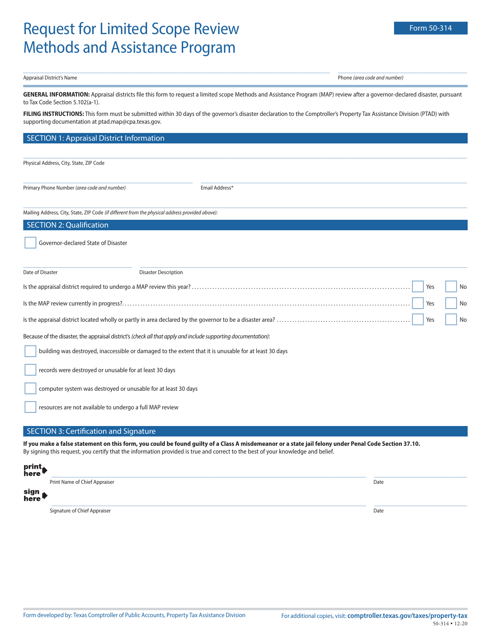

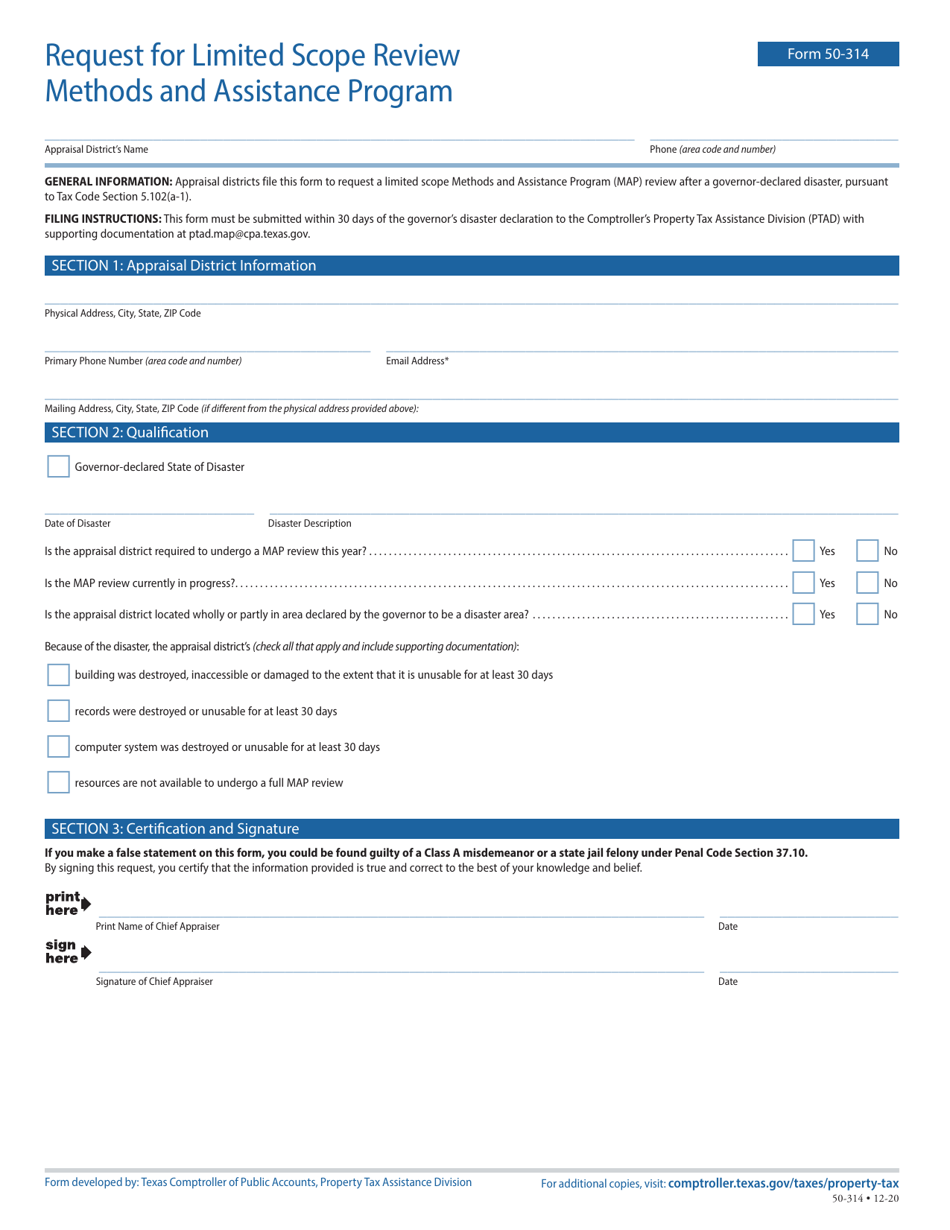

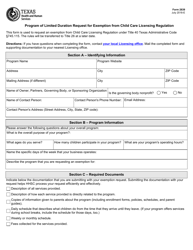

Form 50-314 Request for Limited Scope Review Methods and Assistance Program - Texas

What Is Form 50-314?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-314?

A: Form 50-314 is the Request for Limited Scope Review Methods and Assistance Program in Texas.

Q: What is the purpose of Form 50-314?

A: The purpose of Form 50-314 is to request a limited scope review of a property's appraised value.

Q: Who can use Form 50-314?

A: Any property owner in Texas can use Form 50-314 to request a limited scope review.

Q: What is a limited scope review?

A: A limited scope review is a process where the appraisal district determines the appraised value of a property.

Q: Are there any fees associated with Form 50-314?

A: Yes, there may be fees associated with the limited scope review process. The fees vary depending on the county.

Q: Are there any deadlines for submitting Form 50-314?

A: Yes, the deadlines for submitting Form 50-314 vary by county. It is recommended to check with the local appraisal district for the specific deadlines.

Q: What should I do after submitting Form 50-314?

A: After submitting Form 50-314, you should wait for a response from the appraisal district regarding the limited scope review.

Q: Can I appeal the results of the limited scope review?

A: Yes, if you are not satisfied with the results of the limited scope review, you can appeal the decision to the Texas Appraisal Review Board.

Q: Who can I contact for more information about Form 50-314?

A: For more information about Form 50-314, you can contact your local county appraisal district.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-314 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.