Tax Commission.

Form Details:

- Released on September 10, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41S (EFO00028) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.