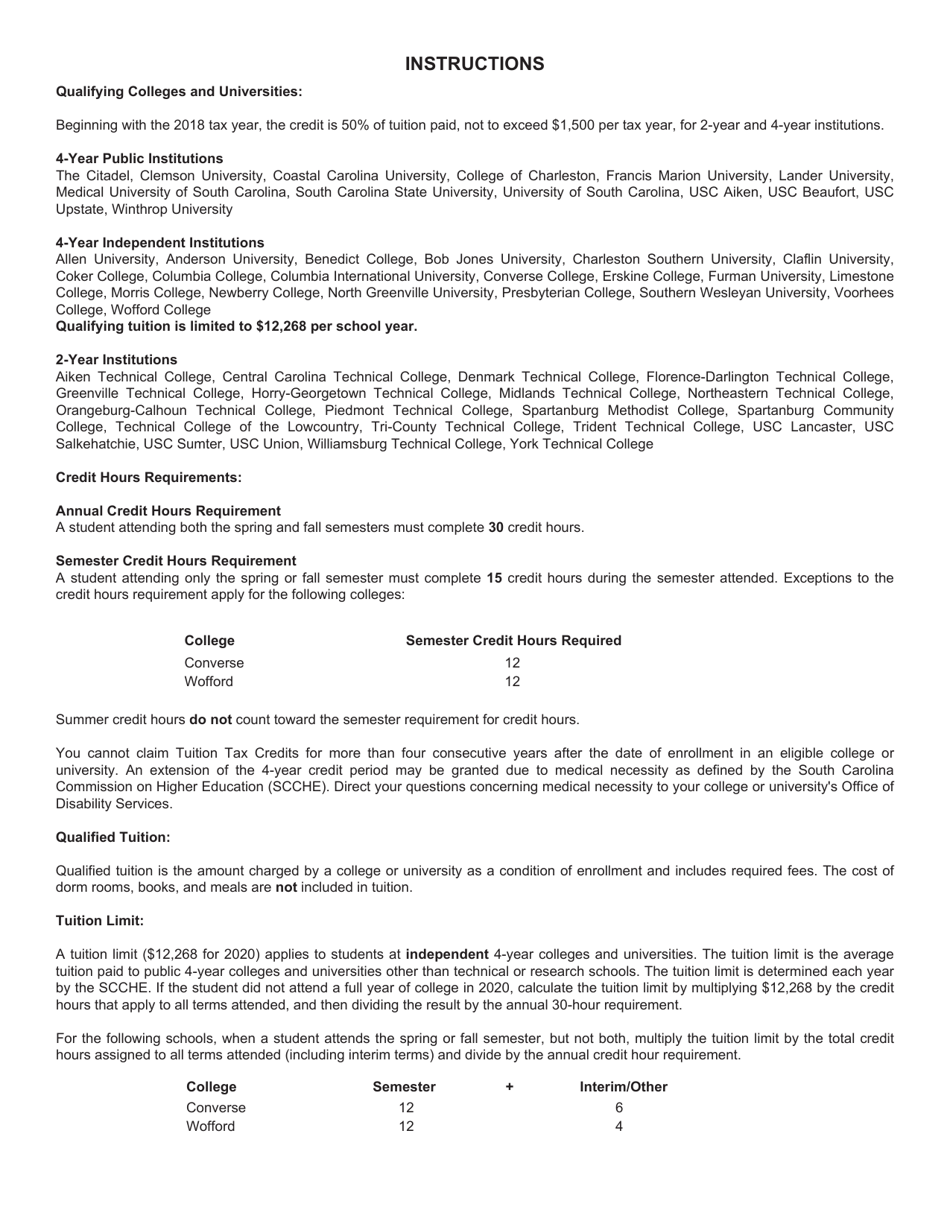

This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-319

for the current year.

Form I-319 Tuition Tax Credit - South Carolina

What Is Form I-319?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-319?

A: Form I-319 is the Tuition Tax Credit form.

