This version of the form is not currently in use and is provided for reference only. Download this version of

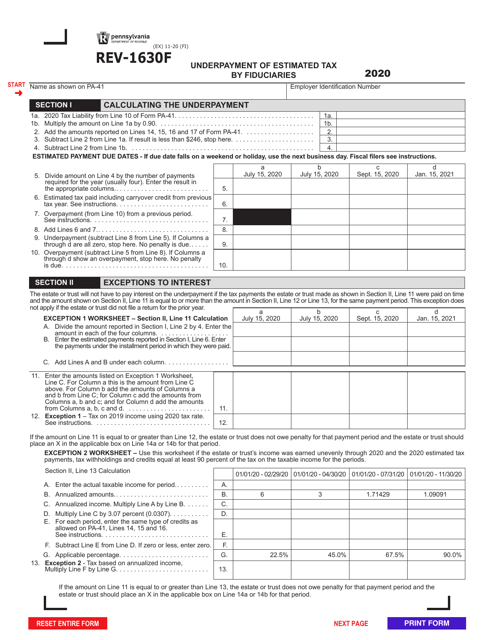

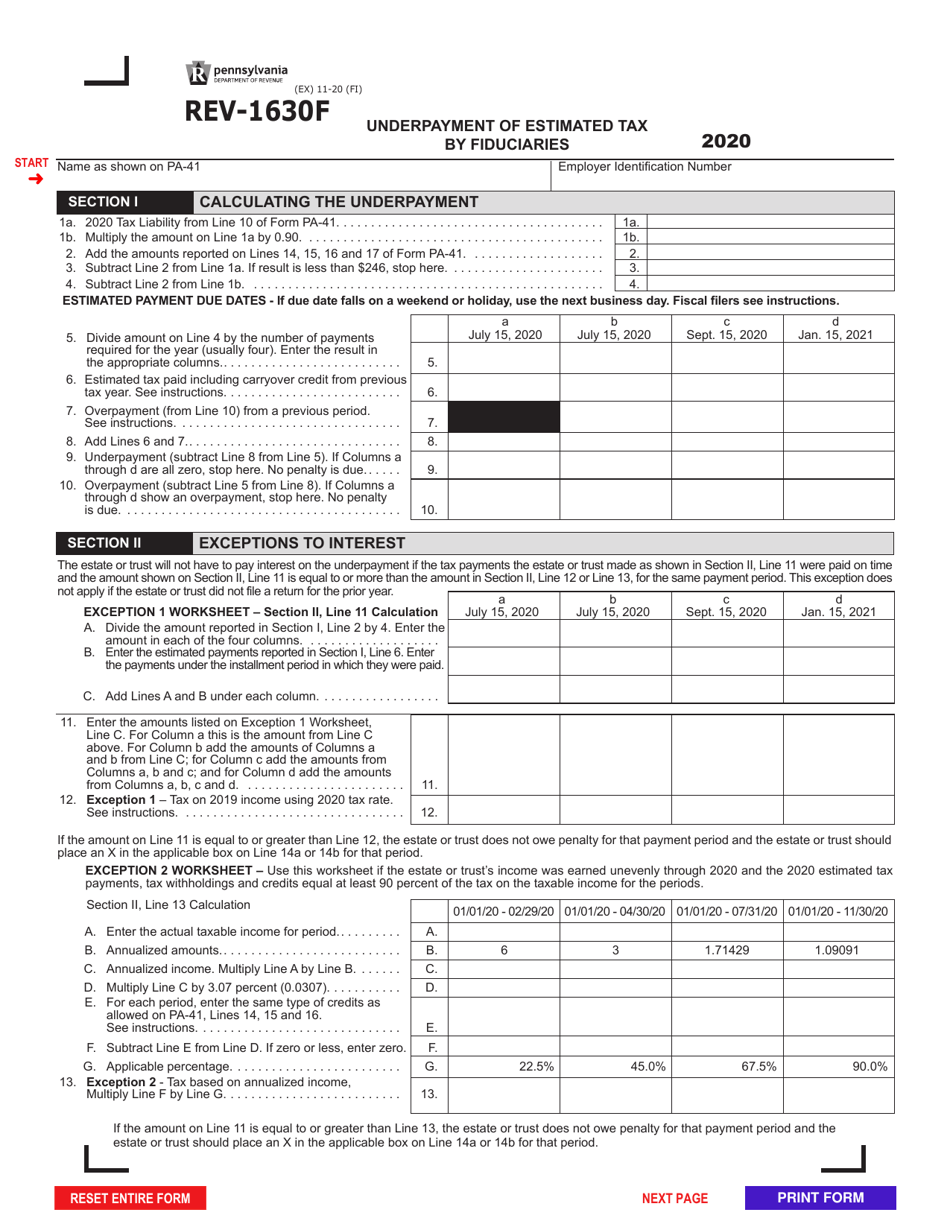

