This version of the form is not currently in use and is provided for reference only. Download this version of

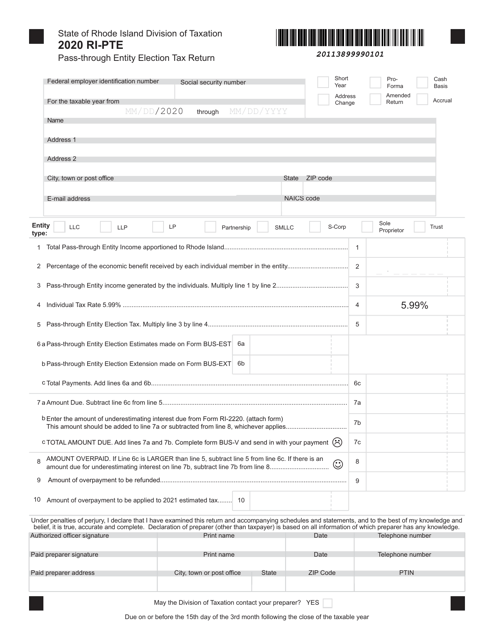

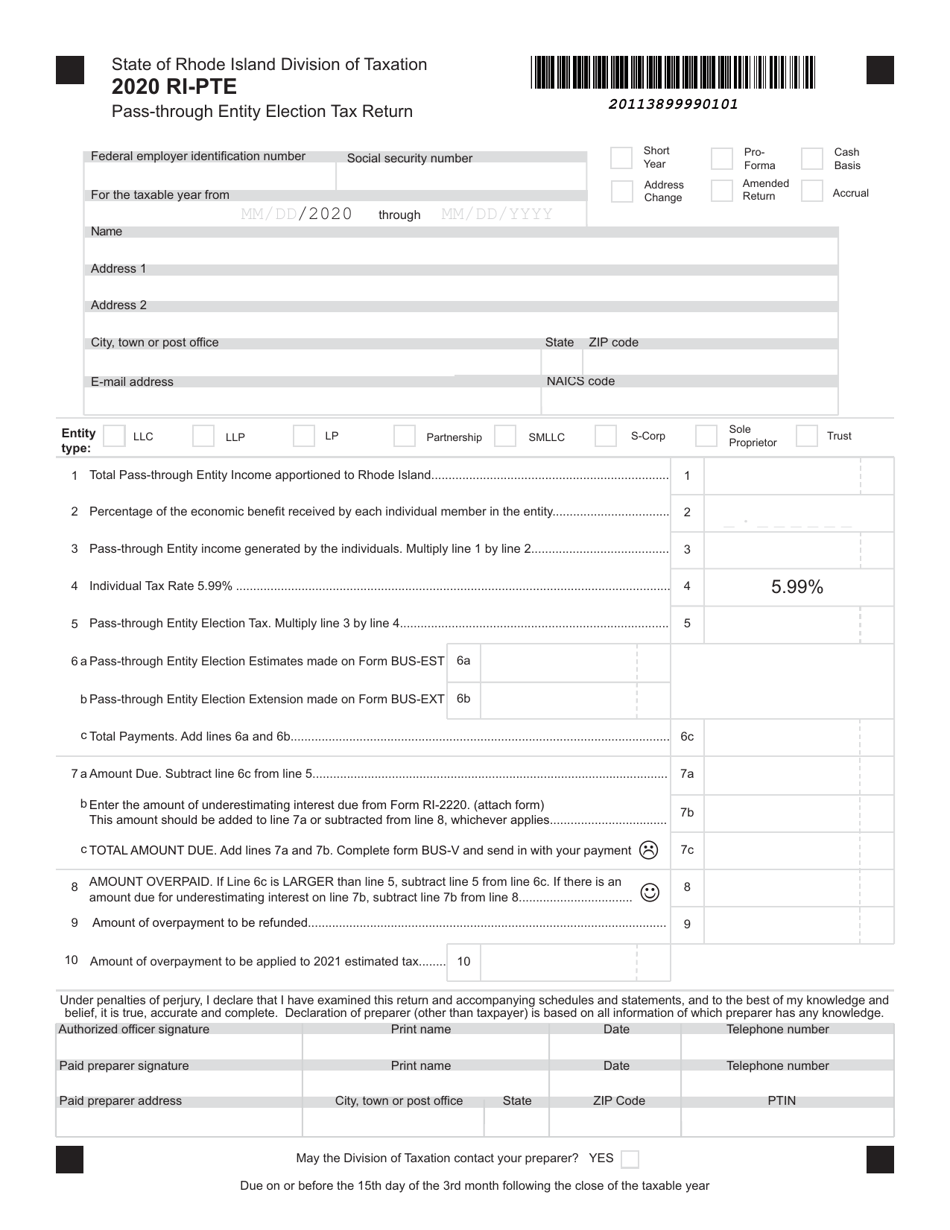

Form RI-PTE

for the current year.

