This version of the form is not currently in use and is provided for reference only. Download this version of

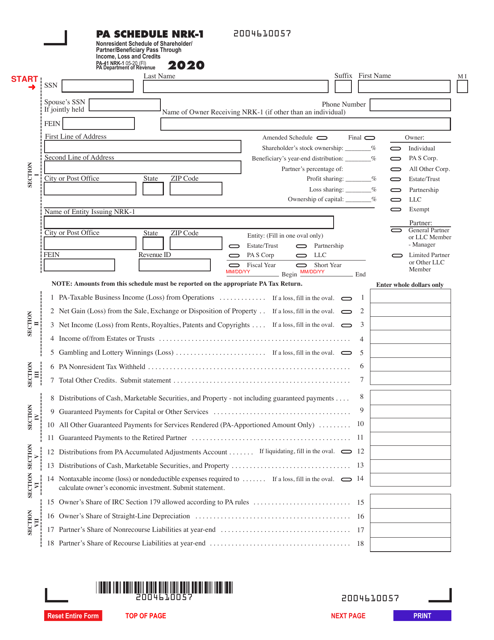

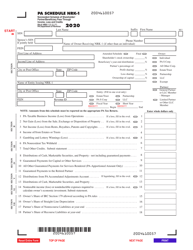

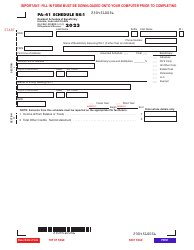

Form PA-41 Schedule NRK-1

for the current year.

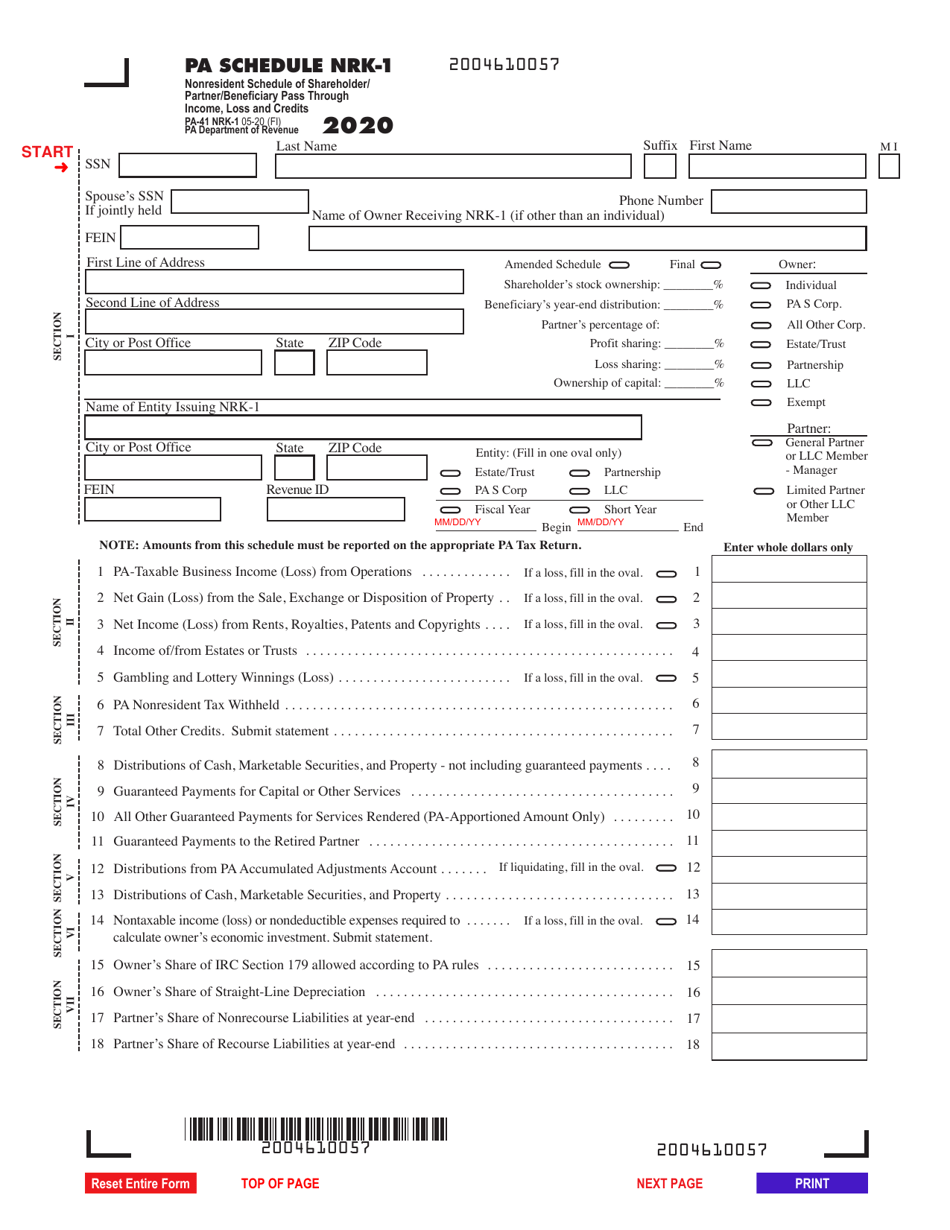

Form PA-41 Schedule NRK-1 Nonresident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-41 Schedule NRK-1?

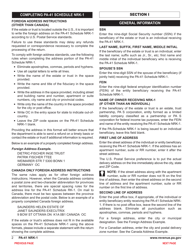

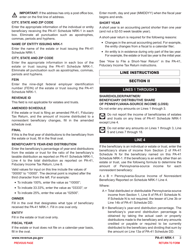

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule NRK-1?

A: Form PA-41 Schedule NRK-1 is a nonresident schedule used to report pass-through income, loss, and credits for shareholders, partners, and beneficiaries in Pennsylvania.

Q: Who needs to file Form PA-41 Schedule NRK-1?

A: Nonresident shareholders, partners, and beneficiaries who receive pass-through income, loss, or credits from Pennsylvania sources need to file Form PA-41 Schedule NRK-1.

Q: What information is included in Form PA-41 Schedule NRK-1?

A: Form PA-41 Schedule NRK-1 includes information about the nonresident shareholder, partner, or beneficiary, as well as details about the pass-through income, loss, and credits.

Q: When is the deadline to file Form PA-41 Schedule NRK-1?

A: The deadline to file Form PA-41 Schedule NRK-1 is the same as the deadline for filing the Pennsylvania income tax return, which is usually April 15th.

Q: Are there any penalties for not filing Form PA-41 Schedule NRK-1?

A: Yes, if you fail to file Form PA-41 Schedule NRK-1 or file it late, you may be subject to penalties and interest on the amount due.

Q: Do I need to include Form PA-41 Schedule NRK-1 with my federal tax return?

A: No, Form PA-41 Schedule NRK-1 is specific to Pennsylvania state taxes and should be filed separately.

Q: Can I make changes to Form PA-41 Schedule NRK-1 after filing?

A: If you need to make changes to Form PA-41 Schedule NRK-1 after filing, you will need to file an amended return with the Pennsylvania Department of Revenue.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule NRK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.