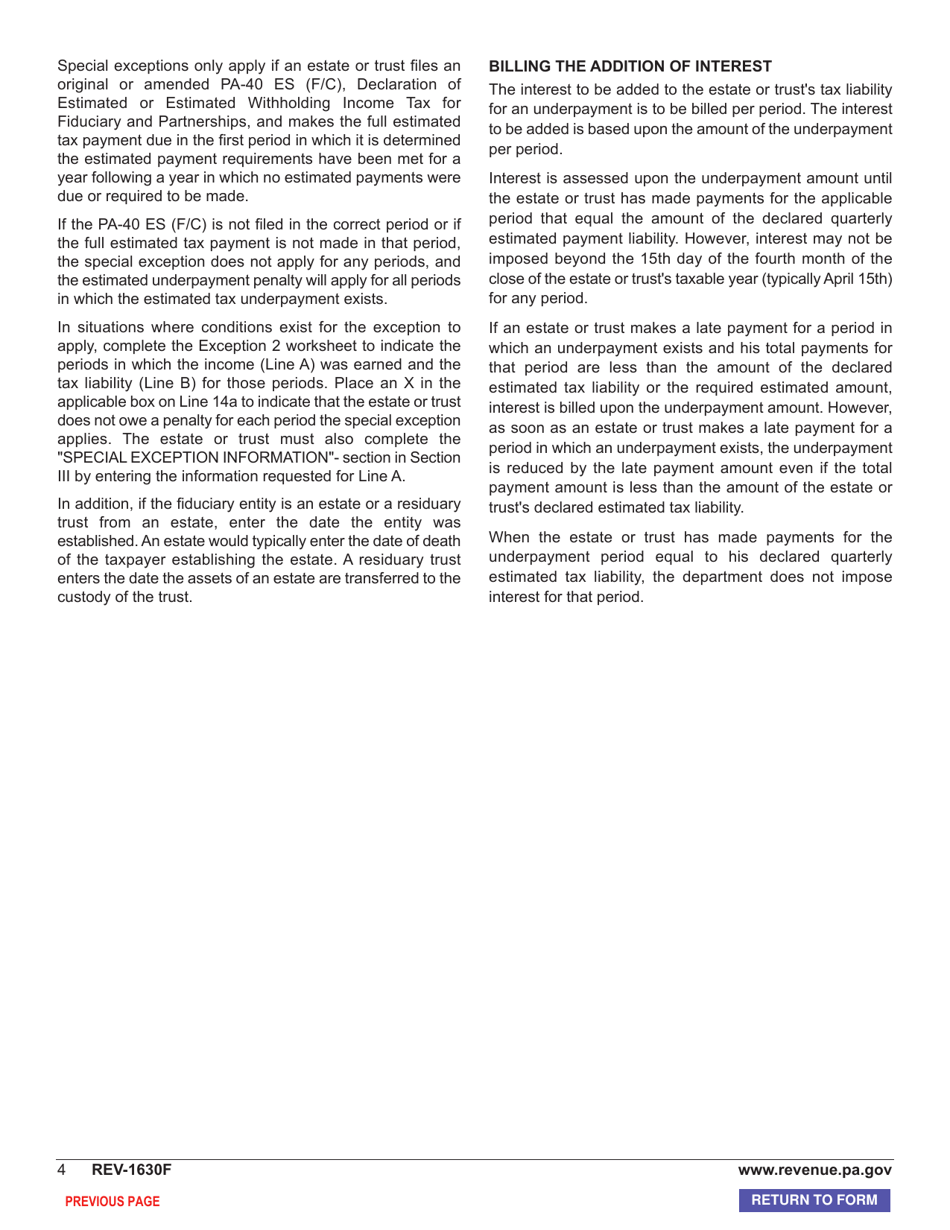

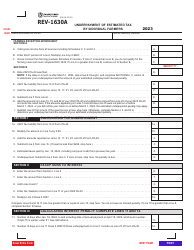

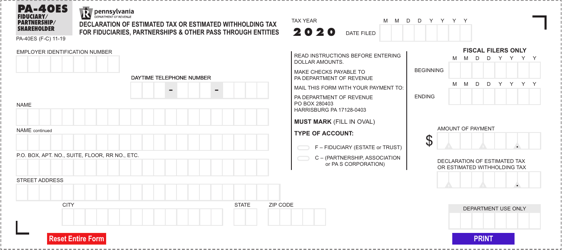

Form REV-1630F

for the current year.

