This version of the form is not currently in use and is provided for reference only. Download this version of

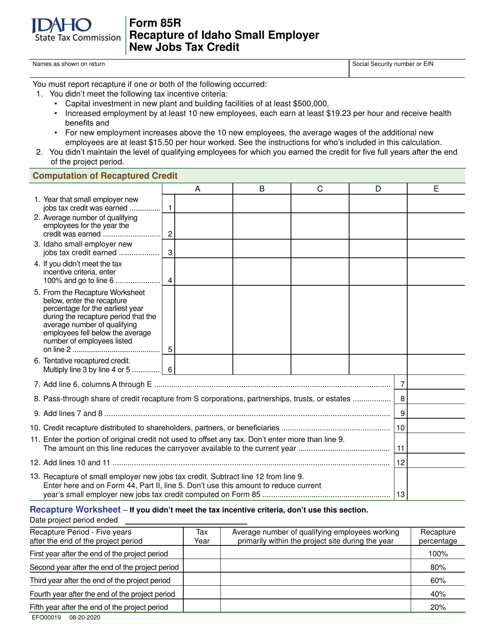

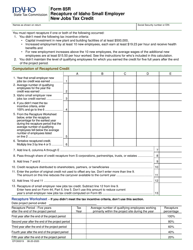

Form 85R (EFO00019)

for the current year.

Form 85R (EFO00019) Recapture of Idaho Small Employer New Jobs Tax Credit - Idaho

What Is Form 85R (EFO00019)?

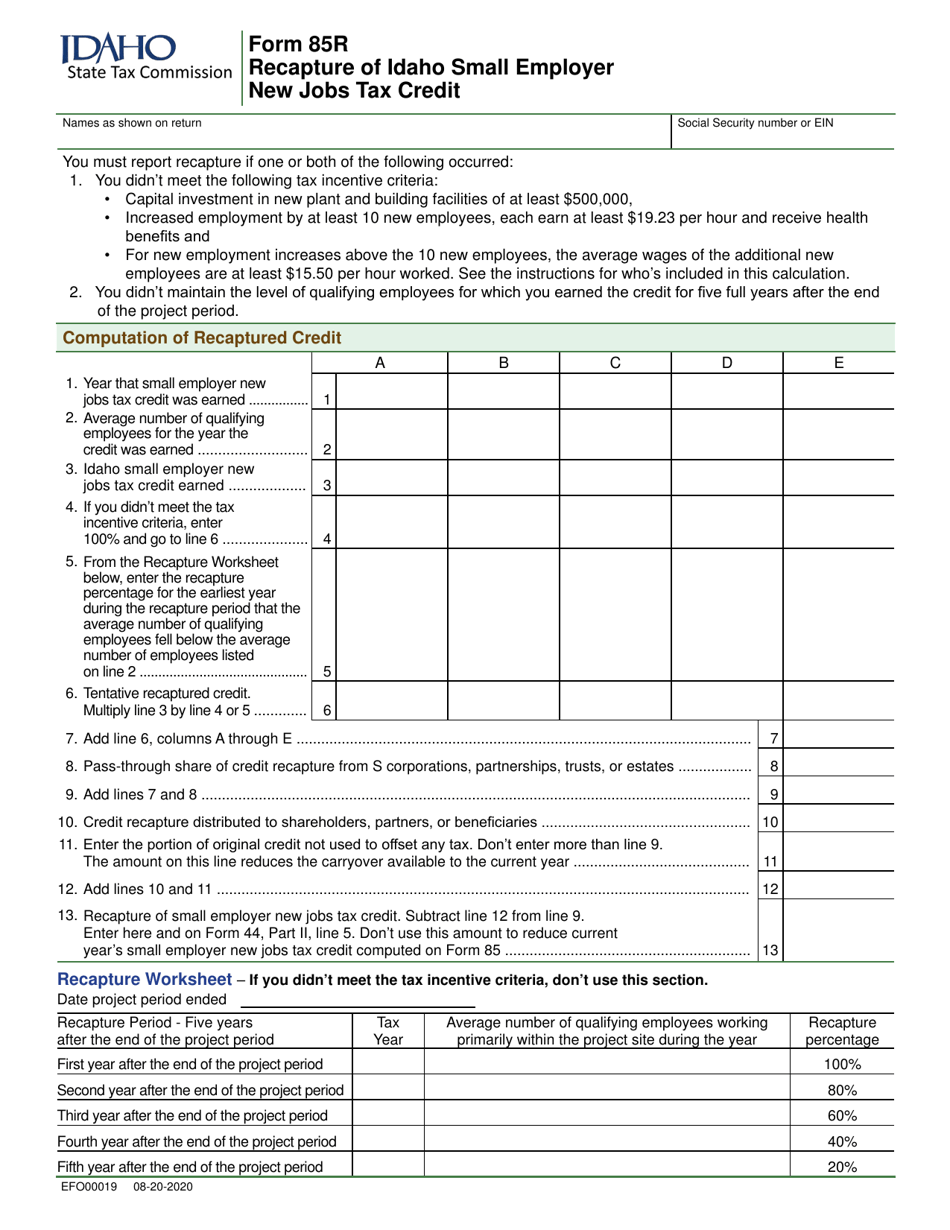

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 85R (EFO00019)?

A: Form 85R (EFO00019) is the Recapture of Idaho Small Employer New Jobs Tax Credit form.

Q: What is the purpose of Form 85R (EFO00019)?

A: The purpose of Form 85R (EFO00019) is to recapture the tax credit previously claimed by small employers in Idaho for creating new jobs.

Q: Who needs to file Form 85R (EFO00019)?

A: Small employers in Idaho who previously claimed the Small Employer New Jobs Tax Credit and no longer qualify for the credit need to file Form 85R (EFO00019).

Q: What is the Small Employer New Jobs Tax Credit in Idaho?

A: The Small Employer New Jobs Tax Credit in Idaho is a tax credit available to small employers who create qualified new jobs in the state.

Q: What does 'recapture' mean in the context of Form 85R (EFO00019)?

A: Recapture means that small employers who claimed the tax credit but no longer qualify for it must pay back a portion or all of the credit they previously received.

Q: Are there any specific requirements for filing Form 85R (EFO00019)?

A: Yes, there are specific requirements outlined in the instructions provided with the form. Employers should carefully review the instructions to ensure they meet all the necessary criteria.

Q: When is the deadline for filing Form 85R (EFO00019)?

A: The deadline for filing Form 85R (EFO00019) varies and depends on various factors. It is important to check the instructions or contact the Idaho State Tax Commission for the specific deadline.

Q: What happens if I don't file Form 85R (EFO00019) when required?

A: If you don't file Form 85R (EFO00019) when required, you may incur penalties and interest, and you will still be responsible for repaying the amount of the tax credit.

Form Details:

- Released on August 20, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 85R (EFO00019) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.