This version of the form is not currently in use and is provided for reference only. Download this version of

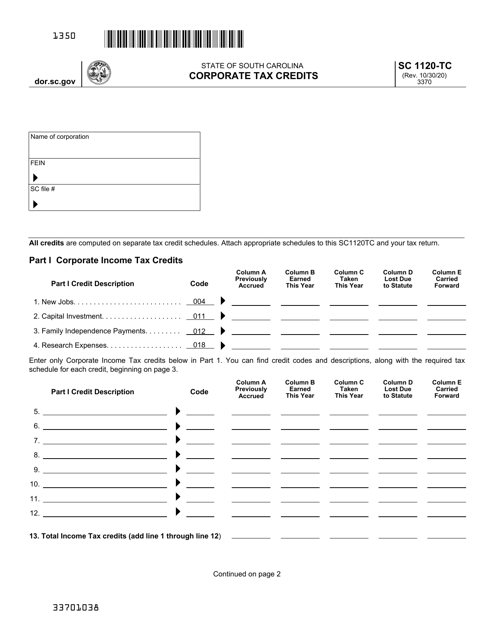

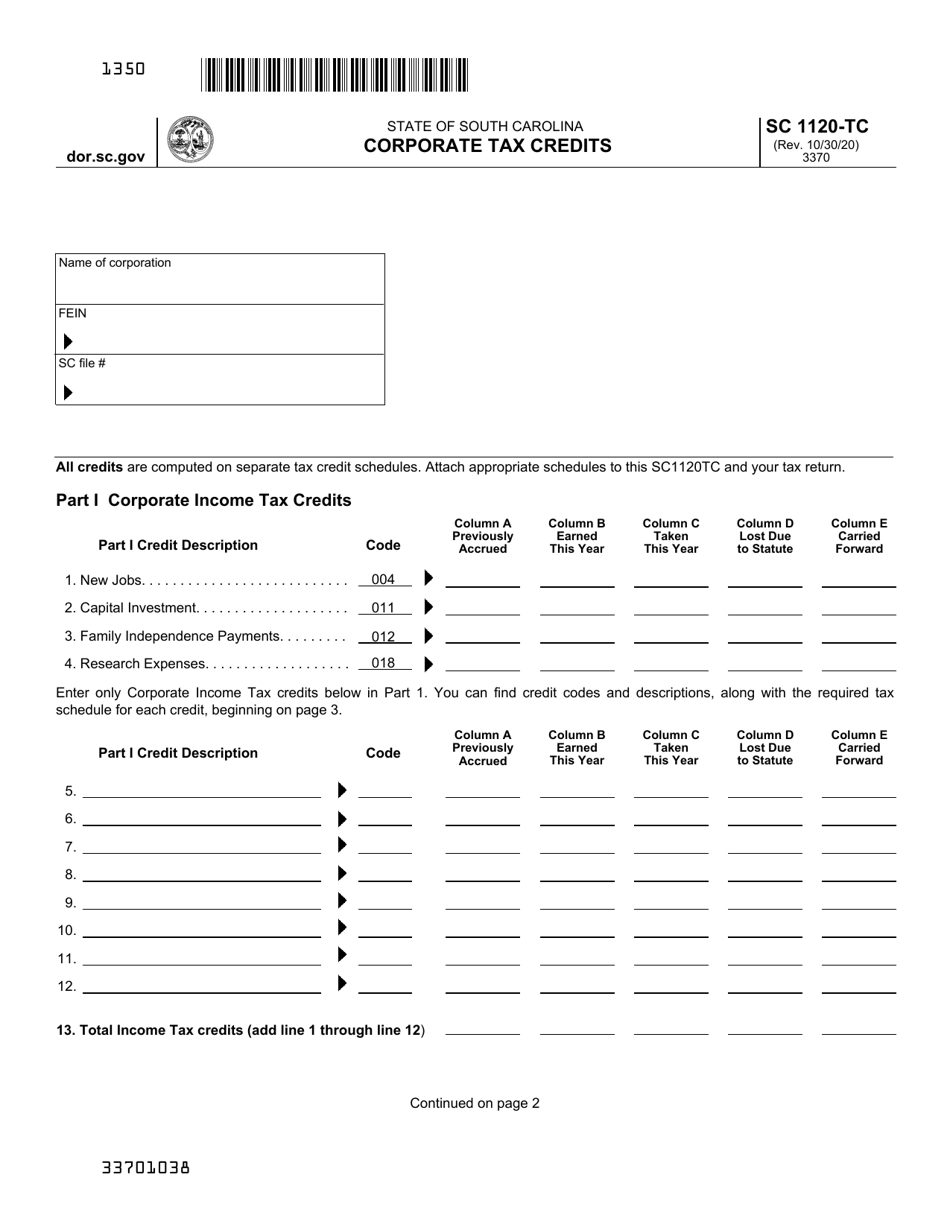

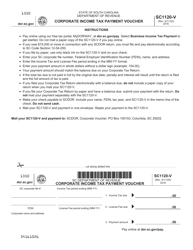

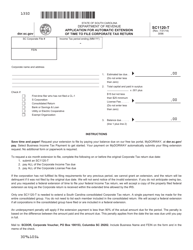

Form SC1120-TC

for the current year.

