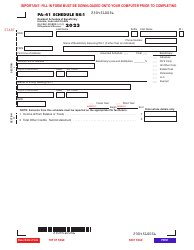

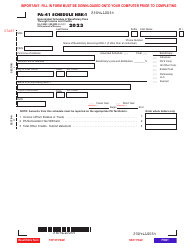

This version of the form is not currently in use and is provided for reference only. Download this version of

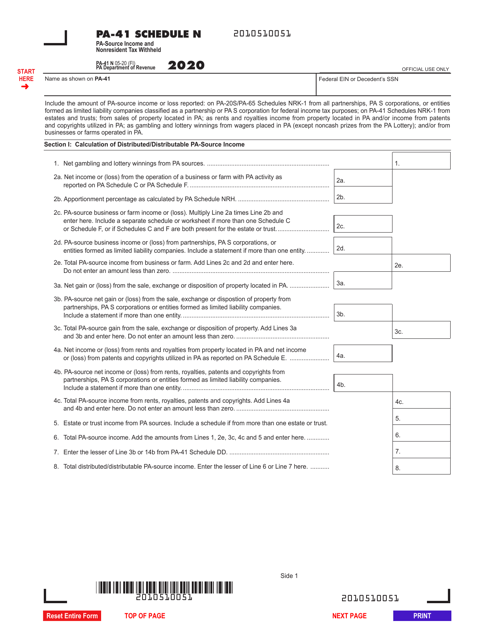

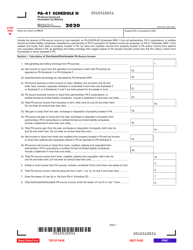

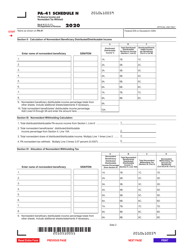

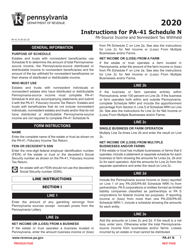

