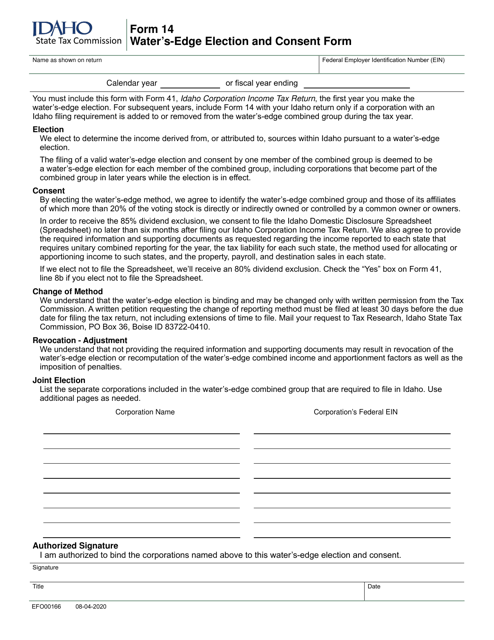

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 14 (EFO00166)

for the current year.

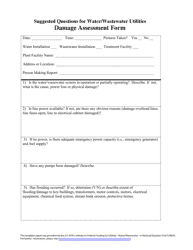

Form 14 (EFO00166) Water's-Edge Election and Consent Form - Idaho

What Is Form 14 (EFO00166)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

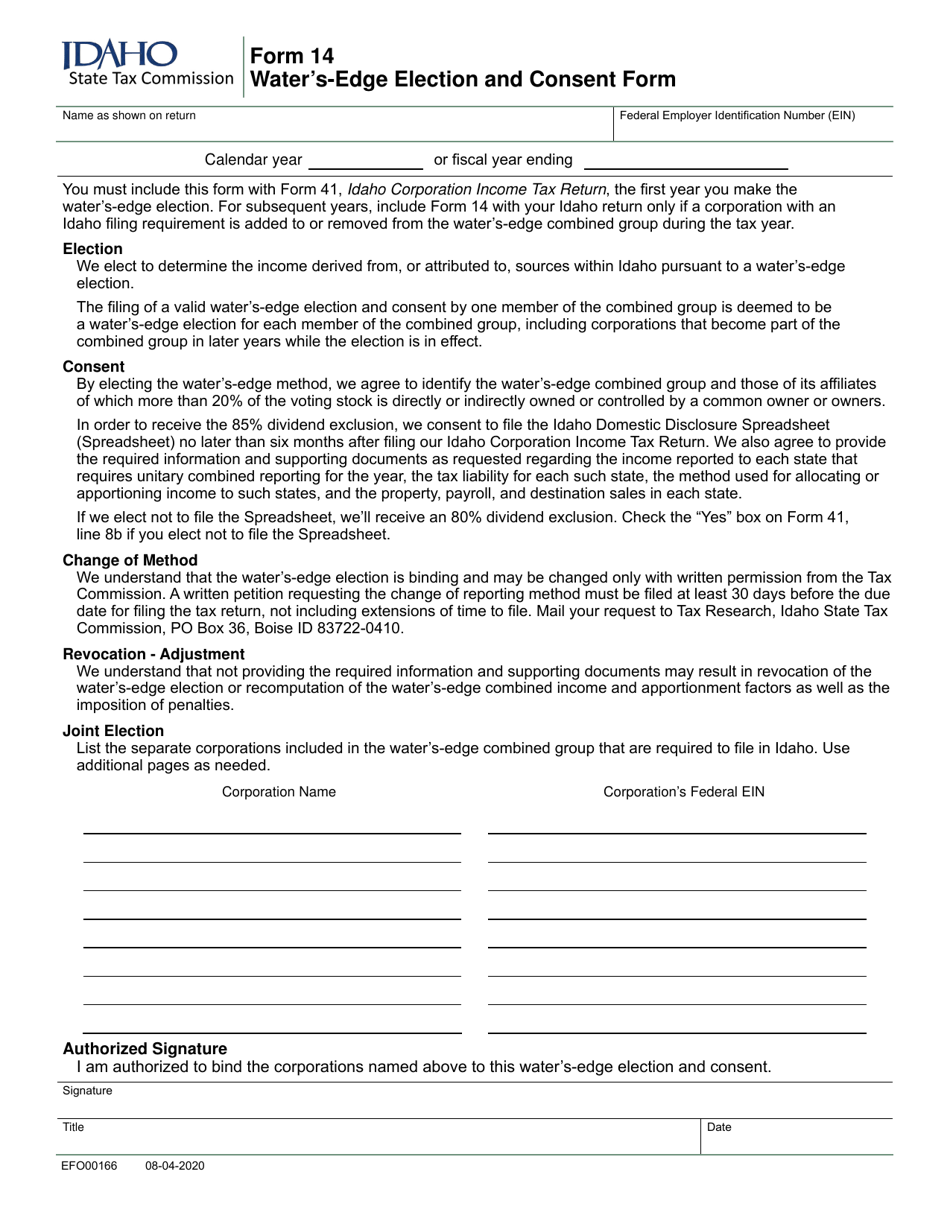

Q: What is Form 14 (EFO00166)?

A: Form 14 (EFO00166) is the Water's-Edge Election and Consent Form specific to Idaho.

Q: What is a Water's-Edge Election?

A: A Water's-Edge Election is a choice made by a corporation to limit its taxable income to only the income earned within the United States, specifically excluding income earned outside of the country.

Q: Why would a corporation make a Water's-Edge Election?

A: A corporation may choose to make a Water's-Edge Election to reduce its overall tax liability by excluding income earned outside of the United States.

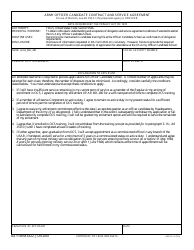

Q: What is the purpose of the Consent Form?

A: The Consent Form is used to obtain consent from all qualified members of a corporation to make a Water's-Edge Election.

Q: Who needs to complete Form 14 (EFO00166)?

A: The corporation and all qualified members need to complete Form 14 (EFO00166) if they intend to make a Water's-Edge Election in Idaho.

Q: Are there any deadlines for submitting Form 14 (EFO00166)?

A: Yes, the completed form must be submitted by the original due date of the corporation's tax return for the taxable year in which the Water's-Edge Election is requested.

Q: What happens if Form 14 (EFO00166) is not submitted on time?

A: Failure to timely submit Form 14 (EFO00166) may result in the denial of the Water's-Edge Election for the relevant tax year.

Q: Can a corporation change its Water's-Edge Election status?

A: Yes, a corporation may make or revoke a Water's-Edge Election in a subsequent taxable year by filing the appropriate forms and following the necessary procedures.

Q: Is making a Water's-Edge Election always beneficial?

A: The decision to make a Water's-Edge Election should be carefully evaluated, as it may affect the corporation's overall tax position and obligations. Consulting with a tax professional is recommended.

Form Details:

- Released on August 4, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14 (EFO00166) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.