This version of the form is not currently in use and is provided for reference only. Download this version of

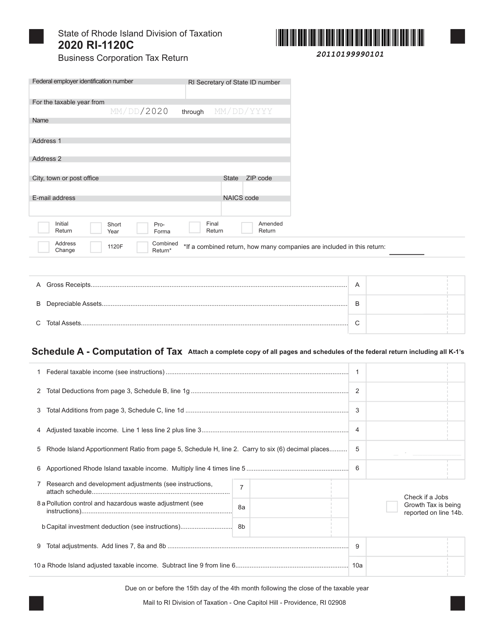

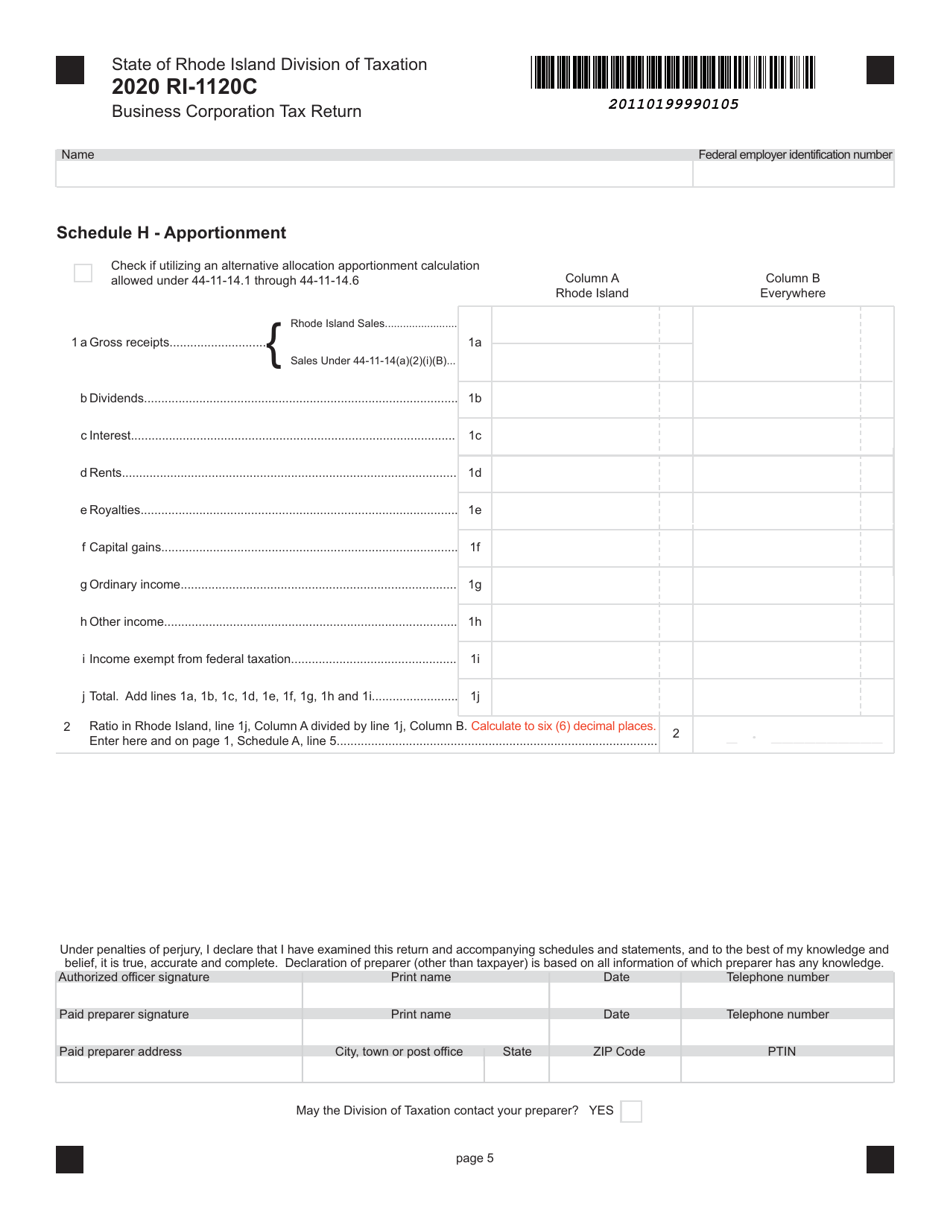

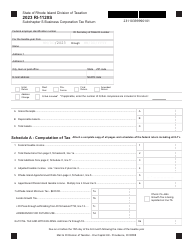

Form RI-1120C