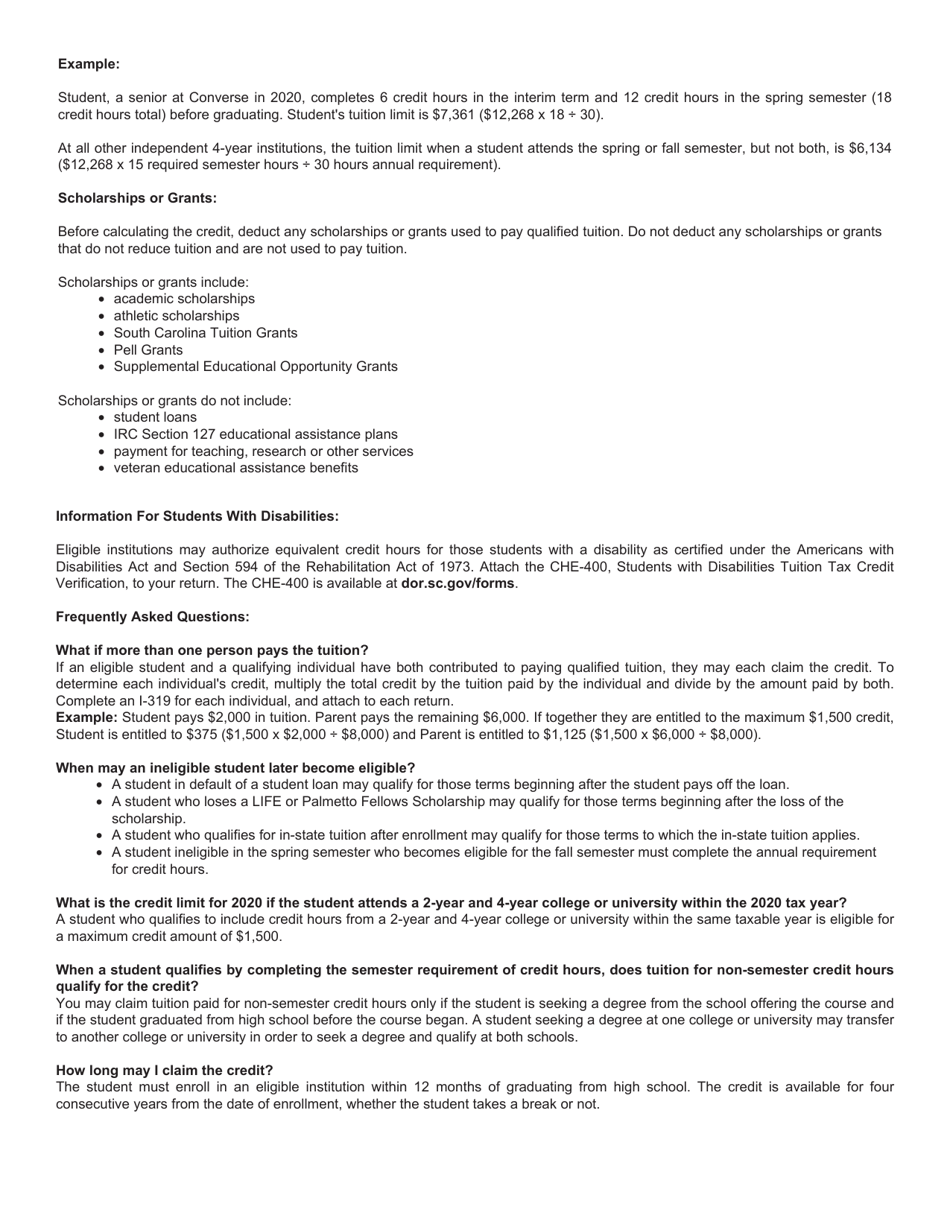

Q: What is the Tuition Tax Credit?

A: The Tuition Tax Credit is a tax incentive offered by the state of South Carolina to help offset the cost of tuition expenses.