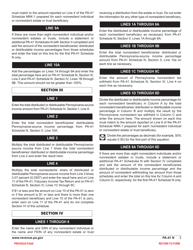

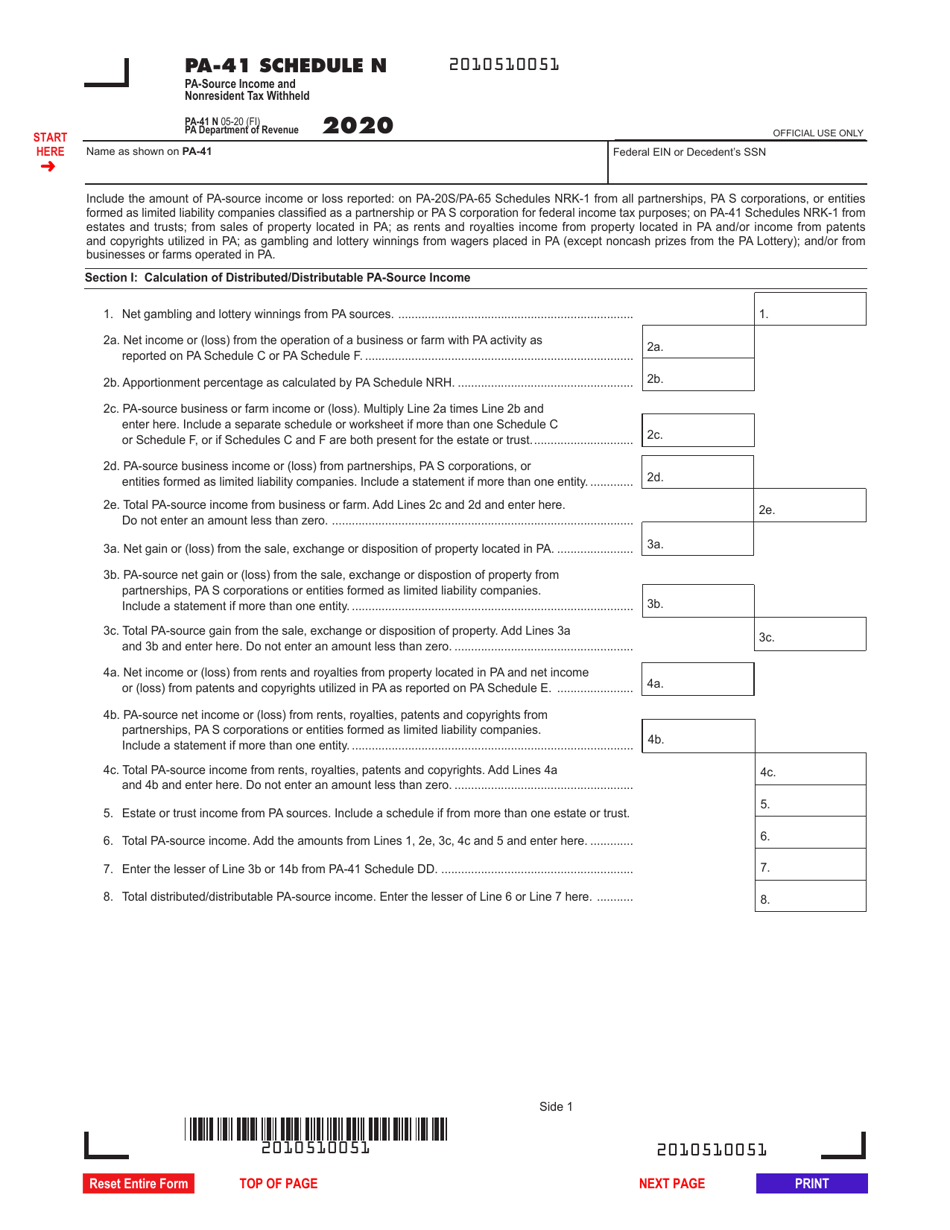

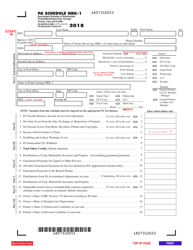

Form PA-41 Schedule N

for the current year.

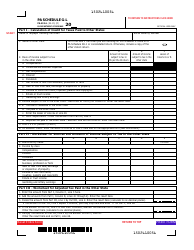

Form PA-41 Schedule N Pa-Source Income and Nonresident Tax Withheld - Pennsylvania

What Is Form PA-41 Schedule N?

