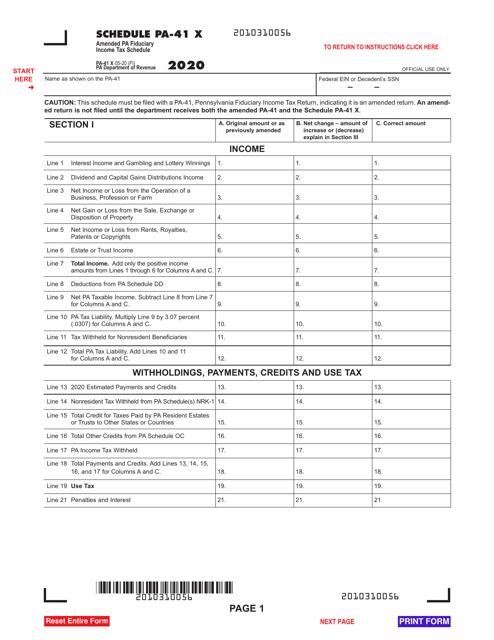

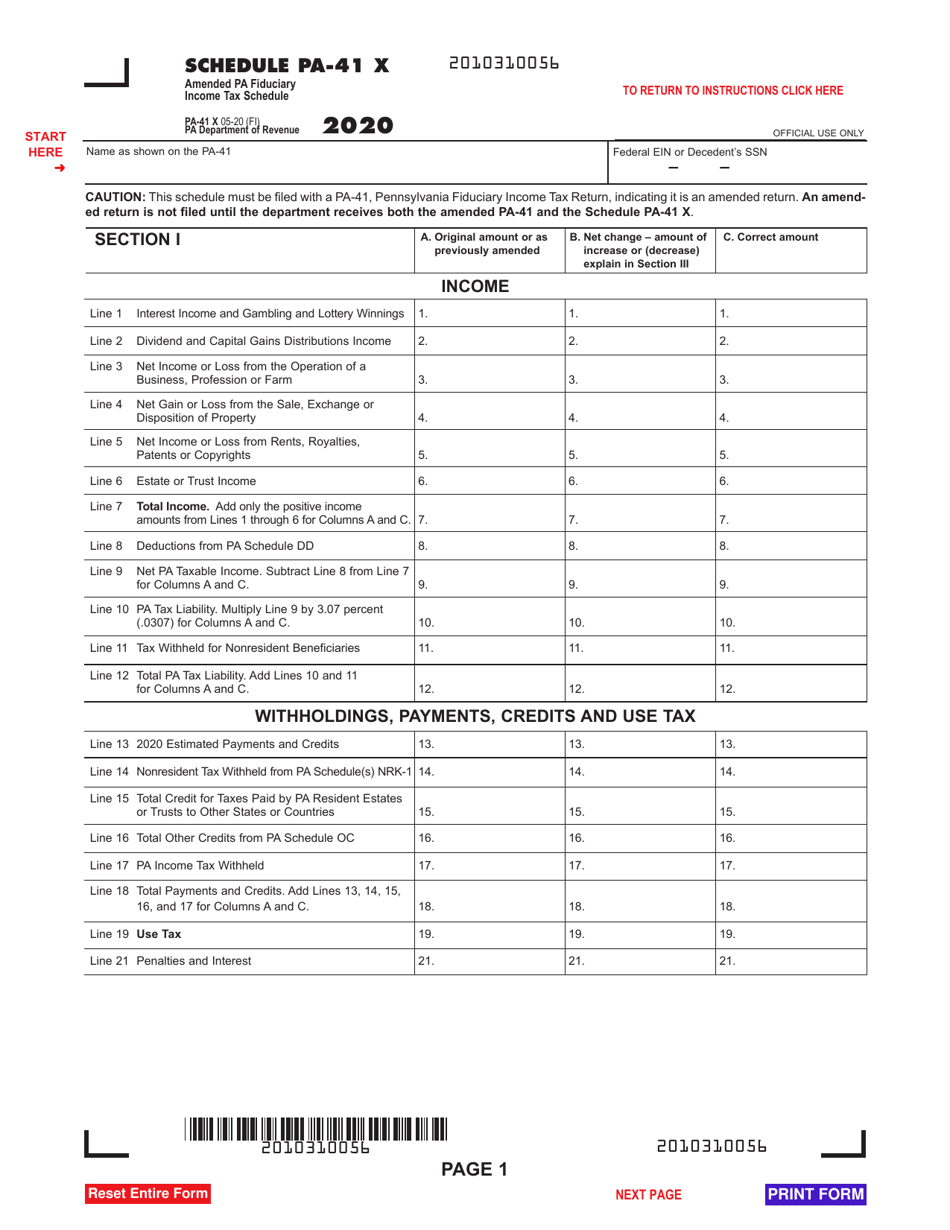

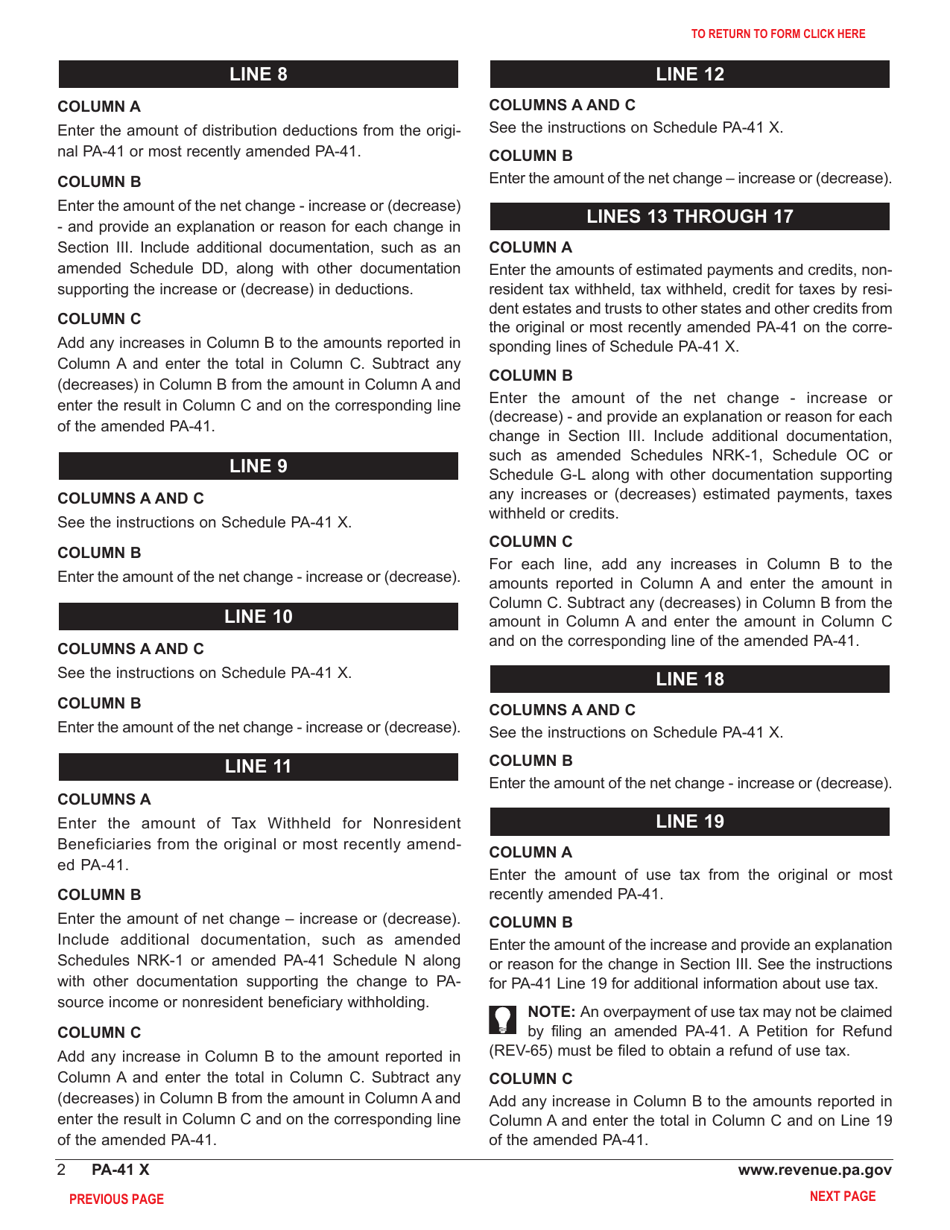

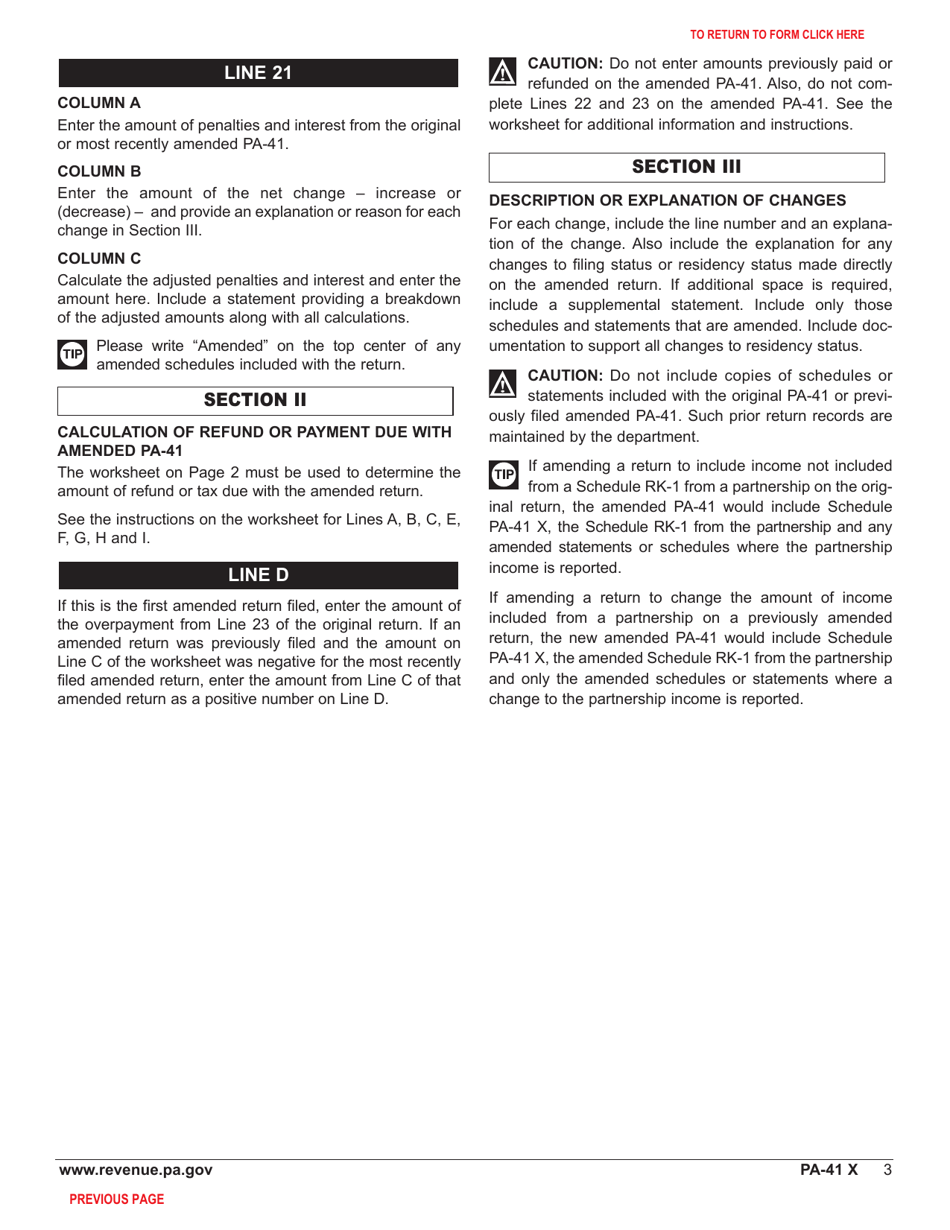

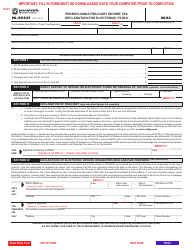

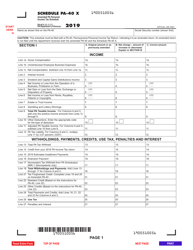

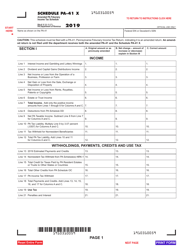

Form PA-41 Schedule PA-41 X Amended Pa Fiduciary Income Tax Schedule - Pennsylvania

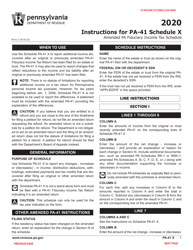

What Is Form PA-41 Schedule PA-41 X?

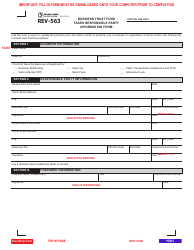

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-41 Schedule?

A: PA-41 Schedule is a form used for reporting certain income and deductions related to the Pennsylvania fiduciary income tax.

Q: What is Schedule PA-41 X?

