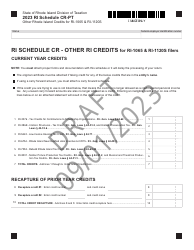

This version of the form is not currently in use and is provided for reference only. Download this version of

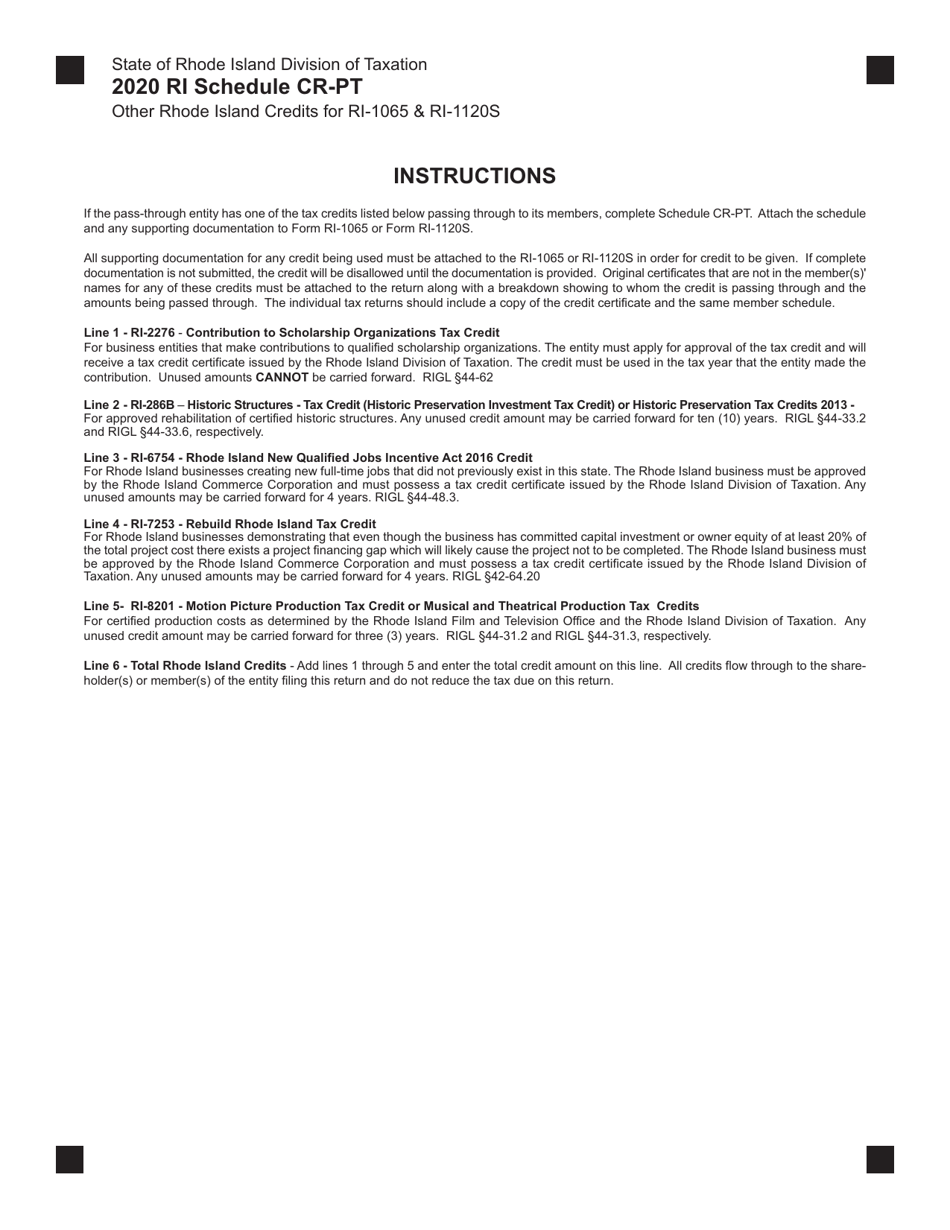

Schedule CR-PT

for the current year.