for the current year.

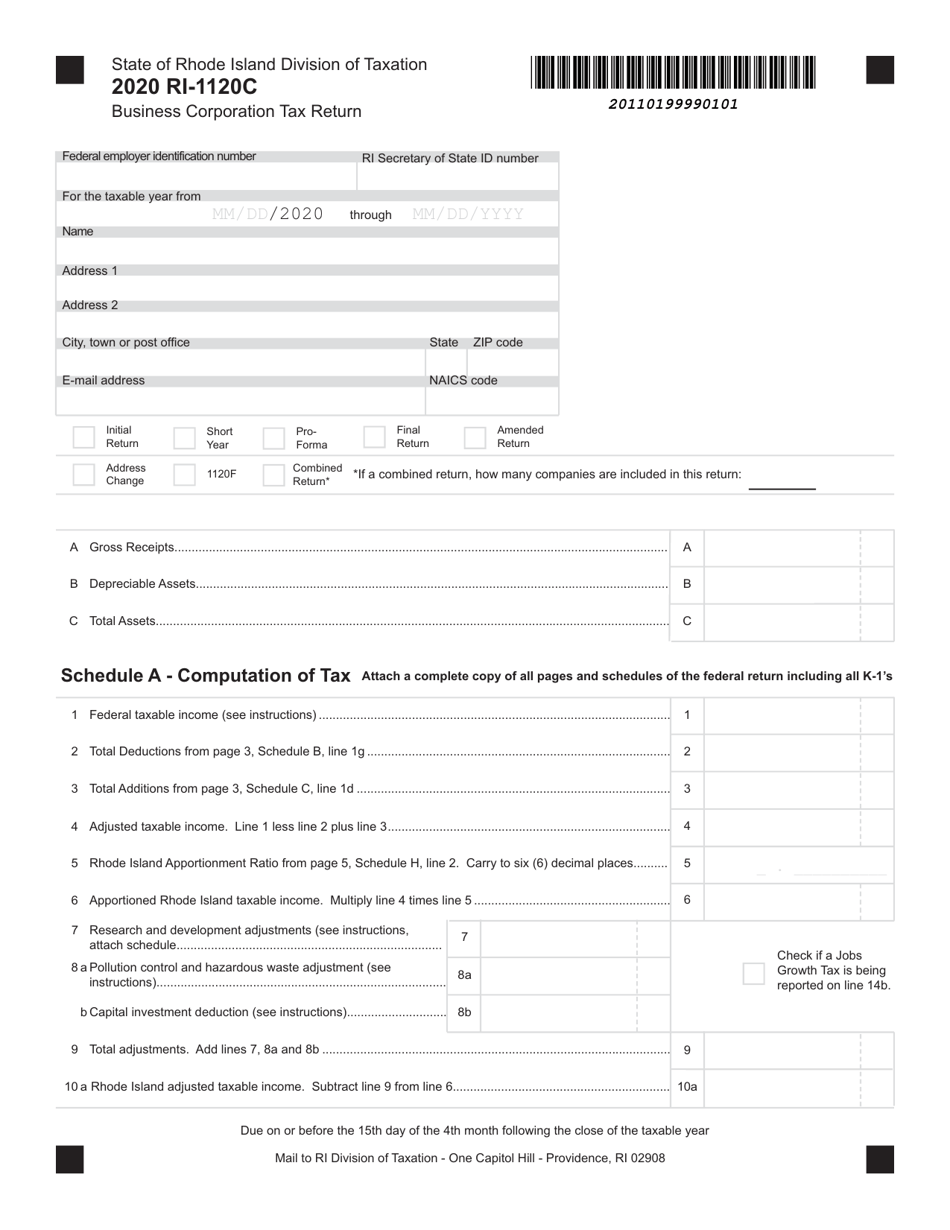

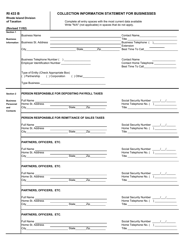

Form RI-1120C Business Corporation Tax Return - Rhode Island

What Is Form RI-1120C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120C?

