This version of the form is not currently in use and is provided for reference only. Download this version of

Form 84R (EFO00015)

for the current year.

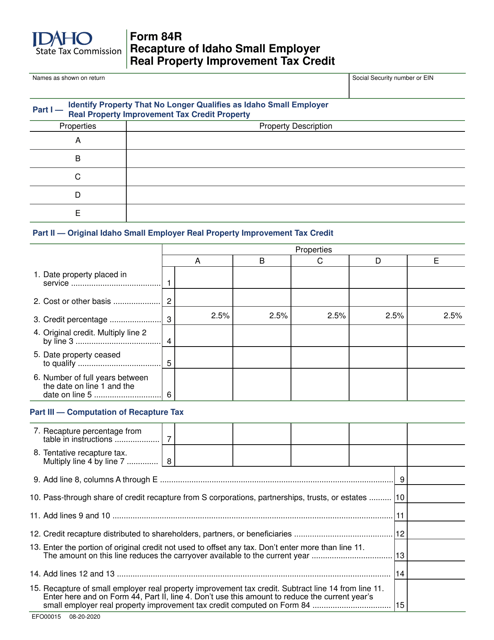

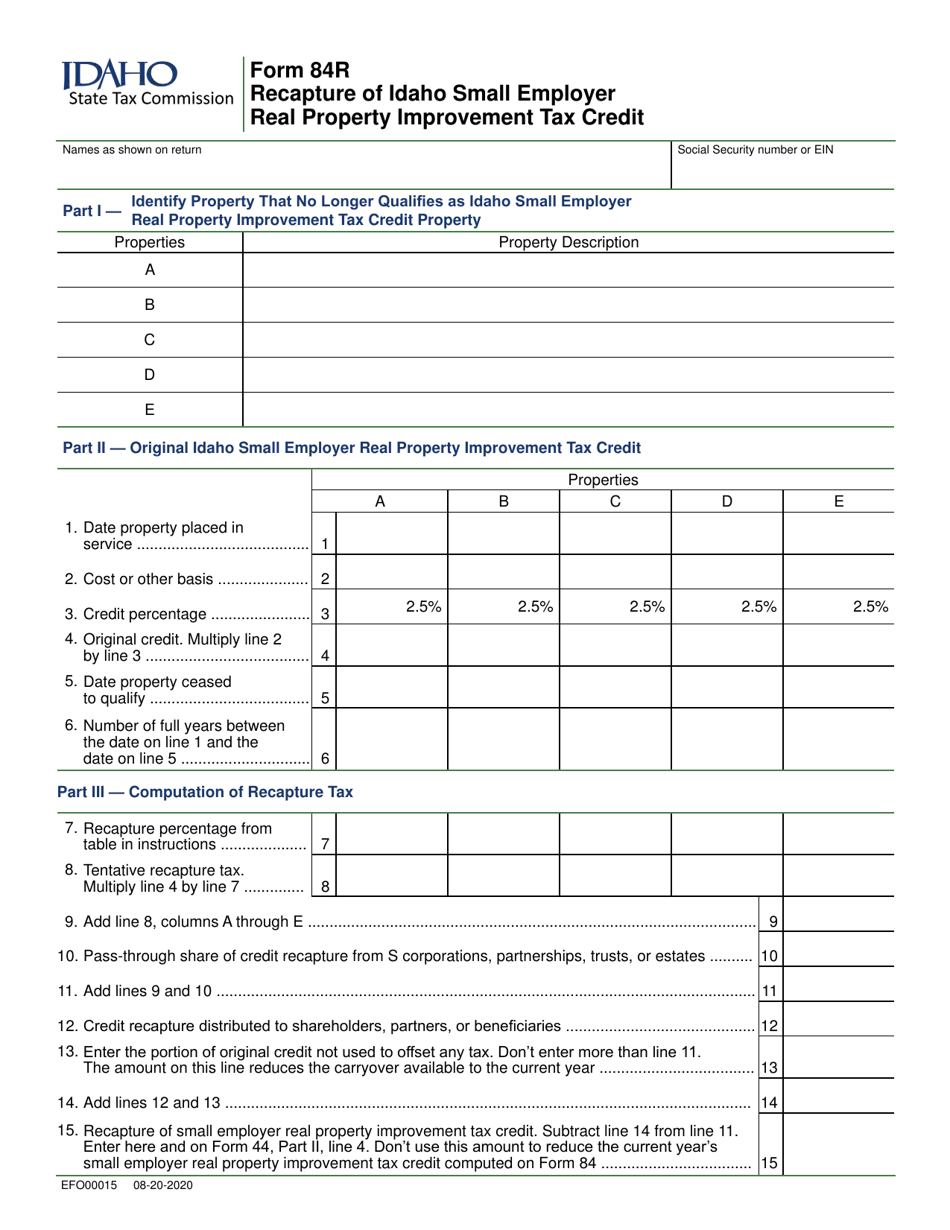

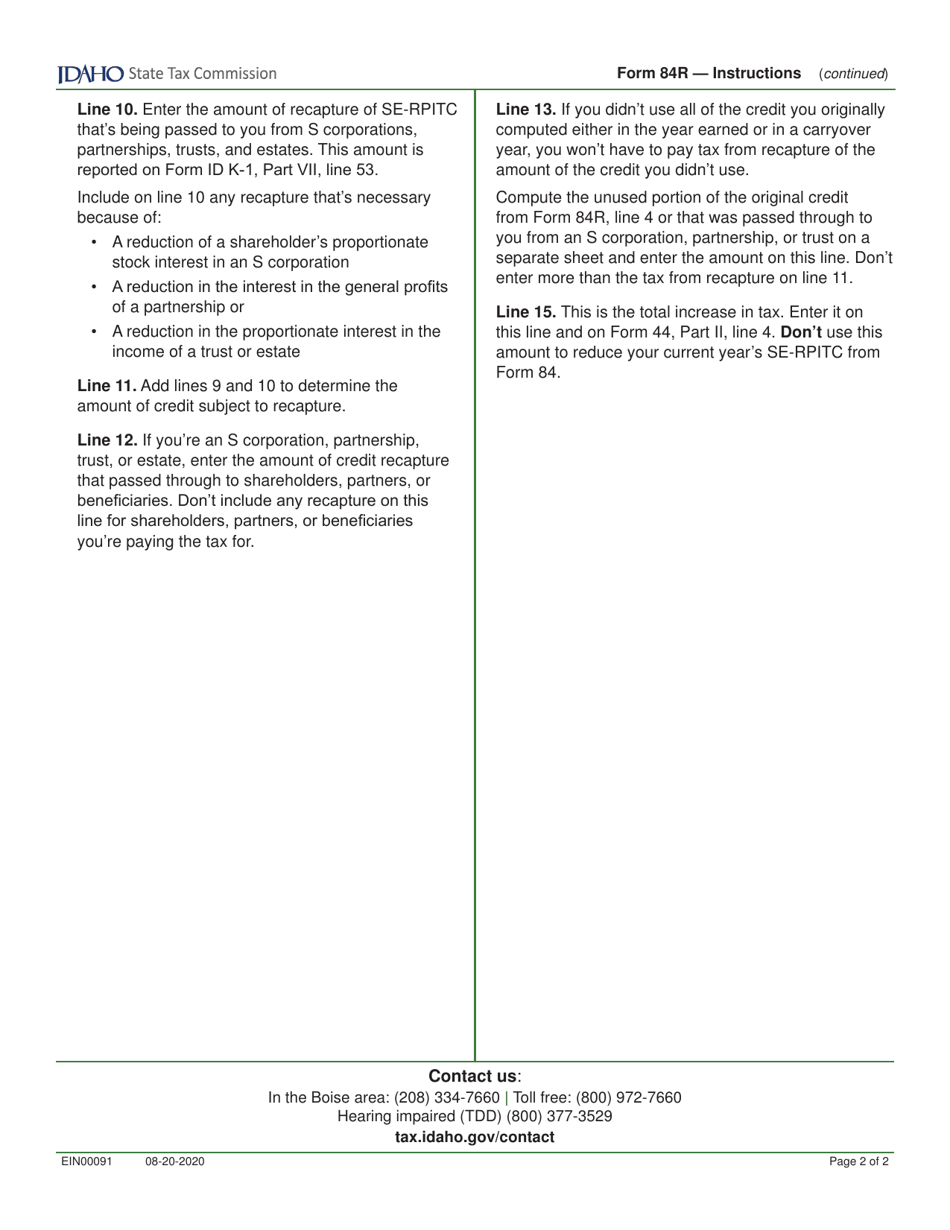

Form 84R (EFO00015) Recapture of Idaho Small Employer Real Property Improvement Tax Credit - Idaho