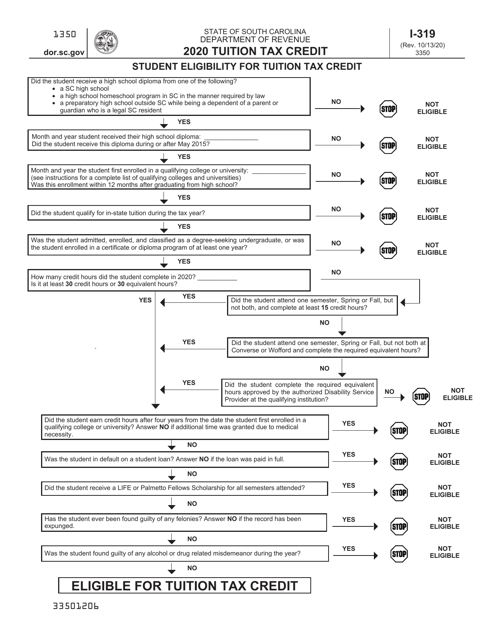

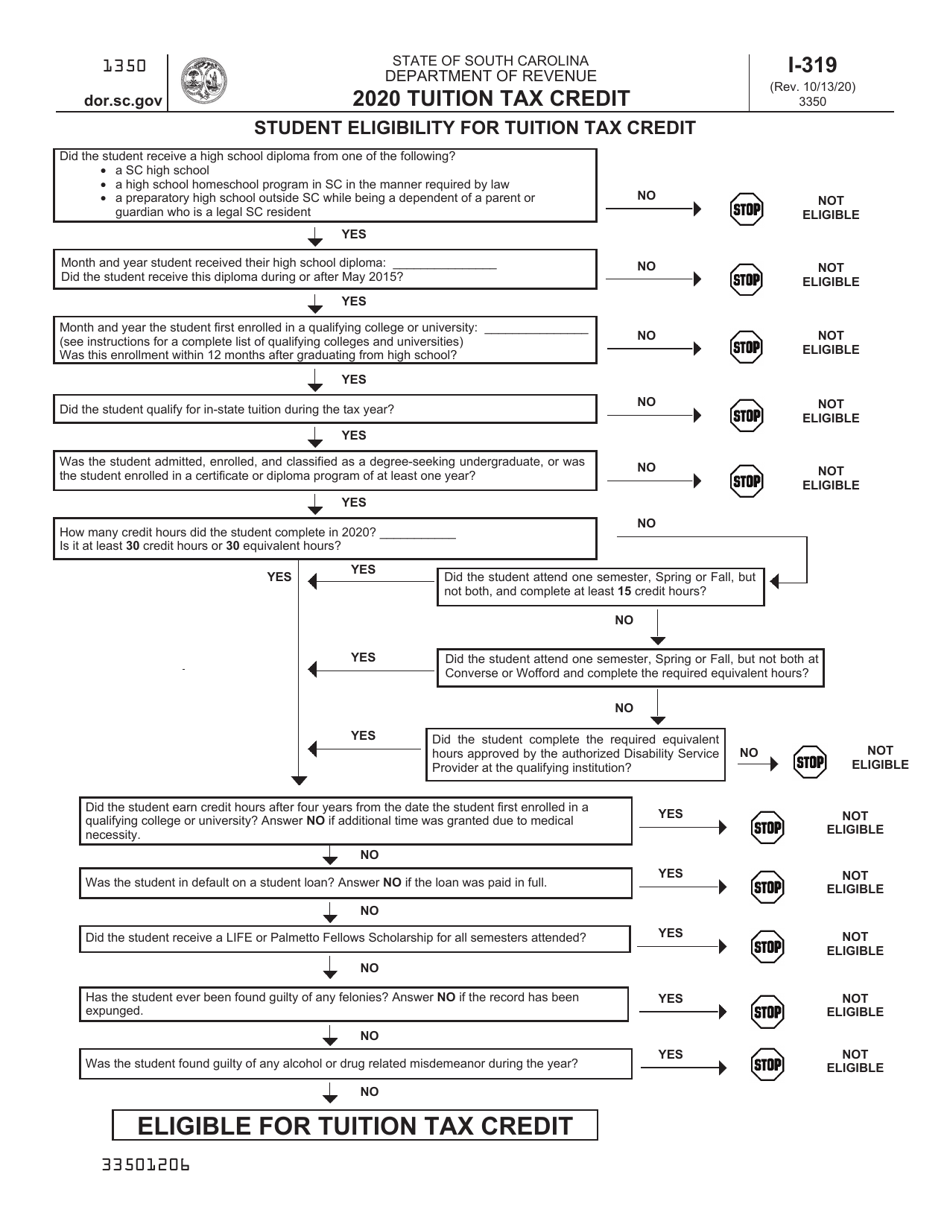

Q: Who is eligible for the Tuition Tax Credit?

A: South Carolina residents who pay tuition to an eligible educational institution may be eligible for the Tuition Tax Credit.

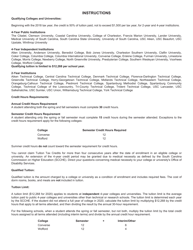

Q: What is an eligible educational institution?