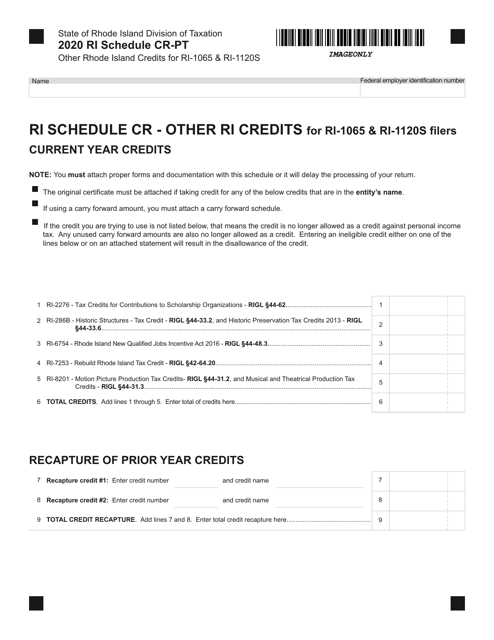

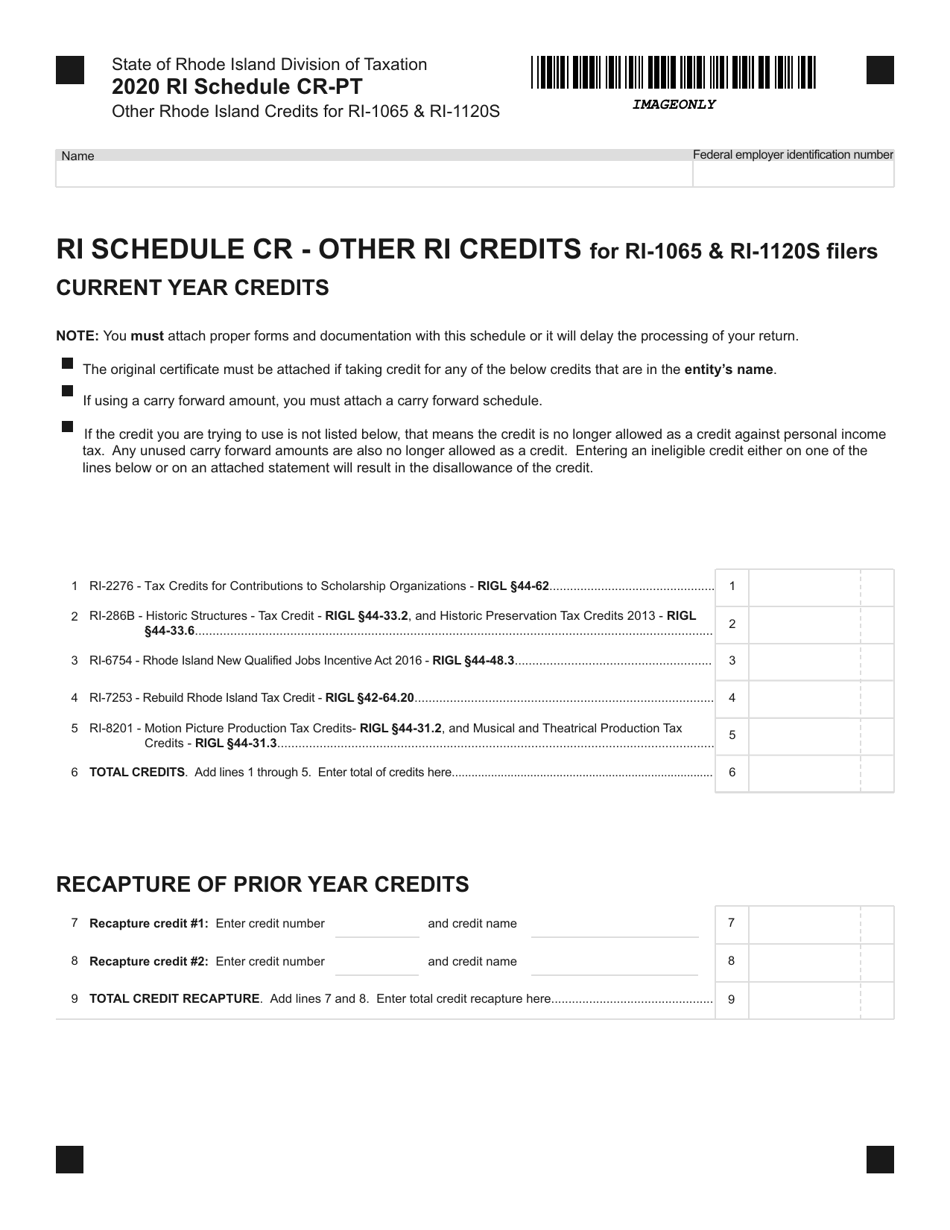

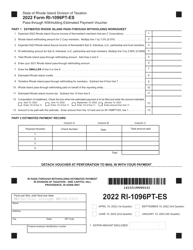

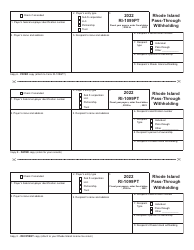

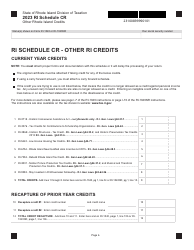

Schedule CR-PT Other Rhode Island Credits for Ri-1065 & Ri-1120s - Rhode Island

What Is Schedule CR-PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CR-PT?

A: Schedule CR-PT is a form used by Rhode Island businesses to claim certain tax credits.

Q: Who needs to file Schedule CR-PT?

A: Rhode Island businesses that are eligible for specific tax credits need to file Schedule CR-PT.

Q: What other Rhode Island credits can be claimed on Schedule CR-PT?

A: Schedule CR-PT allows businesses to claim credits such as the Rebuild Rhode Island Tax Credit, the Qualified Jobs Incentive Tax Credit, and the Motion PictureProduction Tax Credit, among others.

Q: Are there separate versions of Schedule CR-PT for different types of businesses?

A: Yes, there are separate versions of Schedule CR-PT for partnership entities (Ri-1065) and S corporations (Ri-1120s).

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule CR-PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.