This version of the form is not currently in use and is provided for reference only. Download this version of

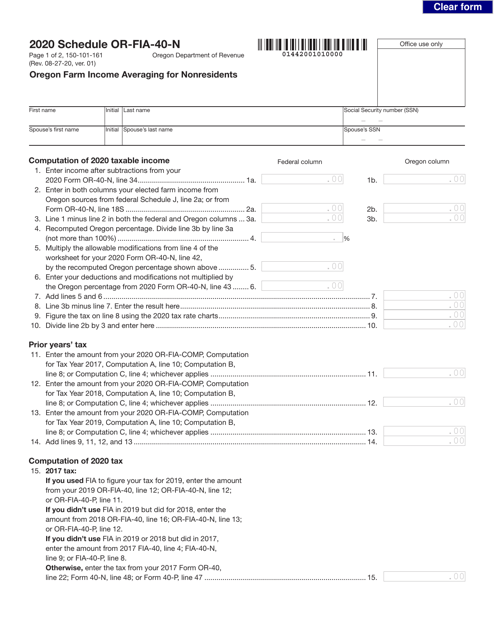

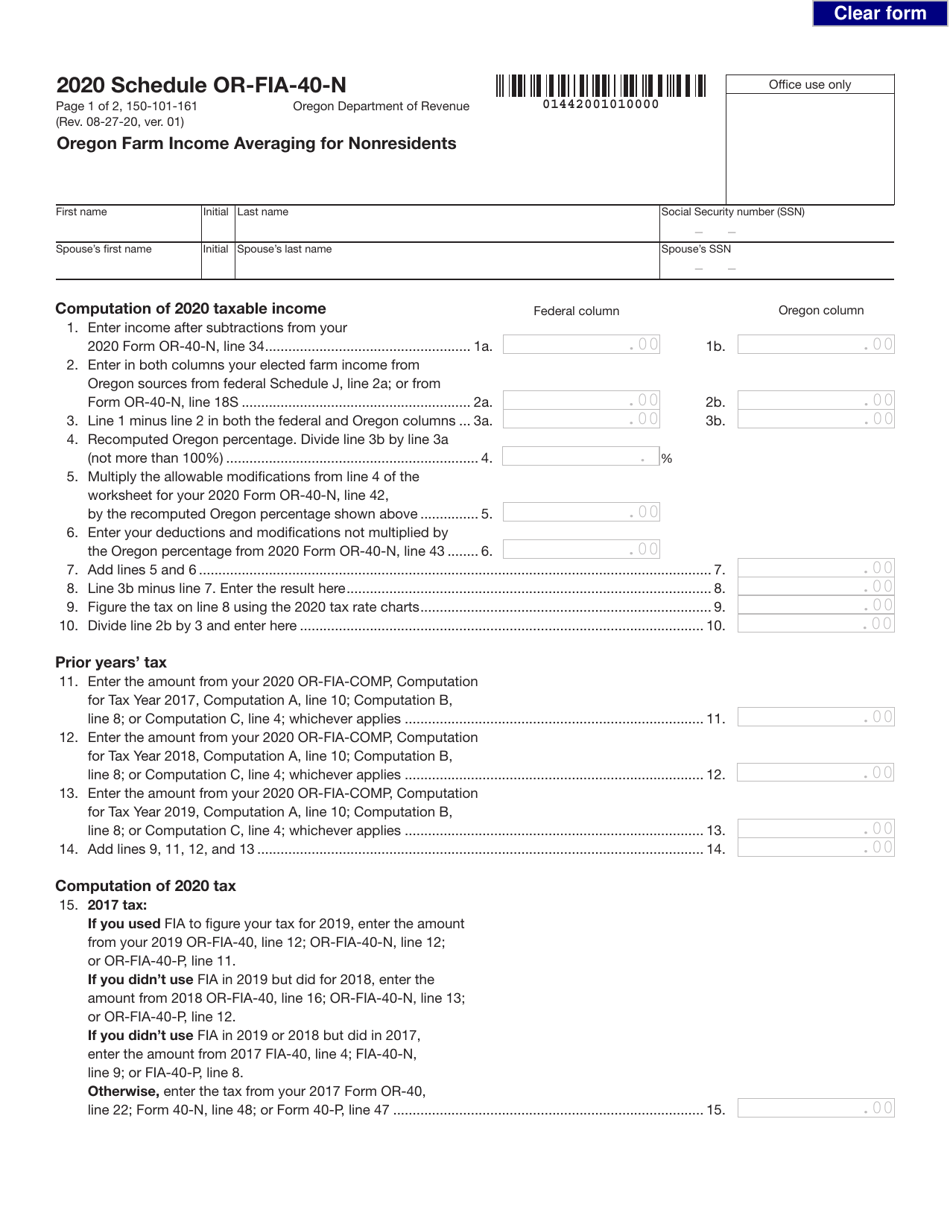

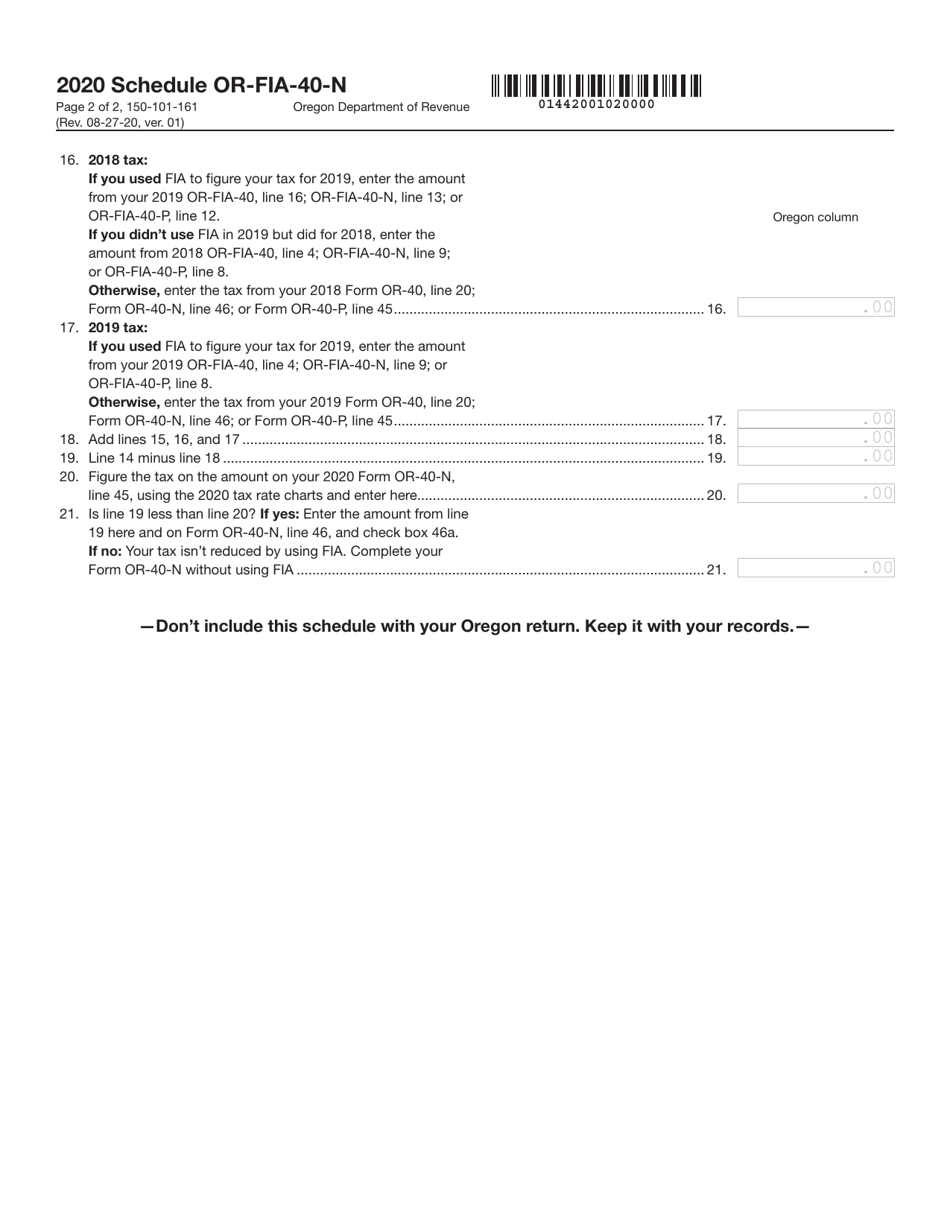

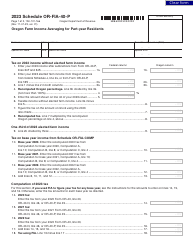

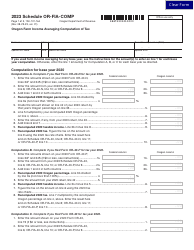

Form 150-101-161 Schedule OR-FIA-40-N

for the current year.

Form 150-101-161 Schedule OR-FIA-40-N Oregon Farm Income Averaging for Nonresidents - Oregon

What Is Form 150-101-161 Schedule OR-FIA-40-N?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-161?

A: Form 150-101-161 is the schedule for Oregon Farm Income Averaging for Nonresidents in Oregon.

Q: Who needs to fill out Form 150-101-161?

A: Nonresidents of Oregon who have farming income in Oregon and want to average their income for tax purposes.

Q: What is Oregon Farm Income Averaging?

A: Oregon Farm Income Averaging is a method that allows farmers to smooth out their income over a three-year period for tax purposes.

Q: Can nonresidents of Oregon use this form?

A: Yes, nonresidents of Oregon can use Form 150-101-161 to average their farming income in Oregon.

Q: How does income averaging work?

A: Income averaging allows farmers to calculate their tax liability based on an average income over a three-year period, which can help reduce their tax burden.

Q: When is Form 150-101-161 due?

A: Form 150-101-161 is due on the same date as your Oregon tax return, which is typically April 15th.

Q: Are there any special requirements for nonresidents?

A: Nonresidents must meet certain criteria, such as having farming income in Oregon and being subject to Oregon income tax, in order to use Form 150-101-161.

Form Details:

- Released on August 27, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-161 Schedule OR-FIA-40-N by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.