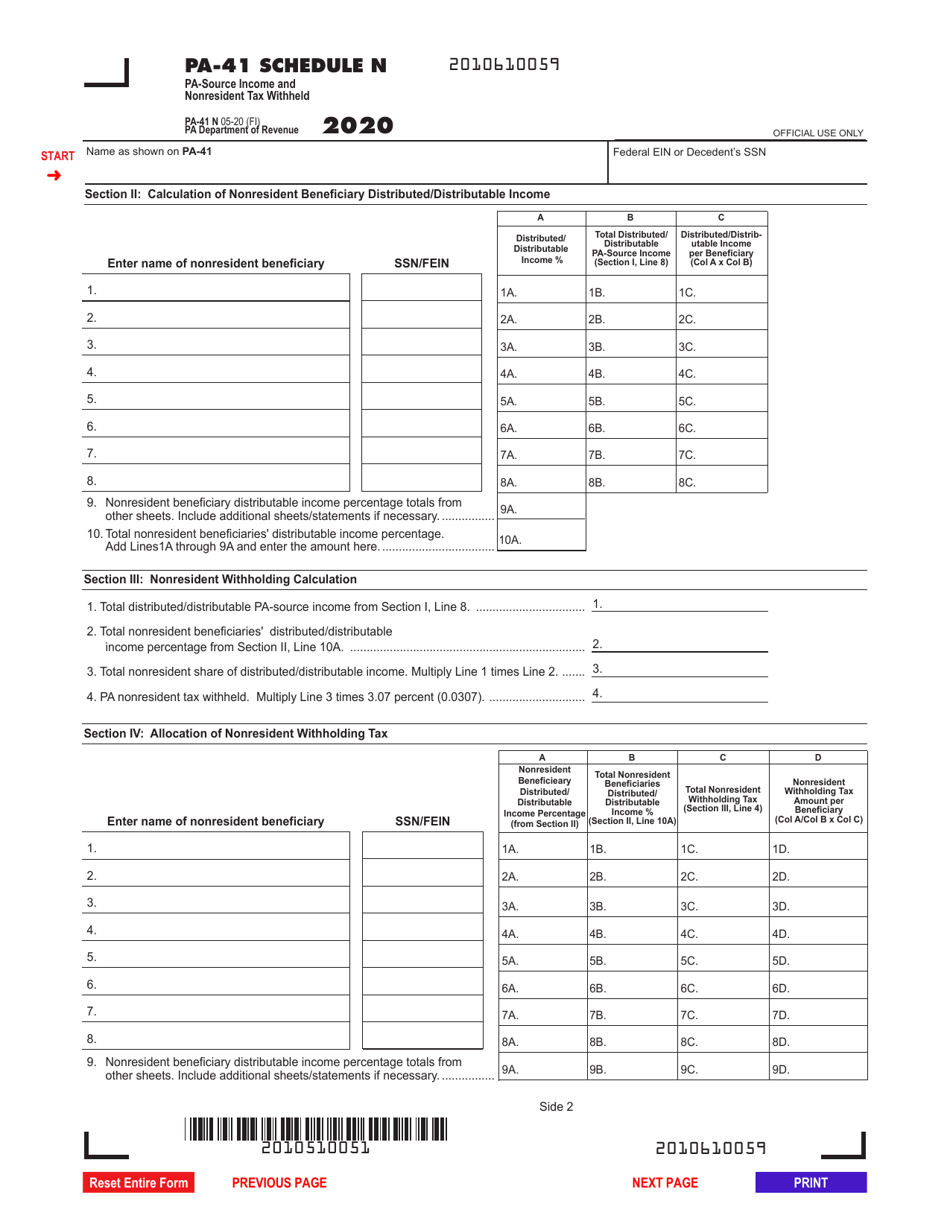

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule N?

A: Form PA-41 Schedule N is a supporting schedule for individuals filing a Pennsylvania state tax return. It is used to report Pa-Source Income and Nonresident Tax Withheld.

Q: Who needs to file Form PA-41 Schedule N?

A: Form PA-41 Schedule N must be filed by individuals who have Pa-Source Income and had nonresident tax withheld from their income.

Q: What is Pa-Source Income?

A: Pa-Source Income refers to income earned within the state of Pennsylvania.

Q: What should I include on Form PA-41 Schedule N?

A: On Form PA-41 Schedule N, you should include details of your Pa-Source Income and any nonresident tax that was withheld from your income.

Q: When is the deadline to file Form PA-41 Schedule N?

A: The deadline to file Form PA-41 Schedule N is the same as the deadline to file your Pennsylvania state tax return, which is usually April 15th.

Q: Can I e-file Form PA-41 Schedule N?

A: Yes, you can e-file Form PA-41 Schedule N if you are filing your Pennsylvania state tax return electronically.

Q: Do I need to include Form PA-41 Schedule N with my federal tax return?

A: No, Form PA-41 Schedule N is specific to Pennsylvania state taxes and should not be included with your federal tax return.

Q: What happens if I don't file Form PA-41 Schedule N?

A: If you have Pa-Source Income and had nonresident tax withheld, it is important to file Form PA-41 Schedule N to report this information. Failing to do so may result in penalties or interest charges.

Q: Can I amend Form PA-41 Schedule N if I made a mistake?

A: Yes, you can amend Form PA-41 Schedule N if you need to correct any errors. You should use Form PA-40X to make the necessary amendments.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule N by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.