This version of the form is not currently in use and is provided for reference only. Download this version of

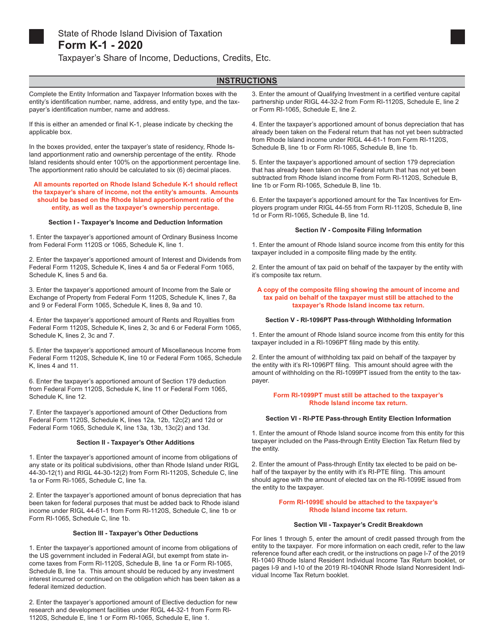

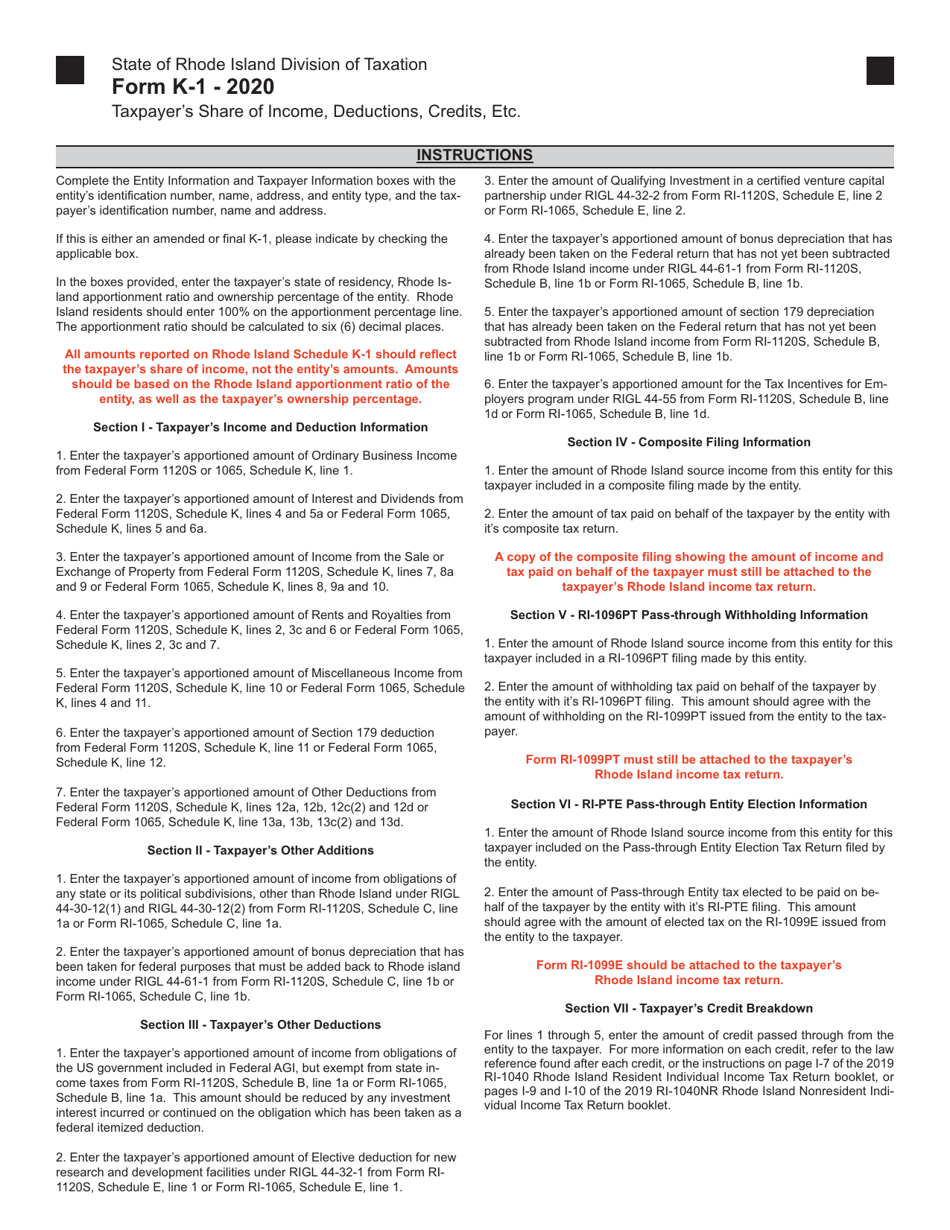

Instructions for Schedule K-1

for the current year.

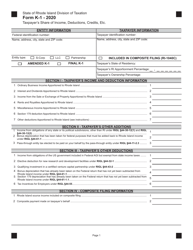

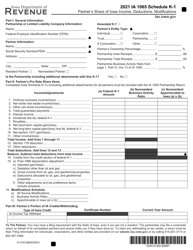

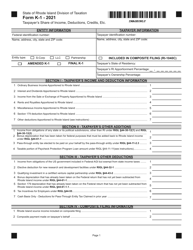

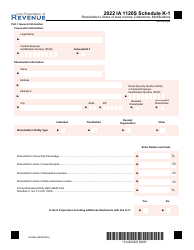

Instructions for Schedule K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island

This document contains official instructions for Schedule K-1 , Taxpayer's Share of Income, Deductions, Credits, Etc. - a form released and collected by the Rhode Island Department of Revenue - Division of Taxation.

FAQ

Q: What is Schedule K-1?

A: Schedule K-1 is a tax form used to report the income, deductions, credits, and other tax-related information of a partnership, S corporation, estate, or trust.

Q: Who needs to file Schedule K-1?

A: Partnerships, S corporations, estates, and trusts that generate income, deductions, credits, etc., need to file Schedule K-1.

Q: What is the purpose of Schedule K-1?

A: The purpose of Schedule K-1 is to inform the partners, shareholders, beneficiaries, or heirs about their share of the entity's income, deductions, credits, etc.

Q: Do I need to attach Schedule K-1 to my tax return?

A: Yes, if you receive a Schedule K-1, you generally need to attach it to your federal or state tax return.

Q: How do I fill out Schedule K-1?

A: The entity that issues Schedule K-1 will provide you with the necessary information to fill out the form. Follow the instructions and enter the relevant information accurately.

Q: What should I do if I receive multiple Schedule K-1 forms?

A: If you receive multiple Schedule K-1 forms, you will need to report the information from each form separately on your tax return.

Q: Are Schedule K-1 forms different for each state?

A: Yes, Schedule K-1 forms may vary by state. Make sure you use the correct form for the state in which you are filing your taxes.

Q: What happens if I forget to include Schedule K-1 with my tax return?

A: If you forget to include Schedule K-1 with your tax return, you may need to file an amended return to include the information. This could result in penalties or interest, so it's important to make sure you include all necessary forms.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Revenue - Division of Taxation.