This version of the form is not currently in use and is provided for reference only. Download this version of

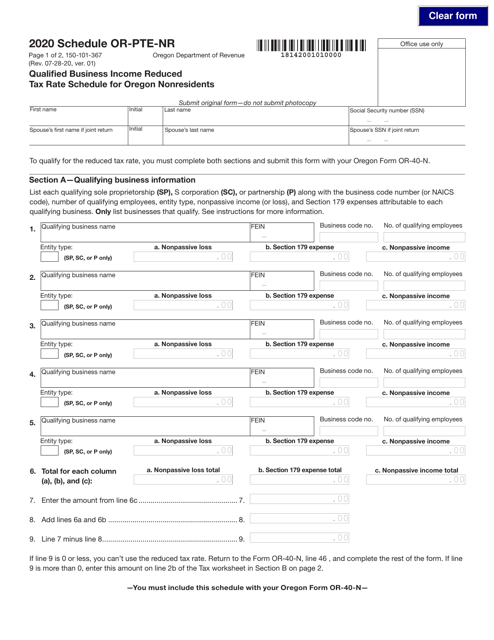

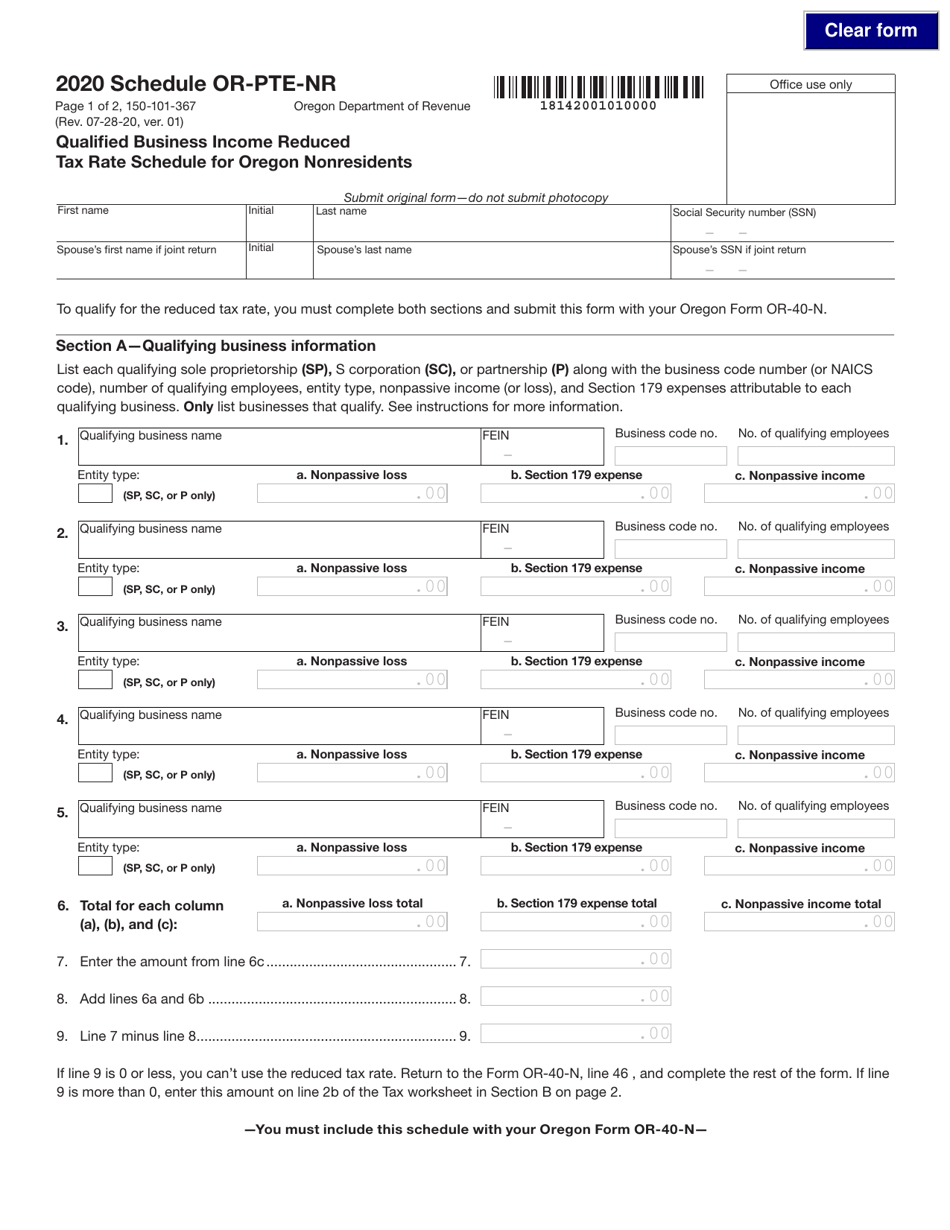

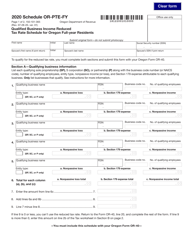

Form 150-101-367 Schedule OR-PTE-NR

for the current year.

Form 150-101-367 Schedule OR-PTE-NR Qualified Business Income Reduced Tax Rate Schedule for Oregon Nonresidents - Oregon

What Is Form 150-101-367 Schedule OR-PTE-NR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-367?

