This version of the form is not currently in use and is provided for reference only. Download this version of

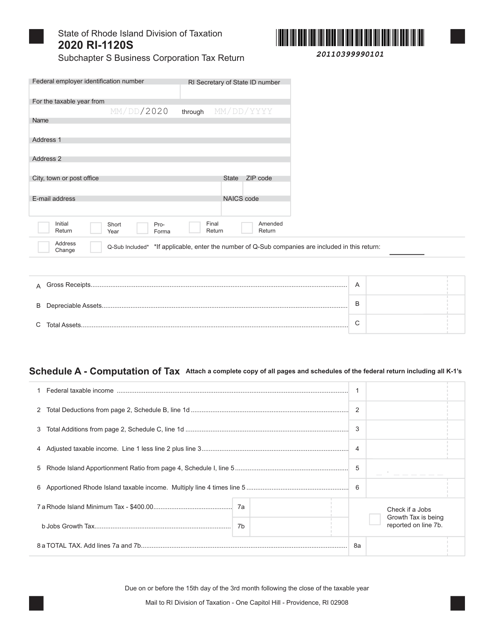

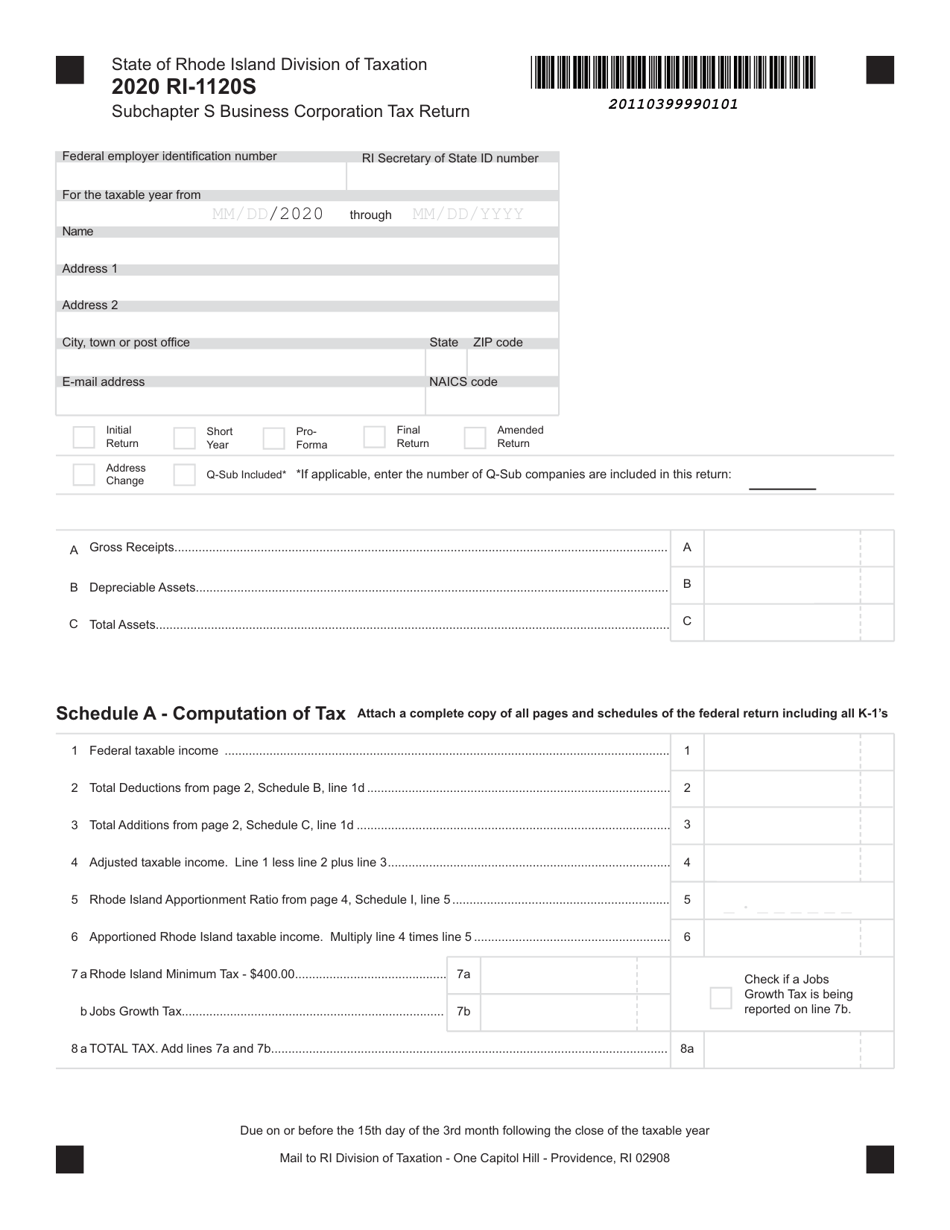

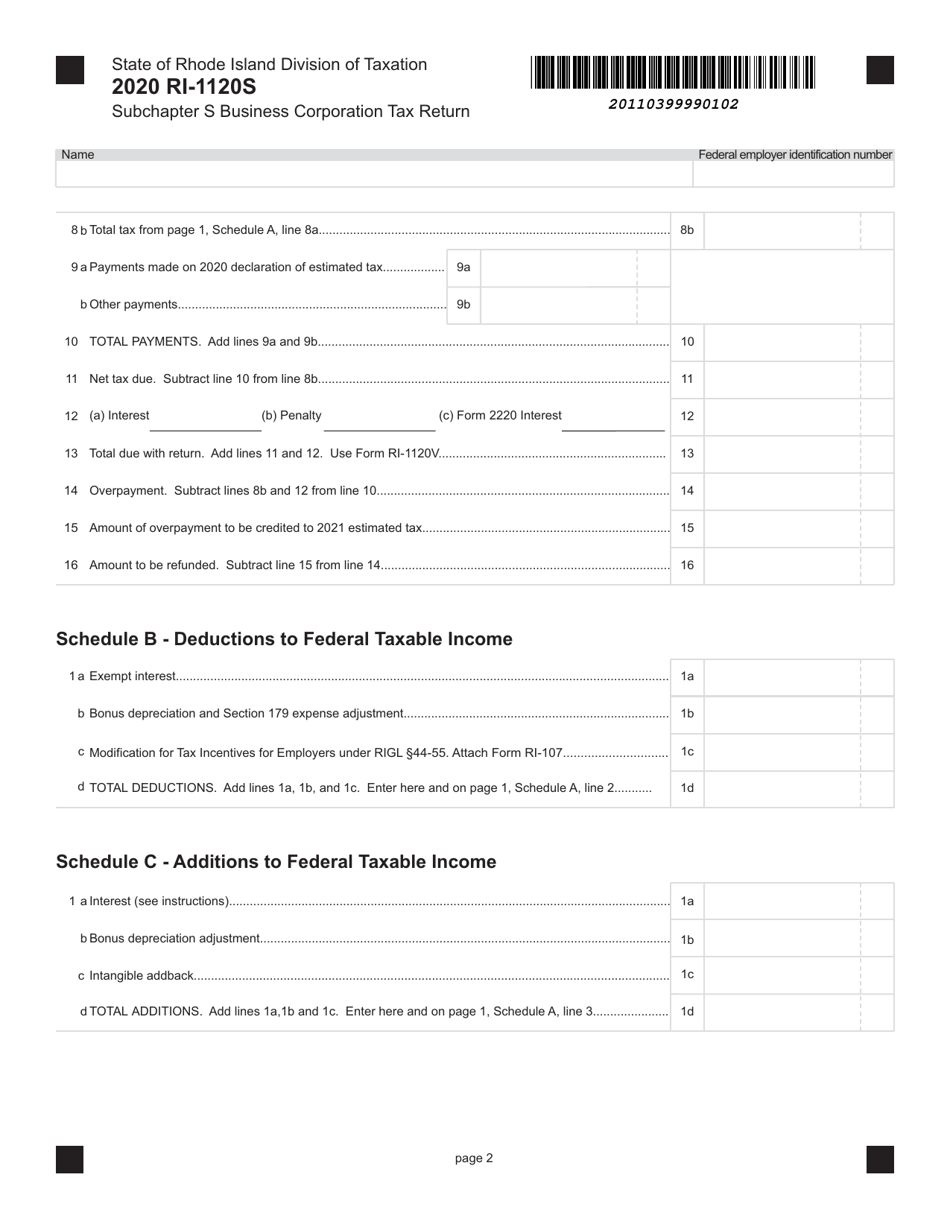

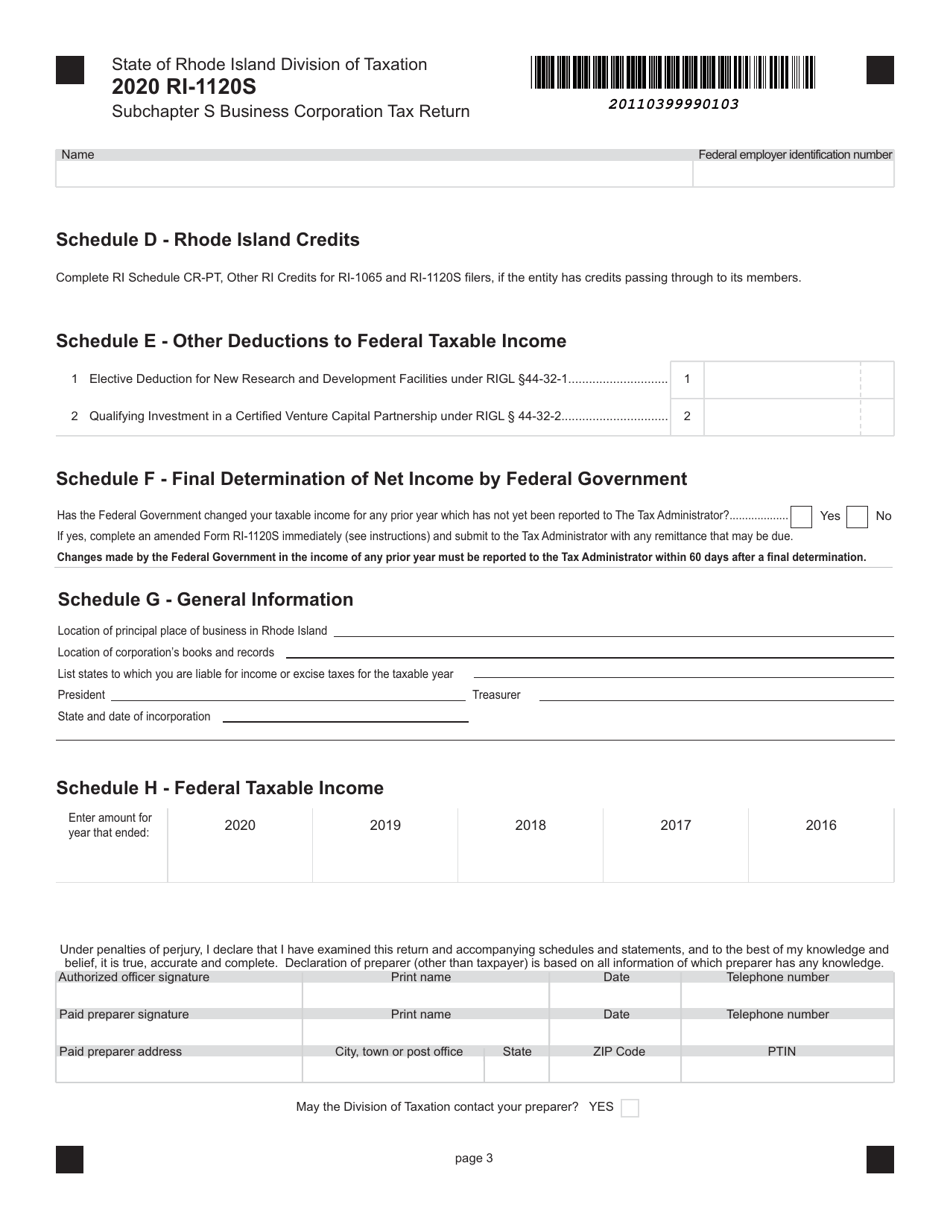

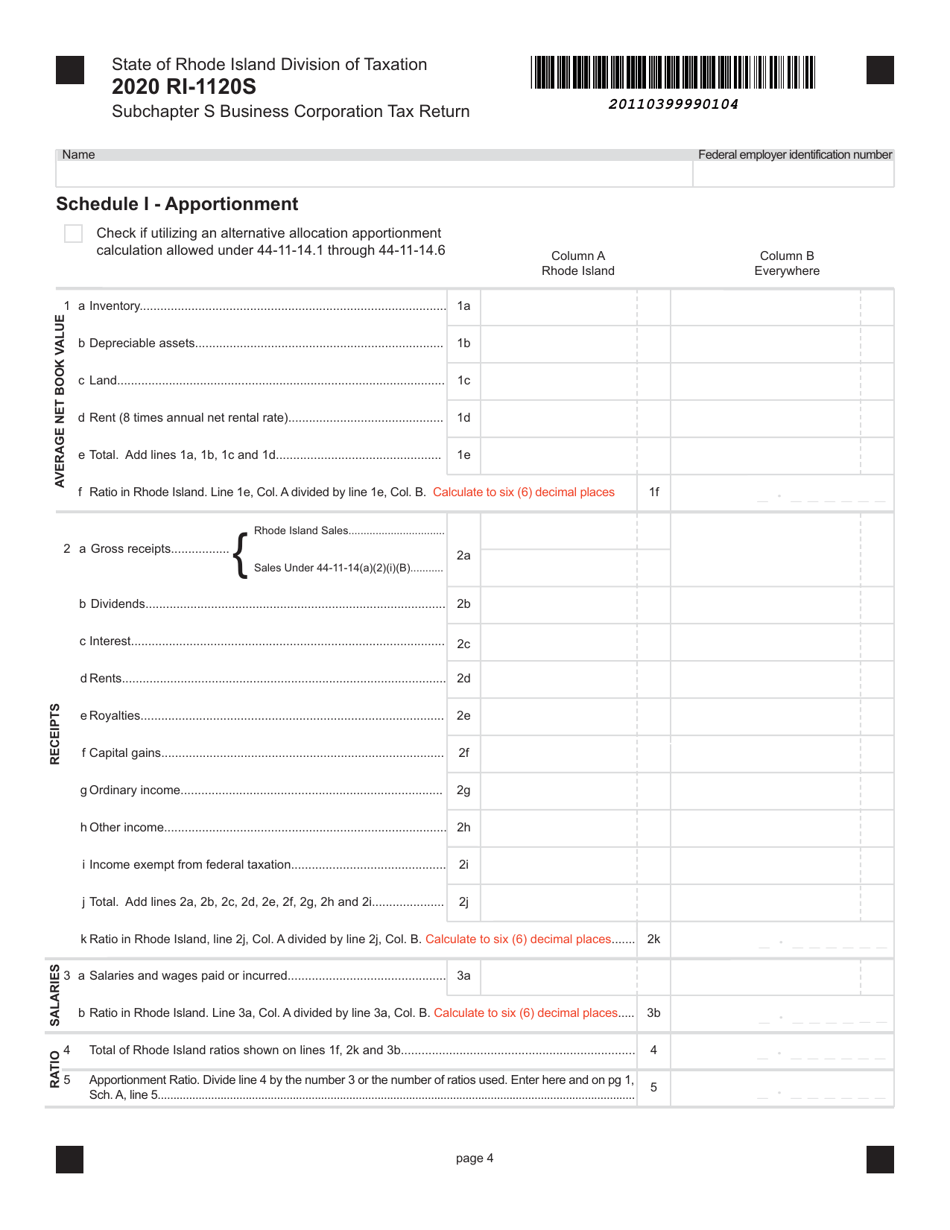

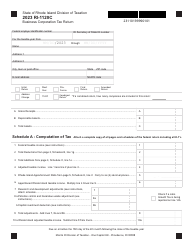

Form RI-1120S

for the current year.

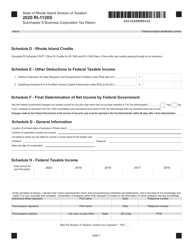

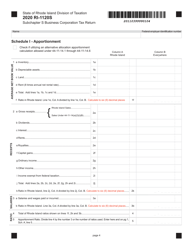

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120S?

A: Form RI-1120S is the Rhode Island Subchapter S Business Corporation Tax Return.

Q: Who is required to file Form RI-1120S?

A: Rhode Island Subchapter S corporations are required to file Form RI-1120S.

Q: What is a Subchapter S corporation?

A: A Subchapter S corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders.

Q: What is the purpose of Form RI-1120S?

A: The purpose of Form RI-1120S is to report the income, deductions, and tax liability of a Rhode Island Subchapter S corporation.

Q: Are there any specific filing deadlines for Form RI-1120S?

A: Yes, the filing deadline for Form RI-1120S is usually the 15th day of the third month following the close of the tax year.

Q: What should I do if I need an extension to file Form RI-1120S?

A: If you need an extension to file Form RI-1120S, you must file Form RI-7004 to request an extension. The extension will typically be for six months.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.