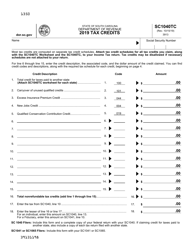

Form SC1120-TC Corporate Tax Credits - South Carolina

What Is Form SC1120-TC?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC1120-TC?

A: Form SC1120-TC is a corporate tax form in South Carolina used to claim tax credits.

Q: Who needs to file Form SC1120-TC?

A: Corporations in South Carolina that are eligible for tax credits need to file Form SC1120-TC.

Q: What are tax credits?

A: Tax credits are incentives provided by the government to corporations to encourage certain activities or behavior.

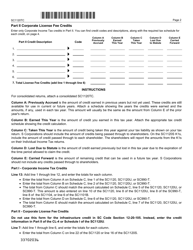

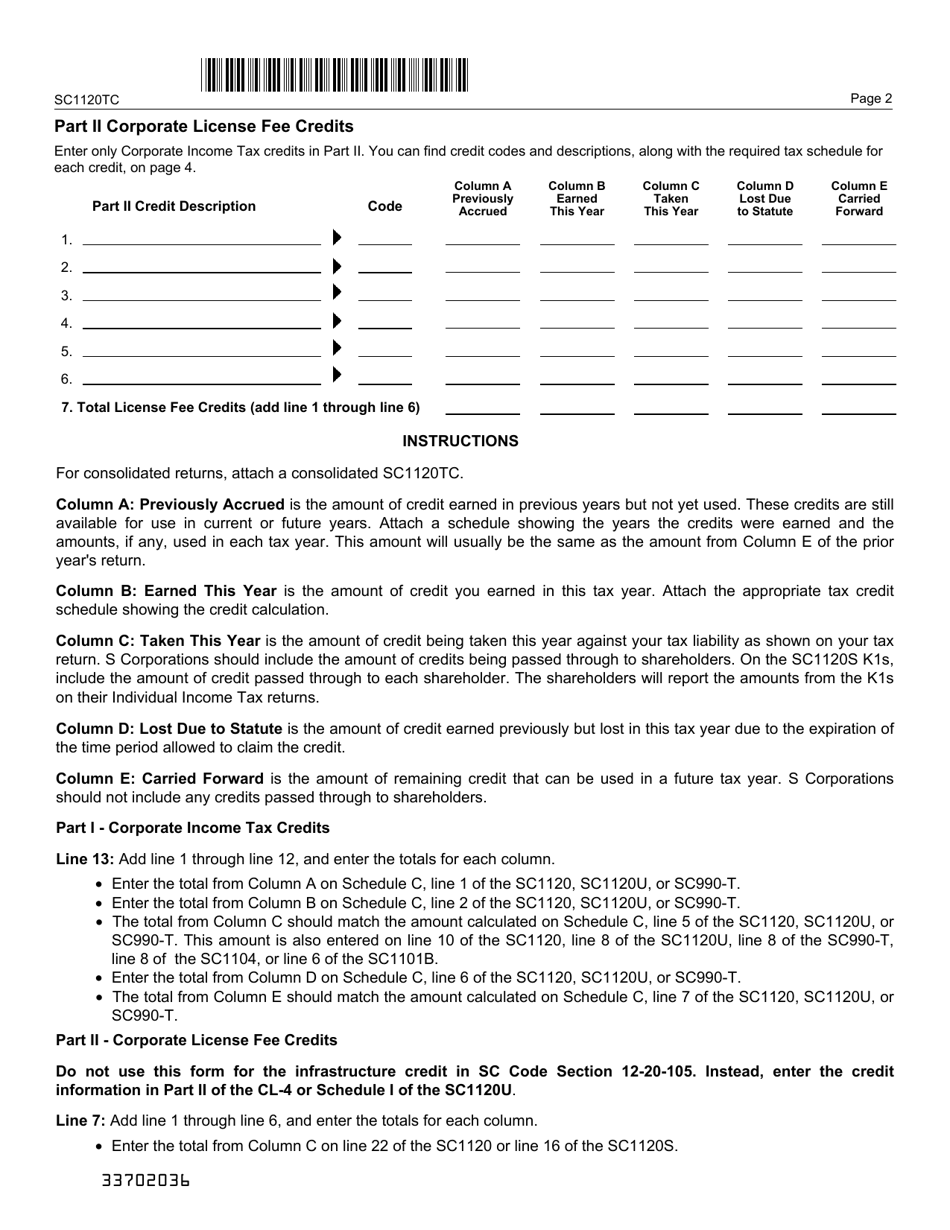

Q: How do I claim tax credits on Form SC1120-TC?