A: An eligible educational institution is a college, university, or technical college located in South Carolina that is recognized by the U.S. Department of Education.

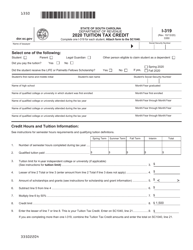

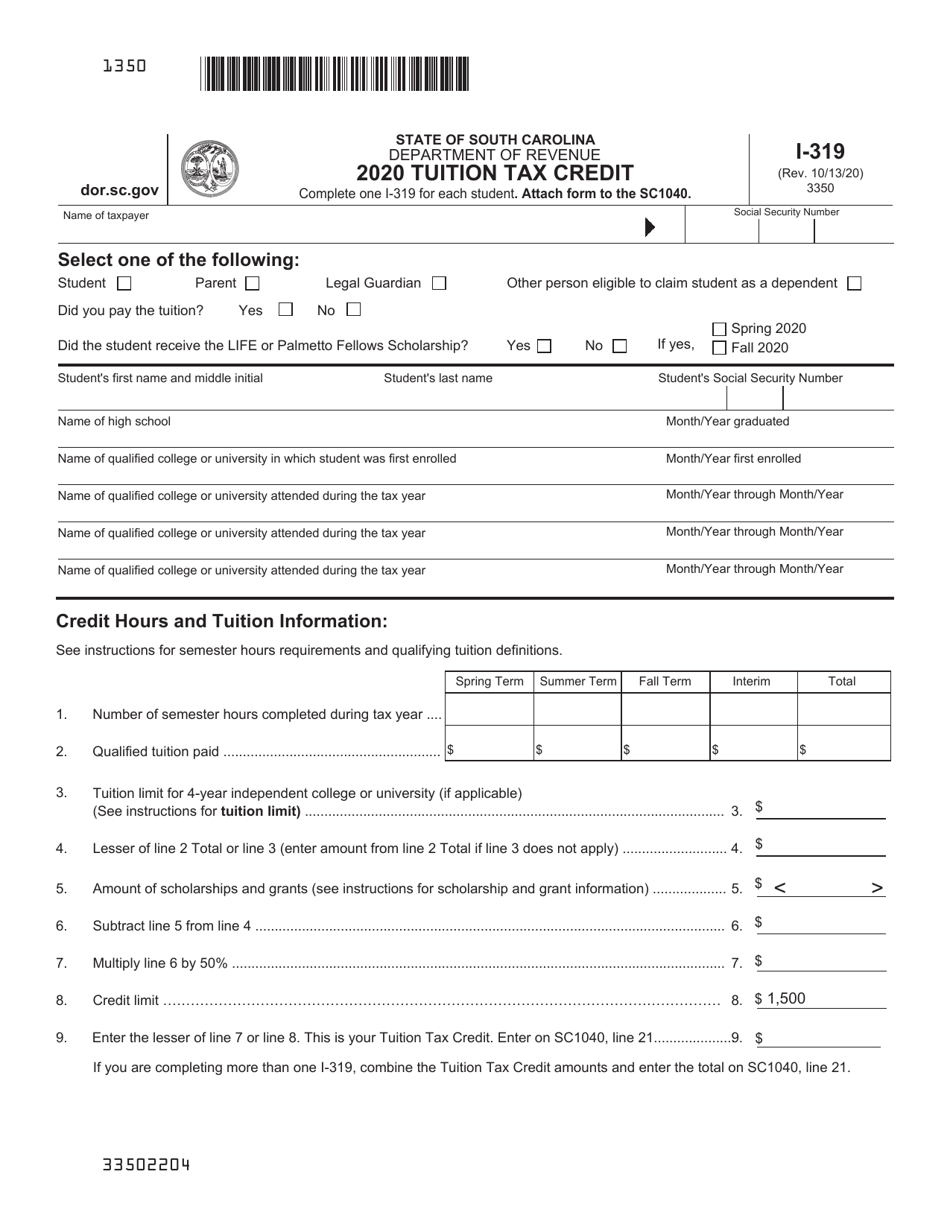

Q: How much is the Tuition Tax Credit?

A: The amount of the Tuition Tax Credit is equal to 100% of the tuition expenses paid, up to a maximum of $1,500 per year.