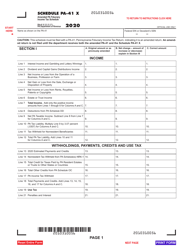

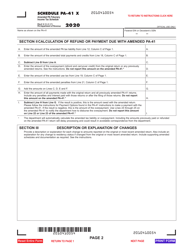

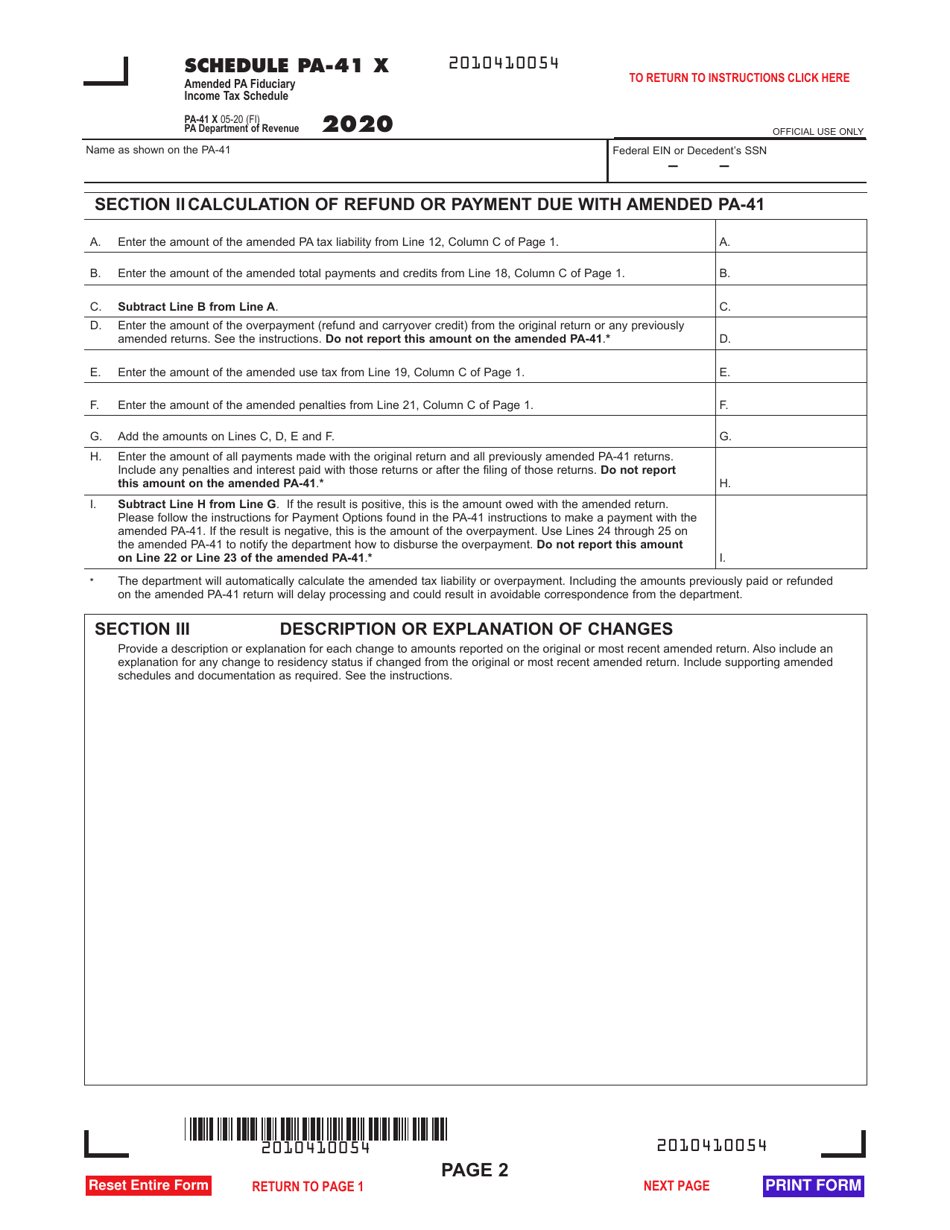

A: Schedule PA-41 X is an amended version of the PA-41 Schedule. It is used to make corrections or changes to previously filed PA-41 Schedule.

Q: What is the purpose of the Amended Pa Fiduciary Income Tax Schedule?

A: The purpose of the Amended Pa Fiduciary Income Tax Schedule is to report any changes or corrections to the original PA-41 Schedule.

Q: Who needs to file PA-41 Schedule?

A: PA-41 Schedule must be filed by fiduciaries, such as estates or trusts, that have income or deductions subject to the Pennsylvania fiduciary income tax.

Q: Do I need to file Schedule PA-41 X?

A: You only need to file Schedule PA-41 X if you need to make changes or corrections to a previously filed PA-41 Schedule.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule PA-41 X by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.