This version of the form is not currently in use and is provided for reference only. Download this version of

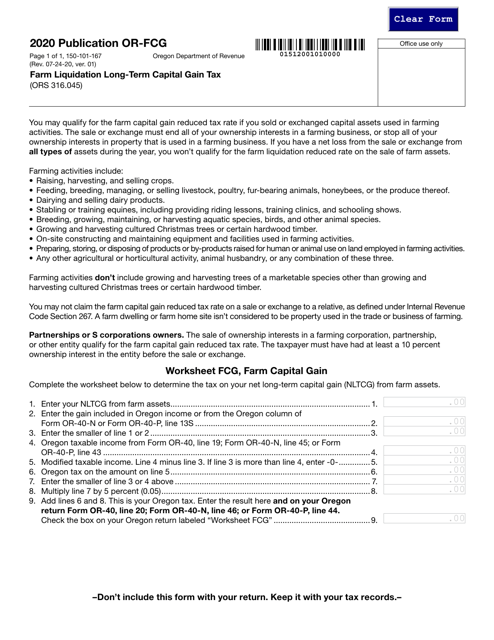

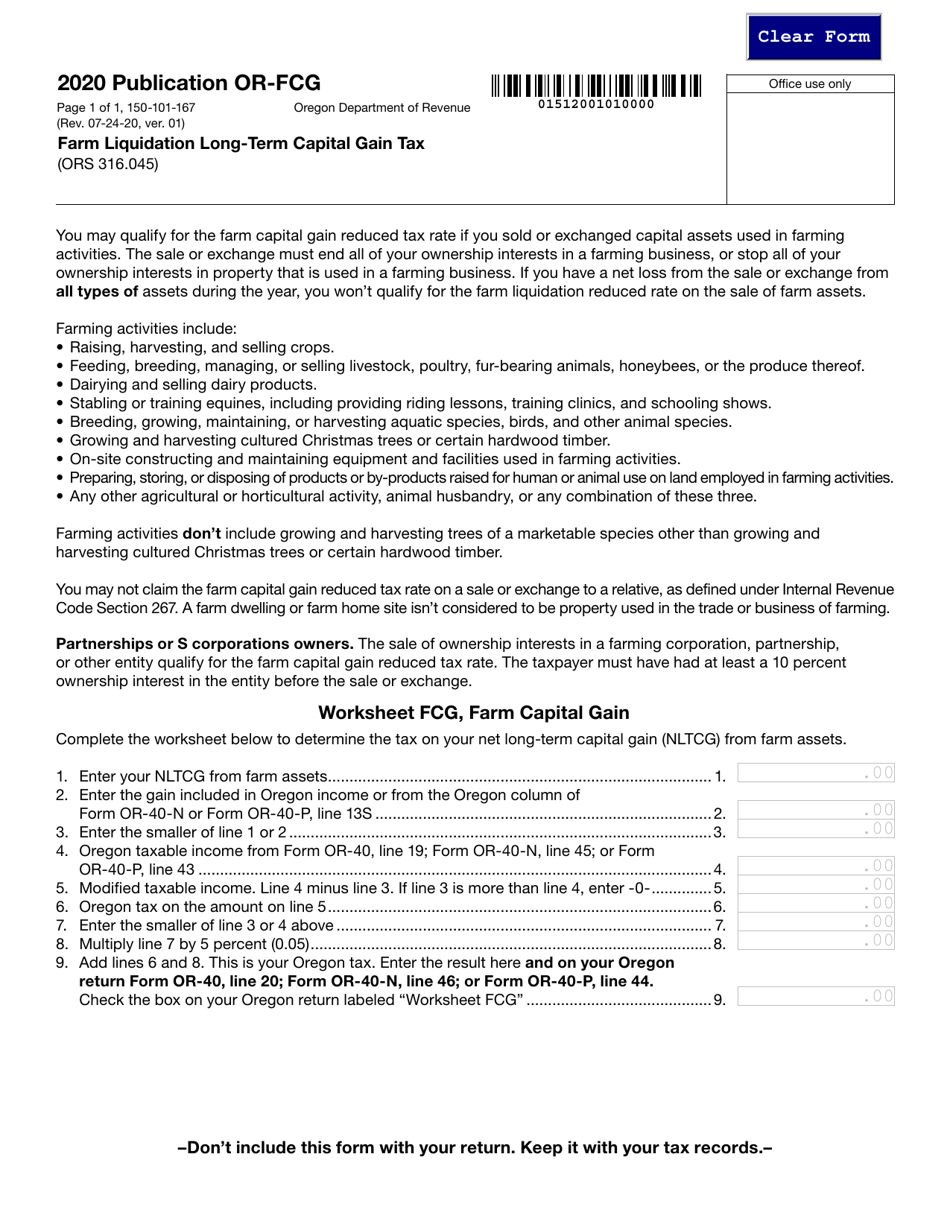

Form 150-101-167 Worksheet OR-FCG

for the current year.

Form 150-101-167 Worksheet OR-FCG Farm Liquidation Long-Term Capital Gain Tax Rate - Oregon

What Is Form 150-101-167 Worksheet OR-FCG?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-167?

A: Form 150-101-167 is a worksheet used for calculating the long-term capital gain tax rate for farm liquidation in Oregon.

Q: What is OR-FCG?

A: OR-FCG refers to farm capital gains, which is an Oregon tax form specifically designed for reporting capital gains from the sale or liquidation of a farm.

Q: What is the purpose of the worksheet?

A: The purpose of the worksheet is to help calculate the long-term capital gain tax rate for farm liquidation in Oregon.

Q: What is a long-term capital gain tax rate?

A: A long-term capital gain tax rate is a tax rate on the profit made from the sale of an asset held for more than one year.

Q: Who needs to use this worksheet?

A: Farmers in Oregon who have sold or liquidated their farm and have capital gains may need to use this worksheet.

Q: Why is it important to calculate the long-term capital gain tax rate?

A: Calculating the long-term capital gain tax rate is important for ensuring accurate tax reporting and determining the amount of tax owed on the farm liquidation.

Q: Is the tax rate the same for all farms?

A: No, the tax rate can vary depending on various factors, such as the length of time the asset was held, the type of asset, and other specific tax laws in Oregon.

Form Details:

- Released on July 24, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-167 Worksheet OR-FCG by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.