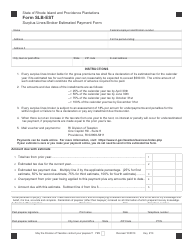

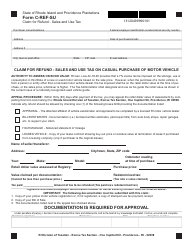

This version of the form is not currently in use and is provided for reference only. Download this version of

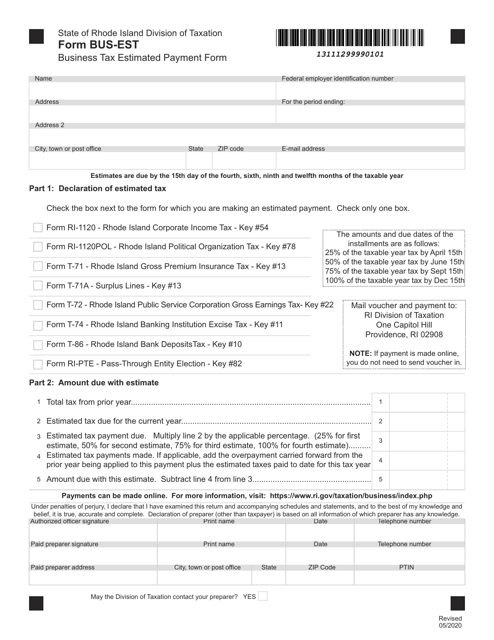

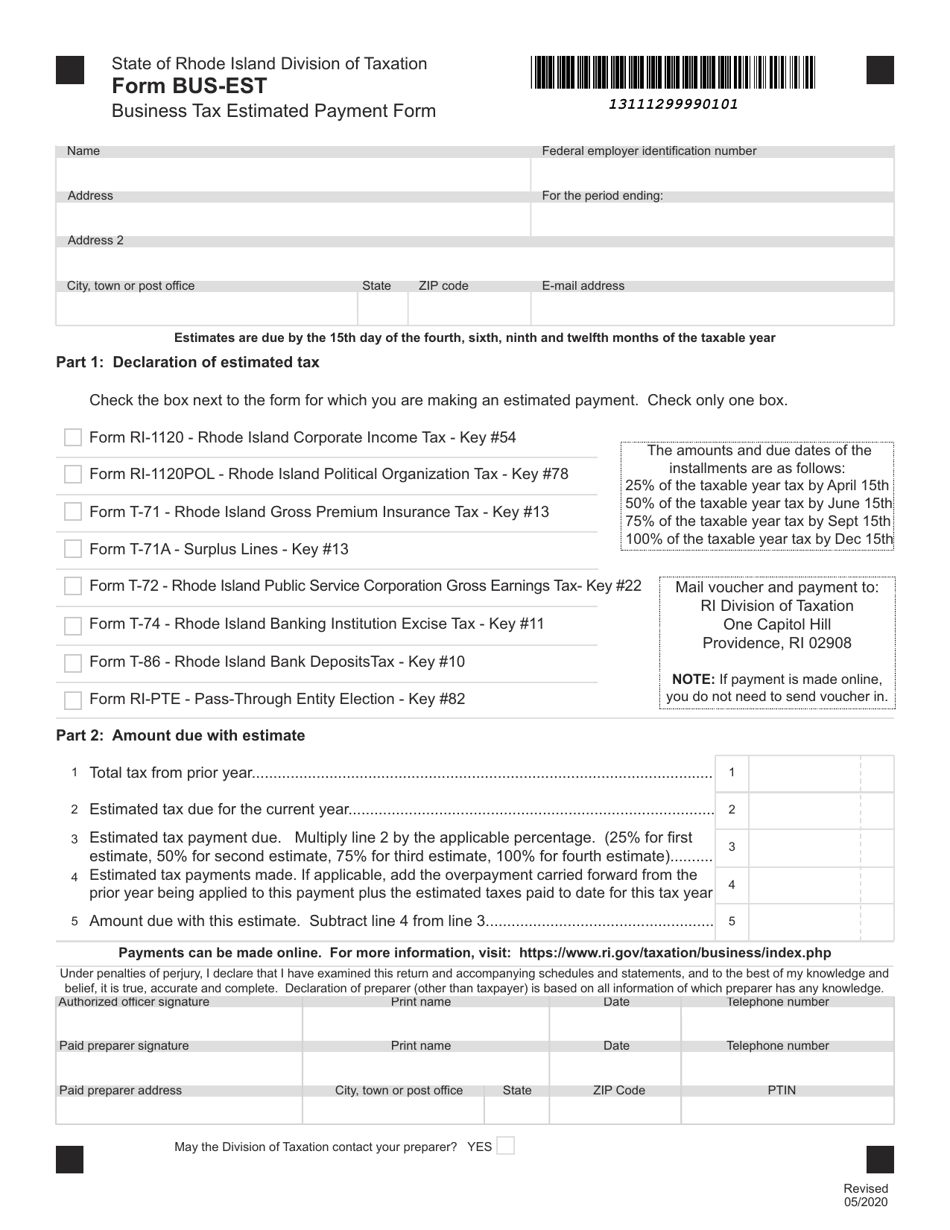

Form BUS-EST

for the current year.

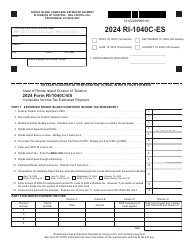

Form BUS-EST Business Tax Estimated Payment Form - Rhode Island

What Is Form BUS-EST?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BUS-EST Business Tax Estimated Payment Form?

A: It is a form used in Rhode Island to make estimated tax payments for businesses.

Q: Who needs to use the BUS-EST Business Tax Estimated Payment Form?

A: Businesses in Rhode Island that are required to make estimated tax payments.

Q: What is the purpose of making estimated tax payments?

A: To pay a portion of the tax owed throughout the year rather than in a lump sum at the end of the year.

Q: When are estimated tax payments due in Rhode Island?

A: The due dates for estimated tax payments vary, but they usually fall on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BUS-EST by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.