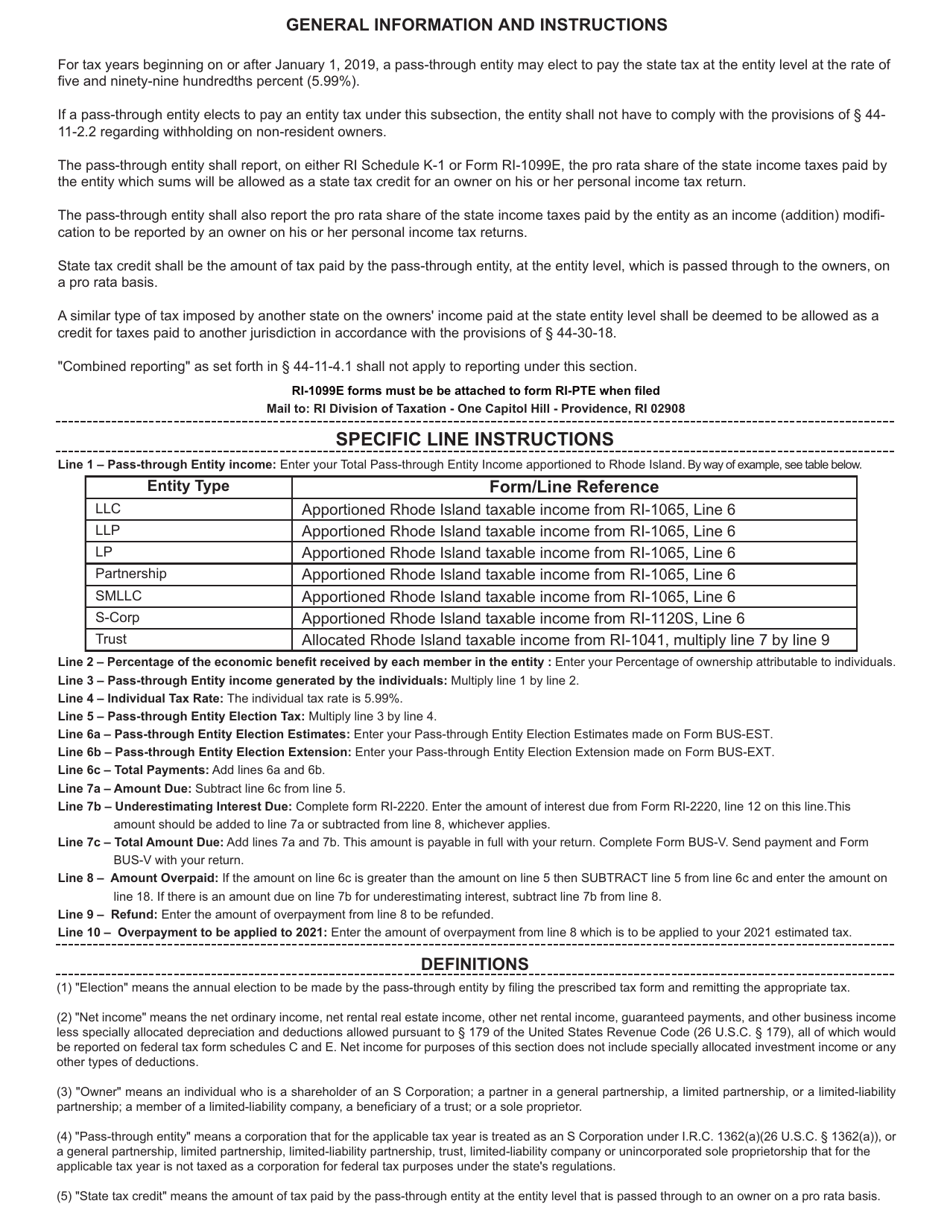

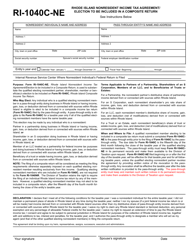

Form RI-PTE Pass-Through Entity Election Tax Return - Rhode Island

What Is Form RI-PTE?

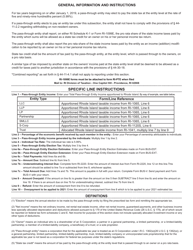

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-PTE?

A: Form RI-PTE is the Pass-Through Entity Election Tax Return for Rhode Island.

Q: Who needs to file Form RI-PTE?

A: Pass-through entities (such as partnerships and S corporations) that want to elect to be taxed at the entity level in Rhode Island need to file Form RI-PTE.

Q: What is the purpose of filing Form RI-PTE?

A: The purpose of filing Form RI-PTE is to elect to be taxed as a pass-through entity at the entity level in Rhode Island.

Q: When is Form RI-PTE due?

A: Form RI-PTE is due on or before the 15th day of the 3rd month following the close of the tax year.

Q: Are there any filing fees for Form RI-PTE?

A: No, there are no filing fees for Form RI-PTE.

Q: Is Form RI-PTE required if the pass-through entity does not want to elect entity-level taxation?

A: No, Form RI-PTE is only required if the pass-through entity wants to elect entity-level taxation in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-PTE by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.