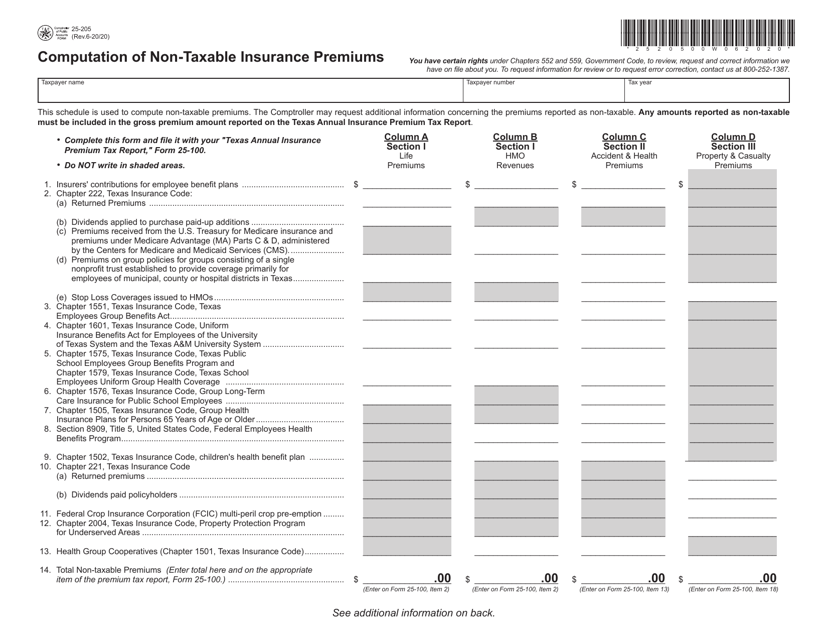

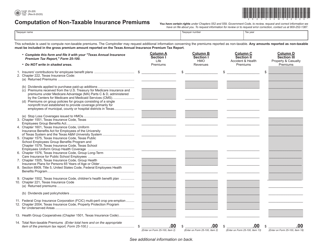

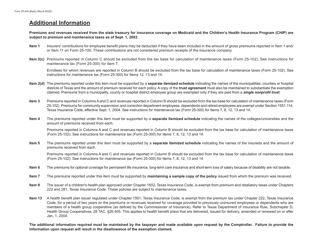

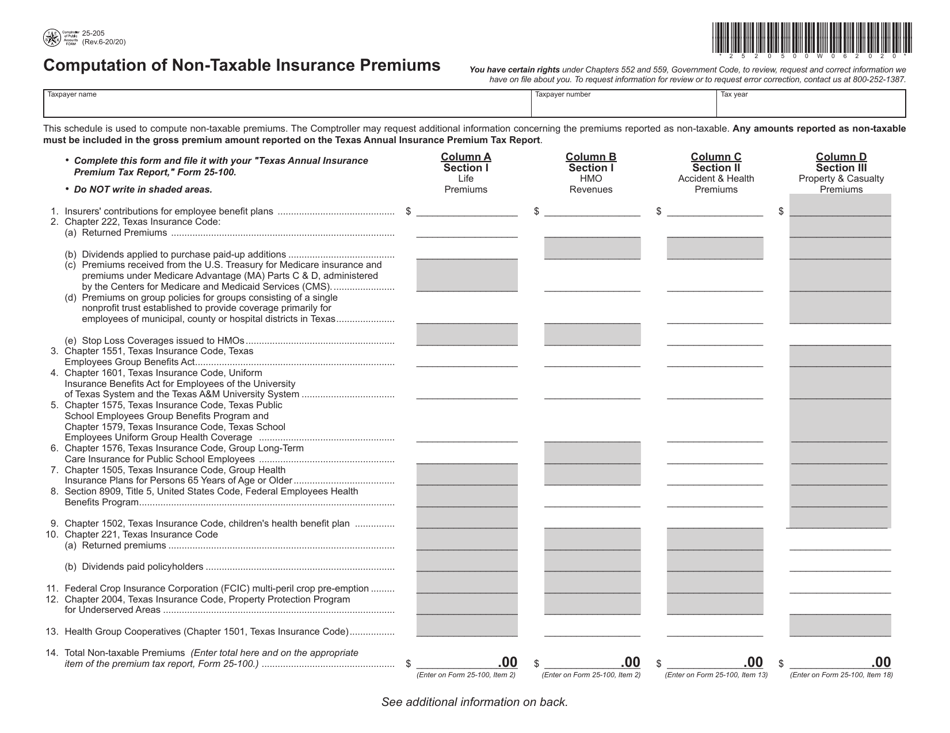

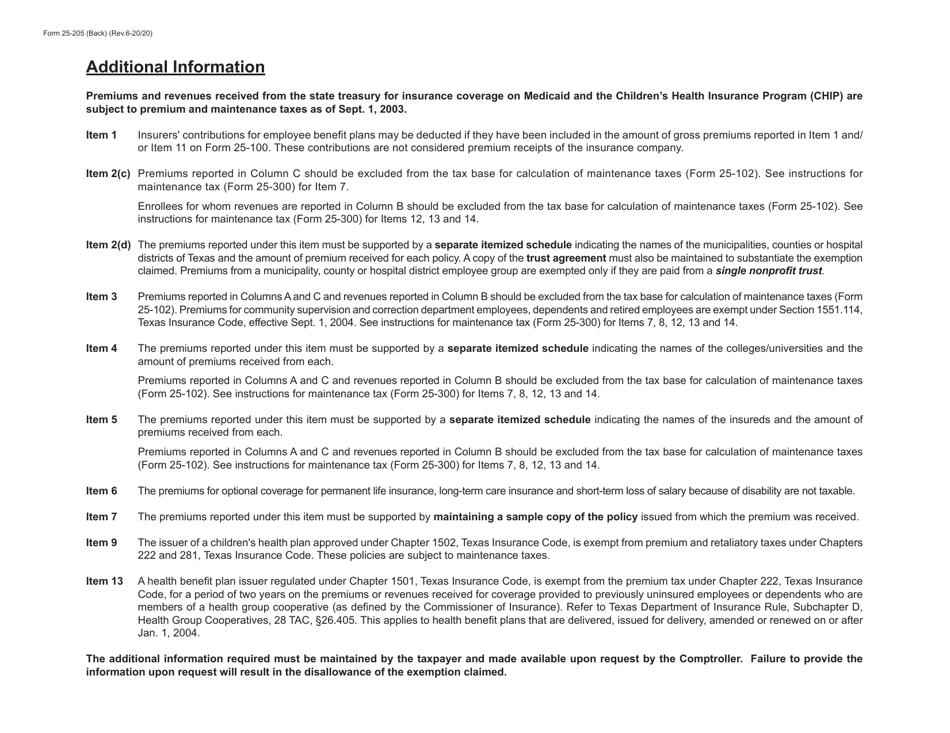

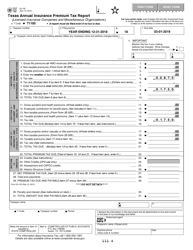

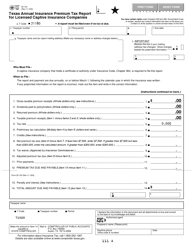

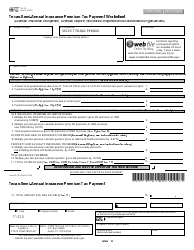

Form 25-205 Computation of Non-taxable Insurance Premiums - Texas

What Is Form 25-205?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25-205?

A: Form 25-205 is a computation form used in Texas to calculate non-taxable insurance premiums.

Q: Who uses Form 25-205?

A: Insurance companies and brokers in Texas use Form 25-205.

Q: What is the purpose of Form 25-205?

A: The form is used to determine the amount of non-taxable insurance premiums in Texas.

Q: How is Form 25-205 completed?

A: Form 25-205 is completed by entering relevant information about the insurance policies and calculating the non-taxable premiums.

Q: When is Form 25-205 due?

A: The due date for Form 25-205 varies, but it is generally due on or before the 15th day of the month following the end of the reporting period.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25-205 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.