This version of the form is not currently in use and is provided for reference only. Download this version of

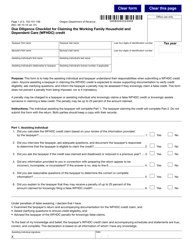

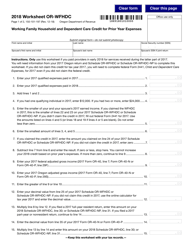

Form 150-101-198 Schedule OR-WFHDC-CL

for the current year.

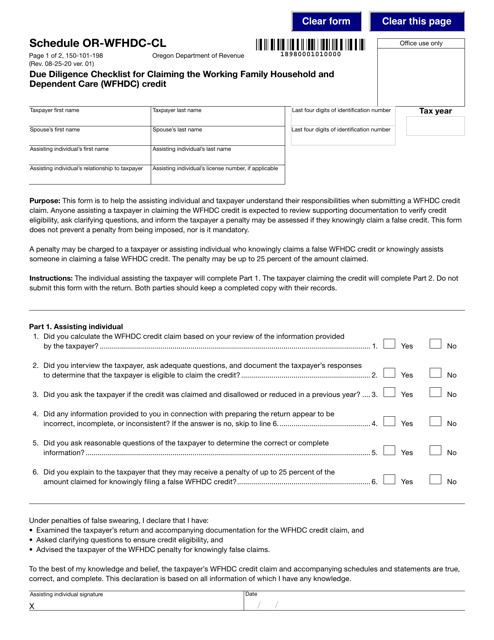

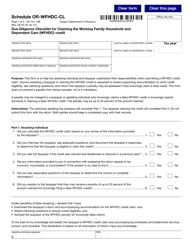

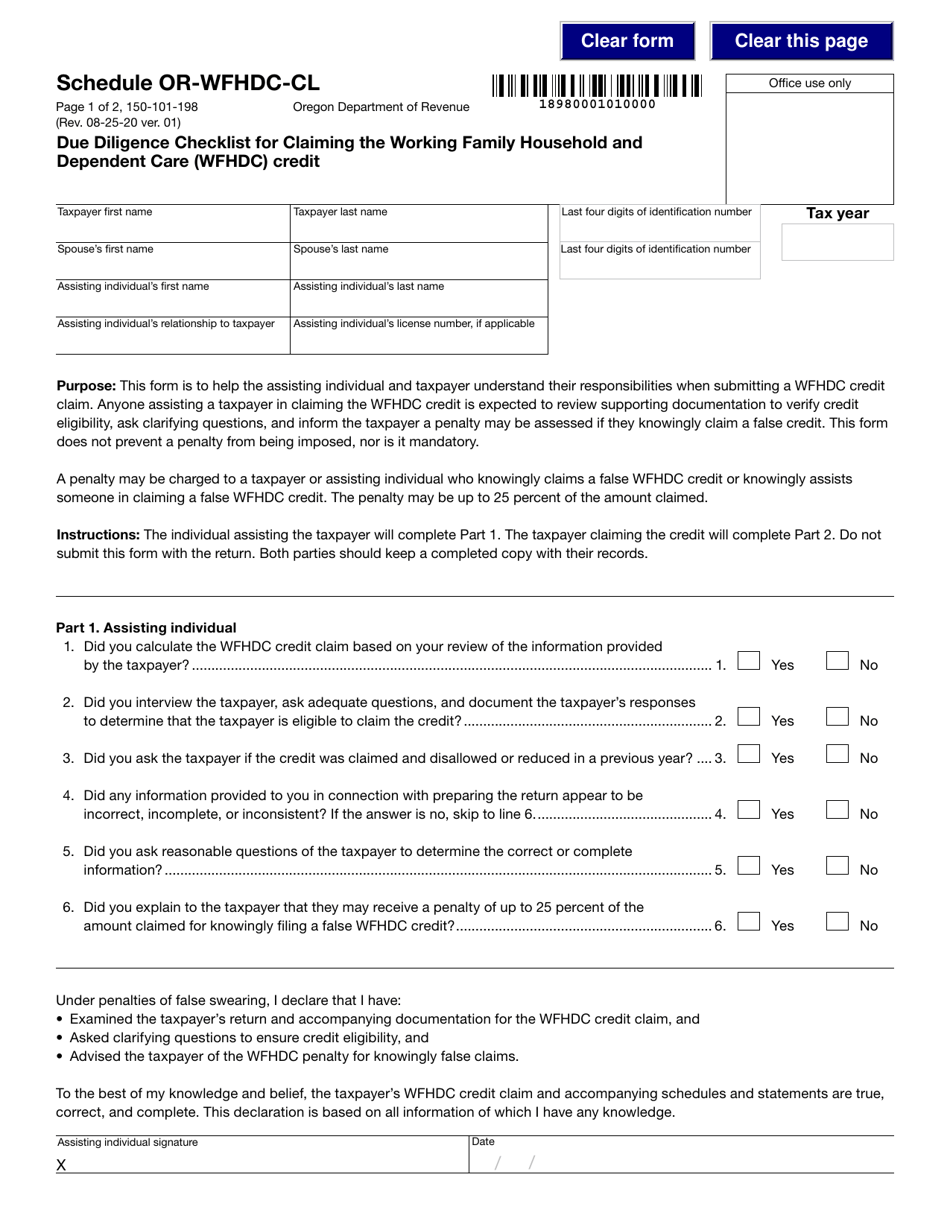

Form 150-101-198 Schedule OR-WFHDC-CL Due Diligence Checklist for Claiming the Working Family Household and Dependent Care (Wfhdc) Credit - Oregon

What Is Form 150-101-198 Schedule OR-WFHDC-CL?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form 150-101-198, Due Diligence Checklist for Claiming the Working Family Household and Dependent Care Credit (Wfhdc). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-198 Schedule OR-WFHDC-CL?

A: Form 150-101-198 Schedule OR-WFHDC-CL is a due diligence checklist for claiming the Working Family Household and Dependent Care Credit in Oregon.

Q: What is the Working Family Household and Dependent Care Credit?

A: The Working Family Household and Dependent Care Credit is a credit available in Oregon for eligible taxpayers who incur expenses for the care of their dependents while they work.

Q: Who is eligible for the Working Family Household and Dependent Care Credit?

A: To be eligible for the Working Family Household and Dependent Care Credit in Oregon, you must meet certain income and residency requirements and have incurred qualifying expenses for the care of your dependents while you work.

Q: What is the purpose of the due diligence checklist?

A: The due diligence checklist, Form 150-101-198 Schedule OR-WFHDC-CL, is used to ensure that taxpayers claiming the Working Family Household and Dependent Care Credit have met all the necessary requirements and have supporting documentation for their claimed expenses.

Q: What should I do with the due diligence checklist?

A: If you are claiming the Working Family Household and Dependent Care Credit in Oregon, you should complete Form 150-101-198 Schedule OR-WFHDC-CL, attach it to your tax return, and keep a copy for your records.

Form Details:

- Released on August 25, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-198 Schedule OR-WFHDC-CL by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.