This version of the form is not currently in use and is provided for reference only. Download this version of

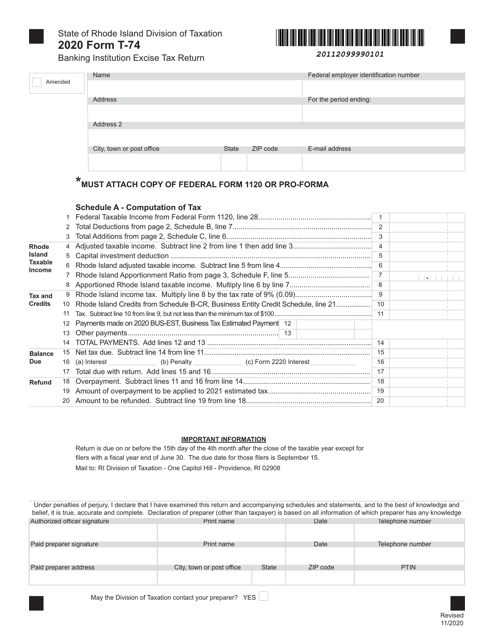

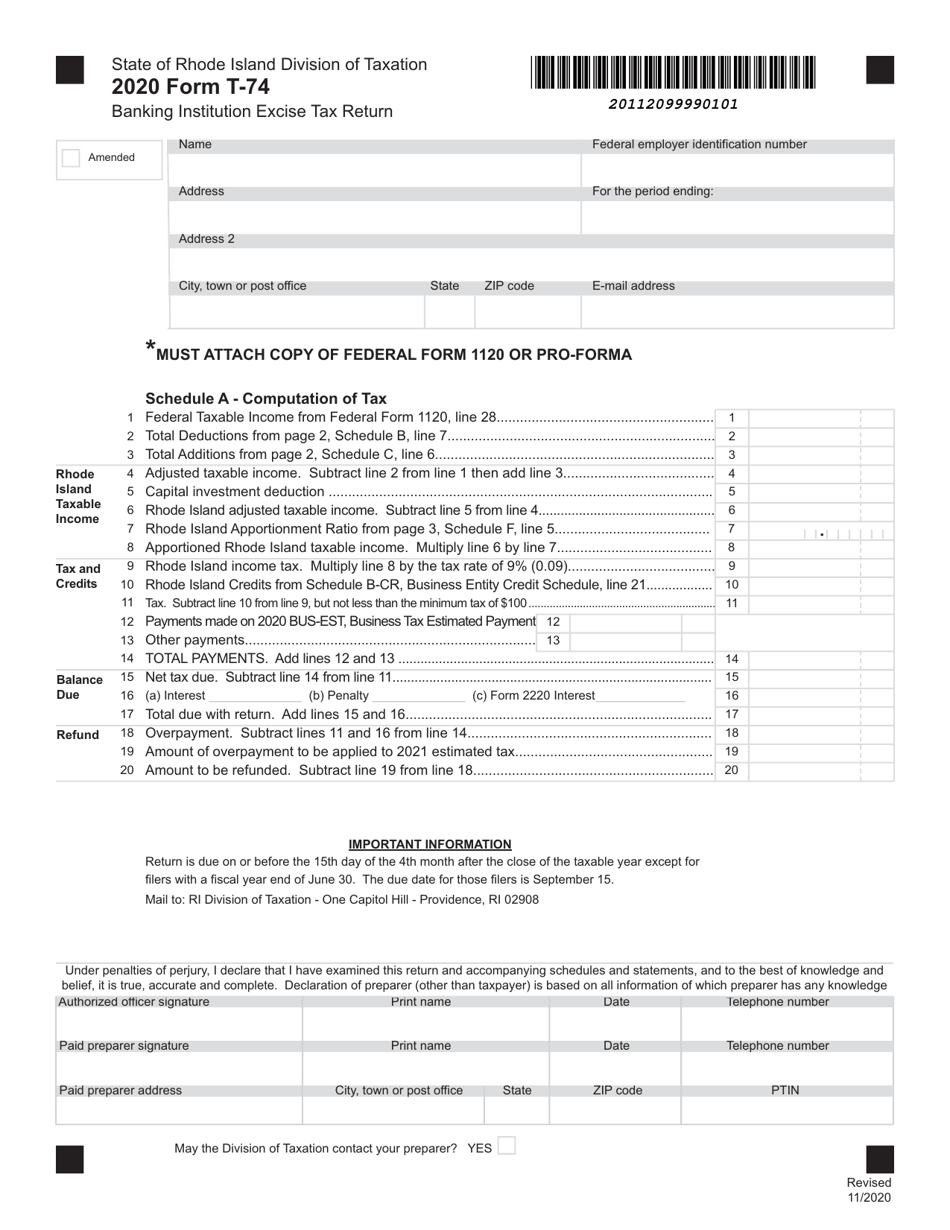

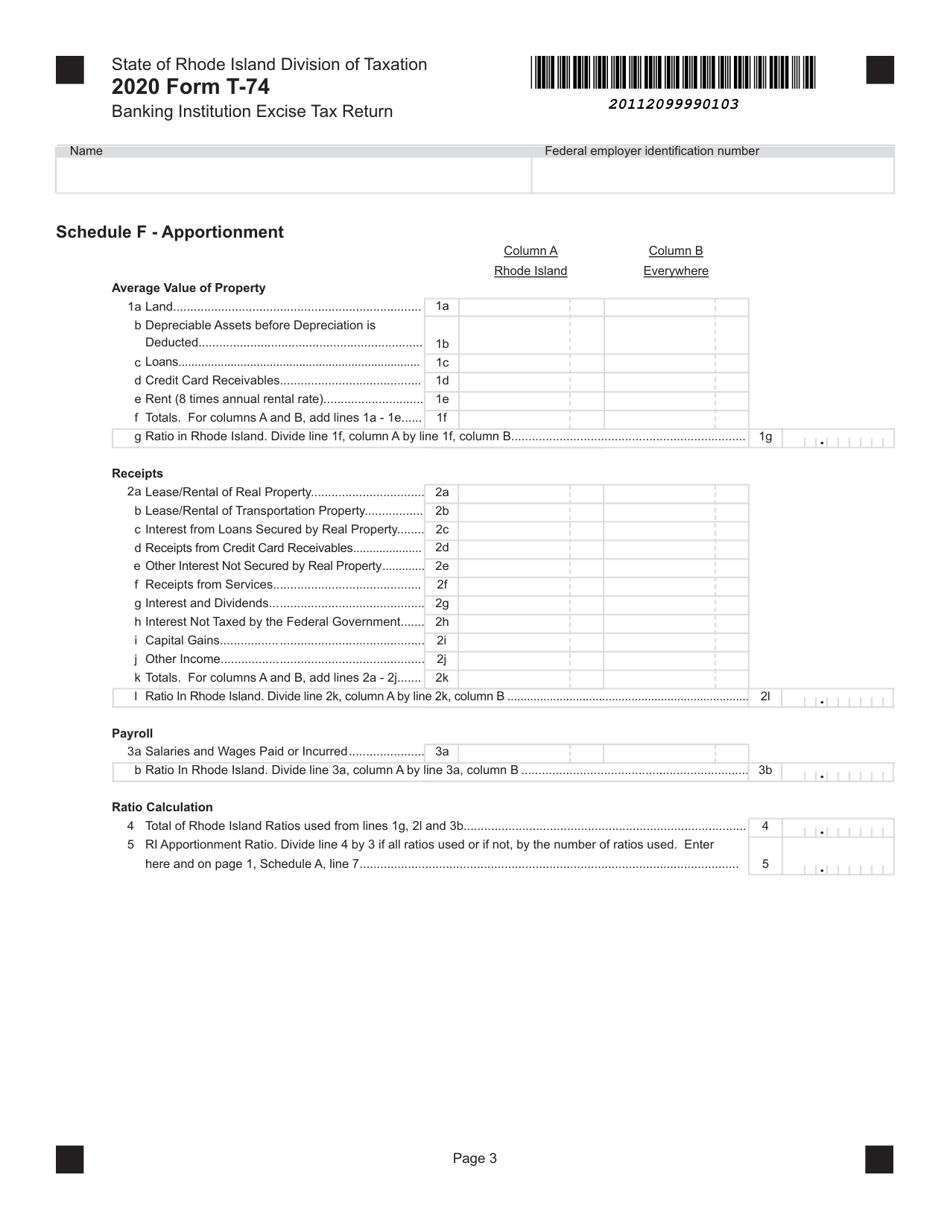

Form T-74

for the current year.

Form T-74 Banking Institution Excise Tax Return - Rhode Island

What Is Form T-74?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form T-74?

A: Form T-74 is the Banking InstitutionExcise Tax Return for Rhode Island.

Q: Who needs to file Form T-74?

A: All banking institutions operating in Rhode Island are required to file Form T-74.

Q: What is the purpose of Form T-74?

A: Form T-74 is used to report and calculate the excise tax owed by banking institutions in Rhode Island.

Q: When is Form T-74 due?

A: Form T-74 is due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, so it is important to submit Form T-74 on time.

Q: Is there a minimum threshold for filing Form T-74?

A: Yes, there is a minimum threshold for filing Form T-74. Refer to the instructions to determine if you meet the threshold.

Q: Are there any specific instructions for completing Form T-74?

A: Yes, the Rhode Island Division of Taxation provides detailed instructions on how to complete Form T-74.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-74 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.