What Is Form 84R (EFO00015)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

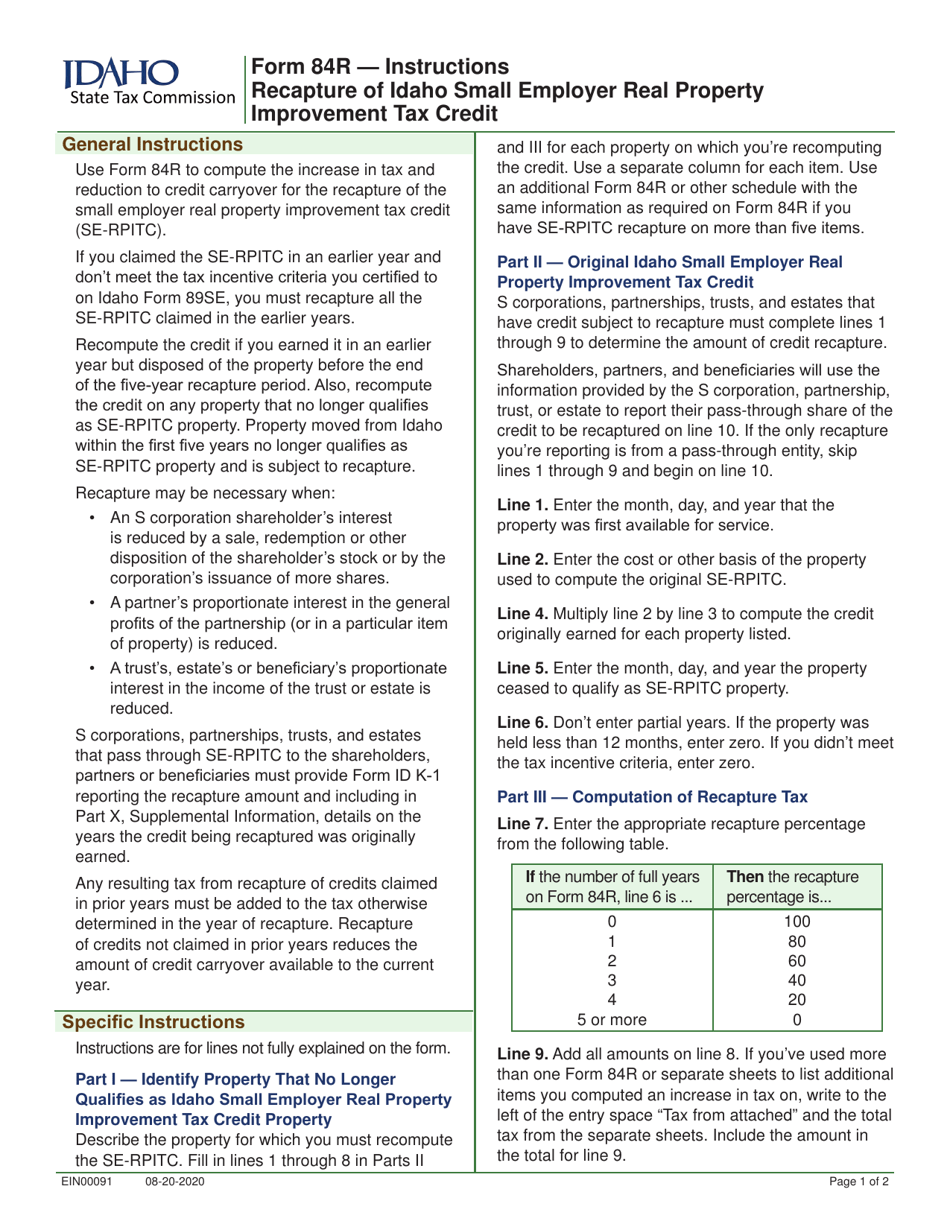

Q: What is Form 84R (EFO00015)?

A: Form 84R (EFO00015) is a tax form used to recapture the Idaho Small Employer Real Property ImprovementTax Credit.

Q: What is the Idaho Small Employer Real Property Improvement Tax Credit?

A: The Idaho Small Employer Real Property Improvement Tax Credit is a tax credit available to small employers in Idaho who make qualified improvements to their real property.

Q: Who needs to use Form 84R (EFO00015)?

A: Small employers in Idaho who have claimed the Idaho Small Employer Real Property Improvement Tax Credit need to use Form 84R (EFO00015) to recapture any unused portion of the credit.

Q: What is the purpose of recapturing the tax credit?

A: The purpose of recapturing the tax credit is to ensure that the credit is not claimed for improvements that are no longer in use or have been sold.

Form Details:

- Released on August 20, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 84R (EFO00015) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.