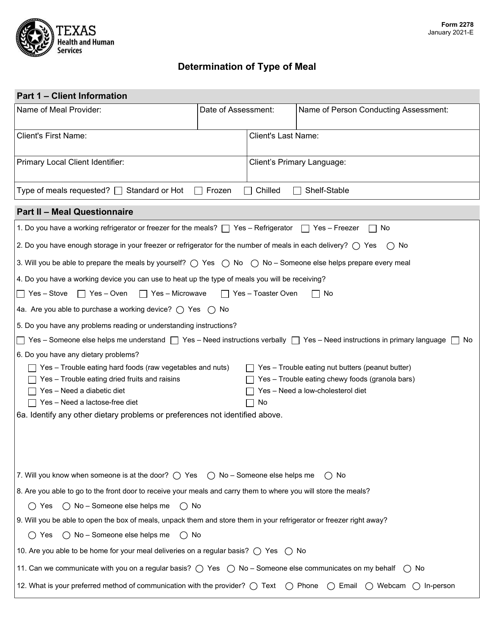

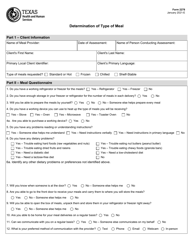

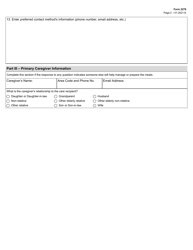

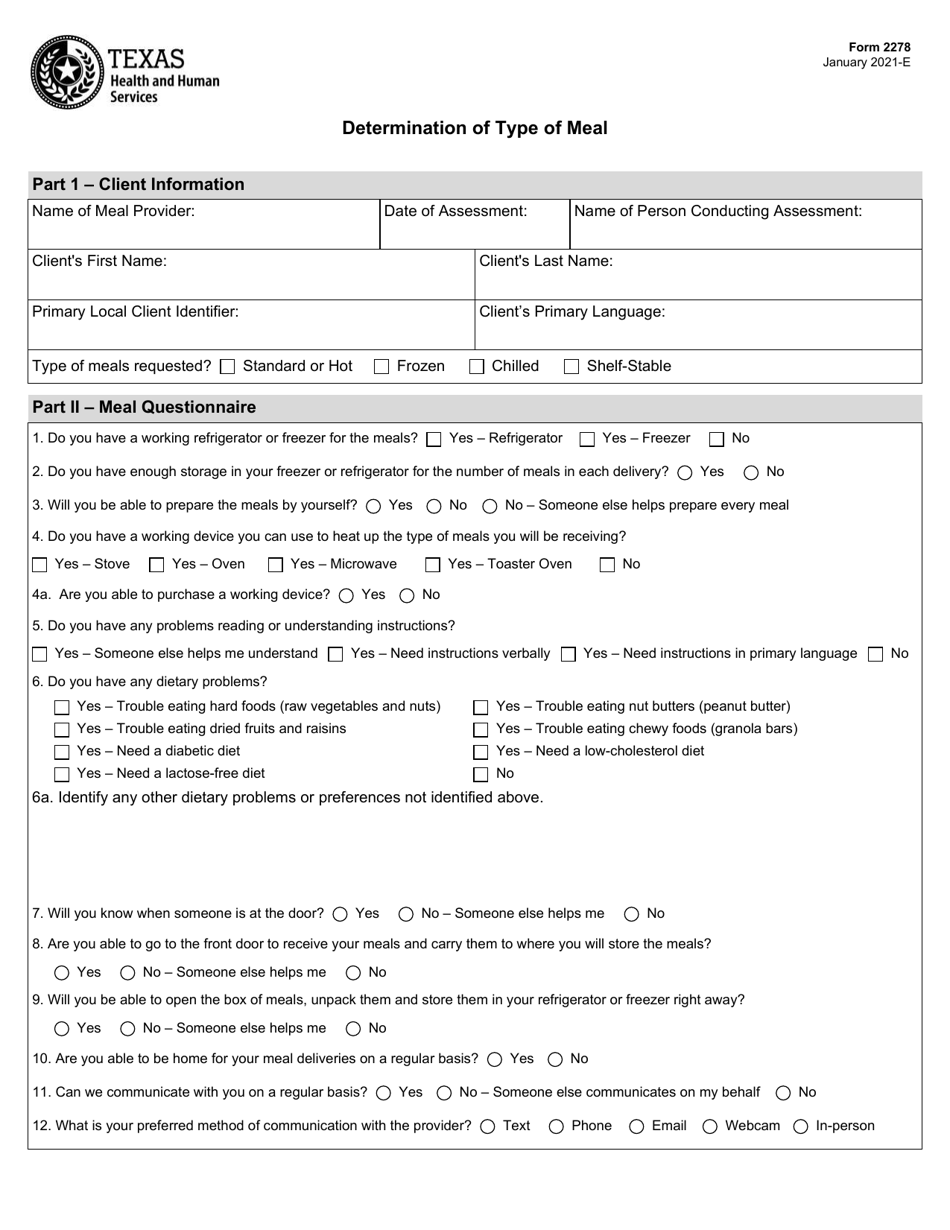

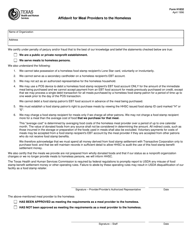

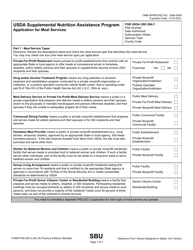

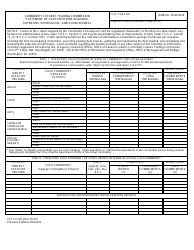

Form 2278 Determination of Type of Meal - Texas

What Is Form 2278?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2278?

