This version of the form is not currently in use and is provided for reference only. Download this version of

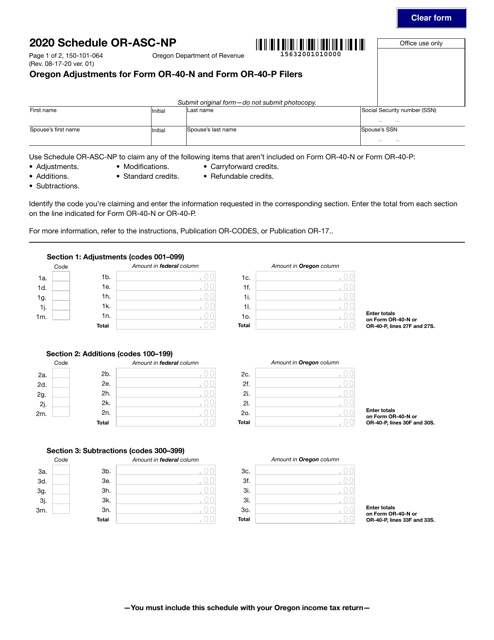

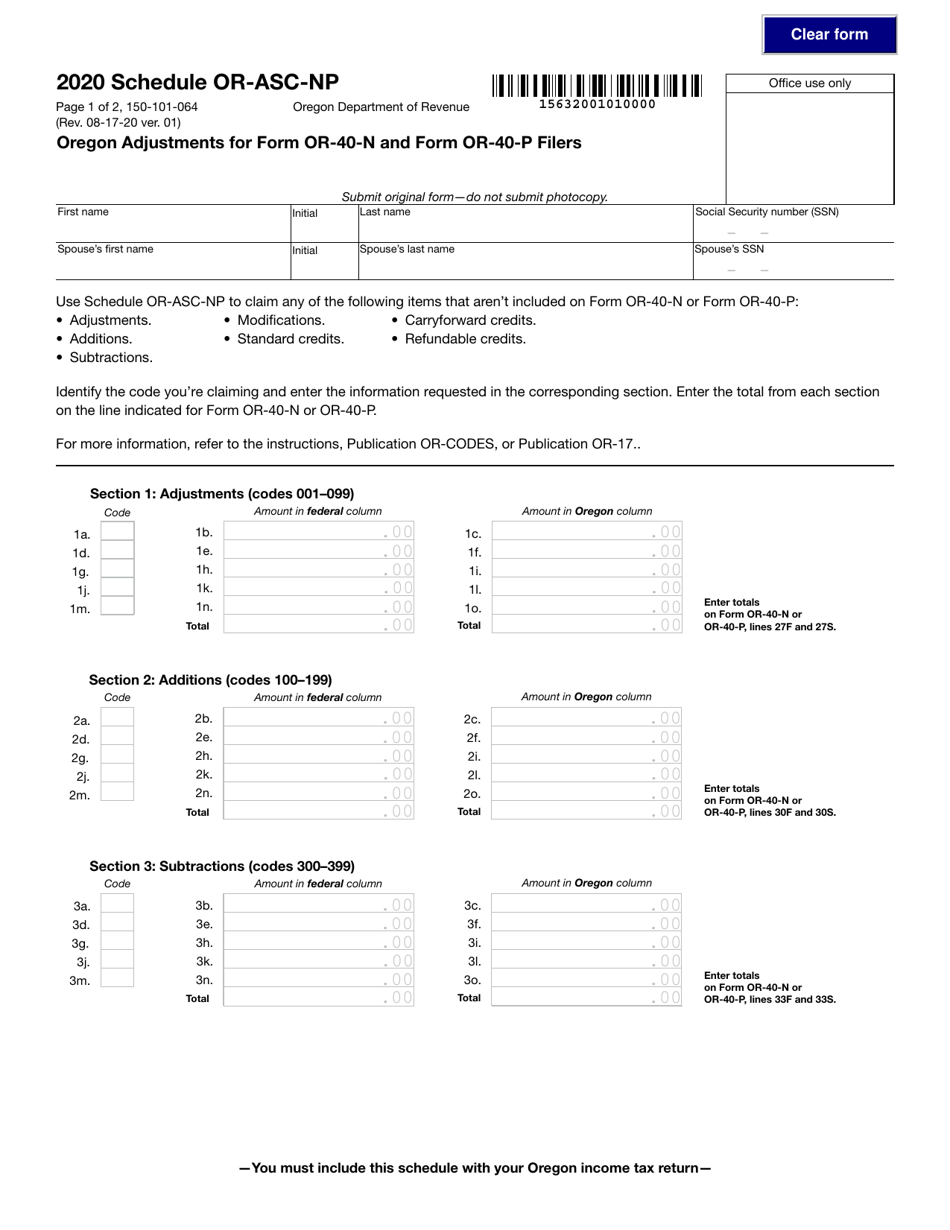

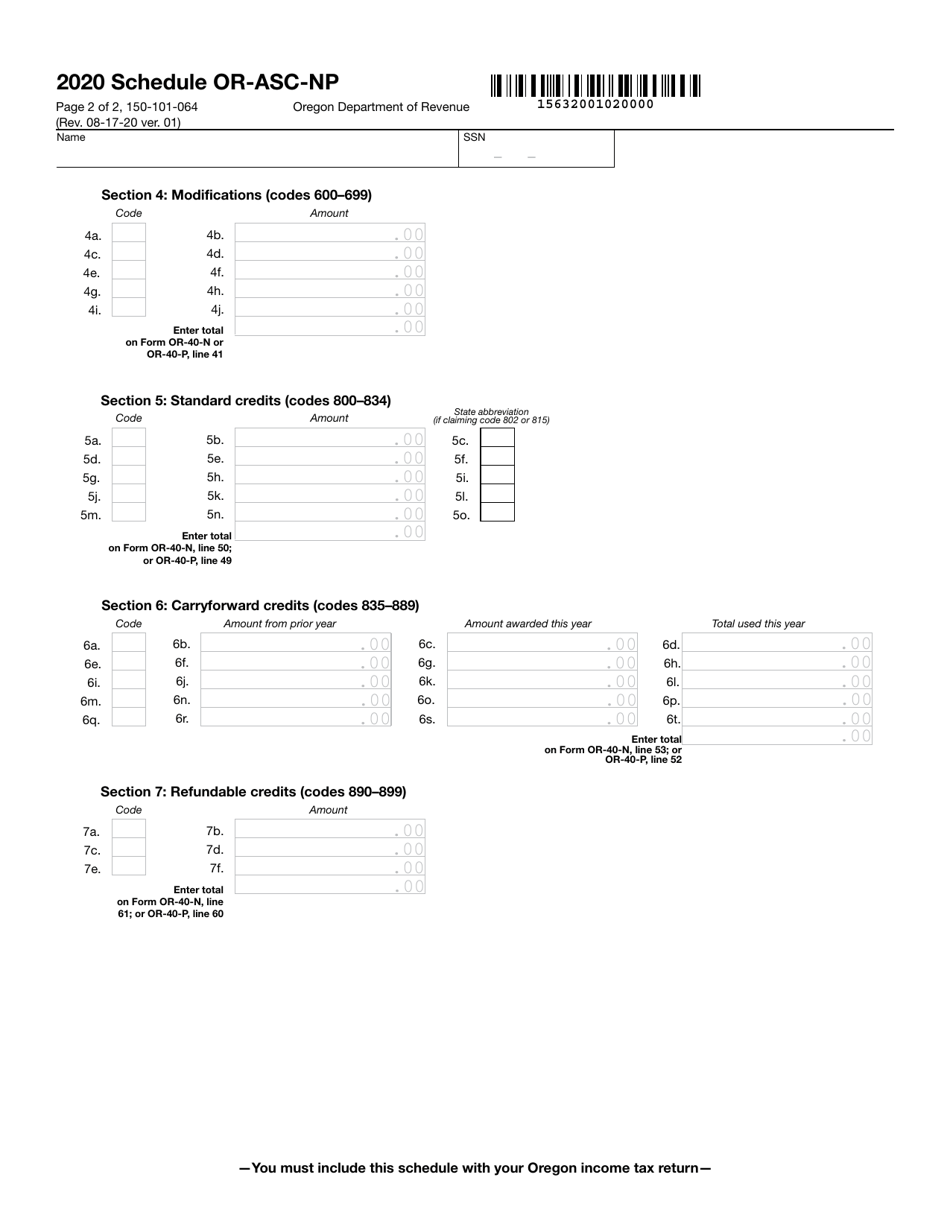

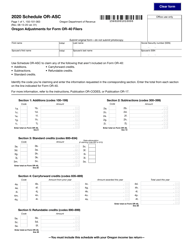

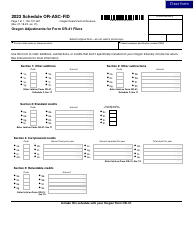

Form 150-101-064 Schedule OR-ASC-NP

for the current year.

Form 150-101-064 Schedule OR-ASC-NP Oregon Adjustments for Form or-40-n and Form or-40-p Filers - Oregon

What Is Form 150-101-064 Schedule OR-ASC-NP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-064?

A: Form 150-101-064 is the Schedule OR-ASC-NP, which is used to report Oregon adjustments for Form OR-40-N and Form OR-40-P filers.

Q: Who needs to file Form 150-101-064?

A: Form 150-101-064 is to be filed by individuals who need to report Oregon adjustments for their Form OR-40-N and Form OR-40-P.

Q: What are Oregon adjustments?

A: Oregon adjustments are specific deductions, credits, and modifications to income that are applicable for Oregon tax purposes.

Q: Are Form OR-40-N and Form OR-40-P the same?

A: No, Form OR-40-N is for part-year residents, while Form OR-40-P is for nonresident filers.

Q: How do I fill out Form 150-101-064?

A: To fill out Form 150-101-064, you need to follow the instructions provided with the form and accurately report your Oregon adjustments.

Q: Do I need to file Form 150-101-064 if I am a full-year Oregon resident?

A: No, Form 150-101-064 is only required for part-year residents and nonresidents.

Q: What should I do if I have questions about Form 150-101-064?

A: If you have questions about Form 150-101-064, you can reach out to the Oregon Department of Revenue for assistance.

Q: When is the deadline to file Form 150-101-064?

A: The deadline to file Form 150-101-064 is the same as the deadline for filing your Form OR-40-N or Form OR-40-P, which is typically April 15th.

Q: Can I e-file Form 150-101-064?

A: Yes, you can e-file Form 150-101-064 if you are also electronically filing your Form OR-40-N or Form OR-40-P.

Form Details:

- Released on August 17, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-064 Schedule OR-ASC-NP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.