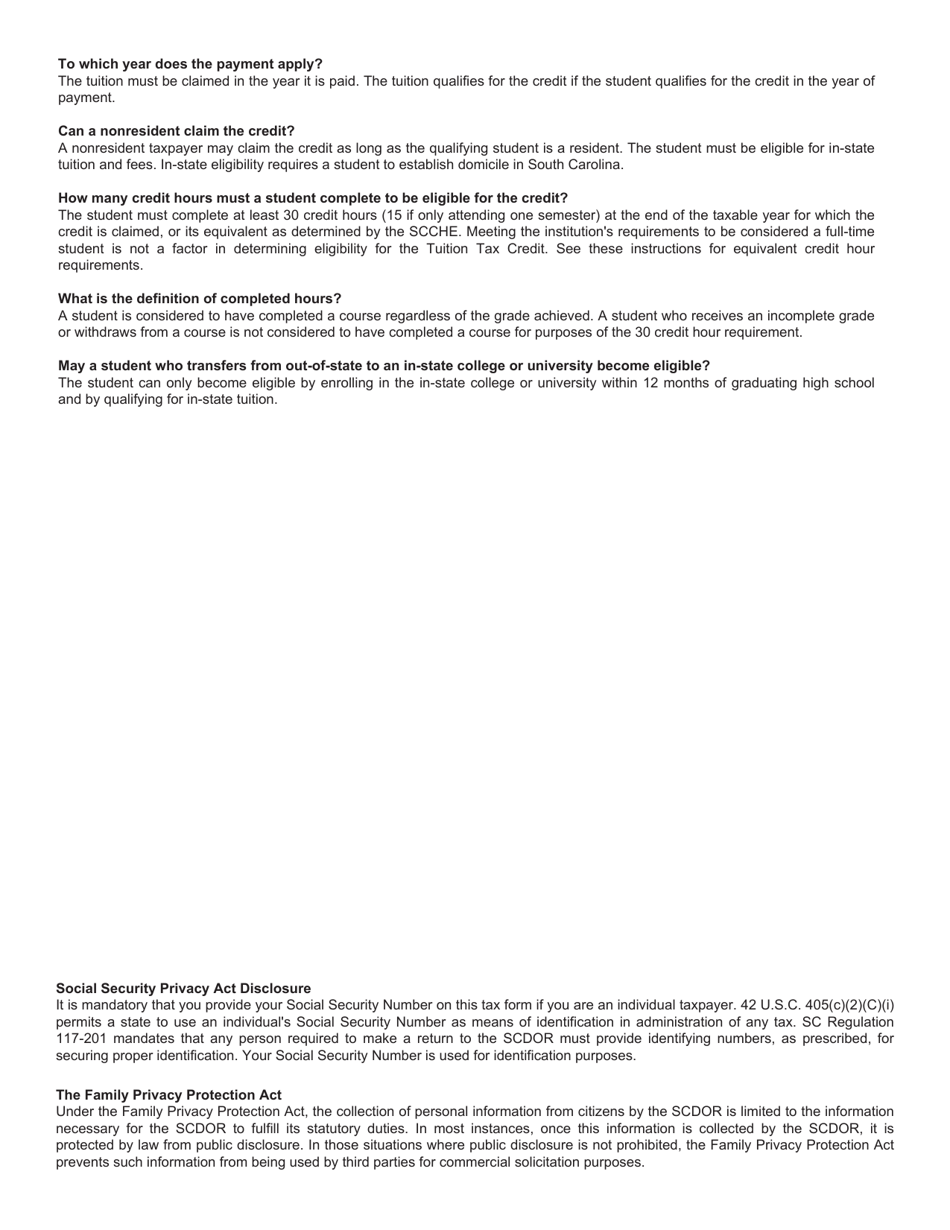

Q: How do I claim the Tuition Tax Credit?

A: To claim the Tuition Tax Credit, you must complete and file Form I-319 with the South Carolina Department of Revenue.

Q: Is there a deadline to file Form I-319?

A: Yes, Form I-319 must be filed by the due date of your South Carolina income tax return.

Q: Can I claim the Tuition Tax Credit if I am not a South Carolina resident?

A: No, the Tuition Tax Credit is only available to South Carolina residents.

Q: Are there any income limitations to qualify for the Tuition Tax Credit?

A: No, there are no income limitations to qualify for the Tuition Tax Credit.

Q: Can the Tuition Tax Credit be carried forward to future years?

A: No, the Tuition Tax Credit cannot be carried forward to future years.

Form Details:

- Released on October 13, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-319 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.