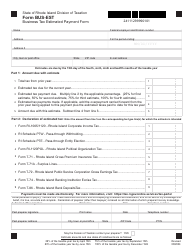

This version of the form is not currently in use and is provided for reference only. Download this version of

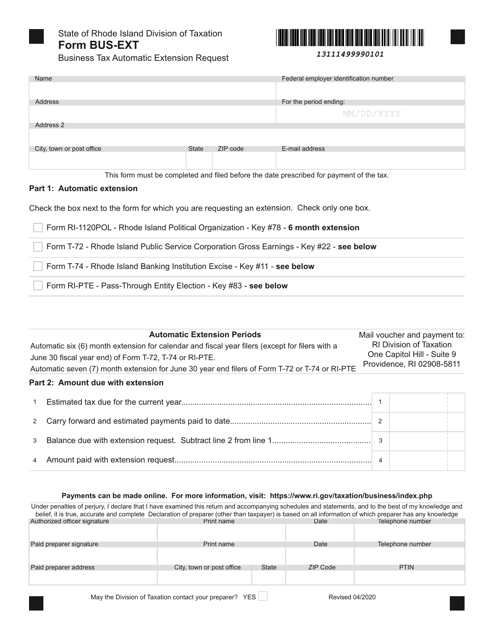

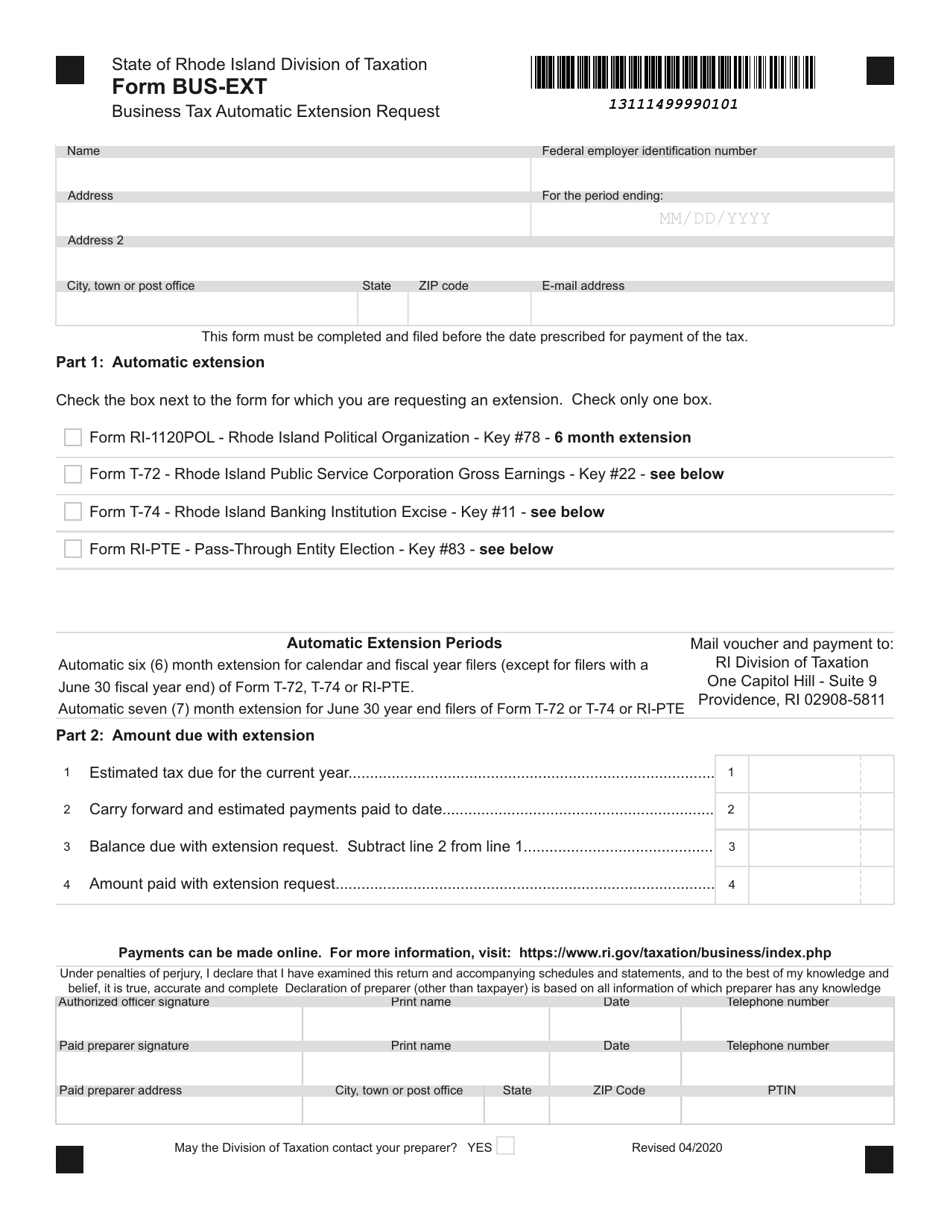

Form BUS-EXT

for the current year.

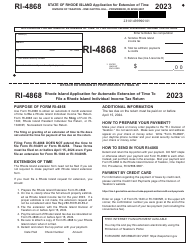

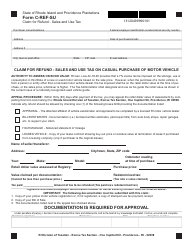

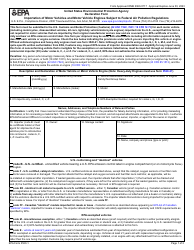

Form BUS-EXT Business Tax Automatic Extension Request - Rhode Island

What Is Form BUS-EXT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

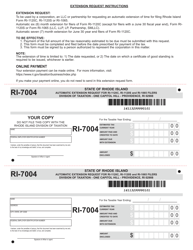

Q: What is Form BUS-EXT?

A: Form BUS-EXT is the Business Tax Automatic Extension Request form for businesses in Rhode Island.

Q: What is the purpose of Form BUS-EXT?

A: The purpose of Form BUS-EXT is to request an automatic extension for filing business tax returns in Rhode Island.

Q: Who is required to file Form BUS-EXT?

A: Businesses in Rhode Island that need additional time to file their tax returns are required to file Form BUS-EXT.

Q: What is the deadline to file Form BUS-EXT?

A: Form BUS-EXT must be filed on or before the original due date of the business tax return.

Q: Does filing Form BUS-EXT grant an extension for payment?

A: No, Form BUS-EXT only grants an extension for filing the tax return, not for payment of taxes owed.

Q: Is there a penalty for late filing of Form BUS-EXT?

A: Yes, there is a penalty for late filing of Form BUS-EXT. It is advisable to file the form before the original due date.

Q: What happens if I don't file Form BUS-EXT?

A: If you don't file Form BUS-EXT and fail to file your business tax return on time, you may be subject to penalties and interest.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BUS-EXT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.