A: Form RI-1120C is the Business Corporation Tax Return for businesses registered in Rhode Island.

Q: Who needs to file Form RI-1120C?

A: Business corporations registered in Rhode Island need to file Form RI-1120C.

Q: When is the deadline to file Form RI-1120C?

A: The deadline to file Form RI-1120C is usually on or before the 15th day of the fourth month following the close of the corporation's tax year.

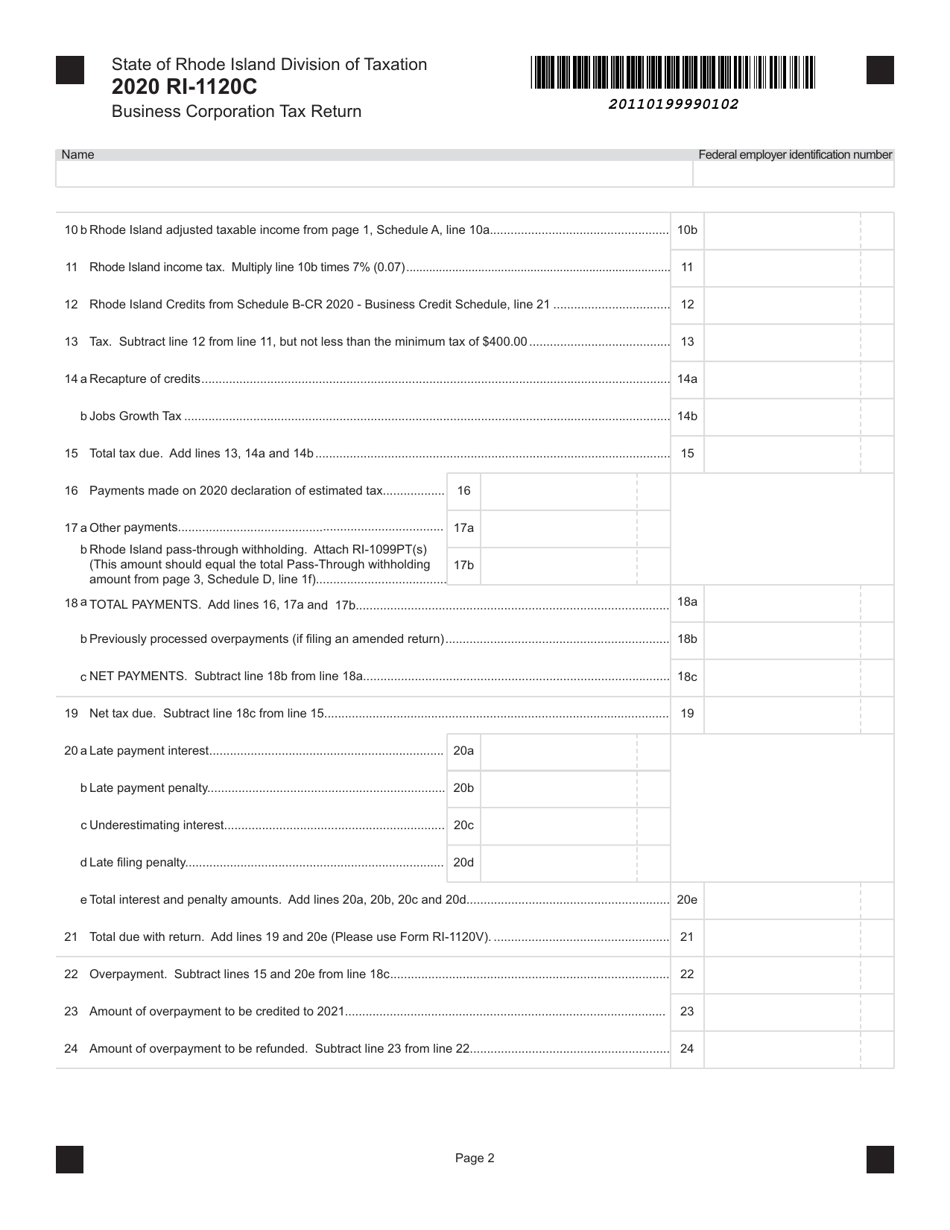

