This version of the form is not currently in use and is provided for reference only. Download this version of

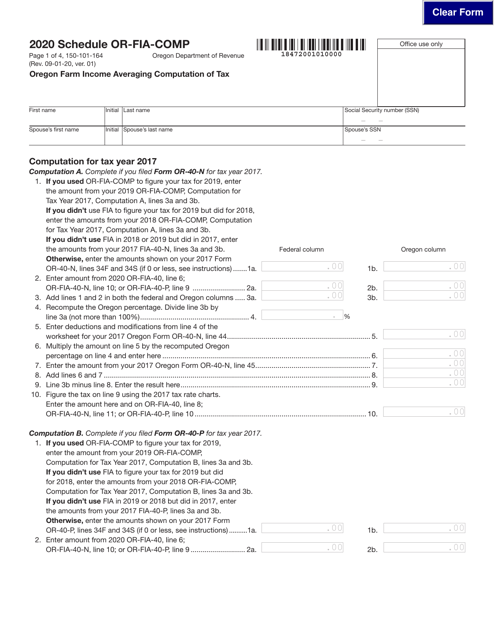

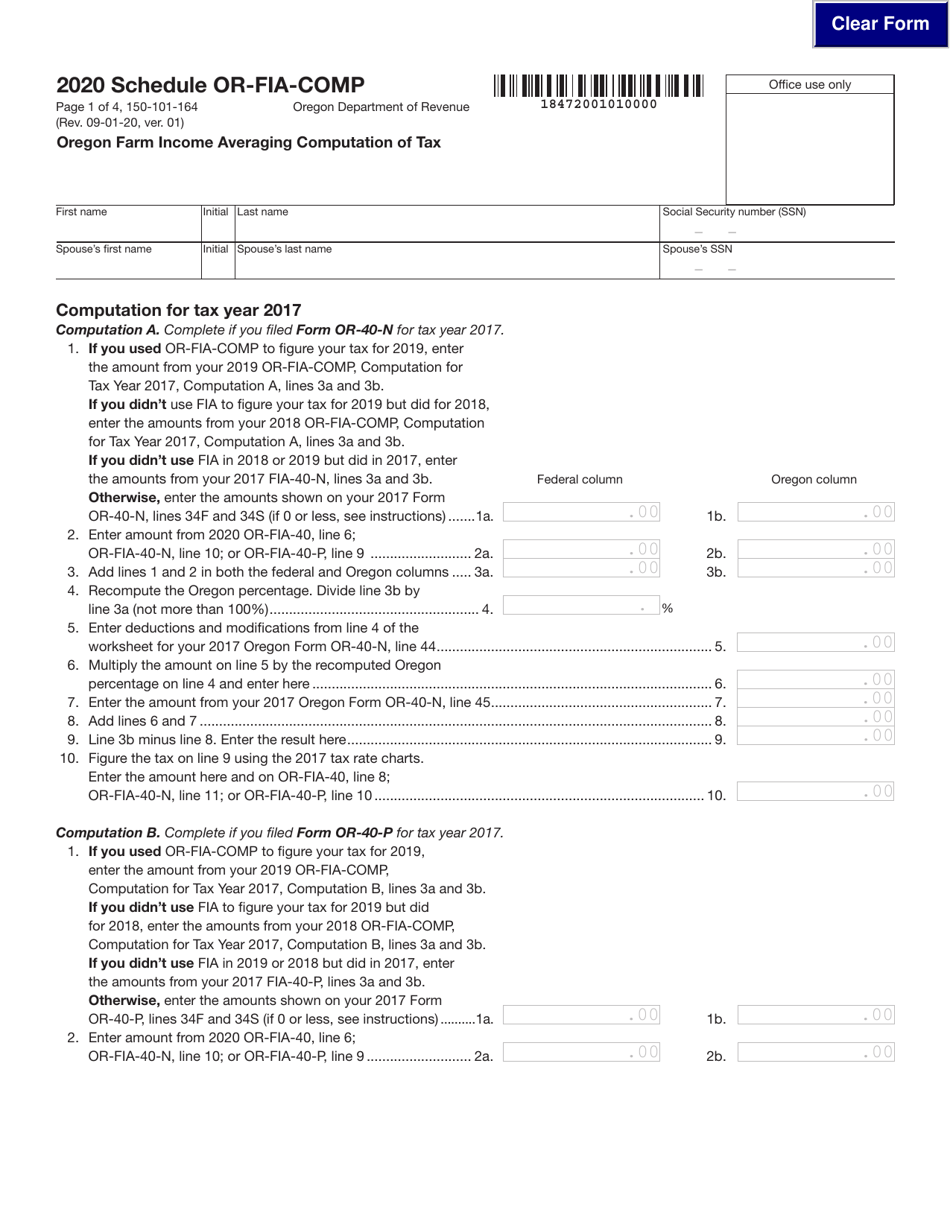

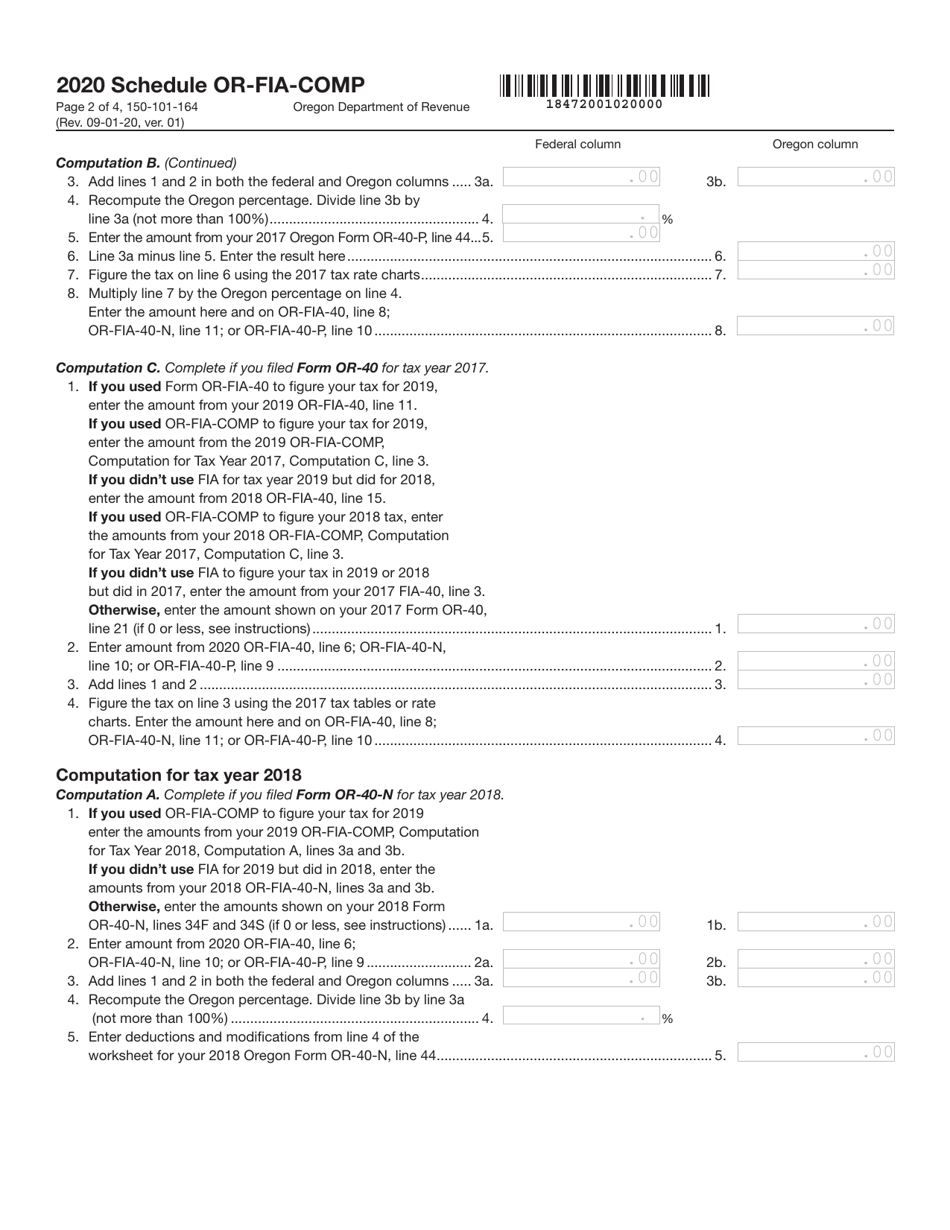

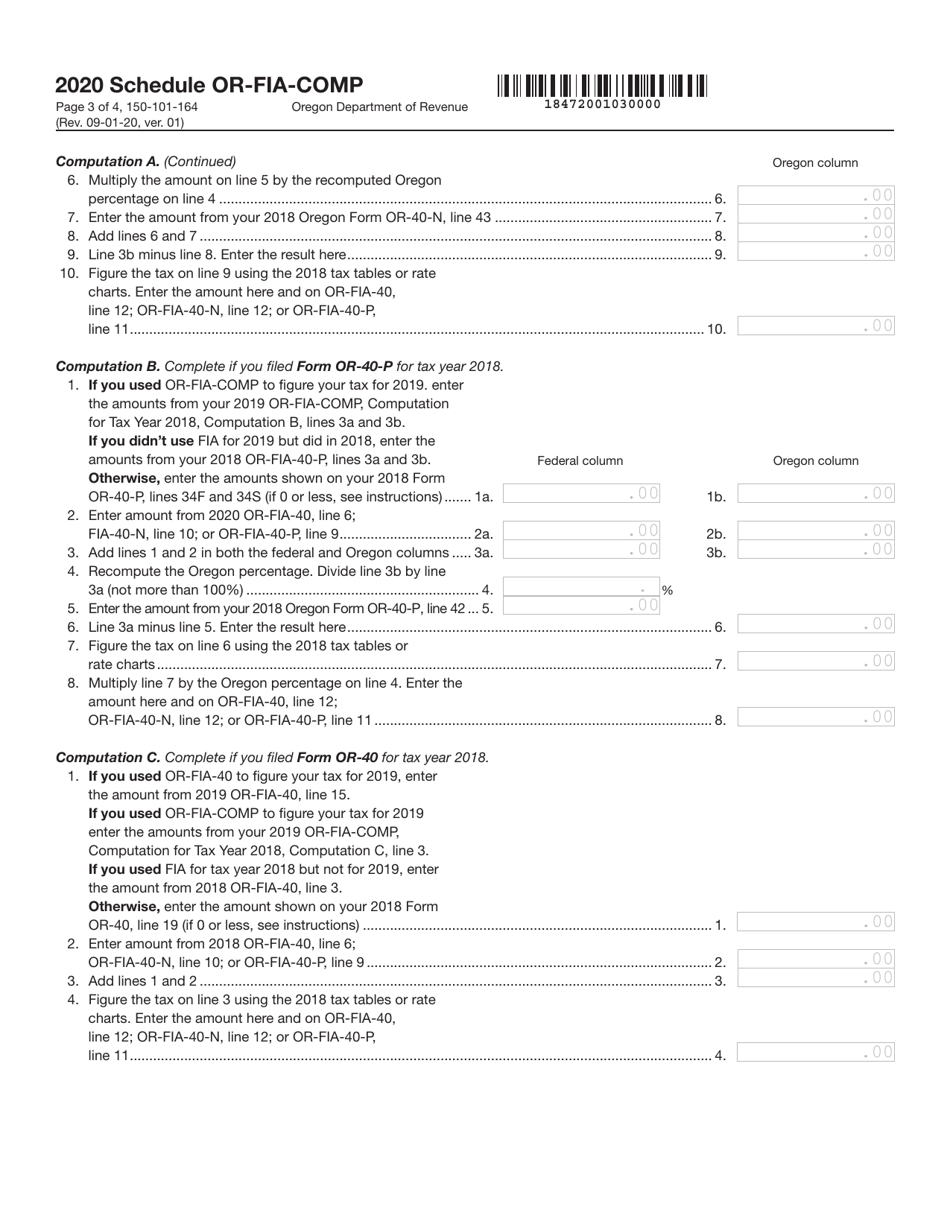

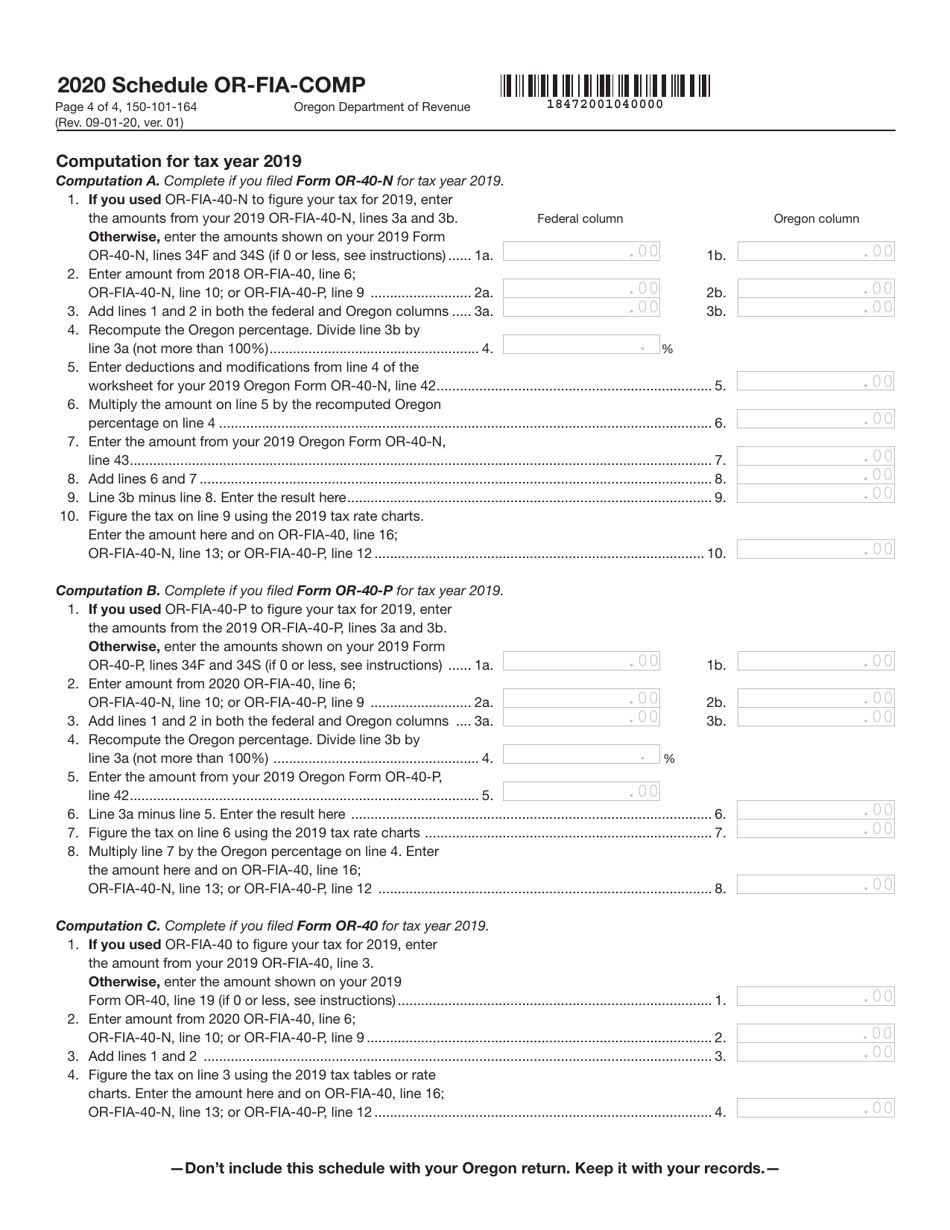

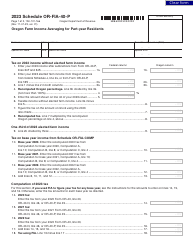

Form 150-101-164 Schedule OR-FIA-COMP

for the current year.

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon

What Is Form 150-101-164 Schedule OR-FIA-COMP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-164?

A: Form 150-101-164 is a tax form specific to Oregon that is used to calculate farm income averaging for tax purposes.