A: Form 150-101-367 is the Schedule OR-PTE-NR Qualified Business Income Reduced Tax Rate Schedule for Oregon Nonresidents.

Q: Who needs to use Form 150-101-367?

A: This form is for nonresidents of Oregon who have qualified business income and are eligible to claim the reduced tax rate.

Q: What is the purpose of Form 150-101-367?

A: The purpose of this form is to calculate the reduced tax rate for nonresidents of Oregon who have qualified business income.

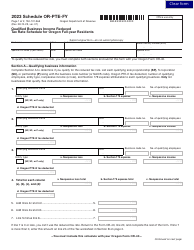

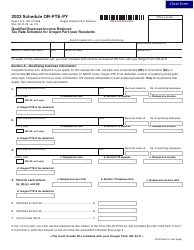

Q: What information is required on Form 150-101-367?

A: You will need to provide your personal information, details about your qualified business income, and any other required information for calculating the reduced tax rate.

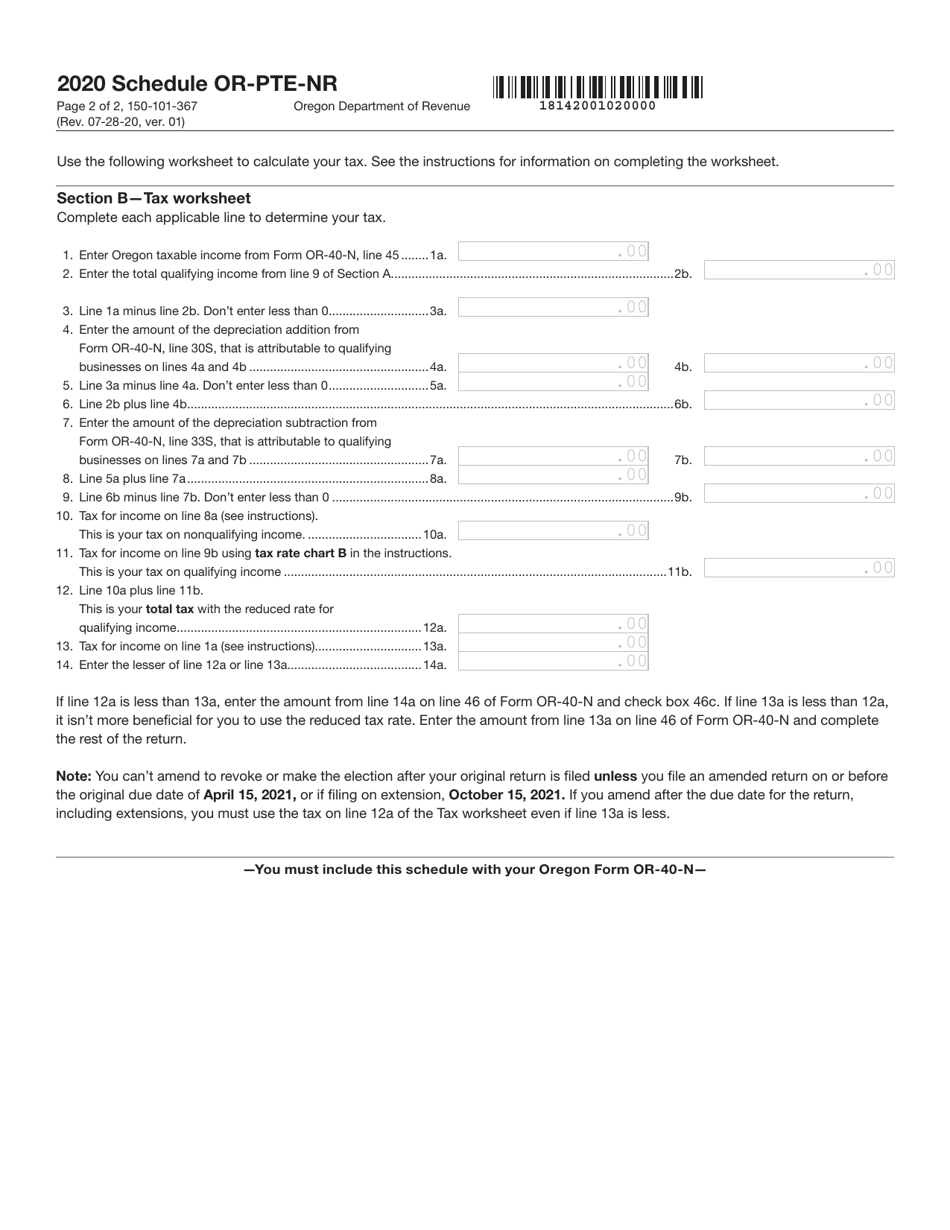

Q: Are there any specific instructions for completing Form 150-101-367?

A: Yes, there are instructions provided with the form that will guide you on how to complete it accurately.

Q: When is the deadline for filing Form 150-101-367?

A: The deadline for filing Form 150-101-367 is the same as the deadline for filing your Oregon income tax return, which is usually April 15th.

Q: Can I file Form 150-101-367 electronically?

A: Yes, you can file Form 150-101-367 electronically if you choose to e-file your Oregon income tax return.

Q: What happens if I don't file Form 150-101-367?

A: If you are eligible to claim the reduced tax rate and do not file Form 150-101-367, you may end up paying a higher tax rate on your qualified business income.

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-367 Schedule OR-PTE-NR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.