This version of the form is not currently in use and is provided for reference only. Download this version of

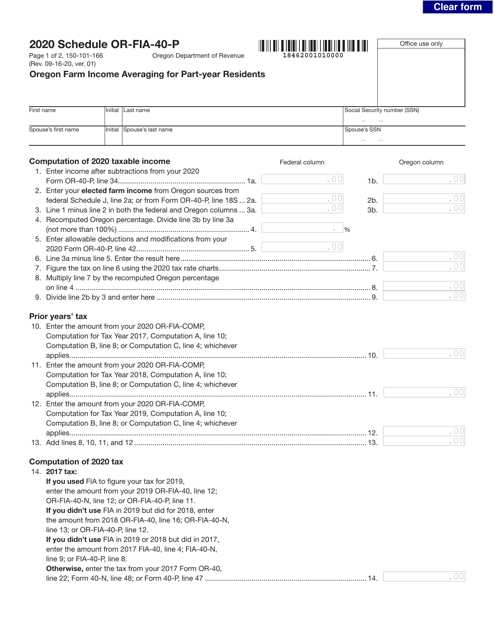

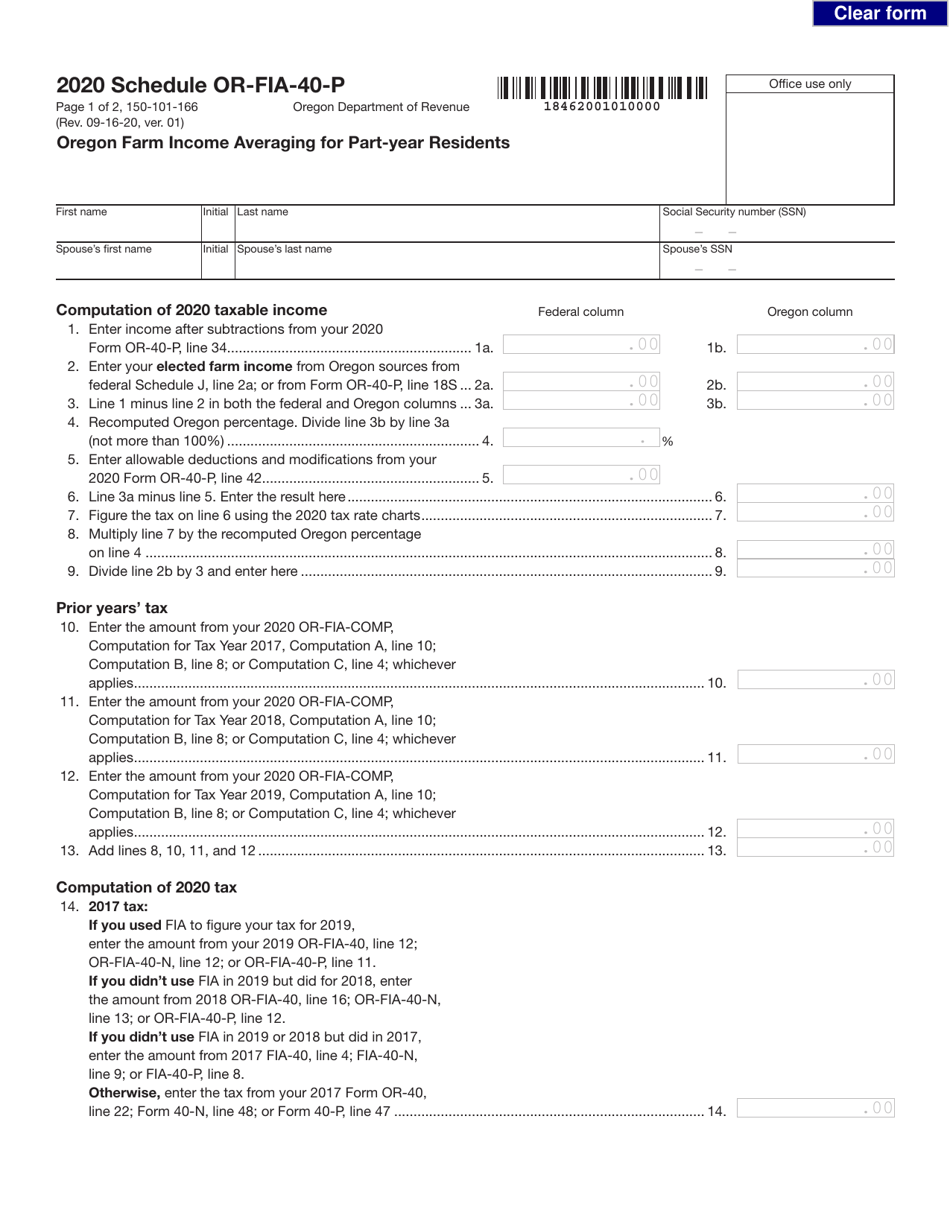

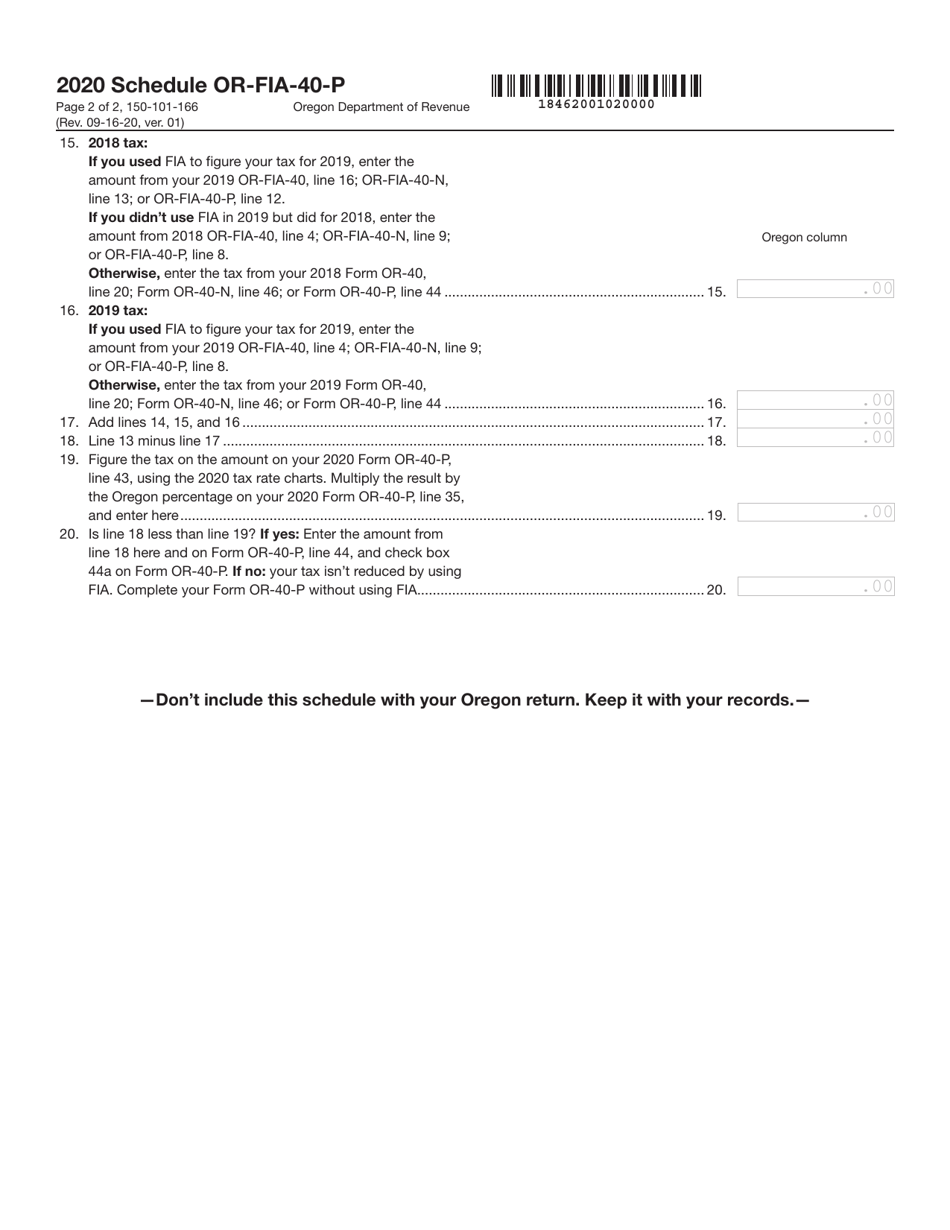

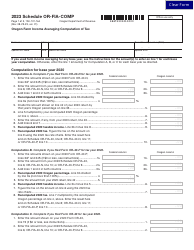

Form 150-101-166 Schedule OR-FIA-40-P

for the current year.

Form 150-101-166 Schedule OR-FIA-40-P Oregon Farm Income Averaging for Part-Year Residents - Oregon

What Is Form 150-101-166 Schedule OR-FIA-40-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-166?

A: Form 150-101-166 is a schedule for Part-Year Residents in Oregon to determine their Farm Income Averaging.

Q: Who should use Form 150-101-166?

A: Part-Year Residents in Oregon who have farm income should use Form 150-101-166.

Q: What is Farm Income Averaging?

A: Farm Income Averaging is a method that allows part-year residents with farm income in Oregon to reduce their taxable income.

Q: Do I need to file Form 150-101-166 if I don't have farm income?

A: No, you only need to file Form 150-101-166 if you have farm income as a part-year resident in Oregon.

Form Details:

- Released on September 16, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-166 Schedule OR-FIA-40-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.