This version of the form is not currently in use and is provided for reference only. Download this version of

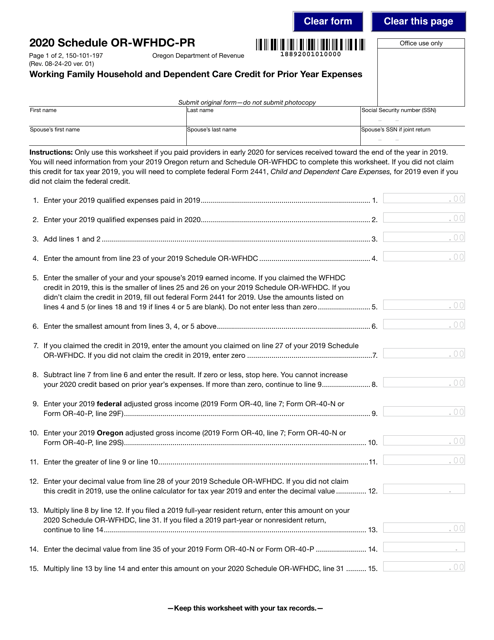

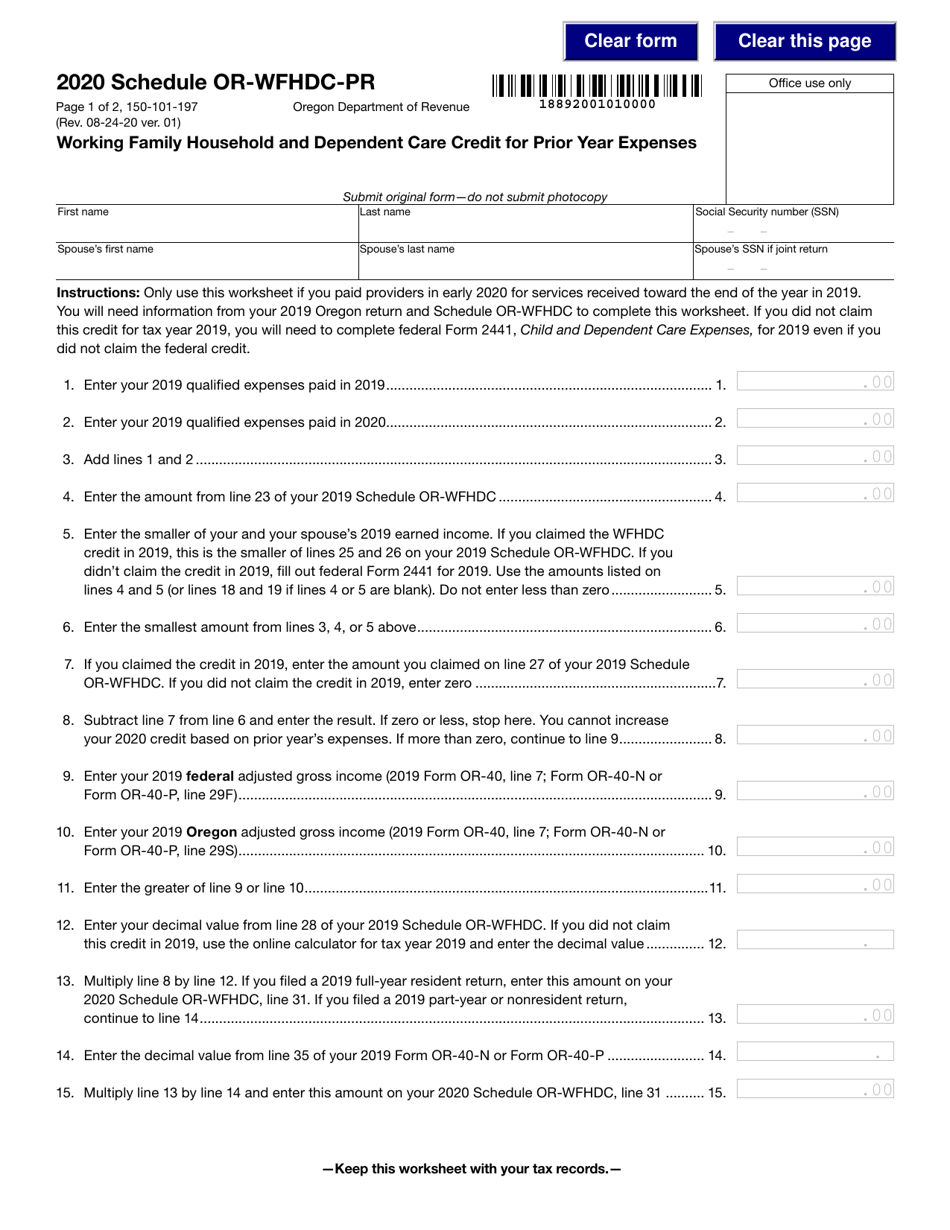

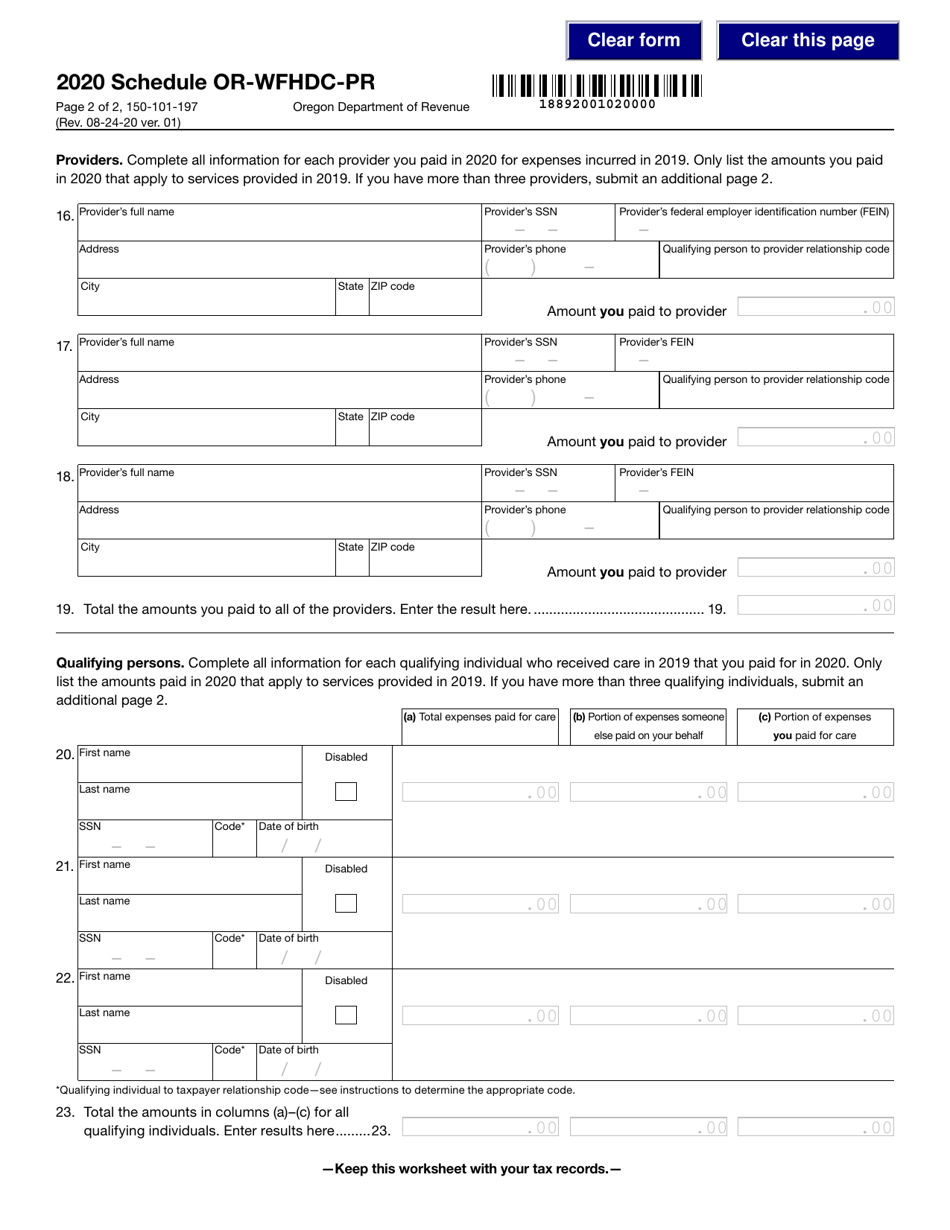

Form 150-101-197 Schedule OR-WFHDC-PR

for the current year.

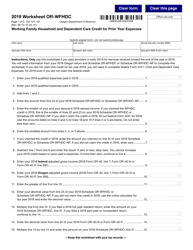

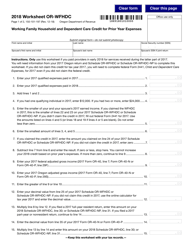

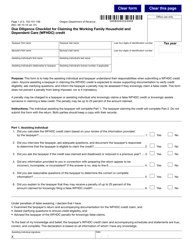

Form 150-101-197 Schedule OR-WFHDC-PR Working Family Household and Dependent Care Credit for Prior Year Expenses - Oregon

What Is Form 150-101-197 Schedule OR-WFHDC-PR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-197 Schedule OR-WFHDC-PR?

A: Form 150-101-197 Schedule OR-WFHDC-PR is a tax form used in Oregon to claim the Working Family Household and Dependent Care Credit for Prior Year Expenses.

Q: What is the Working Family Household and Dependent Care Credit?

A: The Working Family Household and Dependent Care Credit is a tax credit in Oregon that helps eligible taxpayers offset the cost of childcare or dependent care expenses.

Q: Who is eligible for the Working Family Household and Dependent Care Credit?