Form REV-1630F Underpayment of Estimated Tax by Fiduciaries - Pennsylvania

What Is Form REV-1630F?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

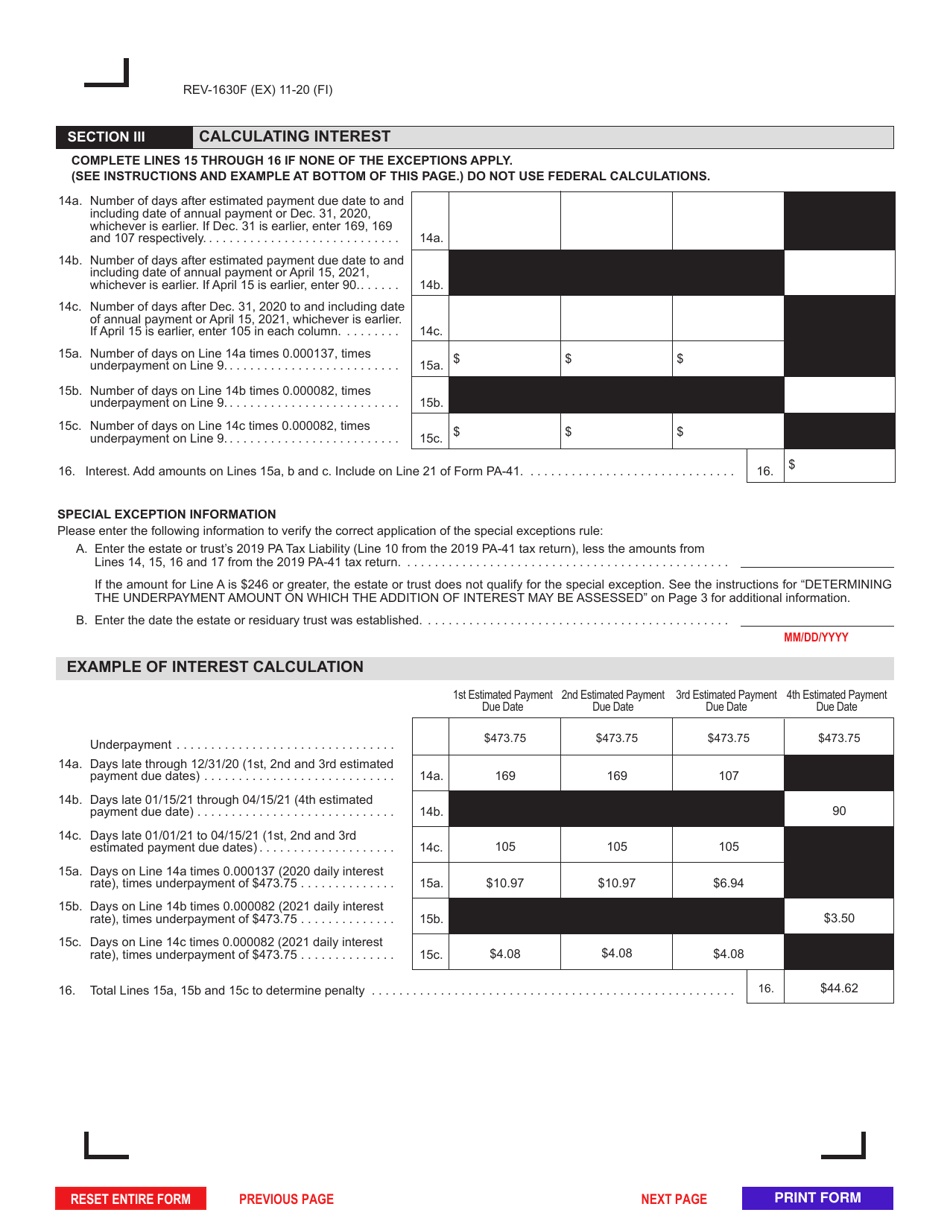

Q: What is Form REV-1630F?

A: Form REV-1630F is a tax form used by fiduciaries in Pennsylvania to report and pay any underpayment of estimated taxes.

Q: Who needs to file Form REV-1630F?

A: Fiduciaries in Pennsylvania who have underpaid their estimated taxes need to file Form REV-1630F.

Q: When is Form REV-1630F due?

A: Form REV-1630F is due on or before the 15th day of the fourth month following the end of the tax year.

Q: How do I submit Form REV-1630F?

A: Form REV-1630F can be submitted by mail to the Pennsylvania Department of Revenue.

Q: What happens if I don't file Form REV-1630F?

A: Failure to file Form REV-1630F or pay any underpayment of estimated taxes may result in penalties and interest.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1630F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.