This version of the form is not currently in use and is provided for reference only. Download this version of

Form FAE170 (RV-R0011001)

for the current year.

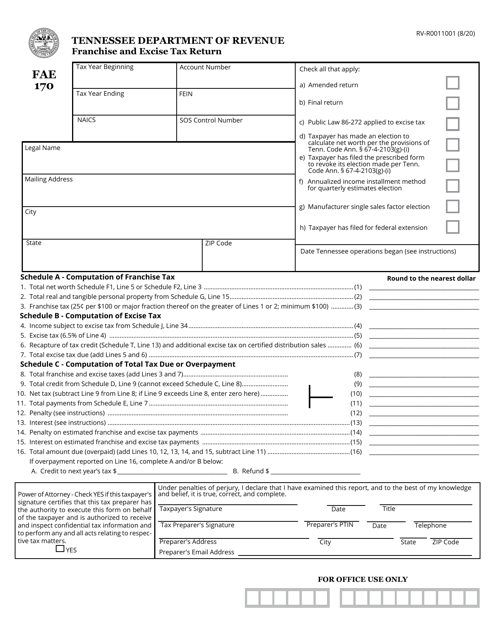

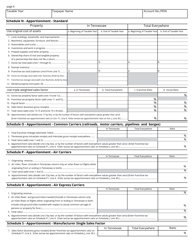

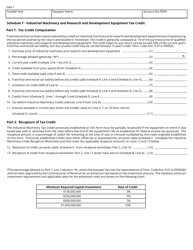

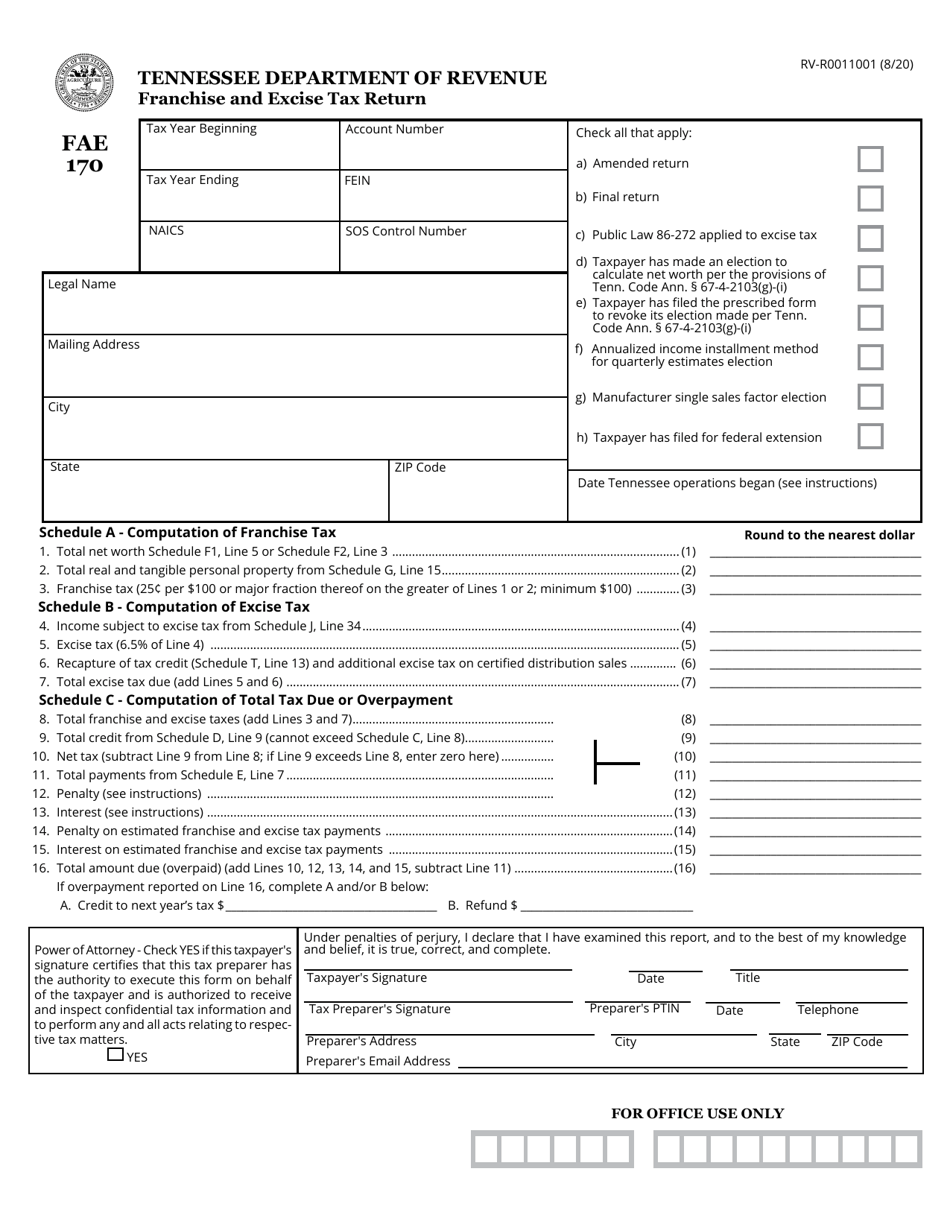

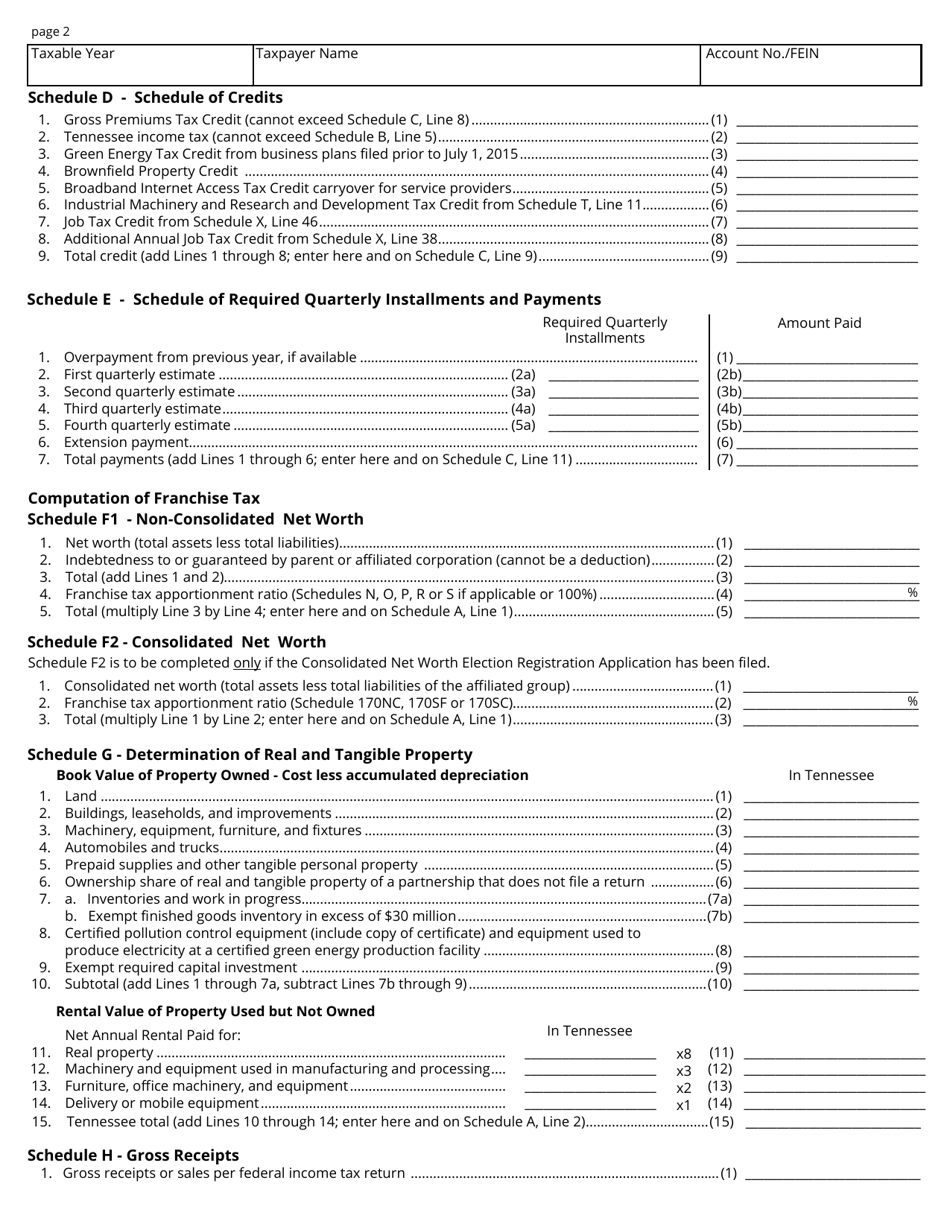

