This version of the form is not currently in use and is provided for reference only. Download this version of

Form T-72

for the current year.

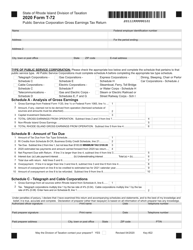

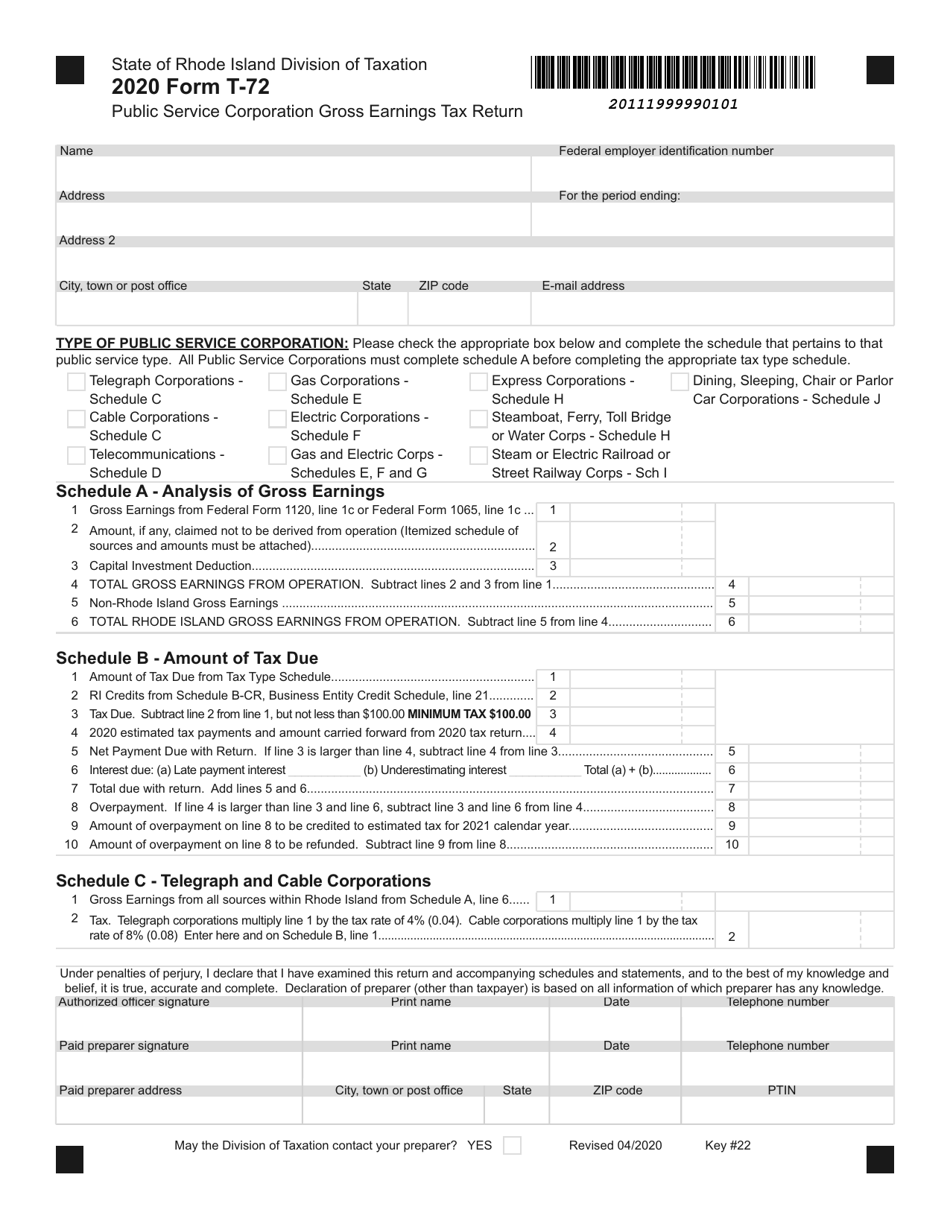

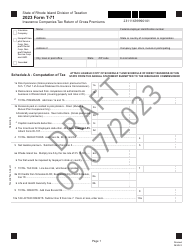

Form T-72 Public Service Corporation Gross Earnings Tax Return - Rhode Island

What Is Form T-72?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form T-72?

A: Form T-72 is the Public Service Corporation Gross Earnings Tax Return in Rhode Island.

Q: Who needs to file Form T-72?

A: Public Service Corporations in Rhode Island need to file Form T-72.

Q: What is the purpose of Form T-72?

A: Form T-72 is used to report and calculate the Public Service Corporation Gross Earnings Tax in Rhode Island.

Q: What are Public Service Corporations?

A: Public Service Corporations are businesses that provide public services such as transportation, communication, or utility services.

Q: How often do you need to file Form T-72?

A: Form T-72 needs to be filed annually.

Q: Are there any deadlines for filing Form T-72?

A: Yes, the deadline for filing Form T-72 is the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form T-72?

A: Yes, there are penalties for late filing of Form T-72. It is important to file on time to avoid these penalties.

Q: Is there any additional documentation required with Form T-72?

A: Additional documentation may be required depending on the specific circumstances of the Public Service Corporation. It is recommended to consult the instructions provided with the form.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-72 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.