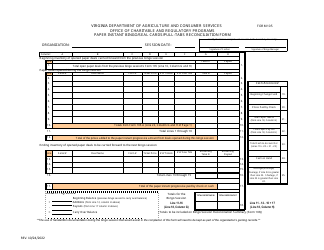

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 104-A

for the current year.

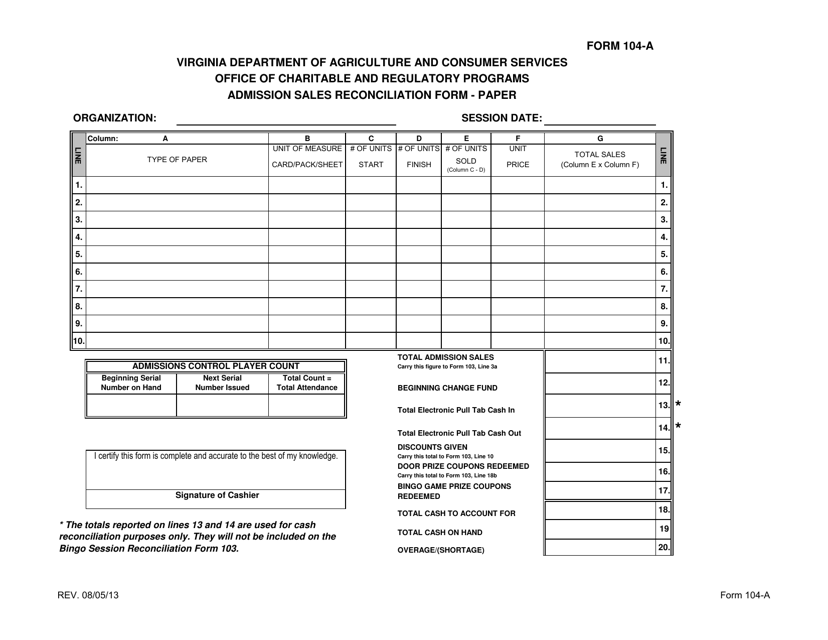

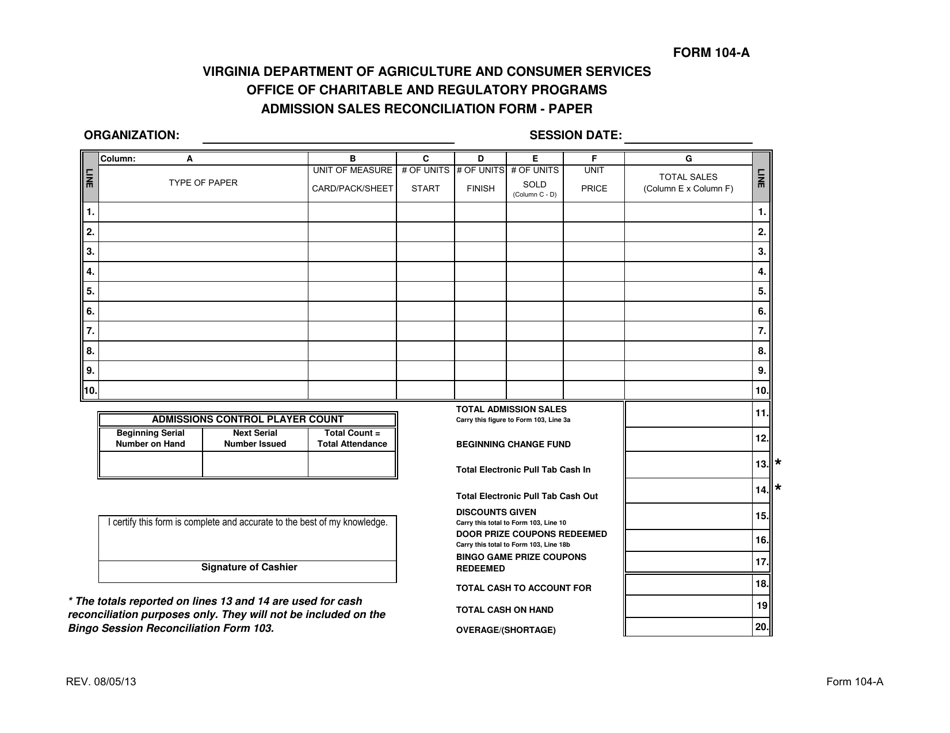

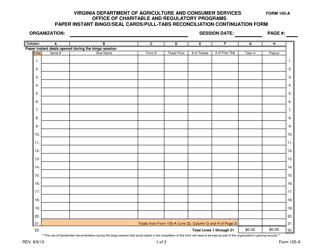

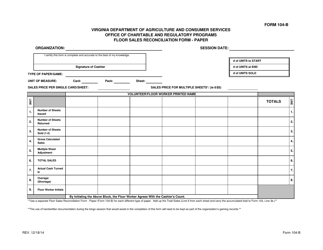

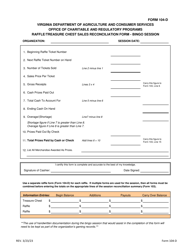

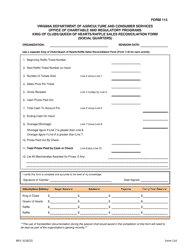

Form 104-A Admission Sales Reconciliation Form - Paper - Virginia

What Is Form 104-A?

This is a legal form that was released by the Virginia Department of Agriculture and Consumer Services - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 104-A?

A: Form 104-A is the Admission Sales Reconciliation Form used in Virginia.

Q: What is the purpose of Form 104-A?

A: The purpose of Form 104-A is to reconcile admission sales for businesses in Virginia.

Q: Is Form 104-A a paper form?

A: Yes, Form 104-A is a paper form that needs to be filled out manually.

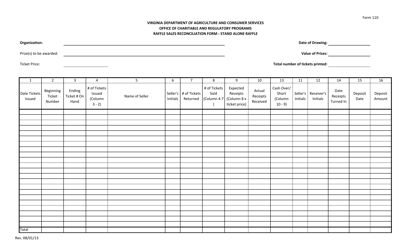

Q: Who needs to use Form 104-A?

A: Businesses in Virginia that sell admissions must use Form 104-A to report their sales.

Q: What is the importance of reconciling admission sales?

A: Reconciling admission sales helps ensure accurate reporting and compliance with tax regulations.

Q: Is Form 104-A specific to Virginia?

A: Yes, Form 104-A is specific to Virginia and is used for reporting admission sales in the state.

Q: Are there any deadlines for submitting Form 104-A?

A: Yes, businesses are required to submit Form 104-A on a monthly or annual basis, depending on their sales volume.

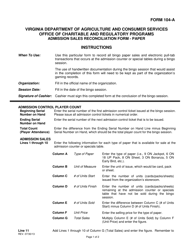

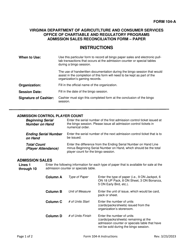

Q: What should be included on Form 104-A?

A: Form 104-A requires businesses to provide details of their admission sales, including the number of tickets sold and the amount of revenue generated.

Q: What other forms and documents might be required along with Form 104-A?

A: Depending on the specific circumstances, businesses may also need to submit supporting documents such as sales records and receipts.

Form Details:

- Released on August 5, 2013;

- The latest edition provided by the Virginia Department of Agriculture and Consumer Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 104-A by clicking the link below or browse more documents and templates provided by the Virginia Department of Agriculture and Consumer Services.