This version of the form is not currently in use and is provided for reference only. Download this version of

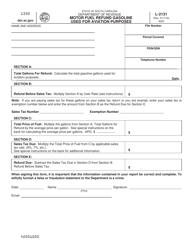

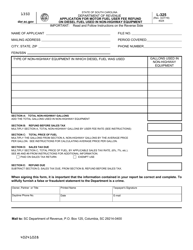

Form I-385

for the current year.

Form I-385 Motor Fuel Income Tax Credit - South Carolina

What Is Form I-385?

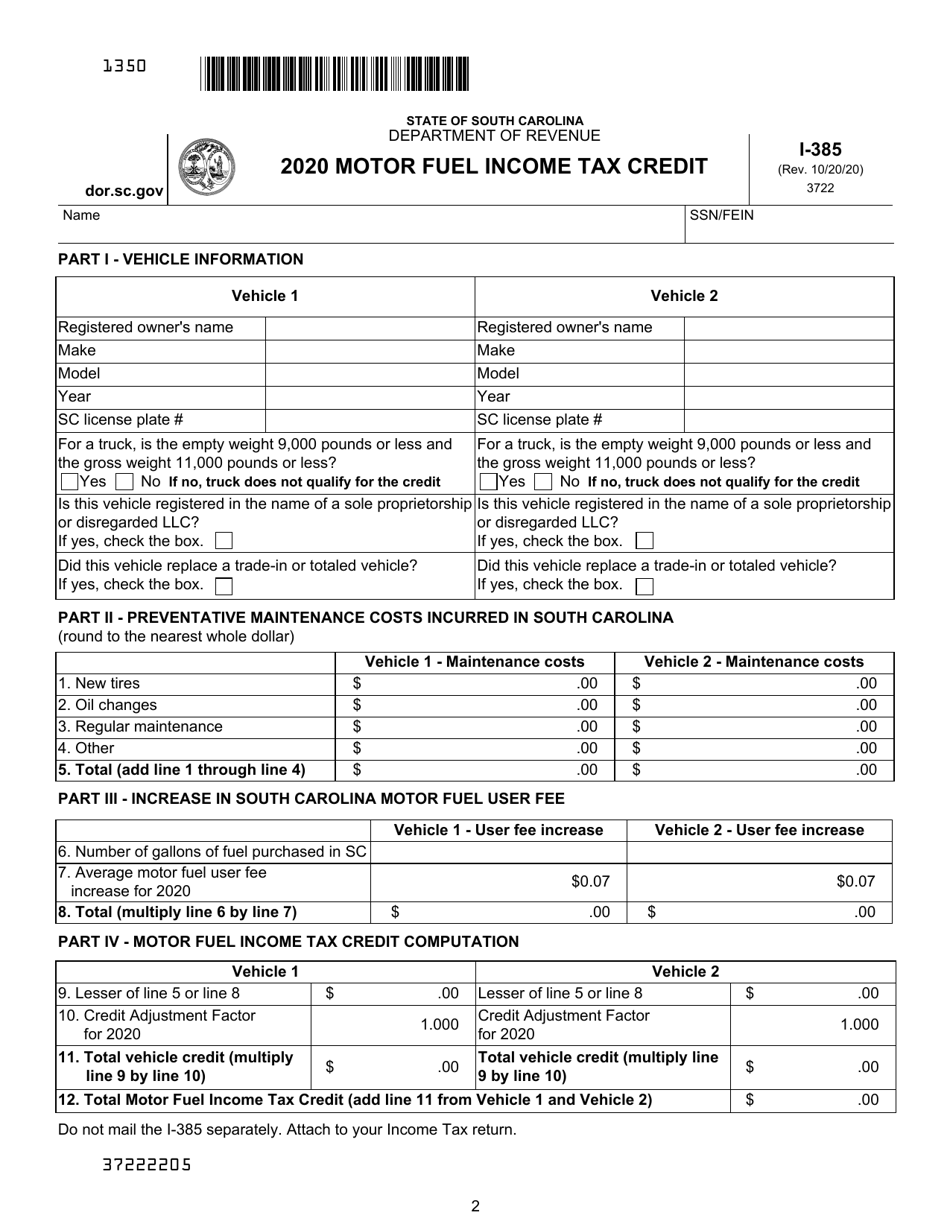

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

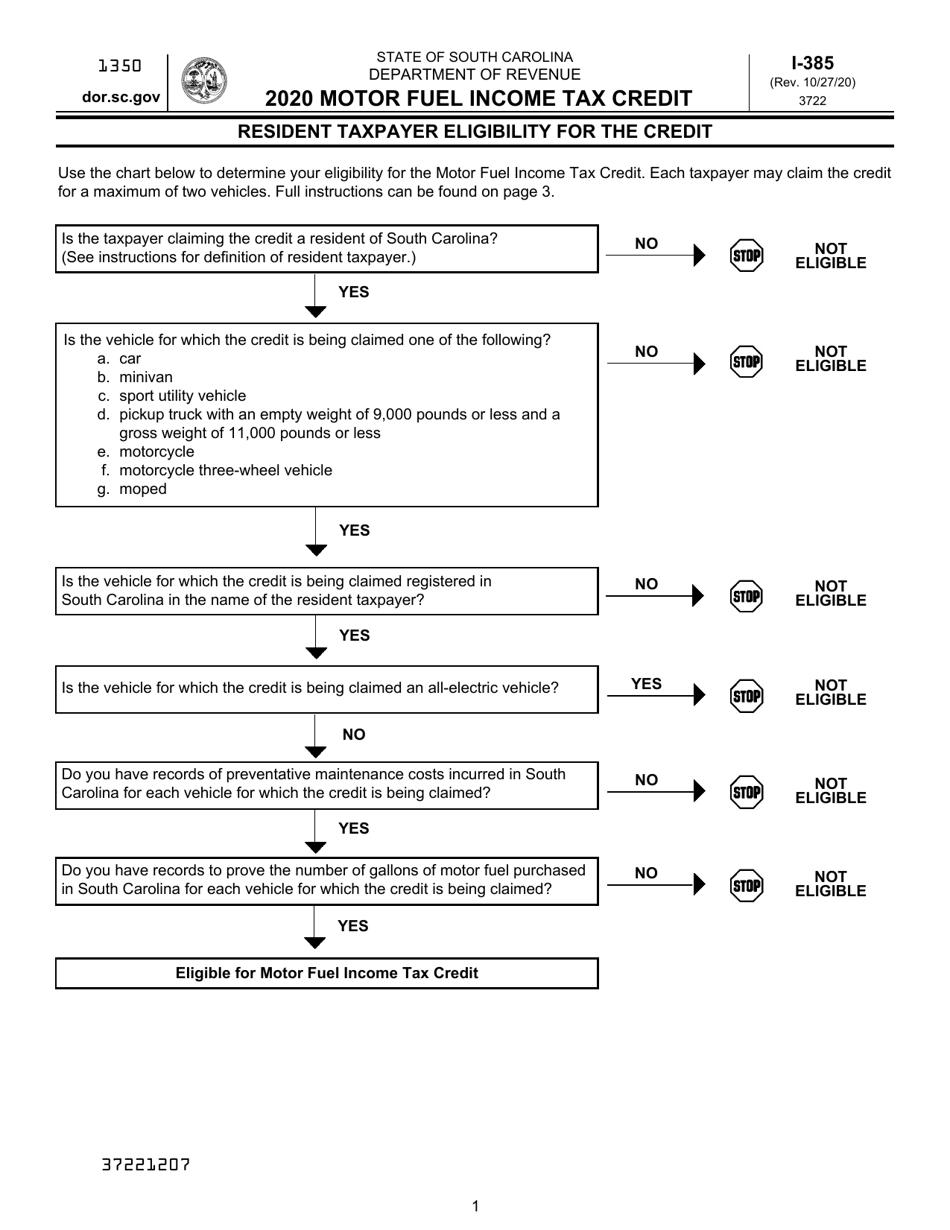

Q: What is Form I-385?

A: Form I-385 is a form used to claim the Motor Fuel Income Tax Credit in South Carolina.

Q: What is the Motor Fuel Income Tax Credit?

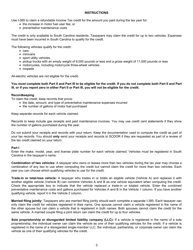

A: The Motor Fuel Income Tax Credit is a credit that can be claimed for certain motor fuels used for non-highway purposes in South Carolina.

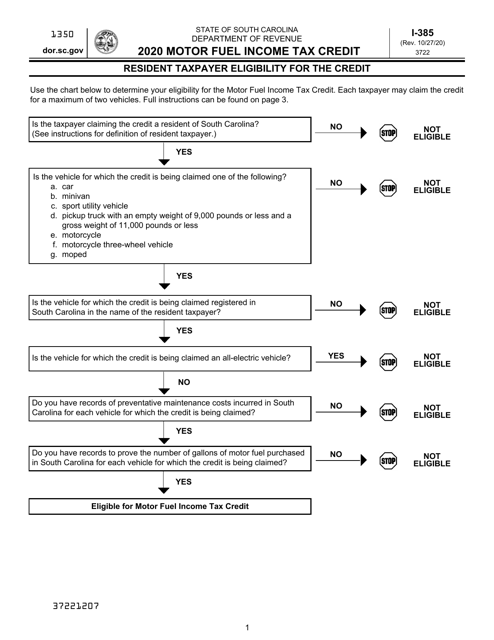

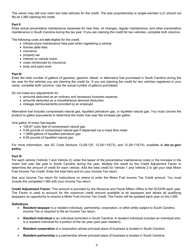

Q: Who is eligible to claim the Motor Fuel Income Tax Credit?

A: Individuals and businesses who use motor fuels for non-highway purposes in South Carolina may be eligible to claim the Motor Fuel Income Tax Credit.

Q: What types of motor fuels are eligible for the credit?

A: Certain types of motor fuels, such as gasoline, diesel fuel, and propane, may be eligible for the Motor Fuel Income Tax Credit.

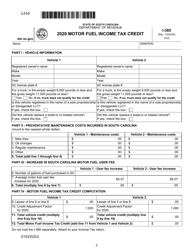

Q: How do I claim the Motor Fuel Income Tax Credit?

A: To claim the Motor Fuel Income Tax Credit, you need to file Form I-385 with the South Carolina Department of Revenue.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the Motor Fuel Income Tax Credit. It is important to review the instructions for Form I-385 and consult with a tax professional for specific details.

Q: Is the Motor Fuel Income Tax Credit refundable?

A: No, the Motor Fuel Income Tax Credit is not refundable. It can only be used to offset income tax liabilities in South Carolina.

Form Details:

- Released on October 27, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-385 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.