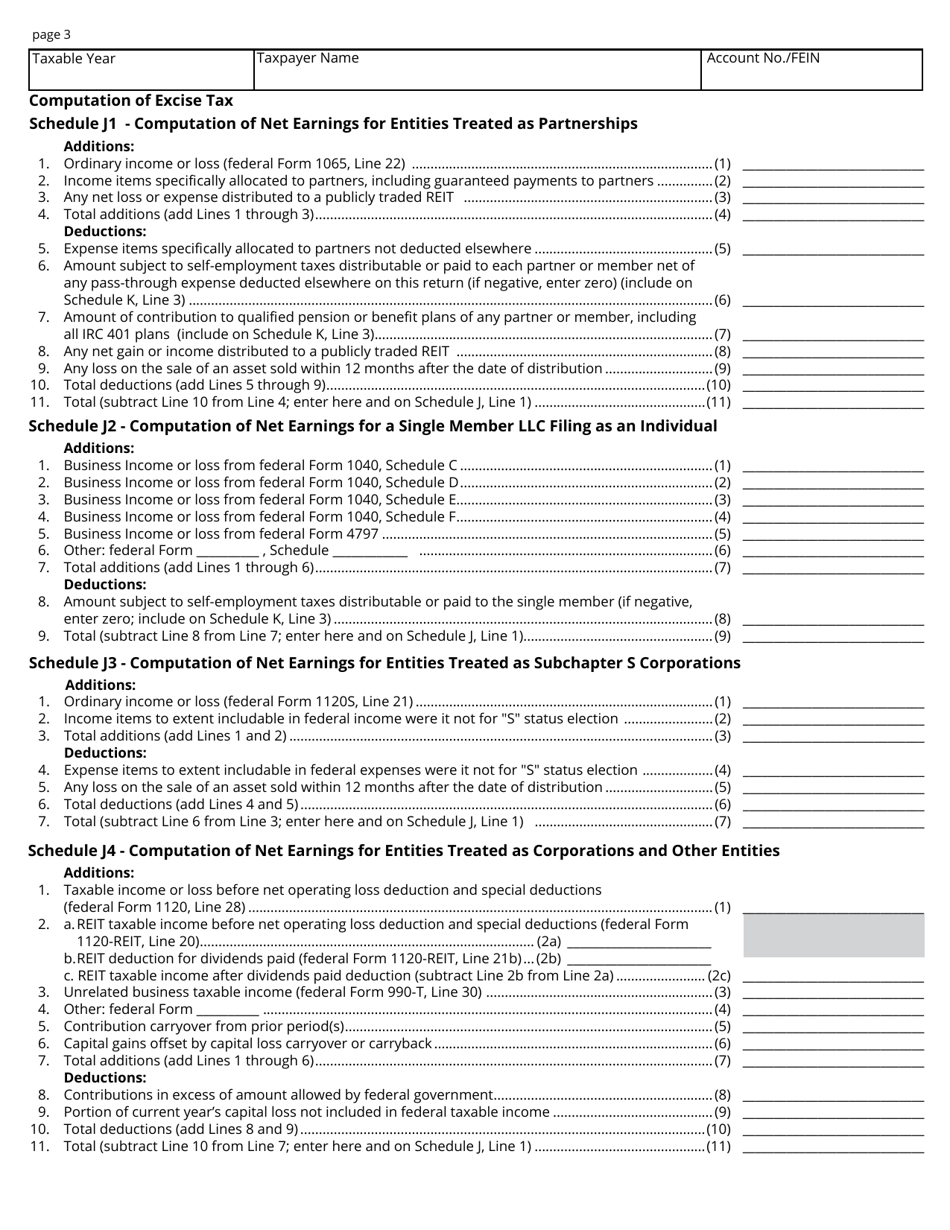

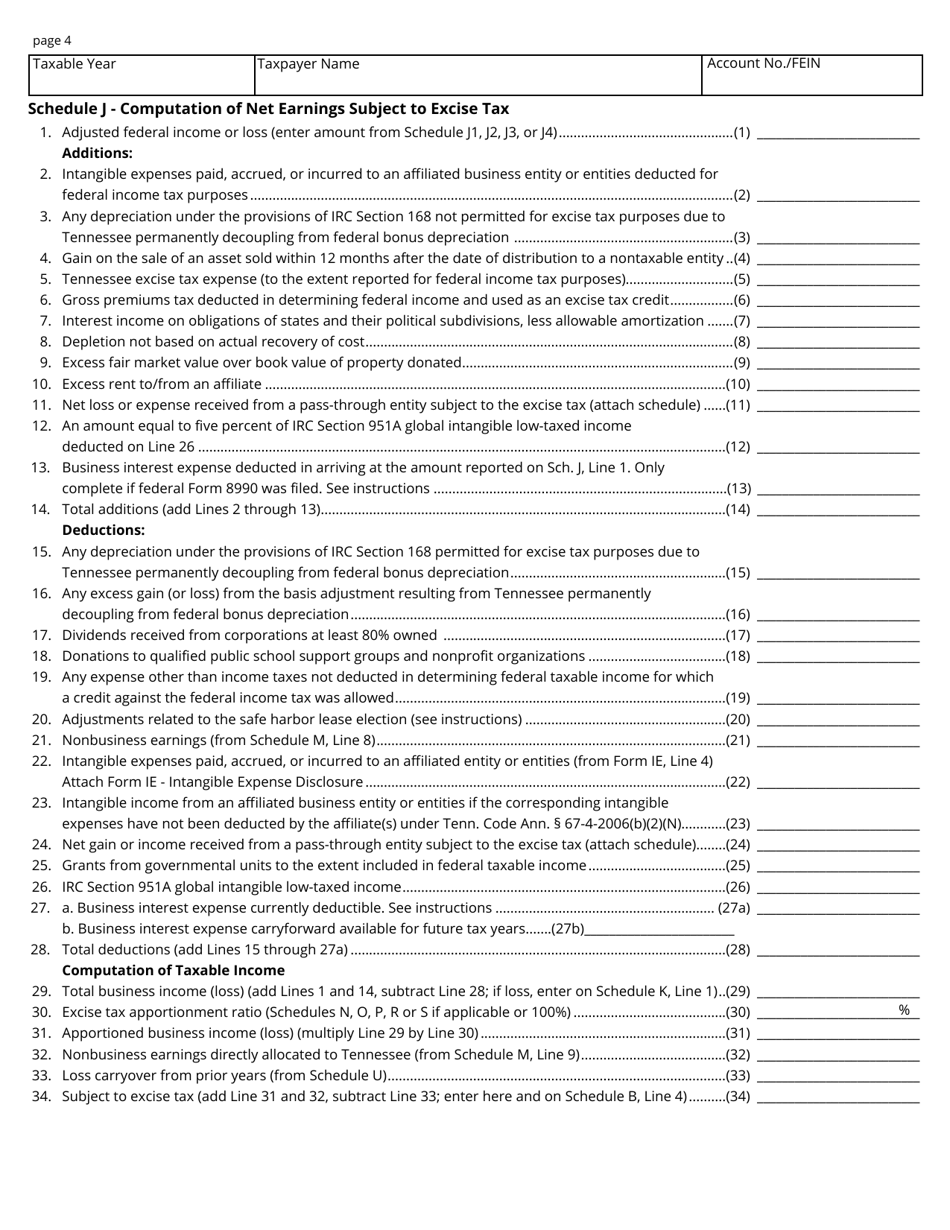

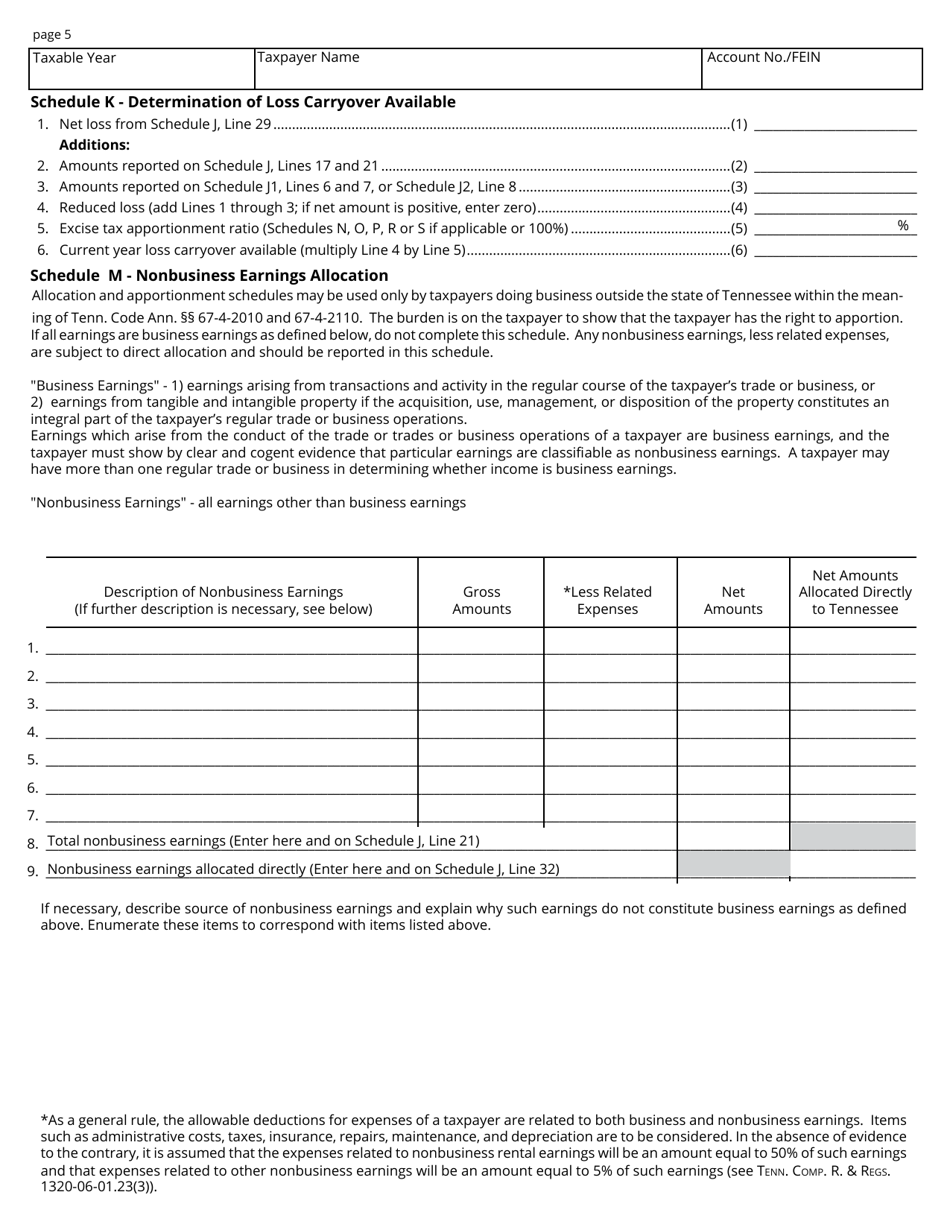

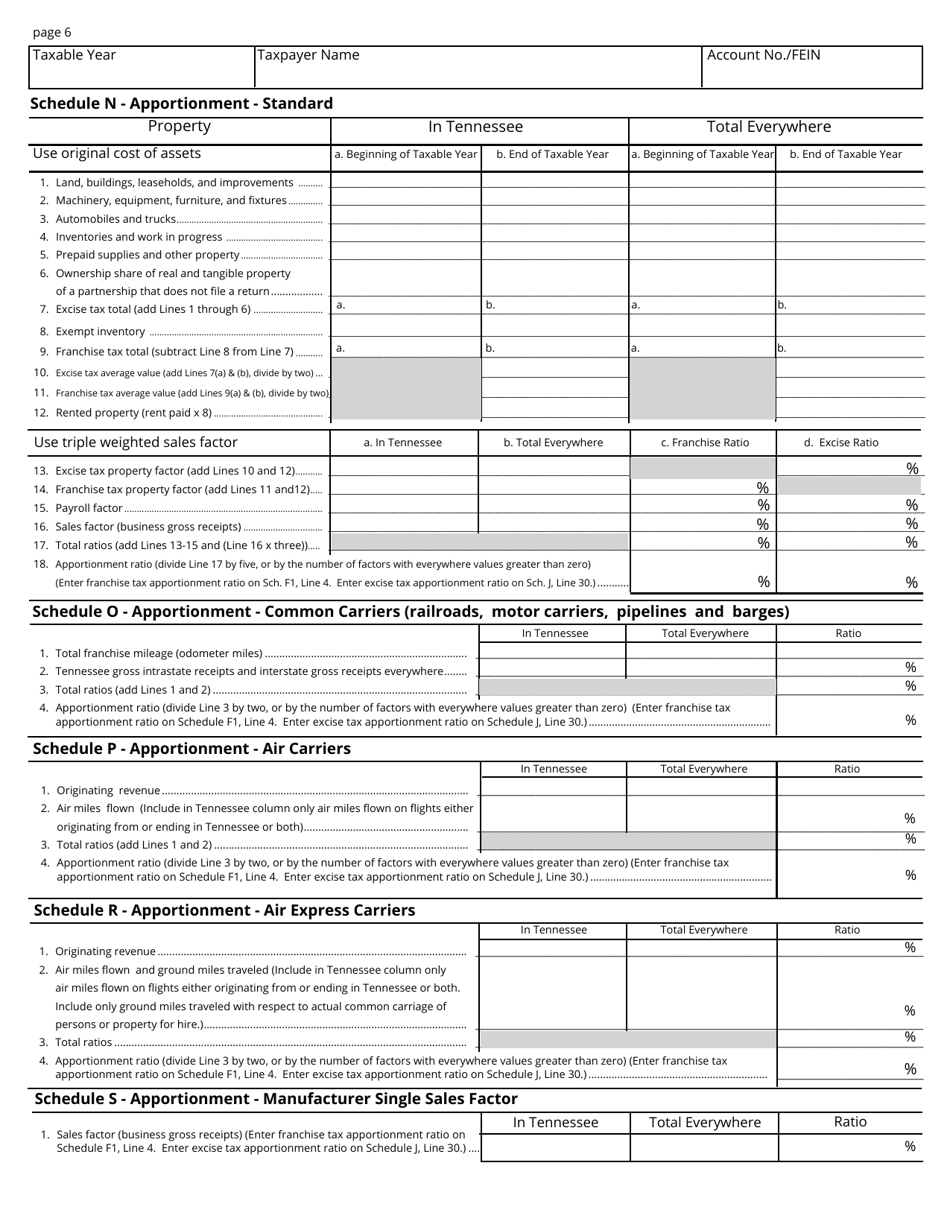

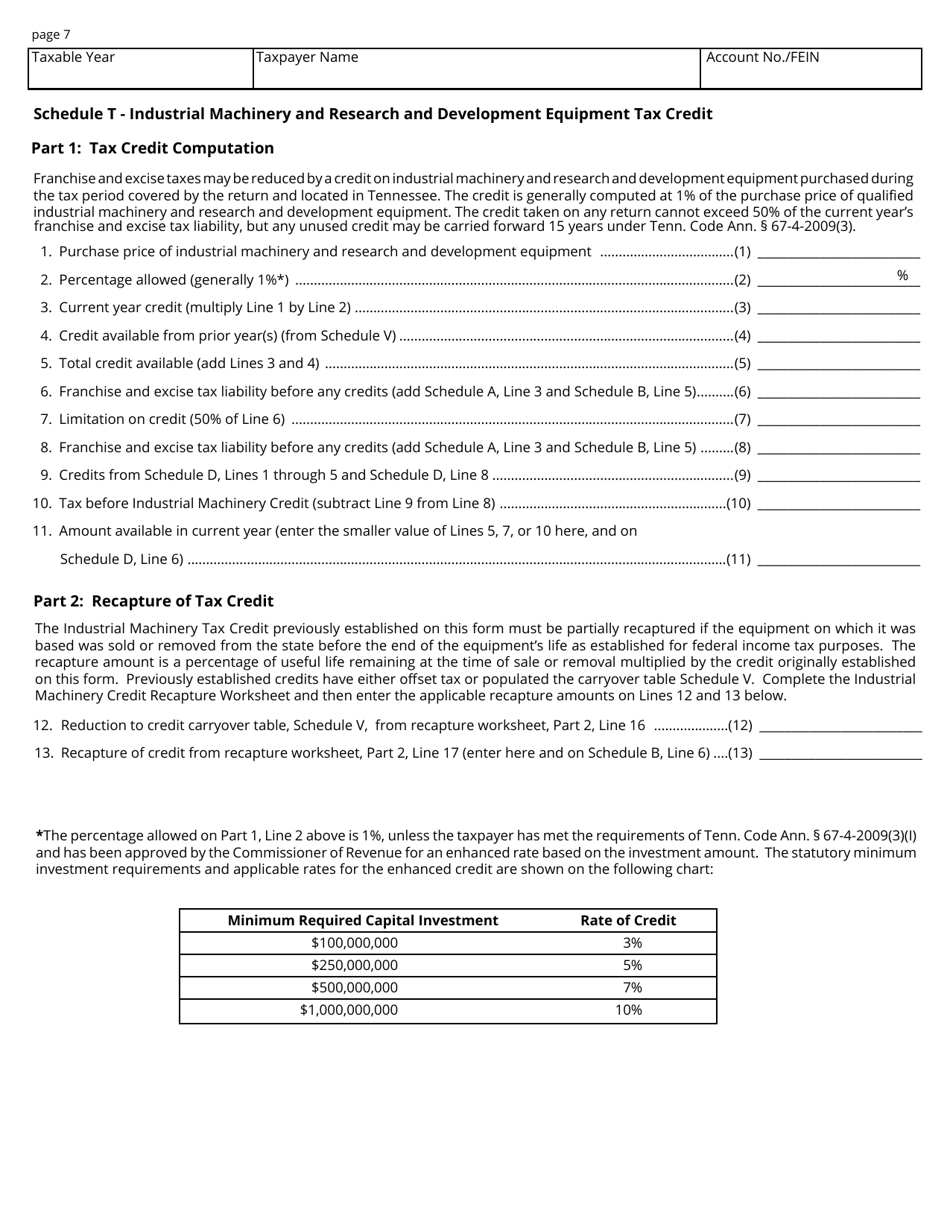

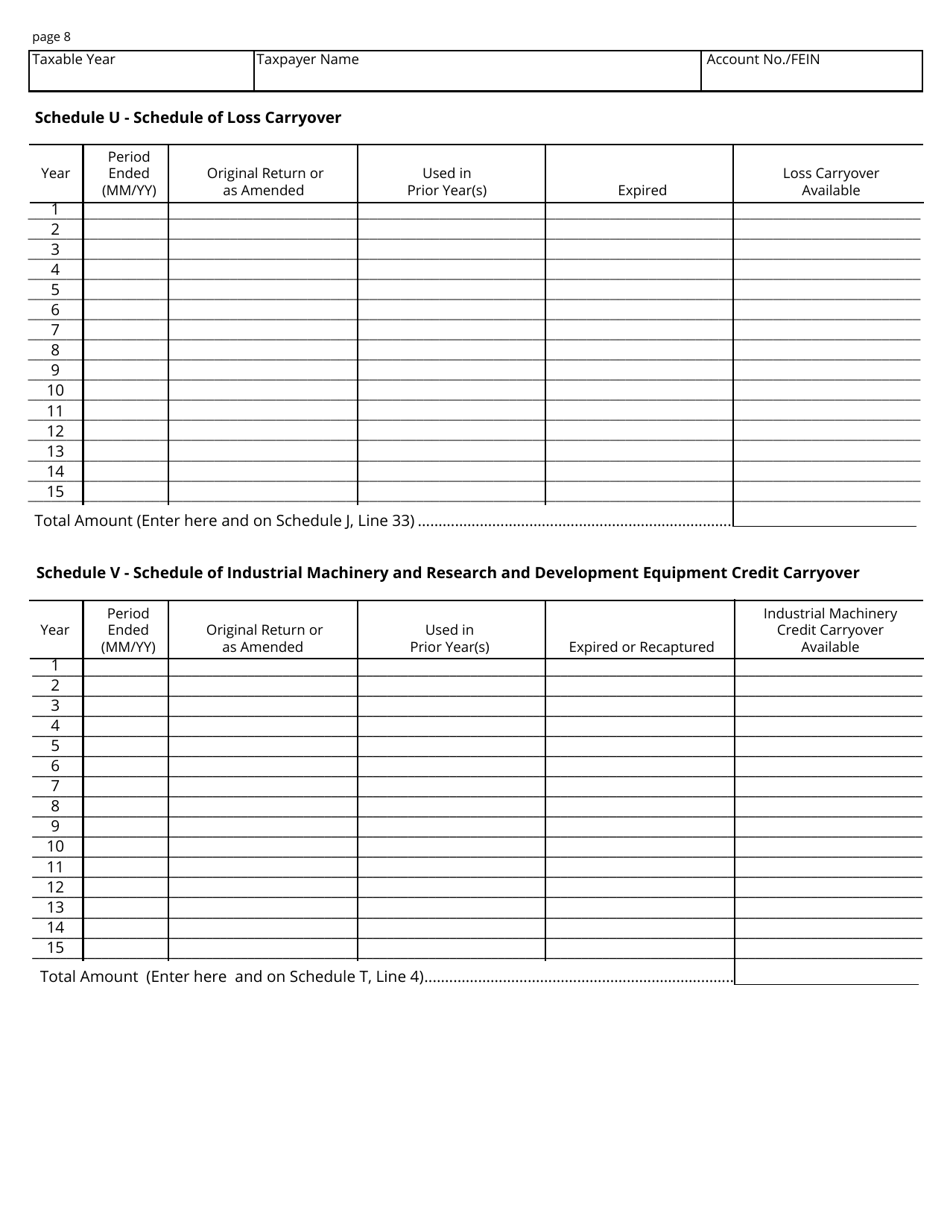

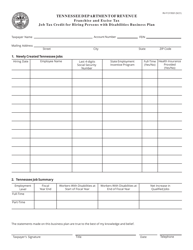

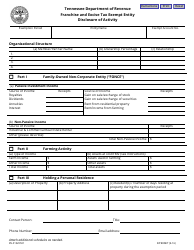

