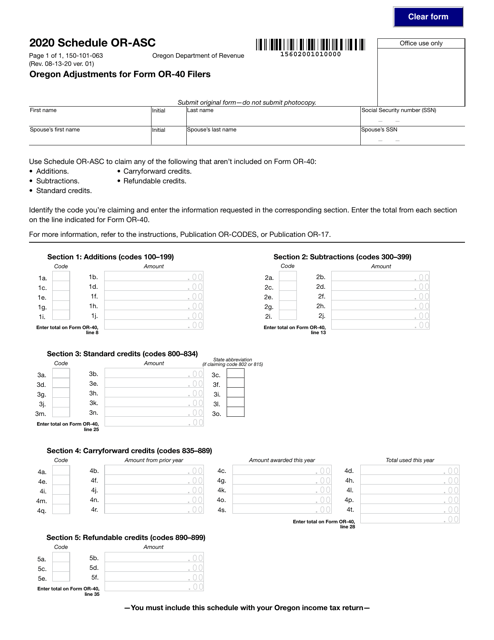

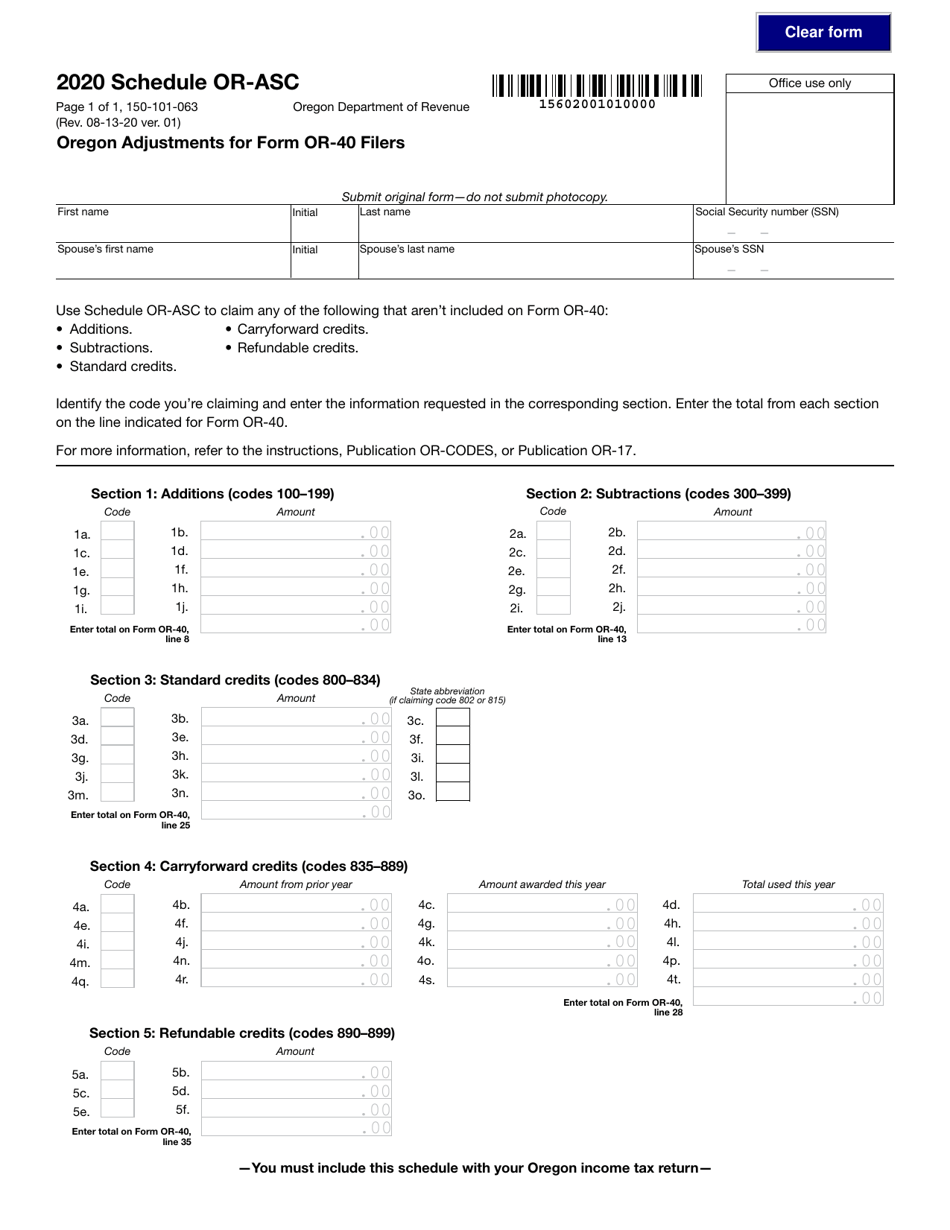

Form OR-ASC (150-101-063) Oregon Adjustments for Form or-40 Filers - Oregon

What Is Form OR-ASC (150-101-063)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-ASC?

A: Form OR-ASC is the Oregon Adjustments for Form or-40 Filers.

Q: Who needs to file Form OR-ASC?

A: Form OR-ASC is for taxpayers who are filing Form OR-40 in Oregon.

Q: What does Form OR-ASC allow you to do?

A: Form OR-ASC allows you to make adjustments to your Oregon tax return.

Q: What are some examples of adjustments made with Form OR-ASC?

A: Examples of adjustments made with Form OR-ASC include adding or subtracting federal income, deductions, and credits.

Q: Do I need to file Form OR-ASC if I don't have any adjustments to make?

A: No, if you don't have any adjustments to make, you do not need to file Form OR-ASC.

Form Details:

- Released on August 13, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-ASC (150-101-063) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.