Q: What is Oregon Farm Income Averaging?

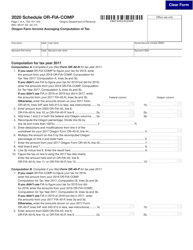

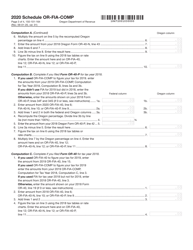

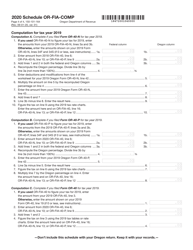

A: Oregon Farm Income Averaging is a tax computation method that allows farmers in Oregon to average their income over a three-year period, reducing their tax liability.

Q: Who is eligible to use Form 150-101-164?

A: Farmers in Oregon who derive a substantial portion of their income from farming activities are eligible to use Form 150-101-164 to calculate their farm income averaging.

Q: How does farm income averaging work?

A: Farm income averaging allows farmers to calculate their tax liability based on an average of their income from farming activities over a three-year period, potentially reducing their overall tax liability.

Q: What information is required to complete Form 150-101-164?

A: To complete Form 150-101-164, farmers need to provide detailed information about their farming activities, including income and expenses for each year in the three-year averaging period.

Q: When is Form 150-101-164 due?

A: Form 150-101-164 is typically due on April 15th of the year following the tax year being averaged.

Q: Is farm income averaging available in other states?

A: Farm income averaging is specific to Oregon and may not be available in other states. However, other states may have similar tax provisions for farmers.

Q: How can farm income averaging benefit farmers?

A: Farm income averaging can benefit farmers by reducing their tax liability, particularly during years when their income from farming activities is significantly higher than in previous years.

Q: Are there any limitations or restrictions on farm income averaging?

A: There may be limitations or restrictions on farm income averaging, such as income thresholds or specific requirements for qualifying as a farmer. It is important to consult the instructions and guidelines provided with Form 150-101-164 or seek professional tax advice.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-164 Schedule OR-FIA-COMP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.