A: You need to complete the form and provide necessary supporting documentation to claim tax credits.

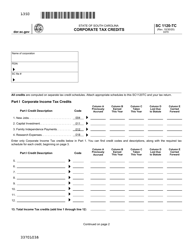

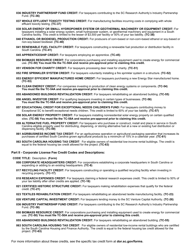

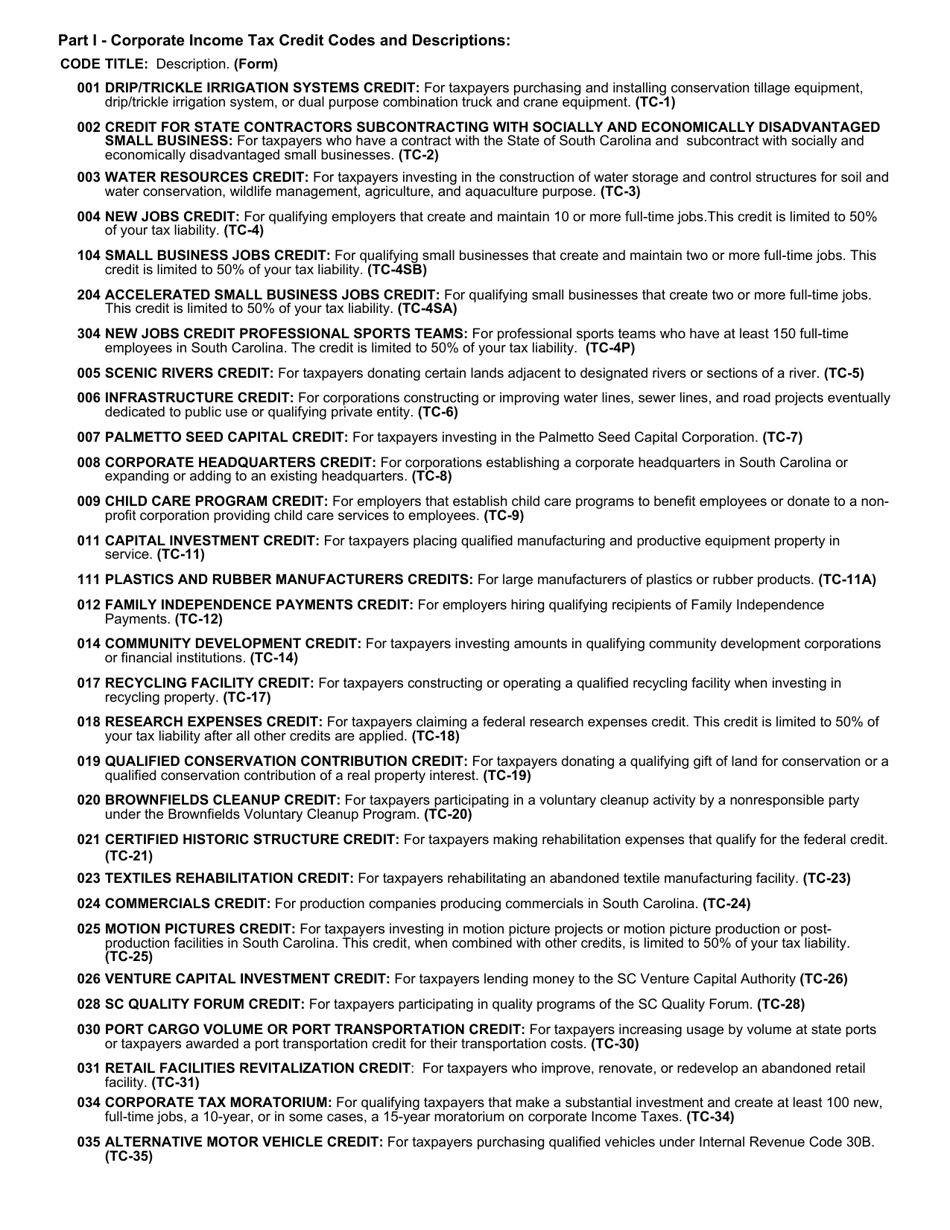

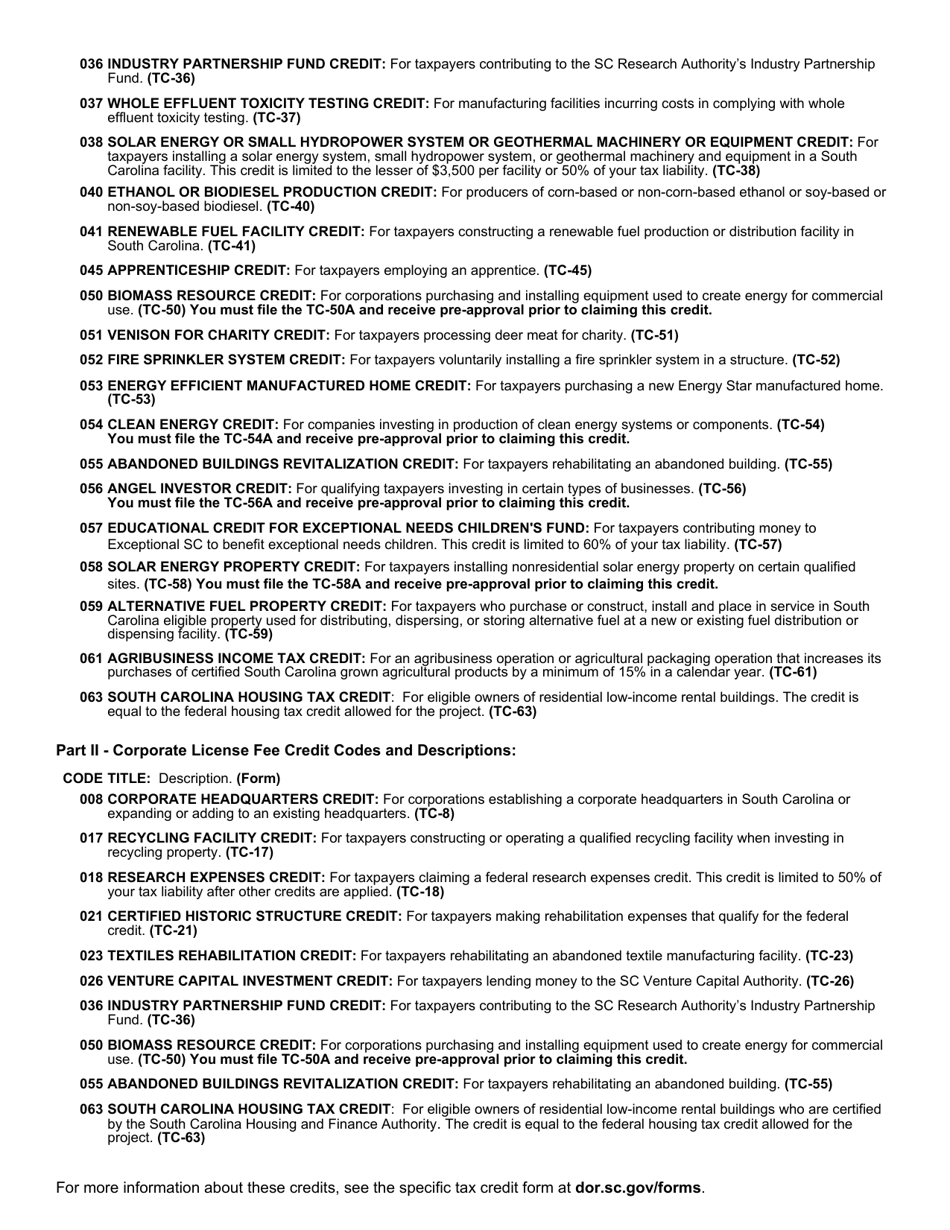

Q: What types of tax credits can be claimed on Form SC1120-TC?

A: Form SC1120-TC allows for the claiming of various tax credits, such as job tax credits, investment tax credits, and research and development tax credits.

Q: When is the deadline for filing Form SC1120-TC?

A: The deadline for filing Form SC1120-TC is the same as the deadline for filing the corresponding corporate tax return, which is generally the 15th day of the 4th month following the end of the tax year.

Q: Are there any penalties for late filing of Form SC1120-TC?

A: Yes, there may be penalties for late filing of Form SC1120-TC, including fines and interest.

Q: Do I need to include supporting documentation with Form SC1120-TC?

A: Yes, you generally need to provide supporting documentation for the tax credits claimed on Form SC1120-TC.

Form Details:

- Released on October 30, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1120-TC by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.