This version of the form is not currently in use and is provided for reference only. Download this version of

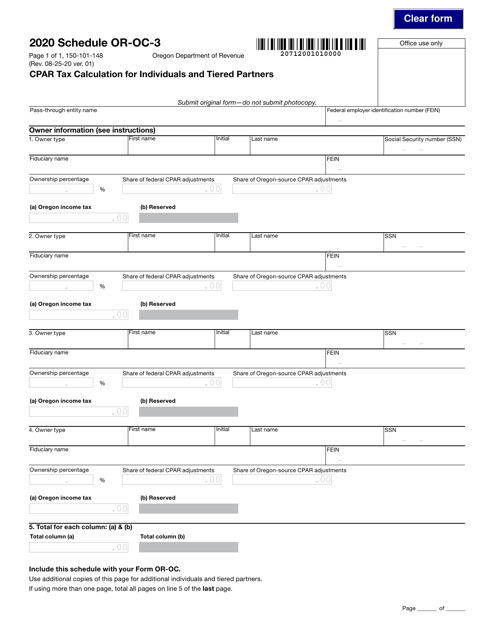

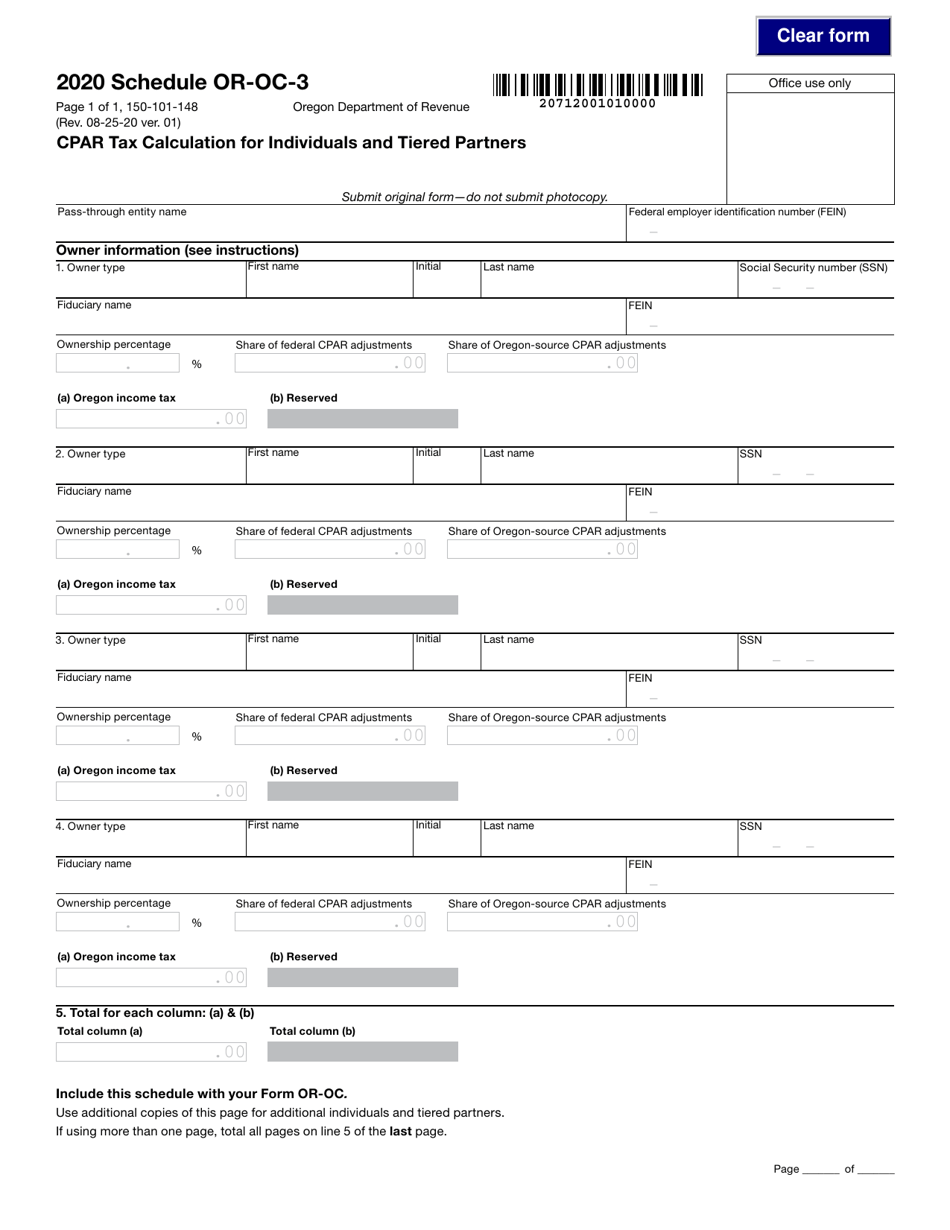

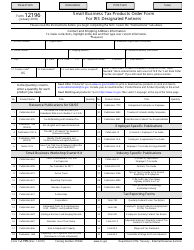

Form 150-101-148 Schedule OR-OC-3

for the current year.

Form 150-101-148 Schedule OR-OC-3 Cpar Tax Calculation for Individuals and Tiered Partners - Oregon

What Is Form 150-101-148 Schedule OR-OC-3?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-148?

A: Form 150-101-148 is a tax calculation form for individuals and tiered partners in Oregon.

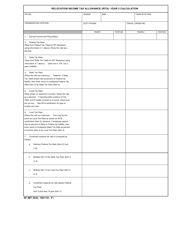

Q: What is the purpose of Schedule OR-OC-3?

A: The purpose of Schedule OR-OC-3 is to calculate Cpar tax for individuals and tiered partners in Oregon.

Q: Who needs to file Form 150-101-148?

A: Individuals and tiered partners in Oregon who are subject to Cpar tax need to file Form 150-101-148.

Q: What is Cpar tax?

A: Cpar tax is a tax imposed on the combined income of partnerships and their partners in Oregon.

Q: What information is required on Schedule OR-OC-3?

A: Schedule OR-OC-3 requires information on combined partnership income, partner's distributive share, and other specific details.

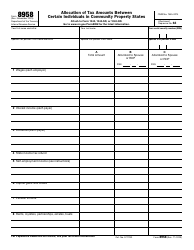

Q: Is Schedule OR-OC-3 applicable for individuals only?

A: No, Schedule OR-OC-3 is applicable for both individuals and tiered partners in Oregon.

Q: When is the deadline for filing Form 150-101-148?

A: The deadline for filing Form 150-101-148 is typically April 15th, or the same date as the federal income tax deadline.

Q: Are there any penalties for not filing Form 150-101-148?

A: Yes, there may be penalties for not filing Form 150-101-148 or for filing it late, so it is important to comply with the tax requirements.

Form Details:

- Released on August 25, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-148 Schedule OR-OC-3 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.