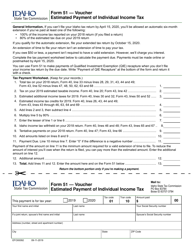

Instructions for Form 41ES, EFO00026 Estimated Tax Payment / Extension of Time Payment Business Income Tax - Idaho

This document contains official instructions for Form 41ES , and Form EFO00026 . Both forms are released and collected by the Idaho State Tax Commission. An up-to-date fillable Form 41ES (EFO00026) is available for download through this link.

FAQ

Q: What is Form 41ES?

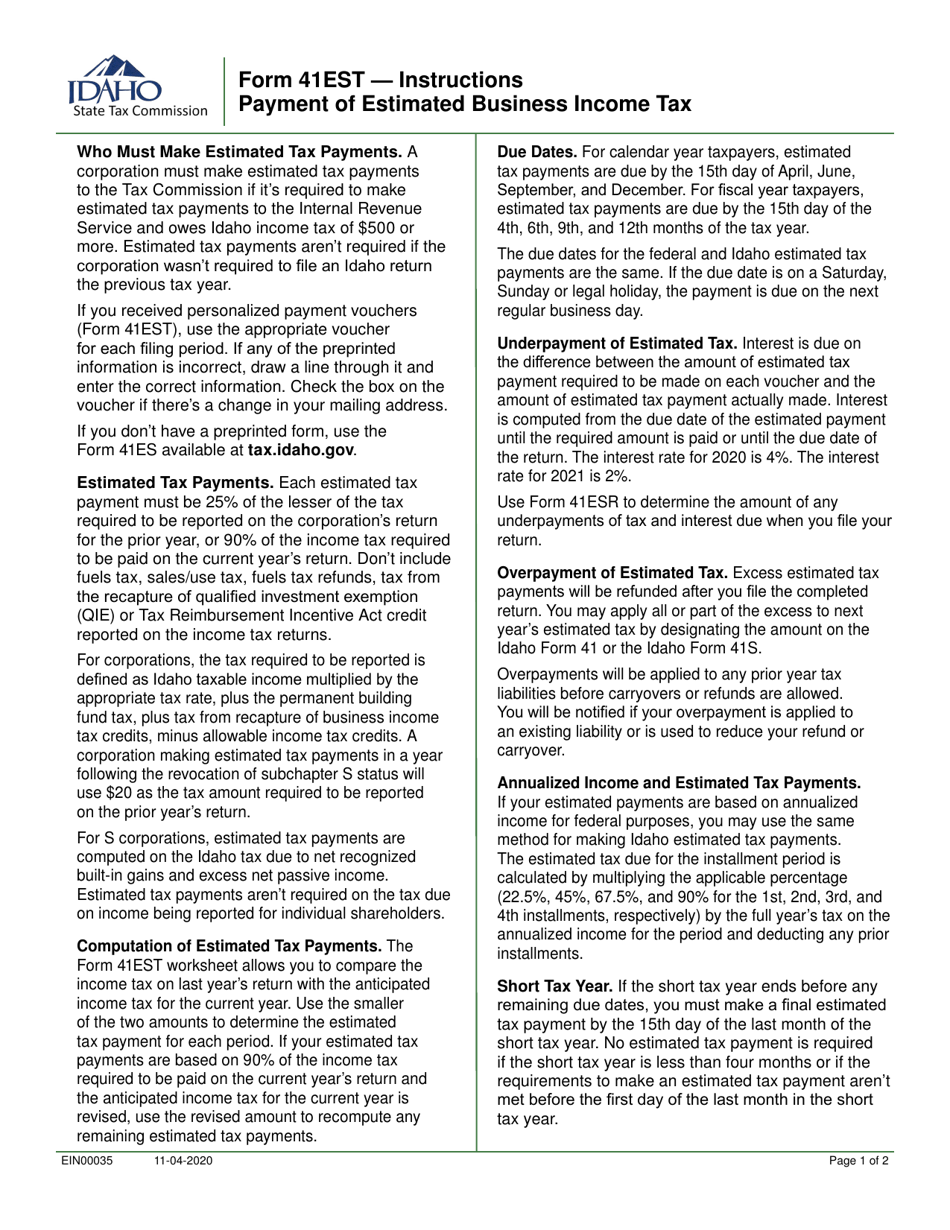

A: Form 41ES is a form used for making estimated tax payments or requesting an extension of time to pay business income tax in Idaho.

Q: Who needs to file Form 41ES?

A: Anyone who owes business income tax in Idaho and wants to make estimated tax payments or request an extension of time to pay needs to file Form 41ES.