A: Eligibility for the Working Family Household and Dependent Care Credit in Oregon is based on income, number of dependents, and qualifying childcare or dependent care expenses.

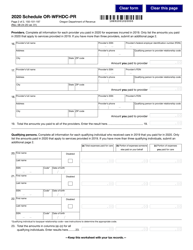

Q: What expenses qualify for the Working Family Household and Dependent Care Credit?

A: Qualifying expenses for the Working Family Household and Dependent Care Credit include costs for childcare or dependent care services, such as daycare, after-school care, or in-home care.

Q: How do I claim the Working Family Household and Dependent Care Credit for prior year expenses?

A: To claim the Working Family Household and Dependent Care Credit for prior year expenses in Oregon, you need to complete Form 150-101-197 Schedule OR-WFHDC-PR and include it with your state tax return.

Q: Is the Working Family Household and Dependent Care Credit refundable?

A: No, the Working Family Household and Dependent Care Credit in Oregon is non-refundable, meaning it can reduce your tax liability but will not result in a refund if it exceeds your tax owed.

Q: Are there income limits for the Working Family Household and Dependent Care Credit?

A: Yes, there are income limits for the Working Family Household and Dependent Care Credit in Oregon. The credit amount gradually decreases as income rises and phases out completely above a certain income threshold.

Q: Can I claim the Working Family Household and Dependent Care Credit if I use a child care subsidy?

A: Yes, you can still claim the Working Family Household and Dependent Care Credit in Oregon even if you receive a child care subsidy, as long as your total qualifying expenses exceed the subsidy amount.

Q: What documentation do I need to support my claim for the Working Family Household and Dependent Care Credit?

A: You may need to provide documentation, such as receipts or statements, to support your claim for the Working Family Household and Dependent Care Credit. Keep records of your qualifying childcare or dependent care expenses in case of an audit.

Form Details:

- Released on August 24, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-197 Schedule OR-WFHDC-PR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.