This version of the form is not currently in use and is provided for reference only. Download this version of

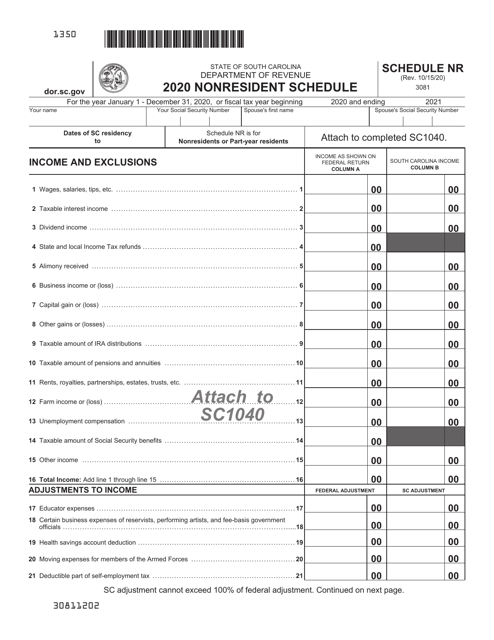

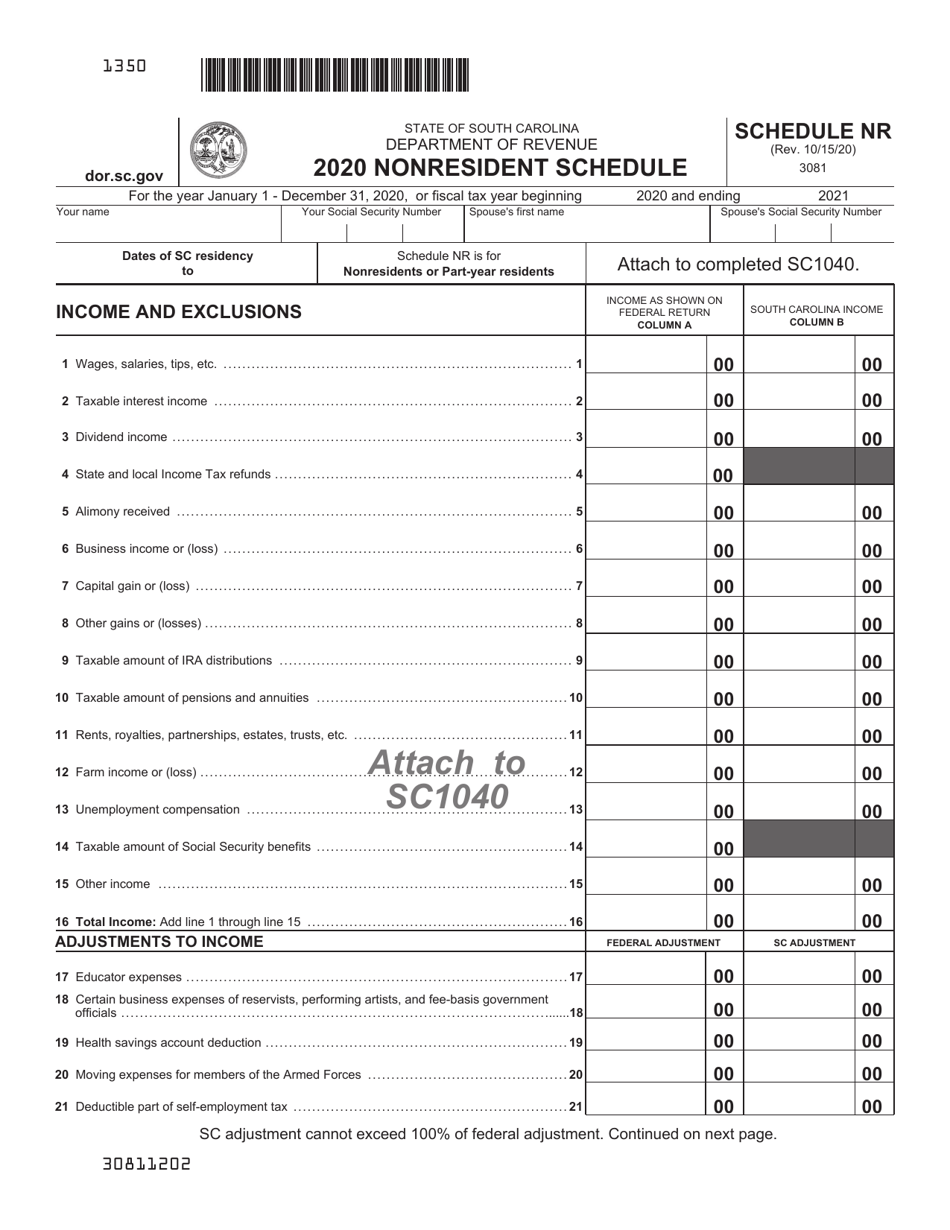

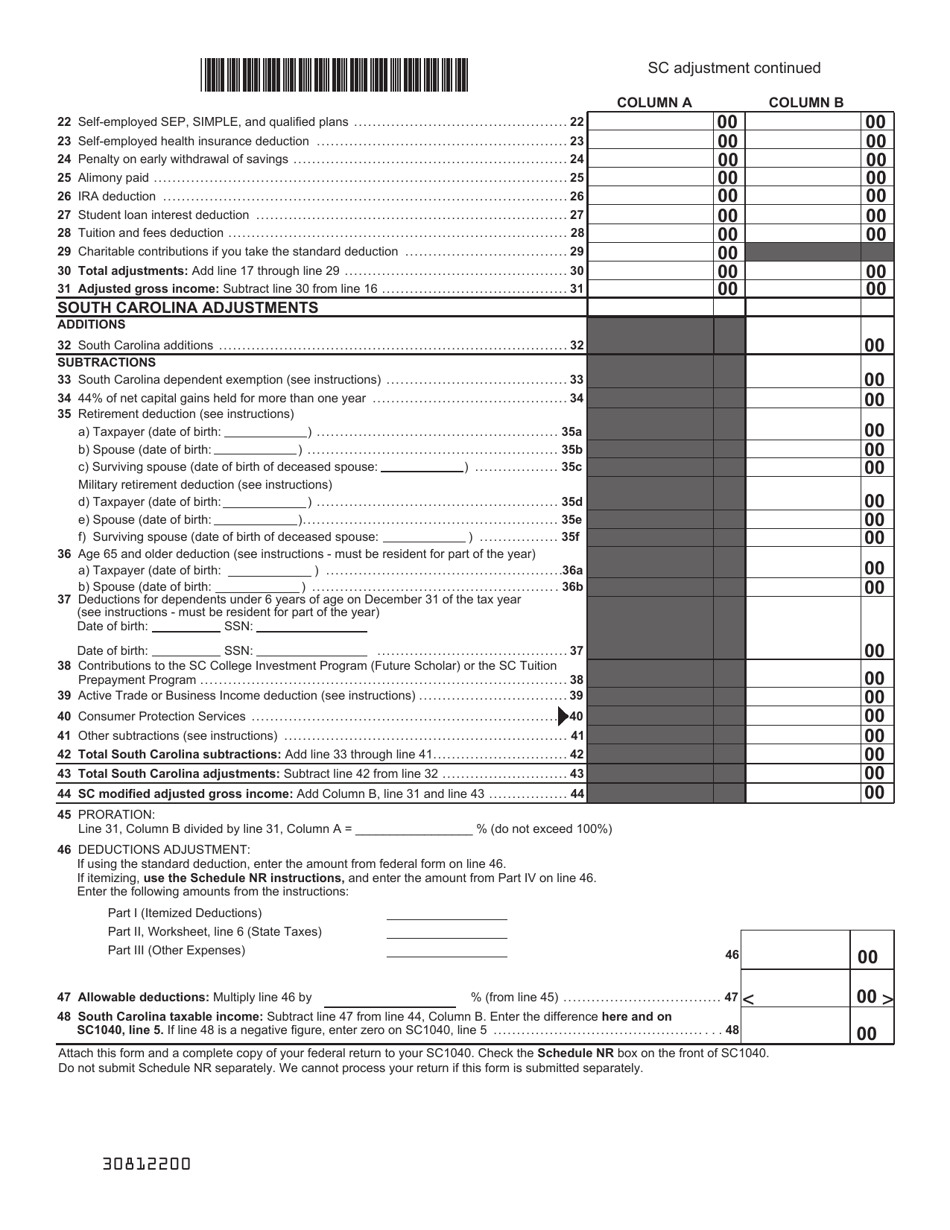

Schedule NR

for the current year.

Schedule NR Nonresident Schedule - South Carolina

What Is Schedule NR?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NR?

A: Schedule NR is the Nonresident Schedule in South Carolina.

Q: Who needs to file Schedule NR?

A: Nonresidents who earned income in South Carolina need to file Schedule NR.

Q: What is the purpose of Schedule NR?

A: The purpose of Schedule NR is to report and calculate taxes owed by nonresidents in South Carolina.

Q: What income should be reported on Schedule NR?

A: Nonresidents should report income earned in South Carolina, including wages, salaries, and business income.

Q: Is Schedule NR separate from the federal tax return?

A: Yes, Schedule NR is a separate form from the federal tax return.

Q: When is the deadline to file Schedule NR?

A: The deadline to file Schedule NR is the same as the deadline for the South Carolina Individual Income Tax Return, which is usually April 15th.

Q: Are there any penalties for failing to file Schedule NR?

A: If you fail to file Schedule NR or pay the taxes owed, you may be subject to penalties and interest.

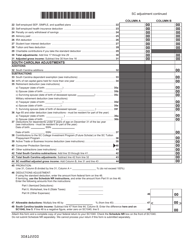

Q: Can I claim deductions or credits on Schedule NR?

A: Nonresidents may be eligible to claim certain deductions or credits on Schedule NR, so it's important to review the instructions carefully.

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NR by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.