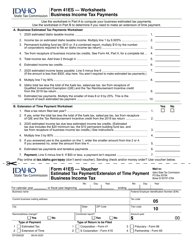

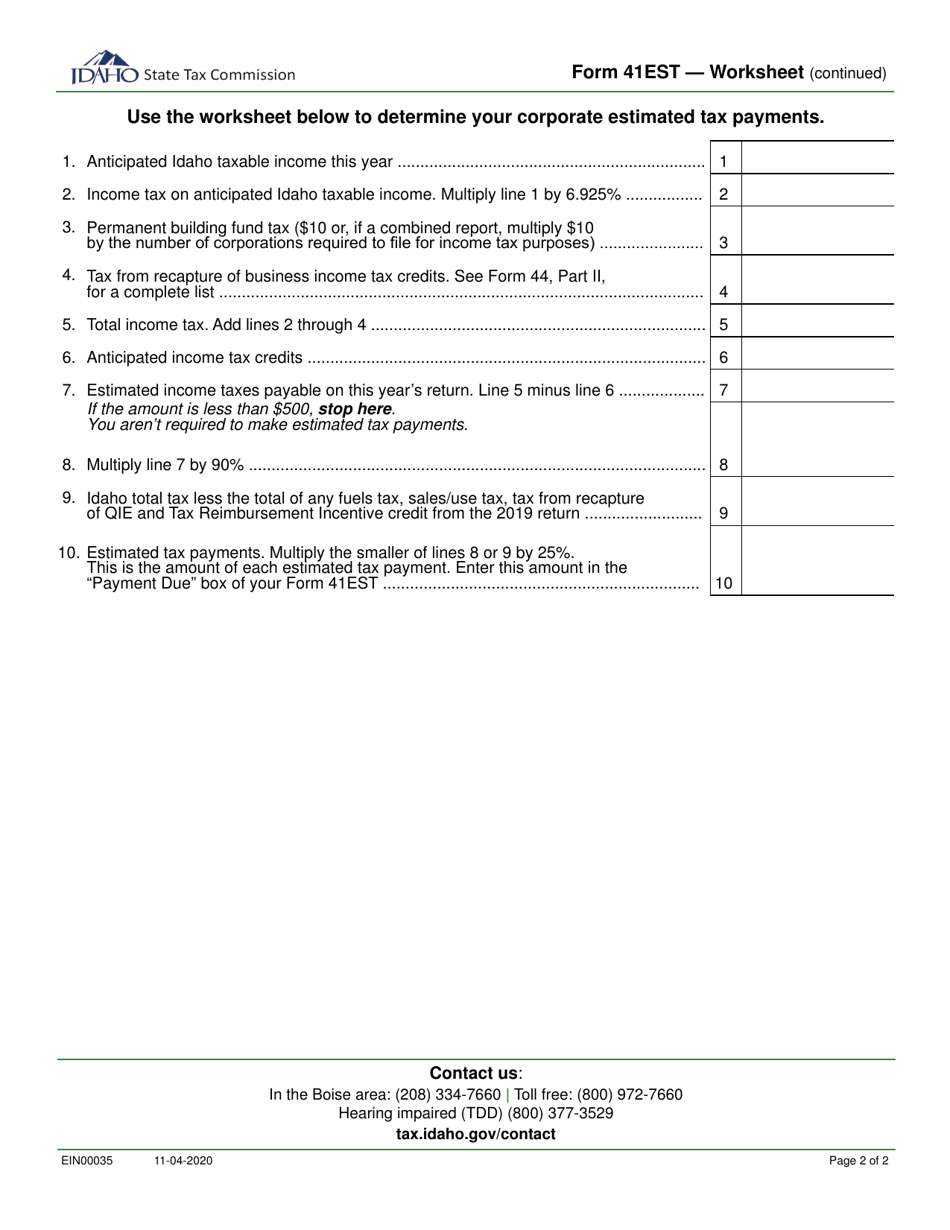

Q: How do I use Form 41ES for estimated tax payments?

A: To make estimated tax payments, fill out Form 41ES and include your payment with the form. The form should be filed quarterly.

Q: How do I use Form 41ES to request an extension of time to pay?

A: To request an extension of time to pay, fill out Form 41ES and submit it by the original due date of your tax return. You must also include any estimated tax payments you are able to make.

Q: Are there any penalties for not filing Form 41ES?

A: Yes, if you do not make estimated tax payments or request an extension of time to pay when required, you may be subject to penalties and interest.

Q: What is the deadline for filing Form 41ES?

A: Form 41ES should be filed by the original due date of your tax return, which is April 15th for most filers.

Q: How often do I need to file Form 41ES for estimated tax payments?

A: Form 41ES should be filed quarterly if you are making estimated tax payments.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.