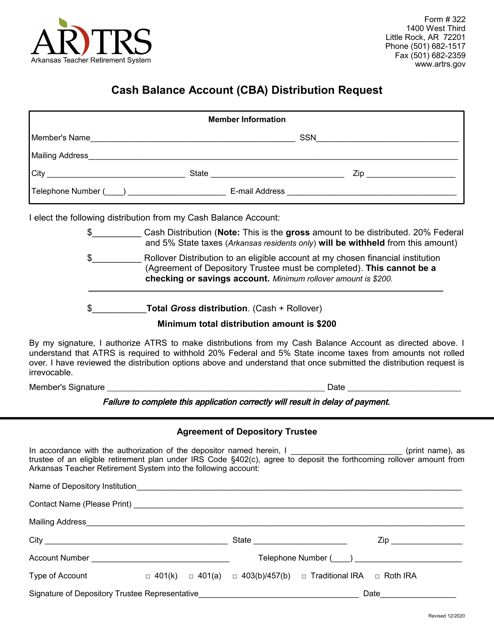

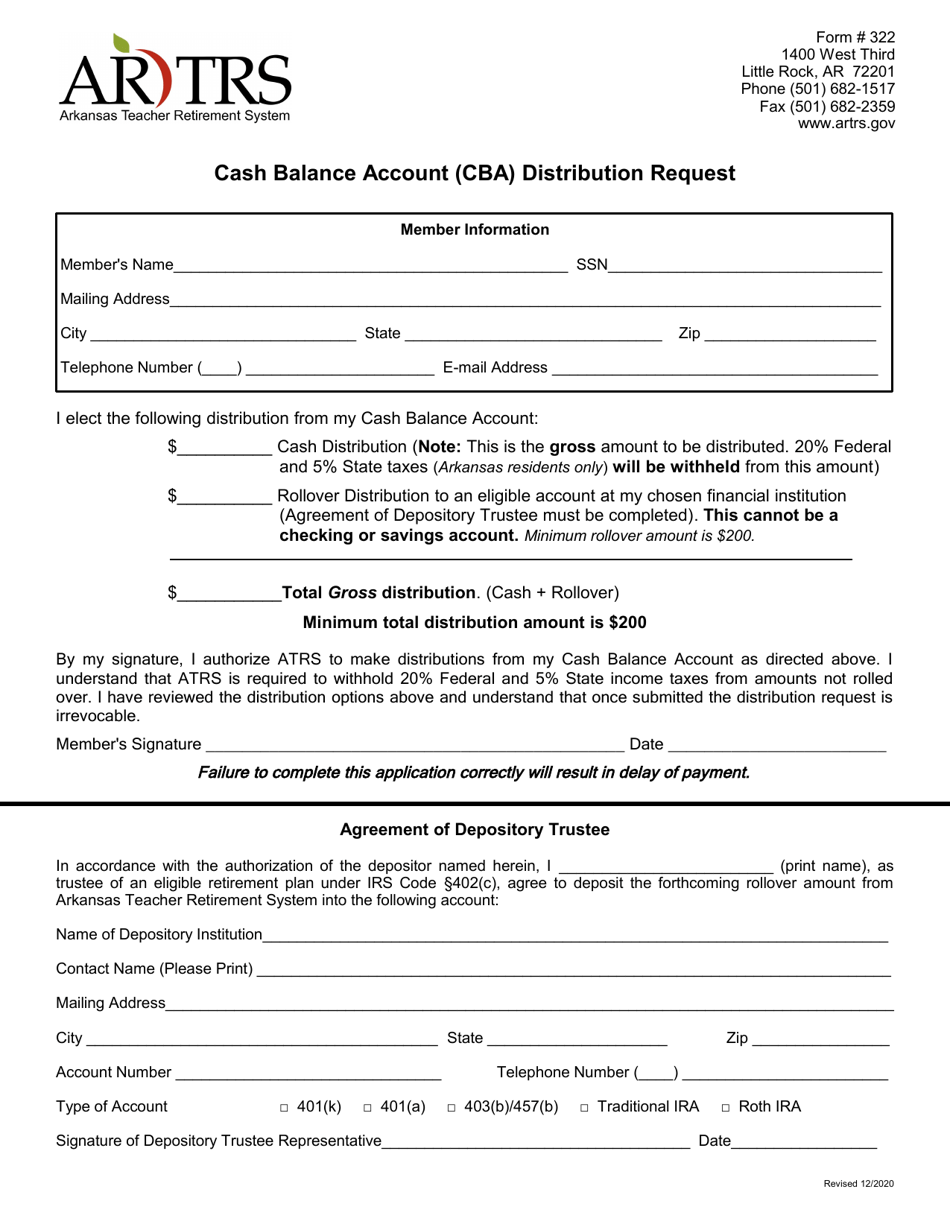

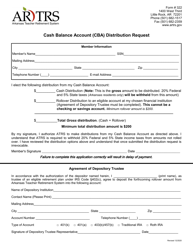

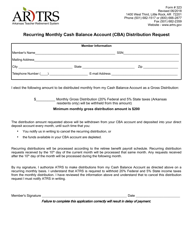

Form 332 Cash Balance Account (Cba) Distribution Request - Arkansas

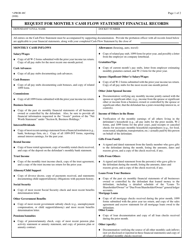

What Is Form 332?

This is a legal form that was released by the Arkansas Teacher Retirement System - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 332 Cash Balance Account (CBA) Distribution Request?

A: Form 332 is used to request a distribution from a Cash Balance Account (CBA) in Arkansas.

Q: Who can use Form 332?

A: Any individual or entity with a Cash Balance Account in Arkansas can use Form 332.

Q: What information is required on Form 332?

A: Form 332 requires information such as the account holder's name, account number, requested distribution amount, and reason for the distribution.

Q: What is a Cash Balance Account (CBA)?

A: A Cash Balance Account is a type of retirement account that combines features of a traditional pension plan and a 401(k) plan.

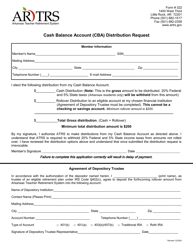

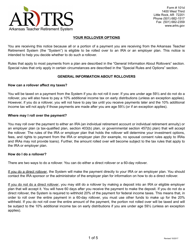

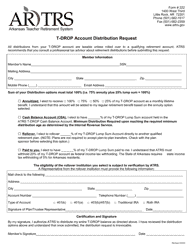

Q: What are the distribution options for a Cash Balance Account?

A: The distribution options for a Cash Balance Account may include lump sum payments, annuity payments, or rollovers to another retirement account.

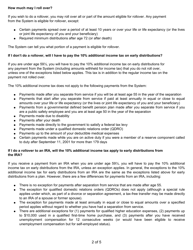

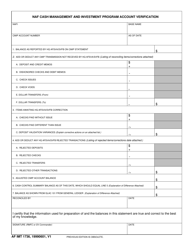

Q: Are there any tax implications for distributions from a Cash Balance Account?

A: Yes, distributions from a Cash Balance Account may be subject to federal and state taxes.

Q: Can I rollover a Cash Balance Account distribution to another retirement account?

A: Yes, it is possible to rollover a Cash Balance Account distribution to another eligible retirement account.

Q: How long does it take to process a Cash Balance Account distribution request?

A: The processing time for a Cash Balance Account distribution request may vary, but it typically takes a few weeks to process.

Q: Is there a fee for requesting a distribution from a Cash Balance Account?

A: There may be fees associated with requesting a distribution from a Cash Balance Account. It is best to consult the relevant state agency for more information.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Arkansas Teacher Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 332 by clicking the link below or browse more documents and templates provided by the Arkansas Teacher Retirement System.