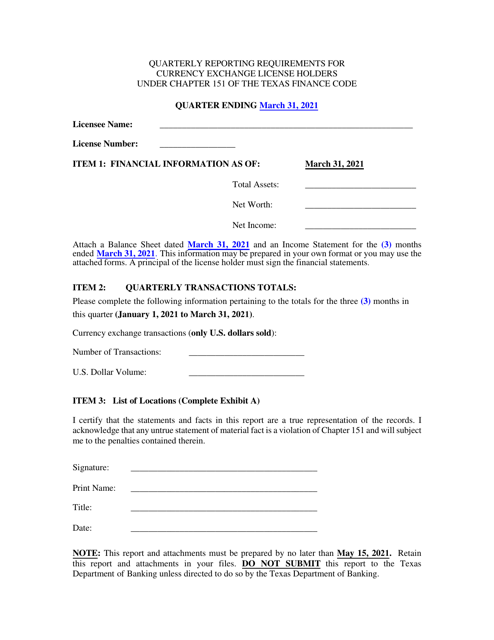

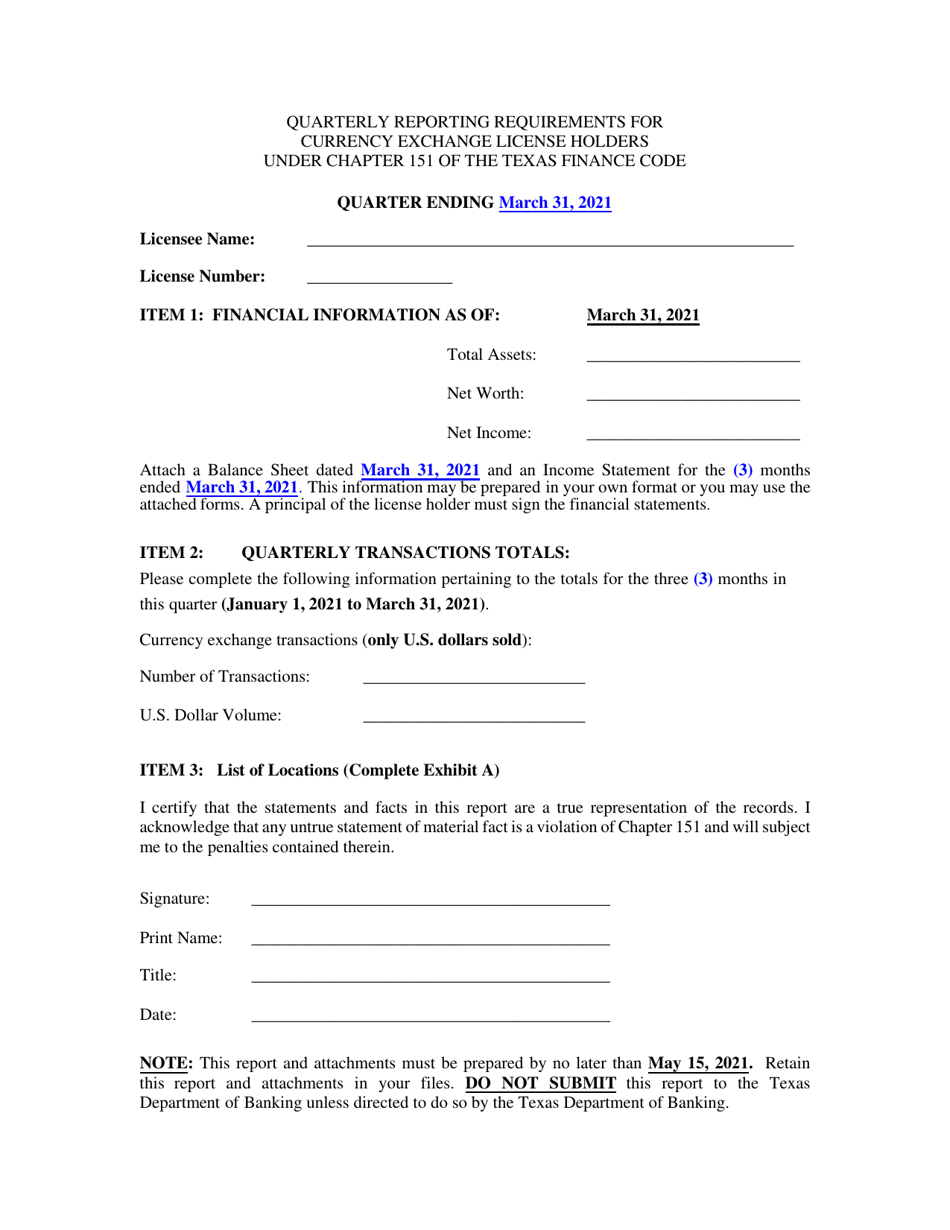

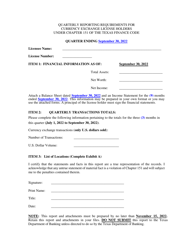

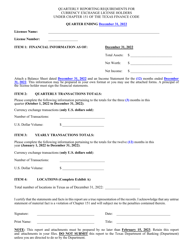

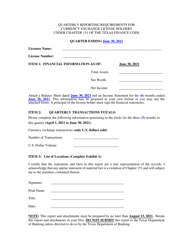

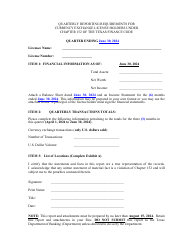

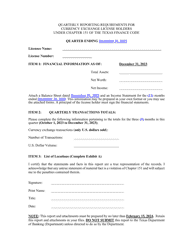

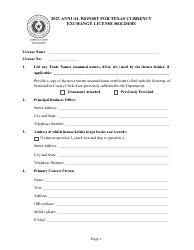

Quarterly Reporting Requirements for Currency Exchange License Holders Under Chapter 151 of the Texas Finance Code - 1st Quarter - Texas

Quarterly License Holders Under Chapter 151 of the Texas Finance Code - 1st Quarter is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: Who is required to file quarterly reports under Chapter 151 of the Texas Finance Code?

A: Currency exchange license holders.

Q: What is the purpose of the quarterly reports?

A: To provide information about the currency exchange activities of license holders.

Q: What is the time period covered by the 1st quarter report?

A: The first three months of the year.

Q: When are the 1st quarter reports due?

A: Reports are due on or before April 30th.

Q: What information is included in the quarterly reports?

A: Information about the amount and type of currency exchanged, fees charged, and any investigations or disciplinary actions.

Q: Are there any penalties for late or non-filing of the quarterly reports?

A: Yes, failure to file can result in fines or the suspension or revocation of the license.

Form Details:

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.