A: Form 2278 is a document used in Texas to determine the type of meal.

Q: What is the purpose of Form 2278?

A: The purpose of Form 2278 is to determine whether a meal is taxable or exempt in Texas.

Q: Who uses Form 2278?

A: Businesses and organizations in Texas that provide meals to customers use Form 2278.

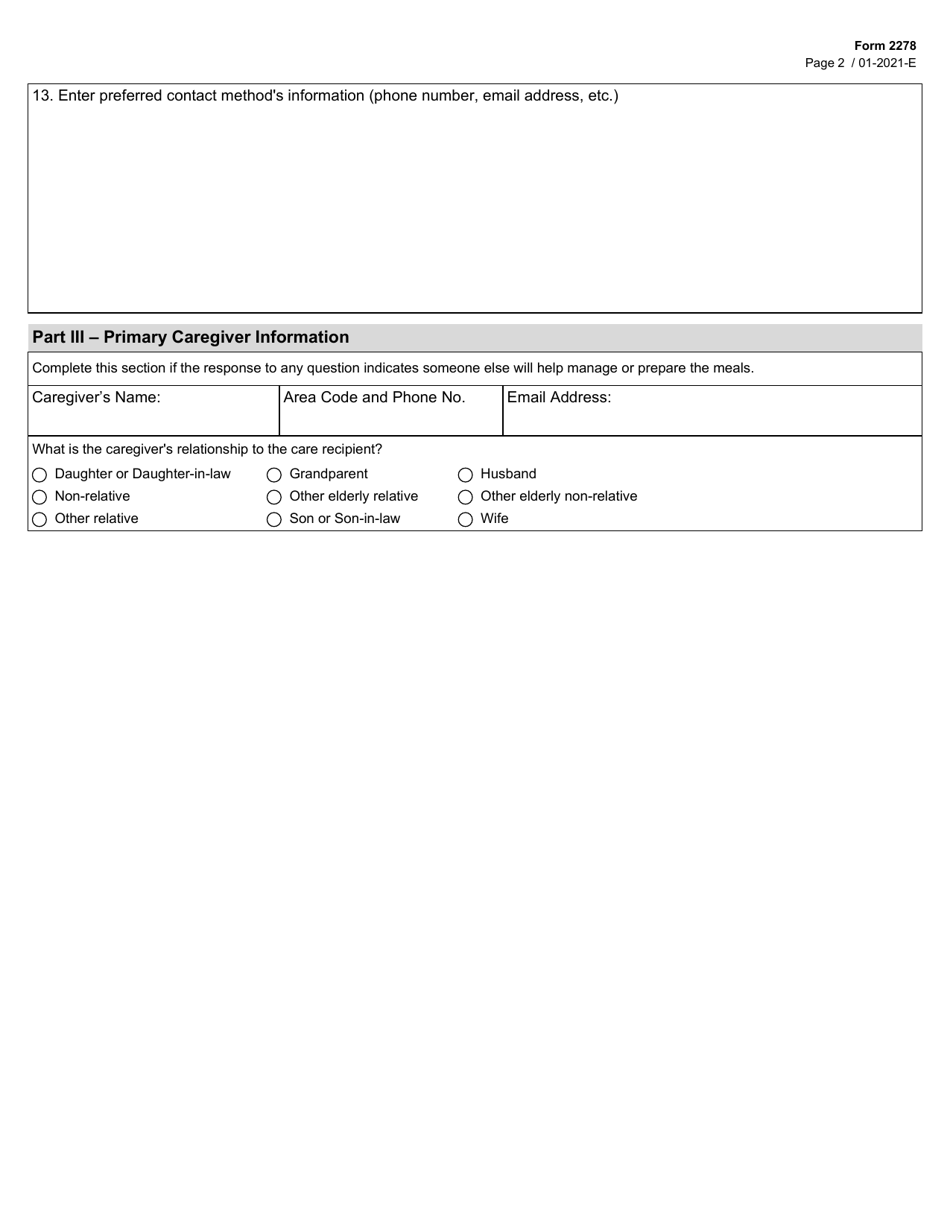

Q: What information is required on Form 2278?

A: Form 2278 requires information about the type of meal, the total number of meals provided, and the location where the meals are served.

Q: How does Form 2278 determine the type of meal?

A: Form 2278 uses specific criteria, such as the purpose of the meal and the manner in which it is served, to determine whether a meal is taxable or exempt.

Q: Is Form 2278 specific to Texas?

A: Yes, Form 2278 is specific to Texas and is used to determine the taxability of meals in the state.

Q: What should businesses do with Form 2278?

A: Businesses should keep a copy of Form 2278 for their records and submit it to the Texas Comptroller of Public Accounts when required.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2278 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.