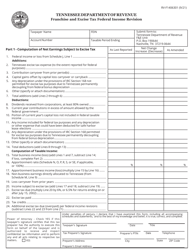

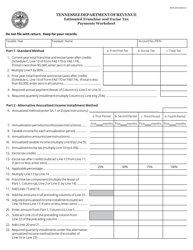

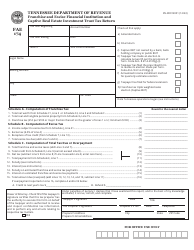

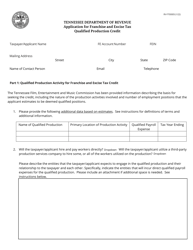

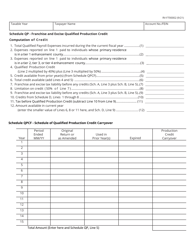

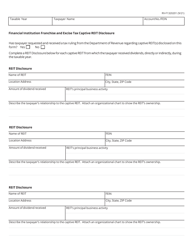

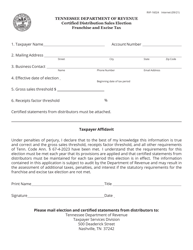

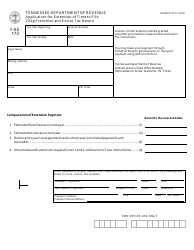