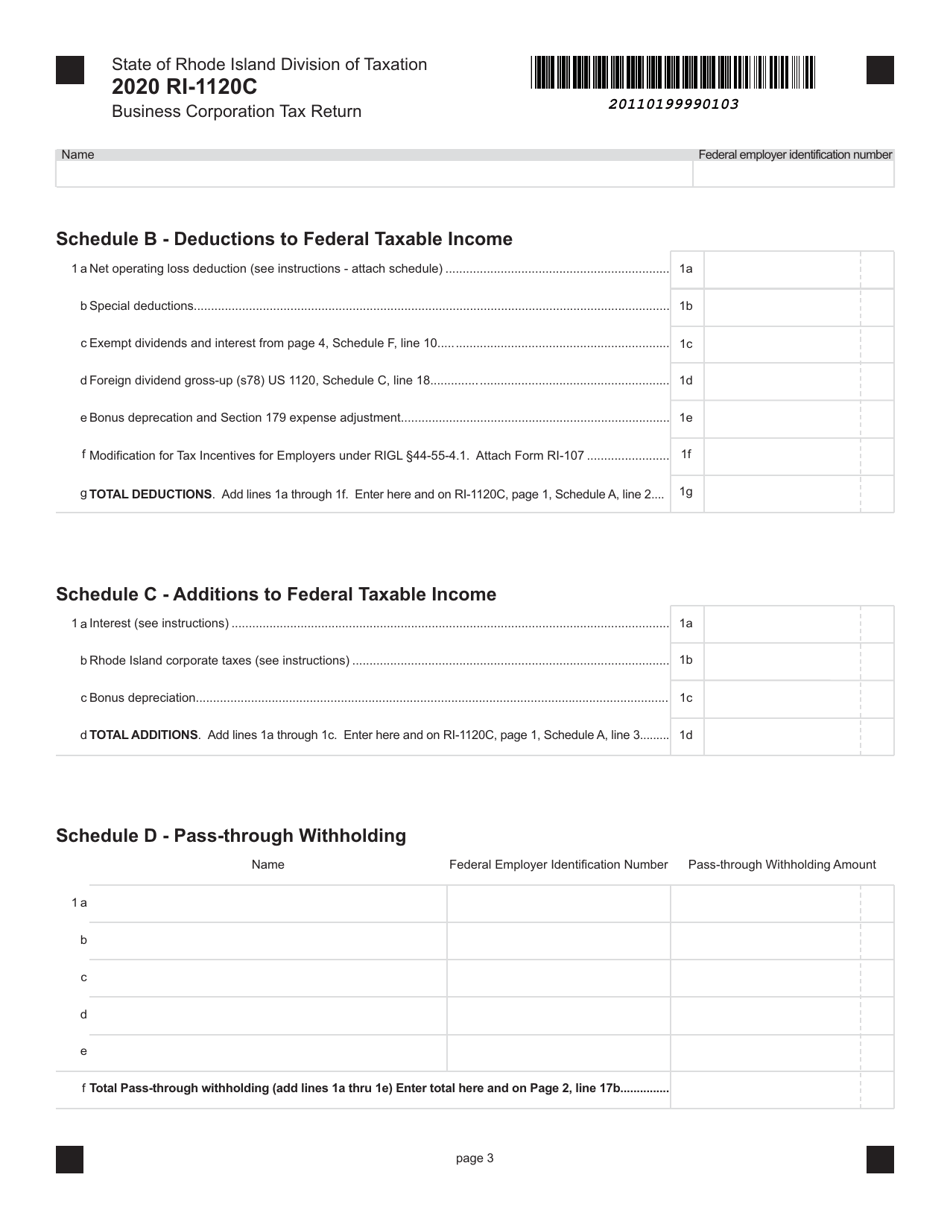

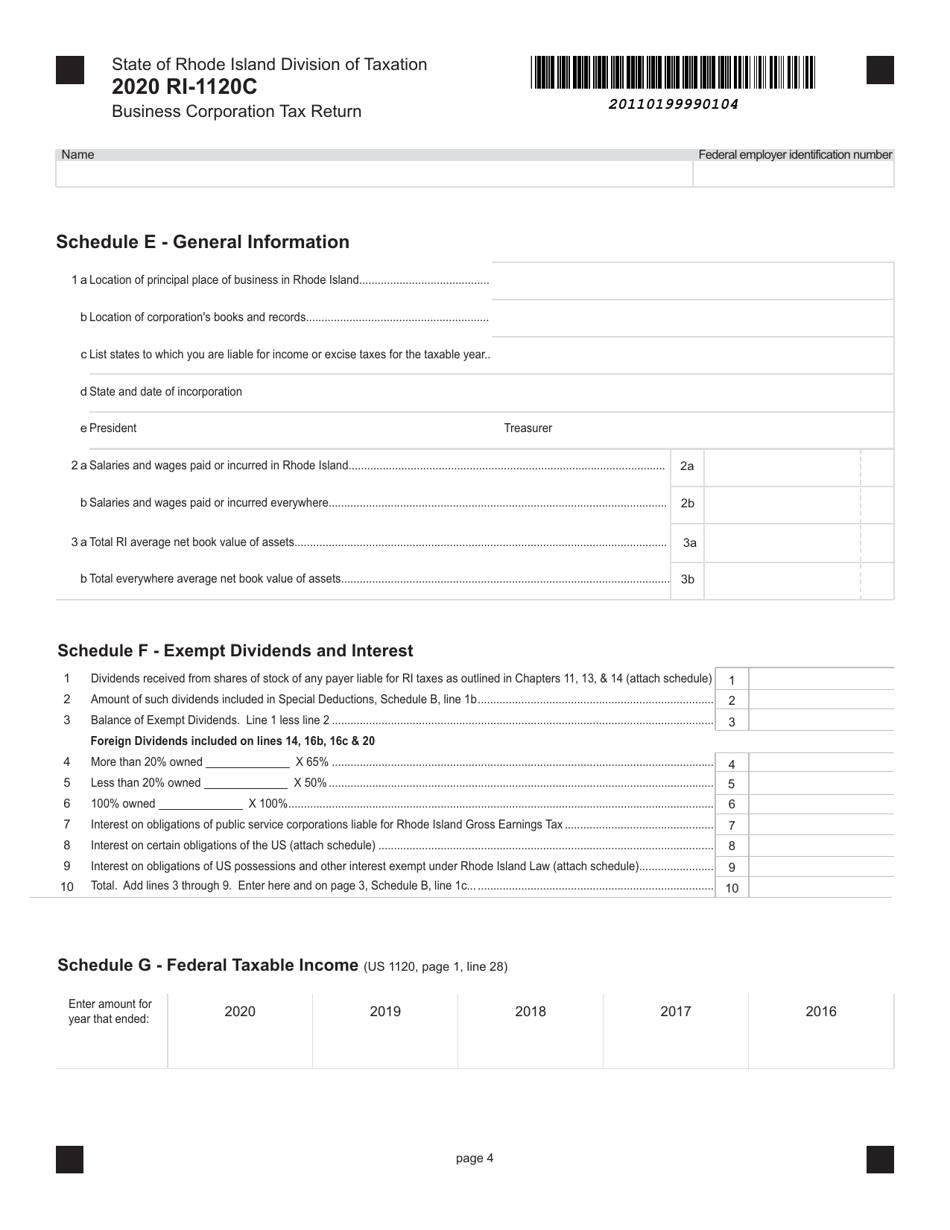

Q: What information is required on Form RI-1120C?

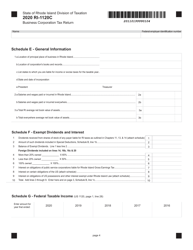

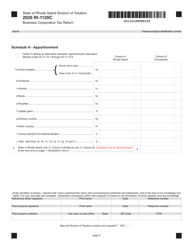

A: Form RI-1120C requires information about the corporation's income, deductions, credits, and tax liability.

Q: Are there any important attachments to include with Form RI-1120C?

A: Yes, certain schedules and documents may need to be attached to Form RI-1120C, such as Schedule M-3, Schedule E, and federal forms.

Q: What if I need an extension to file Form RI-1120C?

A: You can request an extension to file Form RI-1120C by filing Form RI-7004 with the Rhode Island Division of Taxation.

Q: Is there a penalty for late filing of Form RI-1120C?

A: Yes, there may be penalties for late filing of Form RI-1120C. It is important to file on time to avoid penalties and interest charges.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.