This version of the form is not currently in use and is provided for reference only. Download this version of

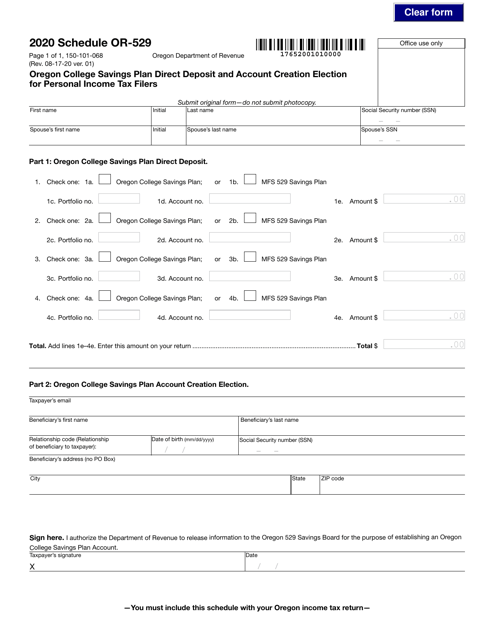

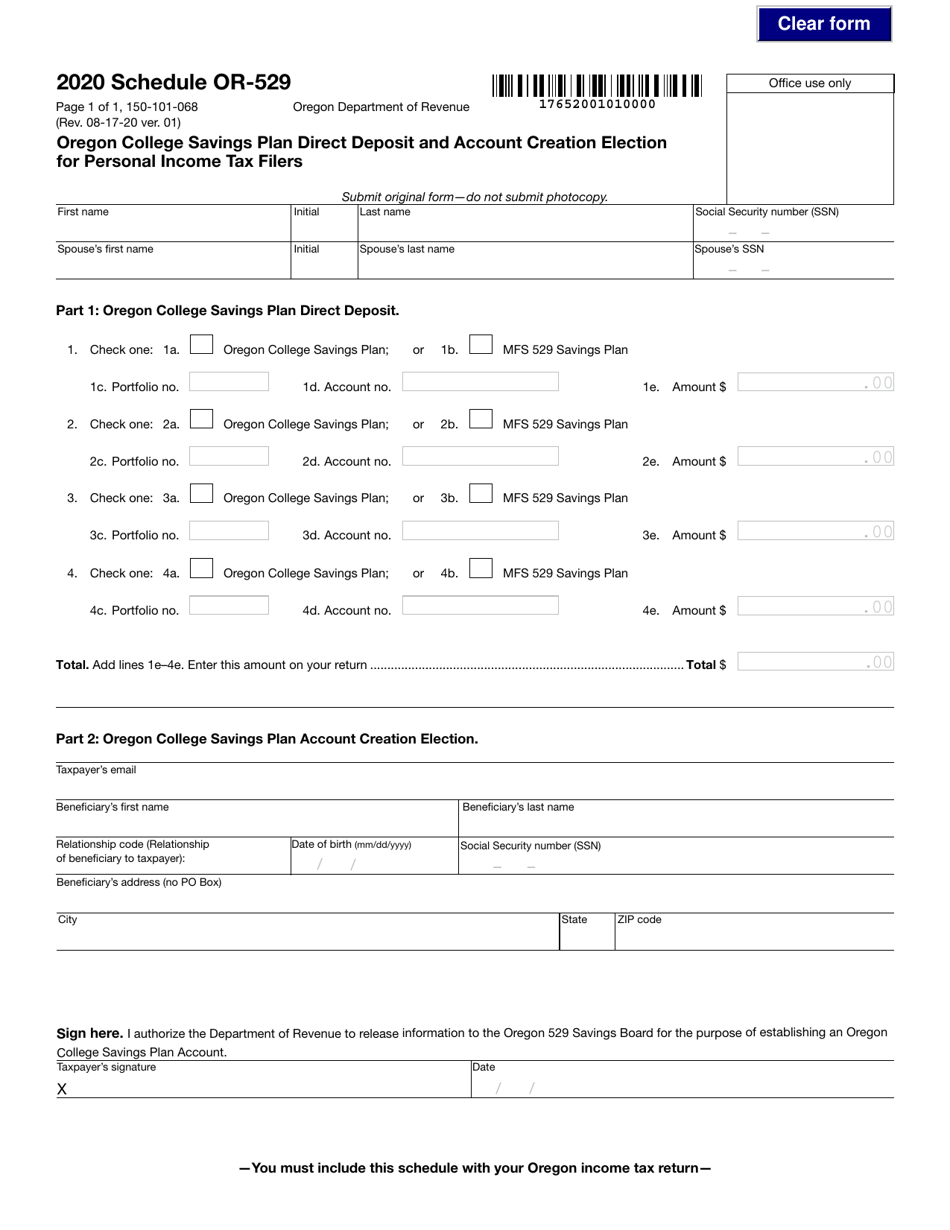

Form 150-101-068 Schedule OR-529

for the current year.

Form 150-101-068 Schedule OR-529 Oregon College Savings Plan Direct Deposit and Account Creation Election for Personal Income Tax Filers - Oregon

What Is Form 150-101-068 Schedule OR-529?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-068?

A: Form 150-101-068 is the official form used for schedule OR-529 in Oregon.

Q: What is Schedule OR-529?

A: Schedule OR-529 is the form used for the Oregon College Savings Plan Direct Deposit and Account Creation Election for Personal Income Tax Filers in Oregon.

Q: What is the purpose of Form 150-101-068?

A: The purpose of Form 150-101-068 is to allow Oregon residents to specify their election for direct deposit and account creation of contributions for the Oregon College Savings Plan, which may have tax benefits.

Q: Who needs to fill out Form 150-101-068?

A: Oregon residents who want to make direct deposit contributions to the Oregon College Savings Plan and create an account need to fill out Form 150-101-068.

Q: Is Form 150-101-068 only for Oregon residents?

A: Yes, Form 150-101-068 is specifically for Oregon residents filing their personal income tax returns.

Q: What is the Oregon College Savings Plan?

A: The Oregon College Savings Plan is a state-sponsored program that allows individuals to save money for higher education expenses, with potential tax advantages.

Q: Are there any tax benefits to using the Oregon College Savings Plan?

A: Yes, contributions to the Oregon College Savings Plan may be deductible on your Oregon income tax return, and earnings can grow tax-deferred.

Q: Can I make direct deposit contributions to the Oregon College Savings Plan?

A: Yes, you can make direct deposit contributions to the Oregon College Savings Plan by filling out Form 150-101-068.

Q: Do I need to create an account with the Oregon College Savings Plan?

A: Yes, you need to create an account with the Oregon College Savings Plan in order to make contributions and manage your savings.

Form Details:

- Released on August 17, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-068 Schedule OR-529 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.