Form FAE170 (RV-R0011001) Franchise and Excise Tax Return - Tennessee

What Is Form FAE170 (RV-R0011001)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAE170 (RV-R0011001)?

A: Form FAE170 (RV-R0011001) is the Franchise and Excise Tax Return form for the state of Tennessee.

Q: Who needs to file Form FAE170 (RV-R0011001)?

A: Any business or taxpayer subject to the franchise and excise tax in Tennessee needs to file Form FAE170 (RV-R0011001).

Q: What is the purpose of Form FAE170 (RV-R0011001)?

A: The purpose of Form FAE170 (RV-R0011001) is to report and calculate the franchise and excise tax liability in Tennessee.

Q: What information do I need to complete Form FAE170 (RV-R0011001)?

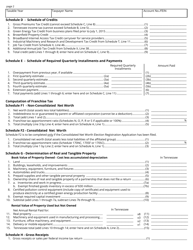

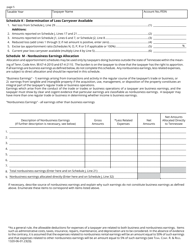

A: You will need information about your business income, deductions, and apportionment factors to complete Form FAE170 (RV-R0011001).

Q: When is the deadline to file Form FAE170 (RV-R0011001)?

A: The deadline to file Form FAE170 (RV-R0011001) in Tennessee is generally the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing of Form FAE170 (RV-R0011001)?

A: Yes, there are penalties for late filing of Form FAE170 (RV-R0011001) in Tennessee. It is important to file the form on time to avoid any penalties.

Q: Can I e-file Form FAE170 (RV-R0011001)?

A: Yes, Tennessee allows taxpayers to e-file Form FAE170 (RV-R0011001). E-filing is a convenient and secure way to file your tax return.

Q: Do I need to include payment with Form FAE170 (RV-R0011001)?

A: Yes, if you have a tax liability, you need to include payment with Form FAE170 (RV-R0011001) when you file your return.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE170 (RV-R0011001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.