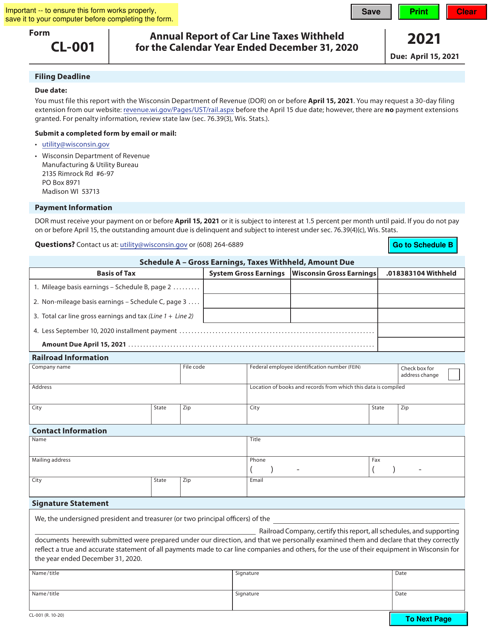

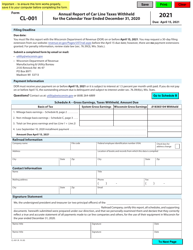

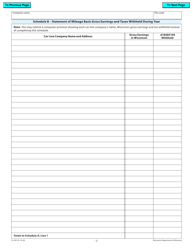

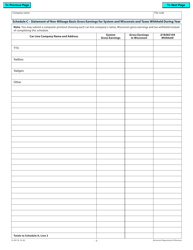

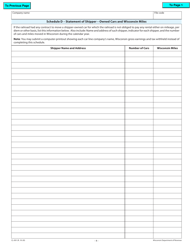

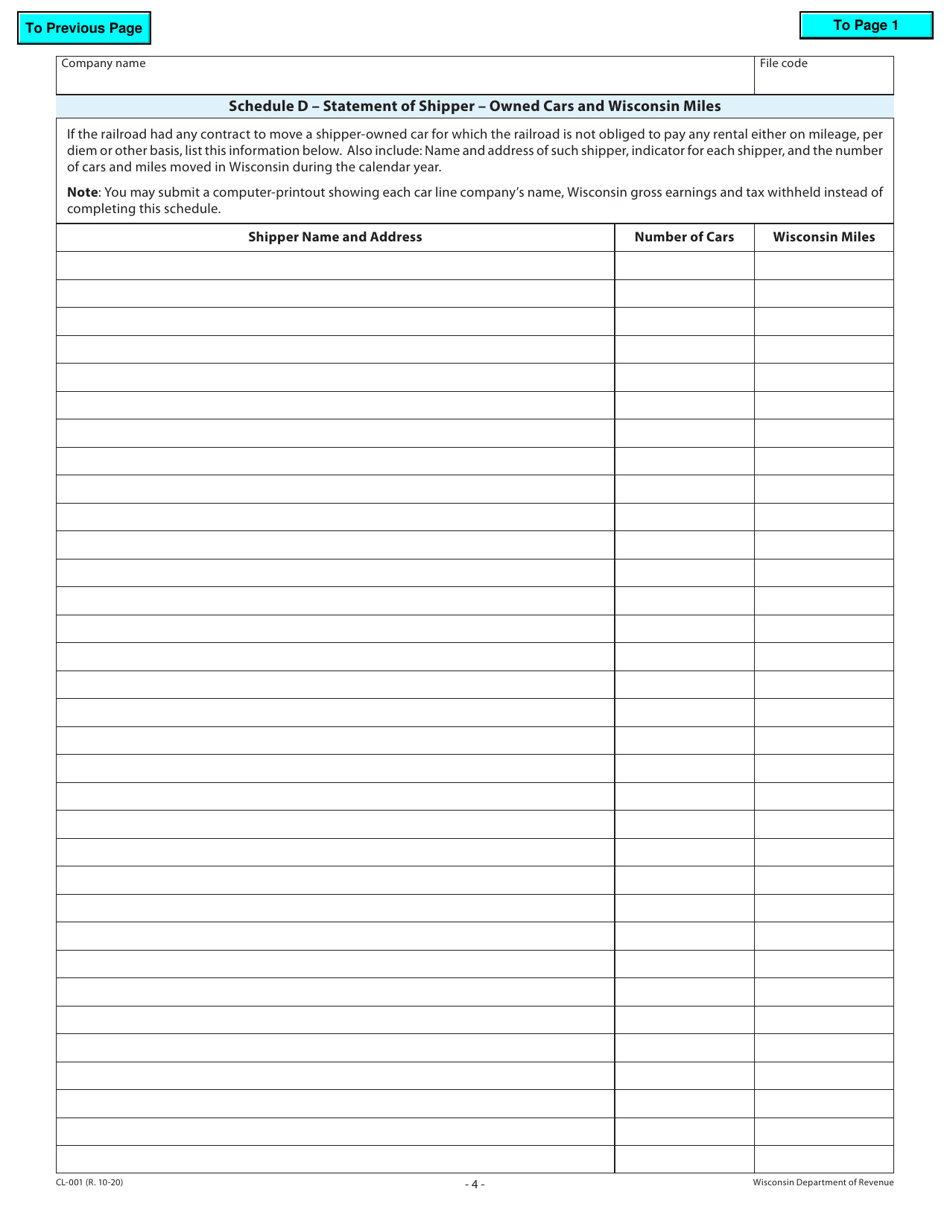

Form CL-001 Railroad Company's Annual Report of Car Line Taxes Withheld - Wisconsin

What Is Form CL-001?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CL-001?

A: Form CL-001 is the Railroad Company's Annual Report of Car Line Taxes Withheld in Wisconsin.

Q: Who needs to file Form CL-001?

A: Railroad companies in Wisconsin need to file Form CL-001.

Q: What is the purpose of Form CL-001?

A: Form CL-001 is used to report car line taxes withheld by railroad companies in Wisconsin.

Q: When is the due date for filing Form CL-001?

A: The due date for filing Form CL-001 is typically March 1st of each year.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CL-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.