This version of the form is not currently in use and is provided for reference only. Download this version of

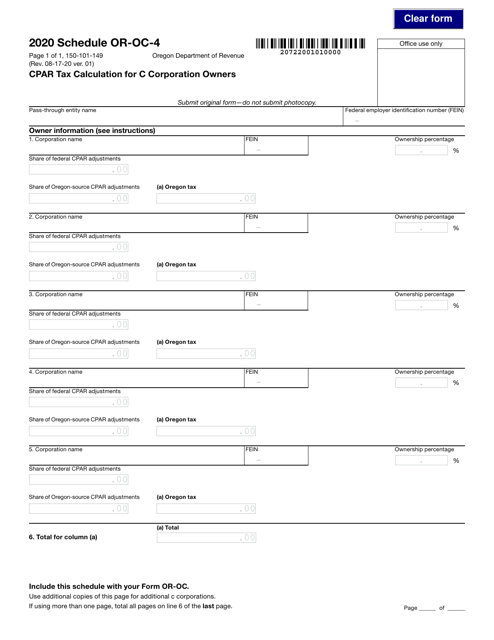

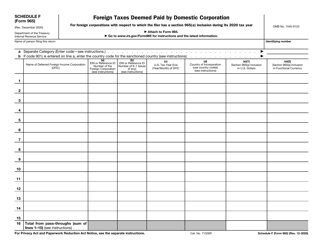

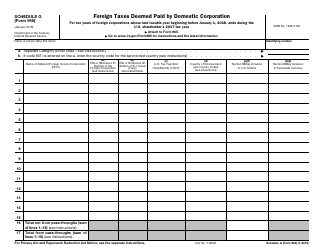

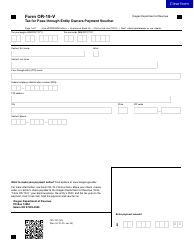

Form 150-101-149 Schedule OR-OC-4

for the current year.

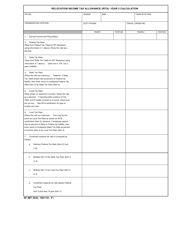

Form 150-101-149 Schedule OR-OC-4 Cpar Tax Calculation for C Corporation Owners - Oregon

What Is Form 150-101-149 Schedule OR-OC-4?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-149?

A: Form 150-101-149 is a tax form used in Oregon for C Corporation owners to calculate their tax liability.

Q: Who is required to file Form 150-101-149?

A: C Corporation owners in Oregon are required to file Form 150-101-149.

Q: What is the purpose of Form 150-101-149?

A: The purpose of Form 150-101-149 is to calculate the C Corporation owner's tax liability in Oregon.

Q: When is the deadline to file Form 150-101-149?

A: The deadline to file Form 150-101-149 is the same as the deadline for filing your C Corporation tax return in Oregon. Typically, it is April 15.

Q: What information do I need to complete Form 150-101-149?

A: To complete Form 150-101-149, you will need information about your C Corporation's income, deductions, credits, and other relevant financial information.

Q: Are there any special instructions for completing Form 150-101-149?

A: Yes, there are specific instructions provided with Form 150-101-149 that you should carefully follow to ensure accurate and complete completion.

Q: What happens if I don't file Form 150-101-149?

A: If you don't file Form 150-101-149, you may be subject to penalties and interest on any unpaid tax liability.

Form Details:

- Released on August 17, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-149 Schedule OR-OC-4 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.